Editorial - 1/1/2005

Nearly every issue in 2004 contained a discourse, by either one of our columnists or me, on the supply/demand issue surrounding carbon fiber -- a hot topic critical to both material suppliers and end users. My November editorial elicited a larger-than-usual response, both pro and con. If you'll recall, it concluded

Share

Nearly every issue in 2004 contained a discourse, by either one of our columnists or me, on the supply/demand issue surrounding carbon fiber -- a hot topic critical to both material suppliers and end users. My November editorial elicited a larger-than-usual response, both pro and con. If you'll recall, it concluded that although demand is growing rapidly, fiber manufacturers were adding enough capacity this time to smooth out what might otherwise be a boom-and-bust cycle similar to those that have plagued the carbon fiber composites business in the past. While some readers thought I was right on, many thought the projected growth was way too low -- and they may be right.

That's certainly the opinion of Ben Rasmussen, whose "Market Trends" column appears on p. 9. The demand projections I used were averages taken from those made by fiber manufacturers and marketing experts at the Intertech Carbon Fiber Conference (held Oct. 18-20, in Hamburg, Germany). To come up with my rough supply numbers, I used published statistics with a 10 percent knockdown factor and a generous 40 percent reduction of 12K nameplate capacity to account for "product mix." When I did the initial calculations, I was surprised. I expected to find evidence of an impending shortage. Yet even if the growth projections are conservative and the supply numbers rough, they don't reveal a drastic imbalance in the next two years, unless there is a boom in demand that is unprecedented in past history. Will we need even more capacity soon? Yes, so fiber manufacturers must continue to invest. However, I agree with Ben that we don't have dependable ways to measure the total international capacity and true demand for fiber, and he may be right in predicting that the big boom is right around the corner. What's your opinion?

The "product mix" of articles in this issue of HPC is telling. The article on p. 26 discusses the demand for physical security products. This market is projected to grow at a rate of 14 percent per year for the next eight years. Composites are key -- various combinations of tough resins and high strength fibers provide ballistic protection in products ranging from personal body armor to "up-armored" vehicles. These applications have been much in the news lately and growth in this market is virtually a sure bet. (Watch for our follow-on story next issue, devoted to blast protection).

Every part that goes into a 21st Century military aircraft has to be stronger and lighter than ever before. In "Inside Manufacturing" (p. 38), engineers reveal how they designed and built ultra-complex cartridge guides that meet the weight, temperature and dimensional-stability requirements of a new weapons system, using a low-cost combination of compression molding and structural carbon SMC. Through excellent design and knowledgeable selection of materials and manufacturing method, these engineers prove, once again, that composites can earn their way into new products previously made exclusively of metal.

Two other feature articles, one covering the design and manufacturing technique used to make elegant one-piece yacht steering wheels (p. 44) and the other taking in a wide variety of "cool" consumer products (p. 20), prove that key elements we've all been waiting for are coalescing to make the future for advanced composites look bright. New and various manufacturing techniques are being perfected, and designers are learning to select the right material combinations and manufacturing methods to optimize composites performance, at prices people are willing to pay. Composite materials are coming down from their aerospace pedestal and proving their down-to-earth worth. Lets hope we can keep the supply side in balance and the price right.

P.S.: The 2005 SOURCEBOOK is up and running on our Web site. See for yourself when you log on to www.compositesworld.com.

Related Content

PEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreCOMPINNOV TP2 project promotes use of thermoplastics in aerospace

Completed in 2023, COMPINNOV TP2 explored thermoplastic composites, enhancing the understanding between prepregs and production methods to foster the potential for French aerospace innovation.

Read MoreMFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

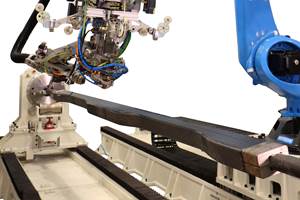

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MoreSmartValves offer improvements over traditional vacuum bag ports

Developed to resolve tilting and close-off issues, SmartValves eliminate cutting through vacuum bags while offering reduced process time and maintenance.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;maxWidth=300;quality=90)