Supply and demand: Advanced fibers (2015)

Demand for advanced fiber, virgin and reclaimed, is on an upswing after a dip during the recent recession. Fiber suppliers are gearing up to meet an expected increase in demand as manufacturers in a number of composites end-markets scale up or start up part development and production programs.

Historically, markets for carbon fiber have gone through boom/bust cycles, making it difficult for fiber manufacturers to predict capacity needs. During the recent and deep recession (2008-2012), carbon fiber demand dipped, as economies in the US and the European Union slowed significantly, but recovery and growth have been the norm since. Fiber demand is now up and continuing to rise. Carbon fiber producers are avidly looking for signals from a variety of end-markets about when and where growth will occur. The aerospace market, as usual, remains a fixed value in this equation. But that demand “anchor” is surrounded by several much more variable markets whose future values are still unknown. Are automotive carbon composites, finally, about to take off? Will carbon fiber find greater use in the wind energy sector, as turbine manufacturers seek to lightweight ever-longer rotor blades? Is the oil & gas industry on the cusp of expansion? Is there a low-cost, non-PAN precursor on the horizon?

Aerospace, automotive and fast-growing wind energy and industrial segments are competing for fiber. As a result the current market for carbon fiber is strong and, this time, it appears that the demand is established. Every carbon fiber producer is currently expanding fiber production, and many are moving to produce both high-end, small-tow as well as industrial large-tow fibers as new fiber manufacturers come into view.

The largest fiber producer, Toray Industries Inc. (Tokyo, Japan), has a multi-year contract in place with The Boeing Co. (Seattle, WA, US) to supply carbon fiber/epoxy prepregs for the 787 Dreamliner program, and a contract expansion was recently announced, under which the company also will supply carbon prepregs to Boeing for its 777X program. Total value of the combined supply agreement reportedly exceeds ¥1 trillion (US$8.3 billion).

Toray believes that carbon fiber demand is growing at a rate of 15% per year. Accordingly, it has expanded all of its production facilities, in Japan, the US, France and South Korea, over the past two years. Toray’s total nameplate capacity is expected to reach 27,100 MT by mid-2015. That expansion includes an announced US$1 billion investment in a new carbon fiber plant in Moore, SC, US, that will provide additional fiber capacity targeted to aerospace and automotive applications. To facilitate the latter, Toray announced in late 2013 that it had purchased Zoltek Corporation (St. Louis, MO, US), making Zoltek a wholly owned subsidiary. The acquisition provides Toray a means to produce and market industrial-grade large-tow fiber in addition to its aerospace-grade small-tow fiber. The fiber giant also is expanding into automotive part production, having purchased a stake in carbon composite automotive part producer Plasan Carbon Composites (Wixom, MI, US) in mid-2013. At about the same time, Toray also acquired Dome Carbon Magic Co. Ltd. (Maibara-shi, Japan) and a 75% interest in that company’s Dome Composites (Thailand) production division in Sriracha, Thailand. Under the names Toray Carbon Magic Co. Ltd. Nd Carbon Magic (Thailand) the two locations will produce carbon fiber-reinforced composite automotive parts to meet increased demand in Japan and Thailand

The SGL Carbon SE (Wiesbaden, Germany), by contrast, is expanding its presence in the aerospace market after scoring an unprecedented success with carbon fiber in the automotive sector through its partnership with automaker BMW Group (Munich, Germany) in a joint venture dubbed SGL Automotive Carbon Fibers (SGL ACF). Formed in 2009 to produce industrial-grade carbon fiber exclusively for BMW’s plug-in electric and hybrid-electric models, the i3 and i8, and, potentially, future BMW cars, built a production plant in record time in Moses Lake, WA, US, an area served by hydroelectrically produced power. In the short time since the plant began production in mid-2011, two expansions have already taken place. Production capacity, for the 6 lines at the facility, will be 9,000 MT by mid-2015.

Wiesbaden-based SGL Carbon opened an aerospace-grade carbon fiber pilot plant at the company’s central research facility in Meitingen, Germany, in mid-2011. SGL then acquired a majority stake in Portuguese acrylic manufacturer FISIPE SA in mid-2012, expanding its European production network for precursor. In addition to its partnership with BMW, SGL also produces carbon fiber in Germany and Scotland, and owns the Carbon Fiber Technology production facility in Evanston, WY, US.

Hexcel (Stamford, CT, US) announced in late 2014 that it will build new precursor and carbon fiber lines at a site in Roussillon, France, to supplement its fiber production in Spain and Salt Lake City, UT, US, and existing precursor lines in Decatur, AL, US. The announced expansions will bring the company’s total capacity to approximately 9,500 MT by 2015.

Mitsubishi Chemical Carbon Fiber & Composites Inc. (Tokyo, Japan) announced in June 2014 a doubling of capacity at its former Grafil Inc. carbon fiber plant in Sacramento, CA, US, now part of Mitsubishi Rayon Carbon Fiber and Composites Inc. (Irvine, CA, US). Nameplate production in Sacramento will be 4,000 MT per year by mid-2016, and will supplement expanded production at Mitsubishi’s plant in Otake, Japan, which came online in 2011. The Otake facility produces PAN-based 60K Pyrofil P330 fibers for industrial applications. Mitsubishi also supplies the PAN precursor for SGL ACF’s Moses Lake fiber facility. Consistent with the activities of other fiber producers, Mitsubishi Rayon in July 2014 acquired a 51% stake in Wethje Holding GmbH (Hengersberg, Germany), a producer of carbon fiber-reinforced polymer (CFRP) automotive parts.

Toho Tenax America Inc. (Wuppertal, Germany) has a capacity of approximately 13,900 metric tonnes at the end of 2014, although announcements of an expansion may be on the horizon.

Cytec Industries Inc. (West Paterson, NJ, US) announced in early 2014 that its new US plant in South Carolina was complete and ready to start production. Cytec confirmed that the new line will yield small-tow (3K-24K) fiber.

Taipei, Taiwan-based Formosa Plastics Corporation also has been expanding over the past several years, with nameplate production now at 8,750 MT. In 2014, Formosa Plastics introduced a new fiber, TC55, with a reported tensile strength of 4,413 MPa and tensile modulus of 379 GPa.

Newer players are also enjoying success. Since its inception less than a decade ago, and first acrylic precursor-based commercial carbon fiber line startup in 2010, AKSACA Carbon Fibers(Istanbul, Turkey) with a current capacity of approximately 3,600 MT of fiber per year on two lines in Turkey is aggressively pursuing carbon opportunities in many sectors, including wind, infrastructure and automotive. After forming a strategic partnership with the Dow Chemical Co. (Midland, MI, US) in 2012, called DowAksa Ileri Kompozit Malzemeler Ltd. Sti, the new joint entity is developing a broad range of products for automotive in particular, and has a development agreement with Ford Motor Co. In late 2014, the company hosted an event in Atlanta, GA, US to announce its intention to build a U.S.-based carbon fiber plant within the next several years. This follows an earlier announcement in 2013 that DowAksa will build a fiber plant in Russia, with US$1 billion quoted as the investment amount for the Russian and U.S.-based facilities combined. DowAksa says it intends to capture a significant piece of the industrial carbon fiber market.

Hyosung Corp.(Gyeonggido, South Korea) began fiber production in mid-2013, and is on course to manufacture 8,000 MT by 2020, estimates one carbon fiber market expert. Its “high-strength” Tansome industrial-grade fiber product achieves a tensile modulus of 5.5 GPa and a tensile modulus of 290 GPa.

In mid-2011, Saudi Basic Industries Corp. (SABIC, Riyadh, Saudi Arabia) announced that it had signed a technology agreement with acrylic manufacturer Montefibre SpA (Milan, Italy), granting SABIC and its affiliates an extensive international license on carbon fiber technology developed by Montefibre. Since that time, ground has been broken on a new plant in Saudi Arabia with a planned annual capacity of 2,000-2,700 MT, which should be online by mid-2015.

Other market entrants include Dalian Xingke Carbon Fiber Co. Ltd.(Dalian City, China) and Yingyou Group Corp. (Lianyungang, China), and at least three other China-based entities, in Shandong, Zhejiang and Guangxi provinces, are reported to be developing carbon fiber production. Kemrock Industries & Exports Ltd. (Vadodara, India) began fiber production several years ago, with a plant capacity of approximately 400 MT. Russia’s Composite Holding Co. together with state-owned Rosatom produces fiber under the company name Alabuga Fibre LLC in the Republic of Tatarstan. Estimated plant capacity is 1,500-3,000 MT.

Demand for other advanced fibers is increasing as well. Continued security concerns have stimulated growth in the armor market, prompting increased production of aramid and polyethylene fibers. DuPont Protection Solutions(Richmond, VA, US) increased production of its DuPont Kevlar aramid fiber by more than 25%, with a US$500 million capacity expansion — reportedly the largest expansion in Kevlar history. Competitor TEIJIN ARAMID BV (Arnhem, The Netherlands), now produces four brands of aramid fiber — Twaron, Technora, Sulfron and Teijinconex. It also expanded its Twaron capacity by 15-20% from its base of 23,000 MT per year in Emmen and Delfzijl, in The Netherlands.

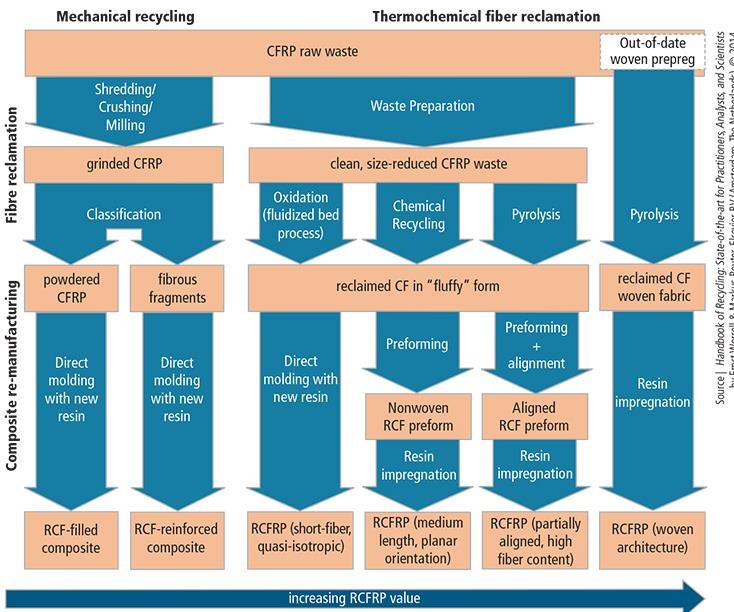

A growing trend is advanced fiber recycling, particularly in the case of carbon fiber. Its high value translates to a potentially significant demand for reclaimed fibers, especially for recovered high-strength, high-modulus aerospace-grade fibers. A number of firms — chief among them MIT-RCF (Lake City, SC, US), Adherent Technologies Inc.(Albuquerque, NM, US) and ELG Carbon Fibre Ltd.(Coseley, Dudley, UK) and CFK-Valley Recycling (Stade, Germany)— are advancing technologies to reclaim fiber that can be reintroduced into the value chain as short, chopped fiber for use in thermoplastic composites, or longer fibers formed into mat products. One Boeing researcher has reported that recovered aerospace short fibers exceed the mechanical properties of virgin chopped industrial fibers, making them attractive for reuse.

Related Content

Recycling hydrogen tanks to produce automotive structural components

Voith Composites and partners develop recycling solutions for hydrogen storage tanks and manufacturing methods to produce automotive parts from the recycled materials.

Read MoreHexagon Purus Westminster: Experience, growth, new developments in hydrogen storage

Hexagon Purus scales production of Type 4 composite tanks, discusses growth, recyclability, sensors and carbon fiber supply and sustainability.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More