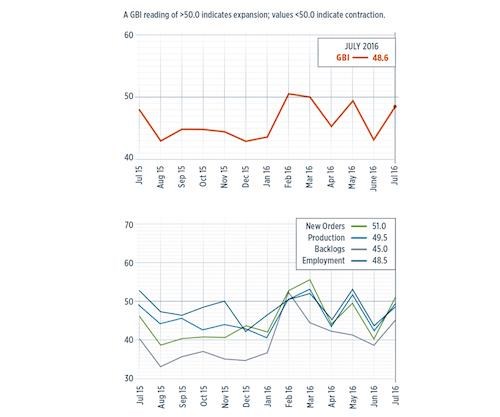

Gardner Business Index at 48.6 in July

Future capital spending plans measure up 53% compared with the same time period in 2015.

With a reading of 48.6, the Gardner Business Index showed that the composites industry contracted at a significantly slower rate in July than it did in June. However, the index was still on a slight downward trend, continuing a slide that had begun in February.

New orders, however, expanded for the first time since March. Although this subindex had experienced a significant spike followed by a dip, the general trend in the new orders subindex had been upward since August 2015. The production subindex contracted in July for the second month in a row and had been trending down since March. The backlog subindex also contracted, and did so for the fourth straight month. But, as a result of the trends in the new orders and production subindices, the backlog subindex at the end of July generally had improved since August 2015. The employment subindex contracted for the third time in four months. Exports were virtually flat in July, but maintained the highest level for that subindex since June 2014. The trend in exports had been moving up noticeably since November 2015. Supplier deliveries in July shortened for only the third time since the GBI Composites survey was first reported in December 2011.

The materials prices subindex had increased, as July closed out, at a consistently high rate since April of this year. Other than a spike in July 2015, it was the fastest increase in materials prices recorded since November 2014. Prices received decreased for the tenth month in a row. The future business expectations subindex, as July came to a close, had been fairly flat for five of the preceding six months.

Among composites fabricators, on average, those with plants employing more than 250 employees contracted in July for the eighth straight month. Facilities with 100-249 employees contracted for the second straight month. Companies with 50-99 employees had expanded four of the past six months. Facilities with 20-49 employees contracted after similarly growing in four of the previous six months. Manufacturers with fewer than 20 employees contracted for the fifth month in a row.

The aerospace industry expanded in July for the fourth time in six months. While the aerospace industry has performed well for composites fabricators recently, the automotive industry has contracted in each of eight consecutive months. This mirrors motor vehicle and parts consumer spending, which at the end of July had contracted in five of the previous six months.

Future capital spending plans were almost at what has been, over time, an average level in July. Compared with the same time period one year earlier, future capital spending plans were up by 53%. Month-over-month, they had increased in four of the preceding five months. The annual rate of change had contracted in July at a decelerating rate since February, which was a positive sign for the composites industry.

Related Content

-

Farnborough Airshow 2024 brings together aerospace innovation, collaboration

The week-long international airshow provided a hub for new announcements made by Boom Supersonic, Airbus, Boeing, GKN, GE, ZeroAvia, Eve, Bell, VoltAero, Eve and Lilium. CW has compiled several below.

-

Orbital Composites wins AFWERX award for Starfighter drone fleet

Under the TACFI contract, Orbital is implementing the AMCM process to build 3D printed composite multi-mission UAS aircraft, surpassing $10 million in government awards.

-

Pull-wound carbon fiber poles enable lightweight, compact, rigid emergency stretcher

Based on military feedback, Epsilon Composite developed an optimized, foldable stretcher that combines telescopic pull-wound carbon fiber tubes.

.JPG;width=70;height=70;mode=crop)