WINDPOWER 2012 report

Continued technology-driven performance gains are overshadowed by PTC gloom and predicted Asian overcapacity.

Attendance was down at the American Wind Energy Assn.’s (AWEA) 2012 WINDPOWER Conference and Exhibition (to 11,000 from 16,000 last year) as the U.S. wind industry braced for a stall due to the lack of U.S. Congressional action to renew the Production Tax Credit (PTC, see the sidebar titled "The PTC: Symptom of policy uncertainty," at the end of this article, or click on its title under "Editor's Picks," at top right). But AWEA CEO Denise Bode noted that the show, held June 3-6 in Atlanta, Ga., “met our expectations for our first entry into the South,” and added, “we’re excited now about our return next year to Chicago, which is where we held the world’s biggest-ever WINDPOWER Conference and Exhibition, in 2009.” But Henrik Hansen, business manager for Jupiter Group A/S (Bogø, Denmark), a supplier of high-quality composite nacelles and spinners, spoke for many who are interested in the U.S. wind market: “Next year will be a matter of survival,” he said. “Only the strong will make it through. Hopefully, the PTC will be renewed by 2014.”

Though attendees were not as numerous, exhibitors — particularly Chinese and Korean manufacturers of wind turbines and rotor blades — were abundant.

Many Asian firms operate in the U.S. via acquisitions — such as DeWind, acquired in 2009 by Daewoo Shipbuilding and Marine Engineering (DSME, Seoul, South Korea) — or as foreign-owned U.S. subsidiaries, such as Goldwind USA (Chicago, Ill.). The larger Asian conglomerates are establishing U.S. wind turbine sales offices through affiliate companies, mostly in construction. For example, Doosan Heavy Industries America Corp. (Fort Lee, N.J.) is a subsidiary of Doosan Heavy Industries & Construction (Changwon, South Korea), and SANY Electric Co. Ltd. (Beijing, China) is marketing in the U.S. through SANY America, incorporated in 2006 as a subsidiary of SANY Heavy Industry, based in a new heavy equipment assembly plant and headquarters in Peachtree City, Ga. But they, too, anticipate difficulty in the U.S. According to RECHARGE magazine, SANY has sold 26 of its 2 MW turbines for installation in the U.S., but a company official noted, “We don’t have 2013 projects right now as this will depend on extension of the Production Tax Credit.” He also says SANY is not considering a U.S. wind turbine plant at this time.

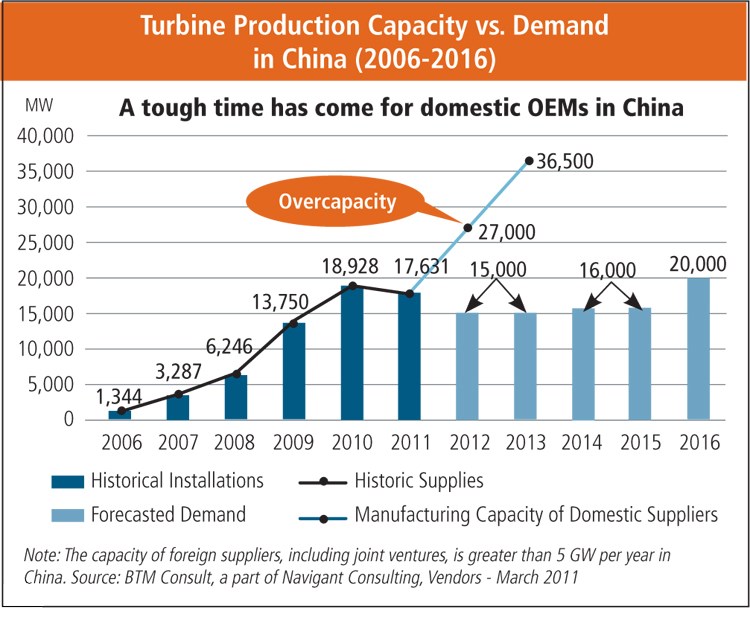

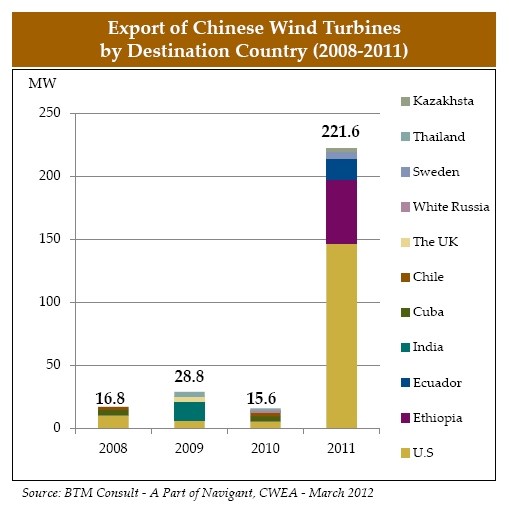

Asian interest in the U.S. market is poised to increase because the Chinese market has slowed dramatically. China’s government has removed subsidies and tightened regulations, seeking to curb “blind expansion” of wind, because more than 15 GW (24 percent) of installations at the end of 2011 still were not connected to the grid. In his WINDPOWER 2012 presentation on the Chinese wind power market and its players, Feng Zhao, an analyst with BTM Consult (Copenhagen, Denmark), a consulting services firm of Navigant (Boulder, Colo.), estimated that Chinese turbine manufacturers face 27 GW of overcapacity in 2012, growing to 36.5 GW in 2013 (see chart). Zhao also noted that the average price of Chinese 1.5-MW turbines has dropped 42 percent since 2009. He states that in the past four years, 11 Chinese OEMs have exported 194 wind turbines — the U.S. is the favored destination with 59 percent of the installations — while the 222 MW exported in 2011 exceeded by three times the 2008 to 2010 total. Zhao says by the end of 2011, Goldwind (Beijing, China) accounted for more than 70 percent of these. Lest anyone come away with an incorrect assumption about U.S. jobs, a Goldwind USA spokeperson assured CT that “the majority of our turbines’ major components are sourced domestically.” And in his WINDPOWER 2012 presentation, Nurdin Bi, VP of Goldwind Capital USA Inc., indicated that more than 60 percent of the wind turbine components used in the company’s 109.5 MW Shady Oaks wind farm project (Illinois) were made in the U.S., which he claims “is higher than many non-Chinese projects here.” Goldwind Science & Technology Inc. is focused on aiding international expansion by building a flexible global supply chain via a local sourcing model. Goldwind has sourced blades from Kolding, Denmark-based LM Wind Power’s North Dakota plant, and would consider a U.S. blade plant of its own, if there weren’t uncertainty about U.S. government wind energy policy.

Industry sources worldwide claim that technology is playing an ever-increasing role in supply decisions. In its report Turbine Technology Unlocks New Market Opportunities, IHS Emerging Energy Research (Cambridge, Mass.) shows that taller towers (90m to 100m or 295 ft to 328 ft) and larger diameter rotors are gaining adoption due to increased net capacity factors and efficiency. In turn, these more optimized turbines are creating opportunities in regions with historically poor wind power economics. Mark Higgins, COO of the U.S. Department of Energy’s (DoE) Wind and Water Power Program, touted DoE’s support for technology development, explaining it as his organization’s major role in helping the industry overcome market and transmission barriers. These include wind energy’s higher levelized cost of energy (LCOE), defined as the price at which electricity must be generated from a specific source to break even, including all costs over its lifetime: initial investment, operations and maintenance, cost of fuel and cost of capital. DoE’s LCOE goal is not just parity with natural gas (6.0 cents/kWh), but full market cost competition without subsidization (estimated 4.2 to 4.8 cents/kWh). It seeks to do this via two major thrusts: establish an offshore wind industry and optimize wind farm performance via improved technology. DOE has awarded $180 million for six offshore wind deployment demonstration projects and $34 million for 25 Innovative Technology projects, including development of an open-source wind turbine design suite for next-generation designs and technologies to mitigate wind turbine impact on aircraft radar systems and wildlife. Higgins pointed out that it took GE Energy (Greenville, S.C.) 10 years to adopt hybrid glass and carbon fiber blade construction based on a 2001 DoE program, and that sizeable gains have been made and will continue to be made, stressing that clearing the barriers will release a backlog of 275 GW in U.S. wind power projects.

Composites-specific technologies on display at WINDPOWER 2012 included a 43.5m/143-ft blade for 1.5 MW turbines, built by We4Ce (Almelo, The Netherlands). Based on the firm’s 25 years of experience in the design and manufacture of composite rotor blades, the new blade is intended for Asia’s lower-wind regions. It features a slender design, a high optimum-tip-speed ratio and a maximum chord of only 2.5m/8.2 ft.

Aeroblade (Vitoria, Spain) exhibited its designs and manufacturing capability for 10 different blades, ranging from 37m to 80m (121.4 ft to 262.5 ft) for turbine capacities of 1.5 MW to 7 MW. Aeroblade is a supplier to Gamesa (Zamudio, Vizcaya, Spain) and Goldwind, among others. Although its main strength is engineering services and blade development worldwide, it also has manufacturing capability and uses epoxy resin, glass fiber and infusion, employing carbon fiber for blades longer than 68m/223 ft.

Energetx Composites LLC (Holland, Mich.) announced that it manufactured and shipped a set of wind blade molds to Aeroblade, based on its 2010 license of Aeroblade’s 45.3m/143-ft IEC Class IIA design. Energetx expected to ramp up production of the same blade this month, supplying an undisclosed North American OEM. Energetx provides design, engineering, tooling, prototype and production services, enabling a single-source solution for structural composites, and has established a manufacturing system that uses Six Sigma tools, such as Process Failure Mode Effects Analysis (PFMEA) and Control Plans, as well as an ISO 9001-2008/AS9100C-based quality system.

Wetzel Engineering (Lawrence, Kan.) offered attendees full design and engineering of blades from 3m to 100m (9.8 ft to 328 ft) for turbines rated 6 kW to 10 MW. The company has developed designs for hybrid carbon/glass fiber blades that feature torsion bending-coupling, twist-bend coupling and other aeroelastic optimization.

DTU Wind Energy (Roskilde, Denmark) touted a wide array of research initiatives within its Composites and Material Mechanics section, headed by Dr. Bent F. Sørensen, including biomass-based and hybrid composites, structural health monitoring and the manufacturing of prototype smart blades that incorporate shape-changing composite structures and embedded sensors.

Astraeus (Eaton Rapids, Mich.), a partnership between Dowding Industries (also in Eaton Rapids) and machinery manufacturer MAG IAS (Sterling Heights, Mich.), will automate blade and spar cap manufacturing using carbon fiber and other composites. In what will be the first implementation of MAG’s Rapid Material Placement System (RMPS), Astraeus aims to bring integrated manufacturing with repeatable process control to wind blade fabrication, lowering the overall cost of its finished blades.

Established in 1985, BACH Composite Group (Hurup, Denmark) is a supplier of composite housings and nacelles for Vestas Wind Systems A/S (Randers, Denmark) wind turbines. It has factories in Denmark, Spain, Lithuania, India, China and the U.S. (Colorado), which use closed molding processes exclusively. One of its newest applications is a 12m/39.4-ft-high deflector used in seabed mapping. These units must be very strong and rigid, spaced 1.8 km/1.1 miles apart, one on each side of expensive and fragile seismic instrument arrays. The hollow structure with an integrated cross-bulkhead is produced as one piece via an innovative one-shot process, using glass fiber, vinyl ester resin and gel coat for maximum saltwater resistance.

Although hand layup is predominant in turbine nacelle production, Jupiter Group has been using light resin transfer molding (RTM) for 22 years. The manufacturing takes place in global low-cost regions (the largest factory is in China) and then parts are transported as needed. Modularized pod construction makes it possible to ship two entire nacelles for a 1.5 MW wind turbine in one 40-ft/12.2m container (each pod is about 2m/6.6 ft high by 12m/39.4 ft long). Each nacelle project begins with a unique OEM-specified outer surface definition and shape, which is very distinct and recognizable. Jupiter applies load cases and calculations to determine the laminate design, and then the nacelle is split into modules for mold fabrication. Nacelle molds are gel coated and then layed up with glass fiber chopped strand mat (a print-through barrier layer), followed by noncrimp glass fabrics and a core of polyester foam, polyurethane foam or balsa wood. The matched metal molds are closed and heated, then polyester resin is injected, with assistance by a vacuum, and cured. Prototypes are made and tested to meet Germanischer Lloyd (GL) and Det Norske Veritas (DNV) regulations.

After its incorporation in 2000, KM (Gunsan, South Korea) pursued wind blade design and production, where others had failed, as a government project in 2002. With GL certification of its 24m/79-ft blade for 750 kW Class I turbines in 2005, KM moved on to offer a full line of blades, each made with glass fabrics from Owens Corning Composite Solutions Business (Toledo, Ohio), epoxy resin from Momentive Performance Materials Inc. (Columbus, Ohio), and cores and resin infusion processing from Diab International AB (Laholm, Sweden) or Alcan Baltek, div. of 3A Composites (Mooresville, N.C.). KM is now performing fatigue tests on a 48m/157-ft blade for a 3-MW Class IIA turbine and is developing a 68m/223-ft blade for a 5.5 MW offshore wind turbine, both for Hyundai Heavy Industries (Ulsan, South Korea). KM has collaborated in the past with blade design firms, such as Aeroblade and WINDnovation (Berlin, Germany). KM also produces the 44m/144-ft blades for Doosan Heavy Industries’ (Seoul, Korea) WinDS3000 onshore/offshore 3 MW turbine, and the company often collaborates with its customers in developing blade designs. It has also worked with design firms such as Aeroblade and Wetzel Engineering Inc.

Related Content

PEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreFrom the CW Archives: Airbus A400M cargo door

The inaugural CW From the Archives revisits Sara Black’s 2007 story on out-of-autoclave infusion used to fabricate the massive composite upper cargo door for the Airbus A400M military airlifter.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreSmartValves offer improvements over traditional vacuum bag ports

Developed to resolve tilting and close-off issues, SmartValves eliminate cutting through vacuum bags while offering reduced process time and maintenance.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;maxWidth=300;quality=90)