SMC resin and primer advances prevent paint pops

David White writes this article in his capacity as executive director of the non-profit Automotive Composites Alliance (ACA), which promotes the uses and benefits of composites in automotive industry. Also the VP of sales and marketing for Meridian Automotive Systems in Dearborn, Mich., U.S.A., White is a graduate

Until recently, there have been two distinct, vocal camps within the OEM automotive community regarding the suitability of sheet molded compound (SMC) or other composites for Class A painted body panel or closure applications. In the positive camp were designers (who love the design flexibility), accountants (who love the low tooling investment and parts consolidation opportunities), and program teams (who love the affordable weight savings as well as all the above). In the negative camp was Vehicle Operations/Manufacturing. Although this group appreciated "all of the above," its job was to build "X" number of cars/trucks per hour, every hour. Anything that made that job tougher was unacceptable in their eyes. SMC and other composites were challenging because body panels produced with these materials gained a reputation for having more surface defects than their steel counterparts on painted Class A surfaces. To fully appreciate this scenario, a little history is necessary. Ford, GM, and DaimlerChrysler have all celebrated their centennials, a milestone that represents 100 years or more of bending, stamping, forging, assembling and painting steel. Vehicle Operations/Manufacturing has this down to a science. Composite materials have had a tough, if not impossible, time competing in this environment because OEM assembly plant processes generally have been optimized for steel. (GM's Bowling Green, Ky., U.S.A. assembly plant, which produces the all-composite Corvette and Cadillac XLR is one of a very few exceptions.)

For SMC and composites in general, the steel-optimized 177°C/350°F e-coat and paint ovens were a real challenge. Under that kind of heat, any microcrack in the SMC surface - usually undetectable to the naked eye - was the precursor to a potential paint "pop" or cratering, caused by "outgassing" through the microcrack. Pops represented the largest single category of composite Class A defects (up to four times the rate experienced with steel panels), and usually required the removal of the panel and a second trip through the paint shop - a time consuming, expensive outcome. No wonder the OEM manufacturing groups winced when asked to process a new SMC part.

SMC got an "A" for effort but a "C" for performance in the paint ovens. In the automotive composite supply base, the consensus was that only revolutionary change would keep SMC viable for painted, Class A applications. Supplier and OEM experts gathered to define problems and formulate solutions.

A major breakthrough came in 2001, with the successful debut of a robotically sprayed, ultraviolet (UV)-curable sealer, which added an impenetrable coating to the Class A surface. This technology did not allow the outgassing and thus eliminated the paint pop defects, overcoming the longstanding paradigm fueling the assumption that composites could not endure the high-heat steel environment. Concurrently, the resin suppliers and molders began to see excellent results from new-technology SMC resin and sheet formulations, which drastically reduced the size and frequency of microcracking. Research and development began paying off in measurable terms. Supporting the new technology were evolutionary gains by the Tier I molders as they refined molding processes by standardizing work, adding open- and closed-loop feedback controls, making and processing SMC sheet that was more consistent, and paying attention to all the little things that can turn into big trouble if left unattended.

By mid-2003, OEM paint shop data reported SMC Class A post-paint defect levels, month after month, that rivaled those of Class A steel. All agreed that victory could be declared.

I would love to predict that by 2015, the application of composites in light trucks and cars would double or triple. It may. It certainly could. I believe very strongly that the improved attributes of SMC and other composite materials make a compelling case for OEM program teams: low mass, low tooling investment, high level of design flexibility, dimensional stability, dent and ding resistance, and huge opportunities for parts consolidation, not to mention environmentally friendliness. But steel is still a formidable competitor and thermoset composites face continued competition from low-mass metals (i.e., aluminum and magnesium) as well as improved thermoplastics. We won the Class A SMC battle, but the wider war goes on. To prevail, the composites industry still will have to use every available weapon to combat the incursions of other lightweight materials, such as aluminum and magnesium.

For a peek at the future, we can look at the aviation industry. I was pleasantly surprised to learn recently that the U.S. Air Force's next-generation, air superiority fighter plane, the F-22 Raptor, contains 24 percent thermoset composites, 16 percent aluminum, and 1 percent thermoplastic! The future of composites in the automotive/transportation industry is bright. Let's go make things happen.

Related Content

Composite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

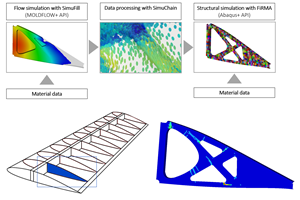

Read MoreImproving carbon fiber SMC simulation for aerospace parts

Simutence and Engenuity demonstrate a virtual process chain enabling evaluation of process-induced fiber orientations for improved structural simulation and failure load prediction of a composite wing rib.

Read MoreComprehensive service formulates standard, custom SMCs

CAMX 2024: As an SMC product manufacturer, Molding Products LLC provides SMC formulations and technical support for diverse markets, from R&D to post-production.

Read MoreAptera joins forces with C.P.C. Group to accelerate solar EV production

Specialized composite bodies are being produced in Modena, Italy, for Aptera’s BinC vehicle, enabling eventual manufacturing ramp-up of 40 vehicles/day to meet demand targets.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More