SPE ACCE 2011: Growing again

The Society of Plastics Engineers’ 11th conference on automotive composites fields a top slate of speakers and attracts its largest crowd.

An event-record 480 automotive and composites professionals attended the Society of Plastics Engineers’ 2011 edition of its Automotive Composites Conference & Exhibition (ACCE) — 40 more than its previous best in prerecession 2008. Held this year on Sept. 13-15 in Troy, Mich., the annual gathering returned, after two seasons in an economy-conscious two-day timeframe, to its original three-day format. Further, ACCE organizers filled the more expansive schedule with one of its best-ever collections of papers and presentations. The event provided attendees a concentrated data- and detail-packed opportunity to catch up on the latest material, design, tooling and processing technologies now in use, and for future use, in automotive applications. CT’s editor-in-chief, Jeff Sloan, was there and returned with the following capsule commentaries on key presentations.

High-pressure compression RTM

Several ACCE presenters focused on research aimed at development of high-speed, out-of-autoclave manufacturing processes. The first of these came from Professor Frank Henning of the German research and development organization Fraunhofer Institute for Chemical Technology (ICT) (Pfinztal, Germany). He reviewed the capabilities of a high-pressure compression resin transfer molding process for automotive applications. The process combines a Krauss-Maffei Corporation (Florence, Ky.) injection system with a compression molding press supplied by Dieffenbacher North America Inc. (Windsor, Ontario, Canada). The material used was a glass fiber unidirectional fabric charge/preform from SAERTEX USA LLC (Huntersville, N.C.) and Araldite epoxy resin from Huntsman Advanced Materials (The Woodlands, Texas). To test the process, a flat, rectangular section of unidirectional fabric was placed flat in a mold. The mold was closed, but a slight gap of 1 mm to 2 mm (0.039 to 0.079 inch) was left between the mold surface and the top of the fabric. Resin was then injected quickly into the gap, in about 5.5 seconds. Then, the mold was fully closed to achieve fiber impregnation, followed by a cure cycle of only four minutes at 150°C/302°F. Henning claims that part fiber content with this process is 55 to 58 percent, with even resin distribution, no dry spots and good mechanical properties. Fraunhofer will continue to assess the process by testing other resins and fiber forms.

Prepreg compression molding

Koishi Akiyama, research director at Mitsubishi Rayon Co. Ltd. (Tokyo, Japan), outlined his firm’s efforts to develop prepreg compression molding (PCM). The process itself is relatively simple: cut carbon fiber prepreg in unidirectional or fabric form (10 minutes), shape it under modest heat (10 minutes) and then press cure it for 10 minutes at 3 to 10 MPa at 140°C to 150°C (284°F to 302°F). Akiyama reported that fiber volume in test parts is about 65 percent and noted that most testing, thus far, has focused on determining optimal resin viscosity. He also pointed out that the process can accommodate the addition of sheet molding compound (SMC) in layers with the prepreg during preforming. Two automotive products have been developed for the process so far. The first, a deck lid, uses unidirectional prepreg in [0/90/0/90] layers, for a total thickness of 1.1 mm/0.043 inch. The deck lid weighs 38 percent less than its aluminum counterpart and achieves comparable mechanical properties. The other part, an engine hood, comprises a PCM outer surface and a carbon-fiber SMC inner. It weighs just 5.3 kg/11.7 lb, compared to 14.5 kg/32 lb for the steel version and, according to Akiyama, has a “good paintable surface.”

Large-part, long-fiber injection

Paul Condeelis, VP of business development at composites molder Romeo Engineering Inc. (Romeo, Mich.), highlighted his company’s new large-part reaction injection molding (RIM) capabilities, made possible by what he says is the largest compression molding machine in the world: 80 ft by 60 ft by 32 ft (24.3m by 18.3m by 9.8m). This massive, highly automated press is used to produce a variety of structural polyurethane (PUR) parts: a structural door inner, a cement truck chute, a structural spa cabinet, an agricultural vehicle cab roof, a Daimler smart car’s roof and a military truck’s front grille. One of the features of this system is the ability to produce parts with a Class A surface, thanks to an in-mold paint system that is integrated into the press. Condeelis walked the audience through the manufacturing process. Paint is applied to the mold surface and a barrier coat is applied over the paint, both via robot; the mold cavity shuttles to the press station where long-fiber-reinforced PUR substrate is robotically applied to the mold; followed by mold close and a cure cycle. Fully decorated parts can be produced in as little as 15 minutes, Condeelis reported, and the double-shuttle system increases efficiency by allowing one mold to be prepped while another is in the cure cycle. Parts, he said, can be up to 11 ft by 11 ft (3.3m by 3.3m) and 3 mm to 6 mm (0.12 inch to 0.24 inch) thick. Romeo RIM’s partners include Bayer MaterialScience (Pittsburgh, Pa.), Krauss-Maffei and paint manufacturer Sherwin-Williams (Cleveland, Ohio).

Carbon fiber capacity

Dave Warren, program manager – transportation, materials and carbon fiber at Oak Ridge National Laboratory (Oak Ridge, Tenn.), brought a big-picture perspective about the supply of carbon fiber in general and the supply of relatively inexpensive carbon fiber to the automotive industry in particular. Pointing out that world oil production has flattened while consumption has increased, Warren emphasized that there is a global push to reduce petroleum consumption. Solutions are few: source more oil domestically, drive less, travel differently and improve fuel economy. One path to improved fuel economy is via weight reduction, and carbon fiber is the best option to achieve this. Warren said a 10 percent mass reduction increases fuel efficiency 6 to 7 percent. There are, however, barriers to increased carbon fiber use in cars: cost, lack of design methods, slow manufacturing processes and the need for crash models. In terms of cost, Warren believes the auto industry needs carbon fiber in the $5/lb to $7/lb range, but he pointed out that carbon fiber in this price range cannot be achieved with a petroleum-based precursor, such as polyacrylonitrile (PAN). Oak Ridge continues work on an inexpensive and renewable alternative. Warren also believes that car designers don’t trust the crashworthiness of carbon fiber, thus he suggests “first applications of carbon fiber must be in parts that are not crash-critical.” Finally, he suggested that the auto industry needs sizings optimized for automotive resin systems and noted that Oak Ridge recently invested $34 million in a carbon fiber line to develop carbon fiber and sizings specifically for automotive.

Styrene challenge

John Schweitzer, senior director, Government Affairs, at the American Composites Manufacturers Assn. (Arlington, Va.), was the first keynote speaker of the conference, educating attendees about the current status of styrene in the composites industry. Earlier this year the U.S. Department of Health and Human Services (HHS) listed styrene as a possible carcinogen, which could place additional regulatory burdens on the material and, possibly, force it out of use. ACMA fought the listing, and Schweitzer said he is attempting to get HHS to retract the listing. He noted that 9 million lb (4,082 metric tonnes) of styrene is consumed annually in the U.S. and that 750,000 people are employed in some capacity that depends on styrene. The HHS decision to list styrene was based, in part, on tests with mice that showed styrene exposure increased the likelihood of lung cancer. Schweitzer argued that styrene in mouse lungs metabolizes into a toxic compound, which leads to the lung cancer. Humans, on the other hand, metabolize styrene in the lungs to nontoxic substances. Further, he noted two human studies — one in the U.S. from 1948 and one conducted in Europe since 1960 — that assessed data from 60,000 people and showed no styrene-related cancers. Schweitzer further argued that the National Toxicology Program (NTP), which initiated the listing, has no peer-review process, does not consider input from outside organizations and lacks the necessary resources to do quality assessments. (Editor’s note: Visit www.acmanet.org for more information about ACMA’s efforts to delist styrene.)

Dielectric sensing technology

Tom Trexler, general manager of Signature Control Systems Inc. (SCE, Denver, Colo.), which is now owned by Ashland Performance Materials (Columbus, Ohio), talked about cure monitoring of thermosets and thermoplastics as a way of optimizing composites manufacturing. SCE’s technology uses in-mold sensors to measure the conductance of a resin (impedance sensing). As a resin crosslinks, its conductance decreases. Molders, then, can measure conductance and establish process settings that help avoid over- or undercuring a part — that is, they monitor the process based on fixed cure state vs. fixed cure time. Further, a part that deviates from optimum cycle time warns of critical variable changes, including resin variation, changes in the physical environment, changes to the machine or changes by the operator. Trexler reported that the benefits of the technology include a 5 to 20 percent cycle time reduction; elimination of undercuring; reduced scrap; better overall process control; and more accurate — and therefore useful — process data. Trexler outlined three case histories in which the impedance sensing technology was successfully applied, including compression-molded SMC and injection-molded BMC. The technology also can be adapted for use in resin transfer molding (RTM).

Economic outlook

Chuck Kazmierski, program manager at Lucintel (Las Colinas, Texas), provided attendees with his outlook on the changing economics of the composites industry over the next several years. In 2010, he reported, composites materials generated $17.7 billion in revenue, and he predicted that annual revenue would rise to $27.4 billion in 2016. Composite finished goods generated $50.2 billion in revenue in 2010, with $78.0 billion annually expected by 2016. Global automotive composite materials accounted for $2.4 billion in 2010, with $3.7 billion expected by 2016. His most notable statistic, penetration of composites into automotive applications, is a mere 3.6 percent while penetration into marine, by comparison, is 68 percent. That indicates room for growth. Yet Kazmierski thinks carbon fiber/automotive joint ventures of the type recently established by SGL Group and BMW Group will be limited, for the most part, to high-end vehicles. Other trends to watch:

• U.S. composites industry growth will beat U.S. GDP over the

next five years.

• By 2026, most of the world’s biggest cities will be in developing

countries; the resulting population density will drive a variety of

composite markets, including automotive.

• The U.S. has the largest composites consumption per capita.

• The U.S. wind industry will grow 16 percent annually

through 2016.

• The Chinese wind industry will grow 20 percent annually

through 2016.

• The U.S. Congress is expected to renew the wind industry’s

production tax credit (PTC) before it expires in 2012.

• Natural gas prices are expected to increase 7 percent annually

through 2016.

Polypropylene and silane grafting

Scott Miller, plastics and composite additives application engineer for the advanced interface markets at Dow Corning Corp. (Midland, Mich.), generated some buzz at the conference with his paper on grafting polypropylene (PP) with silanes using melt-reactive extrusion processing. The result of this polymer engineering is the creation of a new monomer that enables crosslinking of PP resin or coupling with either wood flours or glass fibers to create composite materials with improved mechanical properties and resistance to heat and water (underwater immersion). In testing, properties of the material demonstrated that a silane-modified PP could become a replacement for polyamide (PA), a popular but more expensive engineered thermoplastic. Such an opportunity is significant because it could enable PP to move into automotive applications that are traditionally dominated by PA.

Continuous fiber structures

Kipp Grumm, advanced development engineer at BASF Corporation - Building Systems (Florham, N.J.), reported on his company’s work with Faurecia Automotive Seating (Nanterre, France) to use continuous fiber in a variety of novel processes to produce composite structural members. One process, called overmolded continuous fiber, involves placement of premolded continuous glass or carbon fiber-reinforced composite parts into an injection tool and overmolding them with a thermoplastic to form structural or part-integration features. Parts made via this method include a laptop case made by PMC Baycomp (Burlington, Ontario, Canada) and an Audi A7 front-end module developed with help from thermoplastic material supplier LANXESS Corporation (Pittsburgh, Pa.). The emphasis of the presentation, however, was on an automotive front-seat back structure developed and manufactured by BASF and Faurecia using continuous-fiber tape in a thermoforming process. This involves cutting thermoplastic/carbon fiber prepreg sheets, consolidating them under heat and thermoforming them to a final shape, followed by waterjet or router trimming. The seat project enabled a conversion from a metal structure to a plastic/composite replacement that reduced mass by 6 lb/2.7 kg and overall seat thickness by 1 inch/25.4 mm. The seat back comprises a frame/pan structure injection molded from polyamide 6, reinforced along each side by carbon fiber/thermoplastic inserts that provide structural integrity. Tests of the seat, Grumm reported, show that it meets safety requirements and has close CAE correlation.

Composites sustainability

Ashish Diwanji, VP of Innovations at Owens Corning Composite Solutions Business (Toledo, Ohio), provided a global perspective on trends driving composites use not just in automobiles, but also in a variety of other applications. He emphasized Owens Corning’s increasing focus on composites’ role in meeting sustainability requirements throughout the world. Pointing to macro trends in population growth/distribution, climate change, energy development, globalization, technology research and legislative action, Diwanji said he sees that composites have a major role to play in meeting emerging challenges. In particular, he cited clean energy, water infrastructure, urban infrastructure and industrial lightweighting as significant opportunities. Sustainable composite solutions, he said, must balance government regulations, end-of-life product management, CO2 abatement requirements, recyclability, total product lifecycle cost and social consciousness. Certainly, Diwanji said, legislation and regulation throughout the world looks to be a major factor in composites’ future. He referenced EU legislation that targets certain maximum allowable CO2 levels by 2015, with incremental ratchets downward through 2020. “The challenge of composites begins and ends with legislation,” he concluded.

Related Content

Plataine unveils AI-based autoclave scheduling optimization tool

The Autoclave Scheduler is designed to increase autoclave throughput, save operational costs and energy, and contribute to sustainable composite manufacturing.

Read MoreIndustrial composite autoclaves feature advanced control, turnkey options

CAMX 2024: Designed and built with safety and durability in mind, Akarmark delivers complete curing autoclave systems for a variety of applications.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreBusch expands autoclave solutions

Busch announces its ability to address all autoclave, oven and associated composites manufacturing requirements following the acquisition of Vacuum Furnace Engineering.

Read MoreRead Next

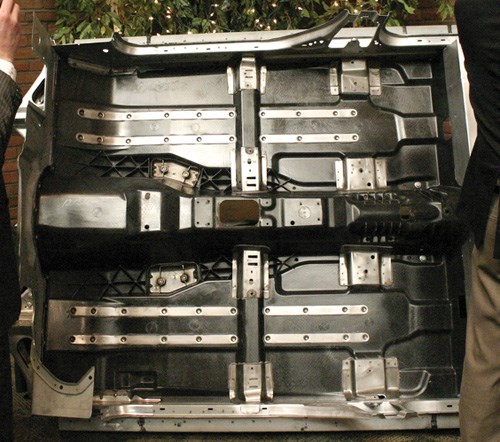

Automotive composites: Structural underbody

For Detroit’s Big Three, a joint precompetitive composite design, development, fabrication and testing program nears successful completion.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More