The Art of Armor Development

Composites are playing a bigger role in antiballistic systems designed to defuse a host of weapons, including improvised explosive devices.

One thing the war in Iraq has taught the military and its suppliers is that the threat — and the enemy that poses it — is no longer clearly defined. Armor manufacturers are being called upon to design protective systems for vehicles and personnel that can meet not only increasing levels of threat, but also withstand damage delivered by a variety of weapons wielded by unlikely combatants. Pressure is on, as well, to reduce armor system weight for security forces, military and civil, that require high mobility and maneuverability in environments as varied as open desert and congested urbanscapes. As a result, fiber-reinforced composites are earning a larger role in protective systems, supplanting or supplementing legacy systems that rely on metals and ceramics.

Today, says Karl Chang, a research associate at DuPont Advanced Fiber Systems (Wilmington, Del.), armor design must meet multiple functional requirements: in addition to ballistic performance, the system must meet weight limits and, when incorporated into vehicles, also fulfill structural requirements. Further, armor systems must account for what the industry calls “over-matching threat.” “Over-matching threat means if I design an armor system, I have to design for a specific threat, but can’t guarantee that the enemy will only shoot at me at the specification I am designing to, so I must be prepared to deal with that,” Chang says. “That” can be armor-piercing bullets (called rounds by insiders) or terrorist bombs and incendiary devices. The latter, which armor designers categorize as improvised explosive devices (IEDs), not only deliver a blast load and projectile fragments but often include a fireball as well, says Chang, who notes that flammability has become a significant issue in armor design. “We can look at reports from Iraq in terms of soldier injuries, and there is a large number of burn injuries,” he says.

Dr. Leo Christodoulou, program manager for the Defense Advanced Research Projects Agency (DARPA), the research arm of the U.S. Department of Defense (DoD), adds that armor also must withstand repeated hits without catastrophic failure and remain environmentally stable — that is, maintain its performance properties when exposed to the elements. Here, says Christodoulou, it is important to remember that armor development is still as much art as science.

A third requirement, and perhaps the most difficult, is that armor design must reflect the changing nature of war. By way of illustration, Chang notes that High Mobility Multi-Purpose Wheeled Vehicles (HMMWVs), commonly referred to as Humvees, are lightweight, lightly armored vehicles that were originally designed to perform behind-the-frontline duties. In Iraq, however, they are highly vulnerable in a war where enemies and civilians are often indistinguishable and “frontline” defies definition. Today, he says, “all vehicles need protection.”

When Humvees in Iraq were retrofitted with legacy steel armor kits, the additional weight hampered vehicle performance. “The suspension systems [of the vehicles] are suffering early failure in supporting the steel armor,” says Lori Wagner, head of technology for Advanced Fibers and Composites Group at Honeywell Advanced Fibers & Composites (Morristown, N.J.). Soldiers are looking for lightweight armor that is easy to handle. Composites are answering the call, offering a variety of choices in the field that can adapt to their environment, says Wagner (also see HPC January 2005, p. 26). Suppliers advanced fibers are stepping up to meet the challenge in vehicle and personnel protection with an un- precedented range of materials.

Armoring vehicles in the field

Since U.S. forces arrived in Iraq, vehicle retrofit kits — chiefly metal — have been in great demand. But many armor manufacturers, according to Wagner, are beginning to use composites with metal or ceramic strike faces to augment protection and reduce weight.

DuPont’s commercialized aramid fiber Kevlar has been used to produce a composite backing, known as a spall liner, specifically designed to deal with over-matching threats and to reduce damage caused by fragments. The Kevlar fiber line possesses a tensile strength ranging from 525 ksi to more than 560 ksi. The highly resilient fibers “catch” projectiles that are slowed down but ultimately pierce the “hard” armor.

Kevlar spall liners are used in a number of the U.S. military’s vehicle armor systems, including the M113, the Low-Signature Armored Cab (LSAC) for the Army’s Family of Medium Tactical Vehicles (FMTV), and the Armor Security Vehicle (ASV). Chang maintains that Kevlar is an ideal material for vehicle armor systems facing IED threat because it is inherently nonflammable, offering high temperature resistance at continuous temperatures as high as 150°C/302°F. Kevlar does not burn, says Chang, but instead chars or decomposes when the temperature rises above 500°C/932°F.

Wagner notes that Honeywell’s Spectra fiber is similarly employed. The high-tenacity, high-modulus polyethylene (HDPE), made into sheet/rolls with unidirectional tapes, can stop, without any additional materials, up through a NIJ Level III threat, as set by the U.S. National Institute of Justice (NIJ).

The NIJ Standard identifies threat thresholds, which range from Level I to Level IV. Although written specifically for personal body armor, the standard is frequently used to compare other armor products. For purposes of this discussion, a key point to note is that, once a threat reaches above NIJ Level III, composites must be combined with another material, i.e., ceramics or metals, to adequately diffuse the threat. (A complete copy of the NIJ standard can be downloaded in PDF format at www.ojp.usdoj.gov/nij/pubs-sum/183651.htm.)

Wagner credits its performance to Honeywell’s gel spinning process. Unlike other fiber spinning processes, gel spinning involves not only melting the polyethylene polymer, but also dissolving it with solvent to facilitate realignment of the molecular chains and then extracting the solvent, explains Wagner. The result is a very high degree of orientation with minimum folding of molecule chains, which optimizes fiber strength. According to Honeywell, Spectra fibers exhibit a tensile modulus between 900 g/d (grams per denier) and 1,500 g/d, compared to a tensile modulus of less than 500 g/d for steel, E-glass and S-glass. “We have yet to reach the top level of strength for the fiber,” Wagner maintains. “We have a large research effort to drive Spectra fiber higher.”

Armoring vehicles on the assembly line

While retro kits for vehicles already in the field have accounted for a significant portion of the armor market in the past five years, the trend today is to integrate armor into new vehicle structure, during the design stage, both to save weight and reduce overall cost.

A notable example is the David armored vehicle from the Armor Div. of Arotech Corp. (Auburn, Ala.). Shorter, lighter and narrower than an armored Humvee, the 3.7-ton (7,400 lb) David holds a crew of seven and is designed to maneuver easily in urban combat situations. It debuted in 2004, offering integrated 360° protection against point-blank assault rifle fire and short-range armor-piercing rounds as well as limited IED protection. A mix of low-cost fiber-reinforced polymer (FRP) and advanced composite armor components — including DuPont Kevlar and Dyneema high-modulus, high-strength polyethylene fibers from DSM (Heerlen, The Netherlands — were designed into the entire cabin, including front and rear doors, by Arotech’s MDT Protective Industries unit. Currently built on a Land Rover Defender platform, the David also can be built on a Mercedes G Wagon platform. In spring 2006, MDT inked a $22 million (USD) deal with the Israel Defense Force (IDF) for the ultra-light combat vehicle.

Meanwhile, AGY (Aiken, S.C.) is outfitting vehicles with its trademarked S-2 Glass armor systems in Europe. First used by U.N. peacekeepers in need of protection against sniper fire and land mines in Bosnia, CAV 100 armored vehicles, for instance, seat six in an all S-2 Glass-reinforced compartment. Made by high-pressure compression molding, the cabin components provide substantial protection against threats from fragmentation, high-velocity small arms and blast threats, according to AGY; a fully armored vehicle, built on a Land Rover frame, reportedly weighs no more than the Rover’s unarmored street version.

S-2 Glass — the only S-glass fiber produced in the U.S. — entered the ballistic armor market in the 1980s. The defense market looked at S-2 Glass fibers as a replacement for spall liners made with aramid. AGY’s new business development manager, David Fecko, says AGY’s S-2 Glass fibers offer better fire/smoke/toxicity (FST) characteristics and no water absorption at a lesser cost. S-2 Glass also is suitable for integrated vehicle armor because it can, in a composite, support structural loads.

The magnesium aluminosilicate chemistry of S-2 Glass yields more desirable mechanical properties than E-glass. According to Fecko, S-2 is about 2 percent lighter, 40 percent stronger and 20 percent stiffer than E-glass, with strain-to-failure of 5.5 percent.

AGY material is currently being used the U.S. Army’s Humvee, the Striker vehicle, light armored vehicles (LAV) and expeditionary fighting vehicles (EFV). The company has tested its material to all NIJ threat levels. AGY works with a host of resin suppliers, including Hexion Specialty Chemicals (Columbus, Ohio), Georgia Pacific Resins Inc. (Atlanta, Ga.) and prepregger Lewcott Corp. (Milbury, Mass.), which makes its own phenolic resin. AGY also has worked with CoorsTek (Golden, Colo.) to test its material with ceramic tiles, which are needed to stop armor piercing rounds, or impacts above the NIJ 4 threat threshold.

Polystrand (Montrose, Colo.) is taking a different tack in the vehicle armor market, using more conventional and less expensive fibers in easily processed thermoplastic matrices. The company’s ThermoBallistic line of structural laminates consists of three offerings: ThermoBallistic-E combines continuous E-glass with Polystrand’s proprietary polypropylene (PP) thermoplastic polymers. ThermoBallistic-S is reinforced with S-glass. An aramid ballistic-grade laminate also is available. The products feature cross-plied (0°/90°) fabric and are available in sheets or rolls. To meet NIJ Standard 0108.01 Level IIIA Requirements of V0 (1400 ft/sec, +/-50 ft/sec) threat level, which is equivalent to the threat posed by a 9 mm handgun, a 3.4 lb/ft2 Polystrand E-glass material is required, while the company’s S-glass version offers the same protection at 2.5 lb/ft2. The latter makes a lighter ballistic panel, says Polystrand president Ed Pilpel, who notes that the company’s product generally is combined with other materials, such as ceramic or steel, when armor must meet a greater threat, which is typical for the use of composites in this sector. “The use of a ceramic strike face with a composite backing is common,” Pilpel explains.

Pilpel points out that high pressures are not needed to process a thermoplastic. Although 2,000 psi to 3,000 psi (137.9 bar to 206.84 bar) are needed to consolidate a thermoset, Polystrand materials achieve equivalent ballistic results at 100 psi/6.89 bar. The company also asserts that its Thermo- Ballistic line meets a Level IIIA requirement of V0 at aerial weights similar to those for thermoset materials. Pilpel says that the velocity at which a bullet penetrates an armor panel of a given areal density half of the time (50 percent) is referred to as the V50. “The V50 determination is a common method for comparing the ballistic performance of different materials,” he says. Polystrand’s material is used by ArmorWorks (Tempe, Ariz.) to create the M915 Tractor Cab for the U.S. military’s over-the-road truck. The M915’s armor protects occupants against small arms fire, IEDs and roadside bombs, according to ArmorWorks. Pilpel also believes thermoplastics are an attractive material for the ballistic armor market because they emit no volatile organic compounds (VOCs) and are recyclable. “One of the reasons Polystrand entered into thermoplastics in the first place was we felt, long-term, that we could answer environmental concerns with this technology,” he explains.

DARPA is funding projects to create innovative armor systems for military vehicles. The group has gone as far as to call individuals and companies to participate in the DARPA Armor Challenge, which is aimed at identifying promising new armor systems, DARPA says.

One beneficiary is Hardwire LLC (Pocomoke, Md.) which has used the funding windfall to further develop Hardwire’s HD Armor systems, a hybrid metallic/composite solution that reportedly offers the same or better protection performance as existing metal armor systems, but at a lighter weight. The solution, according to DARPA’s Christodoulou, brings production technology already proven in the automotive industry to the DoD, which could open a pathway to higher volume production. “DARPA has a continuing commitment to investigate approaches that will provide high-performance, lightweight, affordable ballistic production for our deployed forces,” says Christodoulou.

DARPA is testing a number of different materials, processes and resins in an effort to map out a space for the Hardwire HD Armor, which uses a patented unidirectional high-tensile reinforcement fabric that offers mechanical properties in line with that of carbon fiber. Initial data indicates, according to Christodoulou, that using a composite that incorporates a fine metal wire reinforcement can obtain ballistic performance that can give the same protection as conventional metal armor at a reduced weight. While the Hardwire material may be suitable for various ballistic applications, DARPA is interested in the material for vehicle armor.

Hardwire armor, says John Hammond, the company’s VP of business development, can be processed by a variety of methods, from hand layup to vacuum infusion to pultrusion, depending on the application. “Composites can offer unique advantages over solid metal, such as light weight and differential performance,” says Hammond, but he contends that composites are attractive as long as they remain affordable. Hardwire believes it has gotten the affordability quotient right: Its steel wire fabric runs between $0.75/ft2 to $2.50/ft2 depending on how much reinforcement the customer needs for its application.

Phase II of the DARPA program, which is designed to advance the technology into real application work, will extend over a 20-month period, encompassing fiscal 2007 and 2008.

T.E.A.M. Inc. (Slatersville, R.I.), a weaver that concentrates on the manufacture of two- and three-dimensional fabrics for armor applications, sees promise in the area of three-dimensional (3-D) fabrics for vehicle armor systems, especially to achieve multiple-hit performance. T.E.A.M president Steve Clarke asserts that 3-D woven fabrics can withstand multiple hits because their z-directional fibers tie all the plies together, which makes the material a candidate for next-generation vehicle systems. The company uses a high-speed rapier-type weaving machine to weave fabrics as thick 1.5 inches/38.1 mm. Typical standard woven roving used in ballistic is a 5×5 construction, according to Clarke, who says T.E.A.M. is moving towards 300×300 construction.

In tests, T.E.A.M’s 3-D multilayer glass fiber fabrics have been used to reinforce Humvee hoods produced by TPI Composites (Warren, R.I.) using the SCRIMP process, a patented variation on the vacuum-assisted resin transfer molding (VARTM) process. The design process is being driven by the need to make the hoods structural, as well as formable. To date, a few thousand hoods have been formed, but the project has not yet moved into full production. “3-D fabrics often get stuck in the development cycle,” he says, noting that the need for multi-hit performance is expected to drive future advances. “We would like to see growth in the area of multilayer 3-D structures,” Clarke says. T.E.A.M. also is working with the U.S. Army Research Laboratory (ARL, Adelphi, Md.) to further develop its 3-D fabrics for the ballistics market.

A newer fiber, known as M5, is said to offer greater compression strength than aramid fibers, at a lighter weight. M5 was developed in the 1990s by Akzo Nobel (Arnhem, The Netherlands). In 2001, Akzo sold off its fiber business to a Japanese firm, but Magellan Systems International (Richmond, Va.) bought the M5 patents and laboratory, and hired Dr. Doetze Sikkema, the fiber’s inventor. With the aid of the U.S. Army’s Natick Soldier Center (Natick, Mass.), Magellan relocated the lab to Richmond and partnered with DuPont Advanced Fiber Systems to build a small scale (20 to 60 tons/year) pilot plant on the site and has since been at work on a full-scale production plant. The U.S. Army has been testing the fiber at Natick since 2001. In the 2007 appropriation cycle, Magellan intends to request additional U.S. Congressional support under the Defense Production Act Title III Program for the creation of a commercial-scale facility.

Magellan declined to comment for this article, saying the company is addressing some technical issues that are commonly associated with the scale-up and commercialization of high-performance fibers, but in testimony before the House Armed Services Committee’s Subcommittees on Tactical Air and Projection Forces (June 29, 2005), Magellan maintained that, based on Army tests, the M5 fiber could offer a weight savings of up to 40 percent in body armor systems, yet provide greater protection than other fibers.

Armoring the soldier on the ground

Beyond vehicles, body armor is another growing area for composites. The war in Iraq has put soldiers in more intimate contact with the enemy, which means they need more protection.

According to Wagner, Honeywell’s Spectra Shield composite has helped fill a growing need for expanded small arms protective inserts (ESAPI) — strike plates that fit into pockets sewn into soldiers’ vests. The plates, which are standard issue for every soldier in combat, consist of a ceramic strike face with a Spectra Shield spall liner. The ceramic breaks up a bullet or turns it on its side to diffuse its impact force and rob it of its velocity, while the liner serves as a “fragmentation energy catcher.” “Spectra Shield helps absorb and dissipate energy and catches fragments,” explains Wagner. Spectra Shield composite is a flexible, cross-plied (0°/90°) nonwoven impregnated with thermoplastic resin to optimize its impact absorption characteristics. (Thermoset resin is used to make helmets and other applications requiring more rigidity, according to Wagner.)

One area of growth is in side body panels made from Spectra Shield, which extends the coverage beyond a breast and back plate, says Wagner.

Honeywell also offers an armoring material, Gold Shield, which is used in protective body applications. The product is created by laying parallel strands of aramid fiber side by side and then bonding them in place with an advanced resin system, according to the company. Since May 2006, more than 84,000 vests featuring the Gold Shield product have been ordered for the Afghan National Army.

DuPont’s Kevlar also is used in protective vests for the military. Kevlar, combined with a thermoset resin, is a material of choice for helmets because, according to the company, helmets made of Kevlar are 25 to 40 percent more resistant to fragments than steel helmets of equal weight. Helmets must hold their shape and withstand impact — but also support a soldier’s weight if he sits on it, says DuPont’s Chang. “Structural performance is not always associated with ballistic performance, but it is still important for function.”

On the horizon

Composites use in ballistic protection is ramping up, according to AGY’s Fecko, noting that history has shown that where weight savings is needed, composites are used. Fecko believes the armor systems market will gravitate toward composites use for combat and support vehicles because of a growing need for fuel efficiency, maneuverability and transportability. “Forty percent of the vehicle traffic in Iraq is to supply water and fuel for vehicles already out [in the field], so if we can make our vehicles more efficient, it will decrease traffic,” Fecko says, and decrease the likelihood of a landmine going off.

Polystrand’s Pilpel believes the composite armor market is looking for lighter materials right now, as the war in Iraq continues to create demand for armor kits. “On the horizon, customers will be looking for more integrated, vehicular platforms that incorporate ballistic and structural performance,” Pilpel says.

“Composites provide a tremendous opportunity for armor systems,” says DARPA’s Christodoulou. “Only small changes can be made to metal, while composites offer more opportunity for design configurations.”

As military armorers discover what the aerospace market already knows, we should see increasing integration of composites in a variety of protection applications.

— Susan Rush, Contributing Writer

Related Content

Natural fiber composites: Growing to fit sustainability needs

Led by global and industry-wide sustainability goals, commercial interest in flax and hemp fiber-reinforced composites grows into higher-performance, higher-volume applications.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

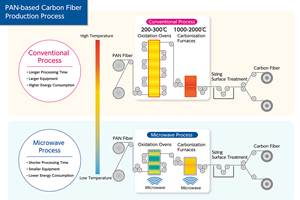

Read MoreMicrowave heating for more sustainable carbon fiber

Skeptics say it won’t work — Osaka-based Microwave Chemical Co. says it already has — and continues to advance its simulation-based technology to slash energy use and emissions in manufacturing.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More