GWEC report indicates wind industry resilience, but a need to triple installation for net zero

Despite marking 2020 as the best year in history for the global wind industry, GWEC warns that new wind power capacity needs to be installed three times faster over the next decade to achieve global climate targets.

Photo Credit: GWEC

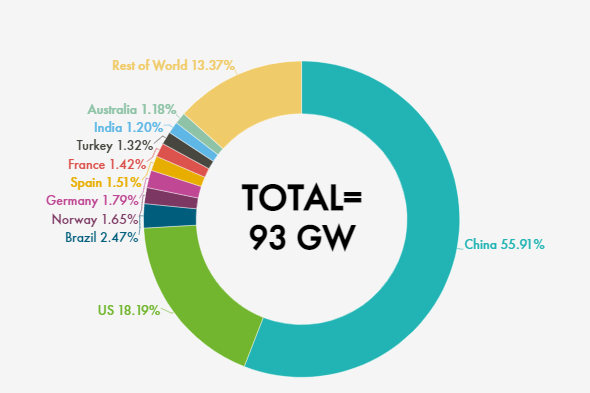

According to Global Wind Energy Council (GWEC, Brussel, Belgium), 2020 was the best year in history for the global wind industry with 93 gigiwatts (GW) of new capacity installed — a 53% year-on-year increase — and the second best year for offshore wind, but a new report published on March 25 warns that this growth is not sufficient to ensure the world achieves net zero by 2050. According to the recently released Global Wind Report 2021, GWEC’s 16th annual flagship report, the world needs to be installing wind power three times faster over the next decade in order to stay on a net-zero pathway and avoid the worst impacts of climate change.

Through technology innovations and economies of scale, the global wind power market has nearly quadrupled in size over the past decade and established itself as one of the most cost-competitive and resilient power sources across the world, GWEC says. In 2020, record growth was driven by a surge of installations in China and the U.S. — the world’s two largest wind power markets, at 48,940 MW and 16,913 MW for 2020 onshore wind capacity respectively — who together installed 75% of the new installations in 2020 and account for more than half of the world’s total wind power capacity.

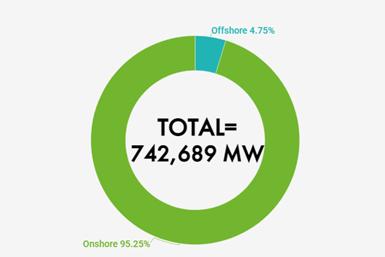

Today, there is now 743 GW of wind power capacity worldwide, helping to avoid more 1.1 billion tonnes of CO2 globally — equivalent to the annual carbon emissions of South America.

New wind power installations in 2020. Photo Credit: GWEC

Yet, as the clean energy technology with the most decarbonization potential per MW, GWEC says the report shows that the current rate of wind power deployment will not be enough to achieve carbon neutrality by the middle of this century, and urgent action must be taken by policymakers now to scale up wind power at the necessary pace.

According to the scenarios that have been established by international energy bodies such as IRENA (International Renewable Energy Agency, Abu Dhabi, United Arab Emirates) and the IEA (International Energy Agency, Paris, France), the world needs to be installing a minimum of 180 GW of new wind energy every year to limit global warming to well below 2°C above pre-industrial levels, and will need to install up to 280 GW annually to maintain a pathway compliant with meeting net zero by 2050. This means that the industry and policymakers need to work collaboratively and act fast to accelerate deployment, GWEC says.

GWEC is calling on policymakers to take a true ‘climate emergency’ approach to allow a faster ramp up including:

- Eliminating red tape and reforming administrative structures in order to speed up and streamline licensing and permitting for projects

- Carry out a massive increase in investments in grid, ports and other infrastructure needed to allow the ramp up in installations

- Re-vamp energy markets to ensure that they account for the true social costs of polluting fossil fuels and facilitate a rapid transition to a system based on renewable energy.

Cumulative global wind power installations by the end of 2020. Photo Credit: GWEC

“Every year we fall short, the mountain to climb in the years ahead gets higher,” Ben Backwell, CEO of GWEC says. “People and governments around the world are realizing that we have a limited window to head off dangerous climate change. While many major economies have announced long-term net zero targets, we need to make sure that urgent and meaningful actions are taken now to make sure this ambition is matched with fast growing investment and installations of renewable power on the ground and in the water. It is really encouraging to see record growth in China and U.S. last year, but now we need the rest of the world to step up to get us where we need to be.”

According to Backwell, GWEC’s current market forecasts show that 469 GW of new wind power capacity will be installed over the next five years. However, a minimum installation of 180 GW every year up to 2025 is required to ensure the world remains on the right path to limit global warming.

Global Wind Turbine Supplier Ranking

GWEC Market Intelligence also released the preliminary rankings for the world’s top five wind turbine OEMS. According to Feng Zhao, head of Strategy and Market Intelligence at GWEC, their preliminary findings from the supply side confirm that 2020 was an incredible year for the wind industry.

“Chinese and American turbine manufacturers had a record of new installations that saw most of them moving up in global turbine OEM market rankings,” Zhao says. “This makes sense as it reflects the situation that the world’s two largest markets, China and U.S., had the lion’s share in global wind installation in 2020.”

Danish manufacturer Vestas (Aarhus, Denmark) held the title as the world’s largest supplier of wind turbines in 2020 across onshore and offshore wind, thanks to the manufacturer’s wide geographic diversification strategy, with new installations in 32 markets last year, and strong performance in the U.S., Australia, Brazil, Netherlands, France, Poland, Russia and Norway.

GE Renewable Energy (Paris, France), a subsidiary of General Electric (Boston, Mass., U.S.) moves up two positions to second place for 2020, mainly due to the explosive growth in its U.S. home market and its strong position in Spain. Despite disruption caused by COVID-19 to local supply chains and project execution in the U.S., GWEC says the American manufacturer reported more than 10 GW of installations, making it the number-one U.S. supplier for a second year in a row.

Chinese supplier Goldwind (Beijing) retains the third position in 2020, although it achieved a record year in its home market with more than 12 GW installations and its new installations in overseas markets passed the one-GW milestone for the first time. Goldwind still held the top spot in China for 2019, but the supplier lost market share at home due to strong competition from Tier 2 local suppliers.

Envision (Shanghai, China) ranks fourth in 2020, moving up from the fifth position in 2019, by taking advantage of strong market growth in its home market, where more than 10 GW was installed by the company in a single year, a record for the company.

Although Siemens Gamesa Renewable Energy SA (SGRE, Zamudio, Spain) had installations in 31 markets last year, GWEC says the manufacturer fell three positions to fifth place. The company reported 8.7 GW of new installations in 2020, 1.2 GW lower than the previous year, primarily due to a relatively slow year of offshore wind in Europe. Nevertheless, Siemens Gamesa retains its title as the world’s largest offshore wind turbine supplier in 2020.

These rankings will be published in the Global Wind Market Development ― Supply Side Data 2020, which will be released in late April 2021. Preliminary results are subject to change between now and the release date of the actual report.

Related Content

NCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreAchieving composites innovation through collaboration

Stephen Heinz, vice president of R&I for Syensqo delivered an inspirational keynote at SAMPE 2024, highlighting the significant role of composite materials in emerging technologies and encouraging broader collaboration within the manufacturing community.

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreRead Next

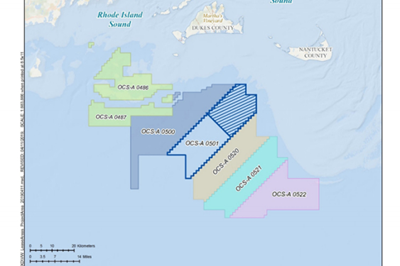

Vineyard Wind I offshore wind project poised for finalization

Bureau of Ocean Energy Management completes environmental analysis for proposed U.S. commercial-scale offshore wind farm with expectations to announce a decision by mid-2021.

Read MoreAcciona, SSE Renewables sign agreement for offshore wind development

The partners will look to develop projects in Spain and Portugal, as well as jointly exploring other potential markets.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More