Tracking energy costs and resin prices

The price of crude oil has, over the past year, dropped precipitously, and resin prices have, as a result, stopped going up. CW editor-in-chief Jeff Sloan asks what this might mean to the composites professional.

Back in April 2011, we started publishing on the CW Web site a report titled, “Composite resins price change report,” a running list of resin matrix price increase announcements. These announcements, typically submitted by manufacturers of “industrial” resins like polyesters, vinyl esters and gel coats, usually go something like this:

“Company XYZ, all unsaturated polyester resins, vinyl ester resins and ancillary products, in Europe, increase by €80/metric ton. Effective for all orders shipped on or after June 8, 2015.”

Included with each announcement, but not published in our running list (which you can find it here), is a statement of some sort from the manufacturer, justifying the price increase. It usually goes something like this:

“‘A sharp increase in the pricing of our key raw materials has left us no choice but to raise the prices of our products as a result,’ explains Joe Smith, Company ABC sales director.”

It goes without saying, I suppose, that price changes are always increases — we’ve not received a price decrease announcement in the 10 years that I’ve been CW editor. Further, since we started this report, I’ve noticed a striking trend: Price change announcements tend to come in waves. That is, I will receive a press release from one supplier announcing a price increase; this will be followed within a few days by press releases from other suppliers, announcing similar increases for similar products.

If you study the CW “Composite resins price change report” for just a few minutes, you can easily detect this “clumping” of price change announcements. You will notice that since 2011, prices have increased, on average, every other month or so. This is not universally true for every resin supplier, but there is a certain regularity in the frequency of price increases.

What drives resin pricing, in part, is the cost of feedstocks (the “raw materials” cited above by our fictional Joe Smith), which are derived primarily from petroleum-based products. So, as oil and natural gas prices rise, so do the prices of the resins derived from them. Of course, as we are all keenly aware, the price of crude oil has, over the past year, dropped precipitously. As I write this, in mid-November, crude oil costs about US$41/barrel. And, according to the US Energy Information Admin. (EIA), crude oil costs will remain in the US$45-$50/barrel territory through 2016.

Given this, it should come as no surprise that it’s been some time since I’ve received a resin price increase announcement. In fact, the last one was July 15, 2015. This represents the longest time we’ve gone without a resin price increase.

What does this mean to you, the composites professional who has to pay for these resins? The upside is that your material and transportation costs are, likely, relatively stable, which makes budgeting and planning more manageable. However, if you are a composites fabricator who supplies parts and structures to the oil patch, the news is not so good. The number of new wells tapped in the US has dropped in proportion to the decrease in crude oil prices, which means reduced demand for composite piping and downhole supplies like hydraulic fracturing plugs.

On top of this, some of the same suppliers that produce the polyesters and vinyl esters at issue here are also working on bio-based resins that are designed to help ween the composites industry of its dependence on petroleum. Technical editor Sara Black explores these products this month (see "Green resins: Closer to maturity," under "Editor's Picks" at top right); her research reveals that bio-based resins are the target of strong R&D work that shows great promise, but low oil prices are making the price premium for bio-resins difficult for customers to swallow.

However this drop in energy prices affects you, it is understood that nothing is permanent — change is always not far away. And we’ll keep an eye on those resin prices and let you know when that change arrives.

Related Content

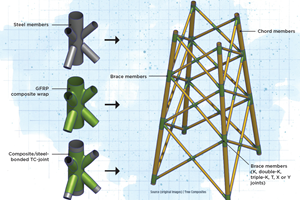

Novel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRTM, dry braided fabric enable faster, cost-effective manufacture for hydrokinetic turbine components

Switching from prepreg to RTM led to significant time and cost savings for the manufacture of fiberglass struts and complex carbon fiber composite foils that power ORPC’s RivGen systems.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

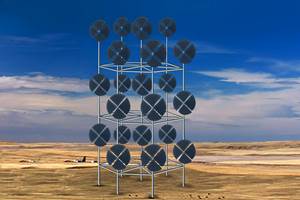

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreRead Next

Green resins: Closer to maturity

As more players approach the market, R&D expands, but overall market growth in the composites arena is still slow but steady.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More