Hybrid electric vehicle market report indicates steady, upward growth

As carbon dioxide emission regulations become stricter across the world, HEV sales show an increasingly upward trend, with expectations to peak at $792 billion by 2027.

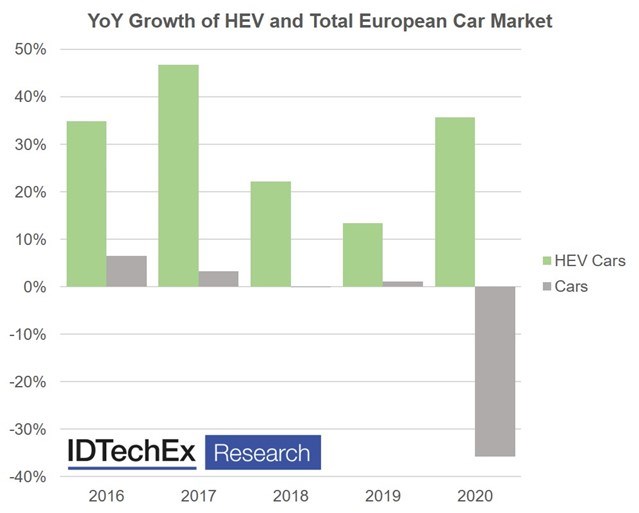

The European car market is expected to see a significant drop in sales for 2020 due to COVID-19-related shutdowns. However, the HEV market is expected to continue its strong growth. Photo Credit: IDTechEx, “Full Hybrid Electric Vehicle Markets 2021-2041.”

A new report from independent market research company IDTechEx on “Full Hybrid Electric Vehicle Markets 2021-2041” gives a granular breakdown of the hybrid electrical vehicle (HEV) market in Japan, Europe, the U.S., China and South Korea for cars, buses, trucks and light commercial vehicles (LCVs) along with their battery and motor-generator technologies with forecasts for the next 20 years. According to the report, HEVs have seen significant growth in sales over recent years, and the HEV market is set to increase in 2020 despite the implications of COVID-19 on the global automotive industry, with expectations to peak at $792 billion by 2027.

These HEVs or “self-charging hybrids” (hybrids which do not plug in but have electric-only driving modes), provide for the consumer that wants reduced fuel consumption and CO2 emissions but isn’t completely convinced by the proposition of plug-in vehicles. This could be due to the increased cost of battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) or the potential lack of charging capabilities at their residence. Either way, the HEV presents a good opportunity in the short term for these consumers.

HEVs can also aid manufacturers, says IDTechEx. With CO2 emissions targets becoming stricter worldwide, sales of HEVs can serve to lower the overall CO2 output of a manufacturers’ fleet and help to avoid the related fines. In fact, in Europe, the report finds several automotive manufacturers are not going to meet the emissions targets and will have to either purchase credits from other manufacturers or face large fines. The CO2 reduction benefits of HEVs are nowhere near that of BEV and PHEV drivetrains, but the technology is more mature, making it a potential stop-gap to meet these targets in the short-term.

Japan has historically been the strongest market for HEVs, with the likes of Toyota, Honda and Nissan all playing significant roles. However, it is expected that Europe will overtake Japan in 2020, even if the majority of HEV sales still come from Japanese manufacturers. While it appears that Europe will remain the largest HEV market for some time, it is an inherently limited one. Several European countries have set out plans or regulations to ban the sales of new ICE vehicles in the 2030s. Several have not made their stance clear on HEVs and PHEVs, but some have. The U.K., for example, is aiming to have no vehicles with combustion engines of any form being sold from 2035. Given that the EU is such a strong market for HEVs, this could drive the trend worldwide.

IDTechEx adds that HEVs not only have to contend with impending regulations but also with competition from other drivetrain technologies. While PHEVs present much better fuel consumption and CO2 emissions figures (at least under testing standards), there is also a threat from the rise of 48-volt (V) hybrid technology, for which some are promising 80% of HEV performance for 30% of the powertrain cost (see the IDTechEx report: “48V Full Hybrid, 48V Mild Hybrid, 48V BEV Cars: Markets, Technology Roadmap 2021-2041”). All three could potentially be limited by future fossil fuel bans, but PHEVs are looked upon more favorably, IDTechEx admits, and the 48V mild hybrids present an easier integration challenge to improve CO2 emissions and fuel economy quickly.

The report notes that there are several factors that could potentially cause a massive growth of the HEV market but also a rapid decline. It also considers extensive historic data, analyzing trends and looks forwards at the potential for HEVs to help meet emissions targets before the fossil fuel bans are enacted across various regions. IDTechEx adds that it created a comprehensive HEV car model database of more than 80 HEV models sold between 2015-2019 to determine trends in historic sales, battery capacity, motor-generator power and number, market share and market value. Forecasts are given for 2021-2041 across the various quantities and regions discussed above, allowing for a deep-dive into the HEV market now and for the future. For more information on this report, please visit here.

Related Content

Thermoplastic composites: Cracking the horizontal body panel nut

Versatile sandwich panel technology solves decades-long exterior automotive challenge.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreJeep all-composite roof receivers achieve steel performance at low mass

Ultrashort carbon fiber/PPA replaces steel on rooftop brackets to hold Jeep soft tops, hardtops.

Read MoreAutomotive chassis components lighten up with composites

Composite and hybrid components reduce mass, increase functionality on electric and conventional passenger vehicles.

Read MoreRead Next

Quiet revolution: Composites in EVs

Startup automakers make use of composite body/chassis components to extend the range of hybrid-electric and battery-electric vehicles.

Read MoreWhat is the role of composites in electric vehicles?

Governments and automakers are sending clear signals that electric vehicles are the future. Lightweighting EVs with composites seems obvious, but Dale Brosius says there are more opportunities not to be missed.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.jpg;maxWidth=300;quality=90)