From the Publisher - 11/1/2007

I’ve been in the field a lot lately, and I’ve sensed a ground swell of activity around carbon fiber. End users tell me they are not having the difficulty getting fiber (with the possible exception of 3K) that they experienced at this time last year. And the future supply looks even better. This is no big surprise:

Share

I’ve been in the field a lot lately, and I’ve sensed a ground swell of activity around carbon fiber. End users tell me they are not having the difficulty getting fiber (with the possible exception of 3K) that they experienced at this time last year. And the future supply looks even better. This is no big surprise: Every major carbon fiber producer is investing big money in capacity expansion. (See “Carbon fiber producers ….” in “Related Content” at left, for details about announced expansions.) The largest international carbon fiber producer, Japan’s Toray Industries — alone — will have nearly 50 million lb of nameplate capacity by 2009. That is only 10 million lb short of meeting the total worldwide demand recorded in 2006. But such increases will be necessary to meet demand that is projected to grow from 12 to 15 percent per year for the next decade.

It seems that companies from Canada, China, India and Saudi Arabia are sizing up entry into the carbon fiber market as well. While at the China Composites Expo in Beijing last month, I discovered that the northern coastal city of Dalian, a center for emerging technology and international outsourcing, has produced two carbon fiber producers: Xingke Carbon Fiber Co. and Sinosteel Jilin Shezhou Carbon Fiber. Each claims to be making 1K, 3K, 6K, 12K and heavy tow. Scott Stephenson and I met with a representative of Dalian Xingke who claims the company holds several patents in areas of manufacturing technology. We found info on two other Chinese companies gearing up to produce fiber usually for their own use.

Although these producers are starting small with million-pound-or-less capacity lines, they have big plans. Last week the China Daily reported that a delegate to the 17th National Congress of the Communist Party of China from the port city of Lianjungang announced that the Yingyou Group has a carbon fiber production facility there that plans to produce 22 million lb annually by 2010. They also intend to become a regional powerhouse in the production of windblades.

Our “Market Outlook” feature on aircraft production in China (see “Boeing, Airbus fuel ….” in “Related Content,” at left) provides a great compilation of the manufacturing partnerships that Boeing, Airbus and other aircraft manufacturers have established with Chinese aerospace companies to produce both composite and metal parts. Although Boeing and Airbus have slightly different strategies in China, it is clear that China is becoming a major producer of aerospace composites, with production of critical primary structure on the horizon.

I think this unprecedented new capacity bodes well for our industry. I know there are those who fear we could be heading for another cycle of excess capacity and falling profits like we’ve experienced in the past. But adequate capacity and stable pricing may well open the door to the applications we’ve been courting for so long but lose every time demand from the aerospace market jumps and fiber prices soar. These applications represent immense potential — manufacturing of offshore oil drill pipe alone could require millions of lb of fiber every year. Then there are huge wind blades, infrastructure applications and unnumbered industrial applications, not to mention the big need in the automotive industry to lightweight its vehicles and improve fuel economy.

While we’re on the subject of carbon fiber, don’t forget that COMPOSITESWORLD’s Carbon Fiber Conference is coming up December 5-7 in Washington. DC. There is still plenty of time to register. We’re looking forward to seeing old friends there and meeting new people from around the globe who have a stake in the future of carbon fiber.

See you there.

Related Content

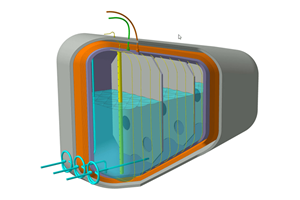

NCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

Read MorePolar Technology develops innovative solutions for hydrogen storage

Conformable “Hydrogen in a Box” prototype for compressed gas storage has been tested to 350 and 700 bar, liquid hydrogen storage is being evaluated.

Read MoreCollins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More