IDTechEx presents EV material and component opportunities outside of the battery cell

With the rapid development of the EV market, IDTechEx poses a greater emphasis on cell-to-pack designs and structural batteries, from thermal interface materials (TIMs), composite enclosures and fire safety.

Share

Read Next

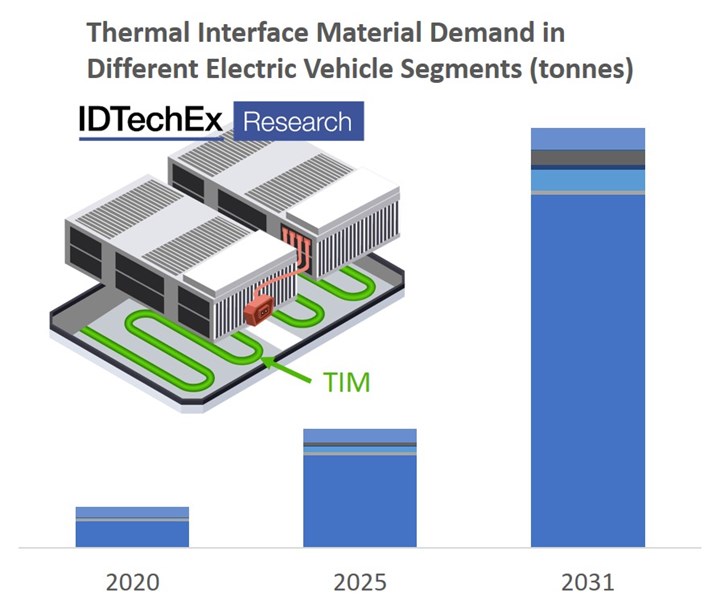

IDTechEx expects EVs to be the largest volume demand for TIMs in 2031. Photo Credit: IDTechEx, Thermal Interface Materials 2021-2031: Technologies, Markets and Opportunities

Research and consultancy firm IDTechEx (Cambridge, U.K.) presents two reports detailing electric vehicle (EV) material and component opportunities outside of the battery cell. While great emphasis is put on battery cell technologies in this market — as they govern the total storage capacity, impact energy density and are a critical supply chain consideration when scaling up to meet the growing EV demand — thermal interface materials (TIMs), fire safety, enclosures, insulation, compression foams and many other options which contribute to pack design are also available for consideration, IDTechEx says.

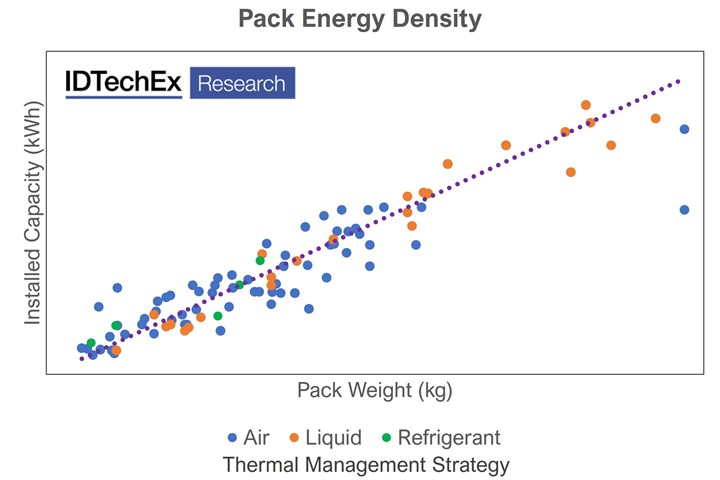

Accordingly, pack design is as much of a battery energy density contributor as are the battery cells, which is indicated by the 30% increase in average pack energy density seen over the past three years since 2020. IDTechEx believes the development of cell-to-pack designs and structural batteries will reinvigorate this plateauing field, and impact several of the materials used within the battery pack.

One example would be the use of gap filler TIMs. Many current pack designs using modules will use gap filler TIMs to help transfer heat from the cells to a cold plate, with liters of TIM used per pack. During the transition to cell-to-pack designs, the emphasis shifts towards thermally conductive adhesives to directly bond the cells to the cold plate. As a result, these adhesives have very different material property considerations. IDTechEx has extensive research in TIMs with its report on Thermal Interface Materials which includes an in-depth look at the EV market and other industries such as 5G, LEDs, data centers and consumer electronics. IDTechEx expects that EVs will be the largest volume demands for TIMs by the end of the decade.

Another key trend has been the news around EV battery fires. While recent recalls from General Motors and Hyundai have been related to cell manufacturing defects, thermal runaway is always a non-zero risk for Li-ion batteries. Combustion engine vehicles also catch fire and EVs, on a mileage basis, catch fire less often, IDTechEx notes. However, with an EV, the fire is typically much more significant in terms of the volatility and with news coverage, potentially harming EV adoption. New regulations have been adopted in China relating to thermal runaway and the necessary warning period for vehicle occupants and IDTechEx expect similar regulations to follow in other regions. This leads to opportunities for fire protection materials such as ceramic films, aerogels, and intumescent coatings, to name a few. IDTechEx expects a ten-fold increase in demand for fire protection materials in 2031 compared to today’s value. IDTechEx’s report on Thermal Management for Electric Vehicles considers fire safety, TIMs and the thermal management strategies for EV batteries, motors and power electronics.

IDTechEx analyses more than 160 EV models to determine material intensities. Photo Credit: IDTechEx, Materials for Electric Vehicle Battery Cells and Packs 2021-2031

In addition to the components discussed above, there is also great interest in composite enclosures to further reduce weight and materials that sit between or around the cells like insulating compression foams or heat spreaders. IDTechEx has published a report on Materials for EV Battery Cells and Packs which covers the use of the previously discussed materials as well as demand for inter-cell materials, enclosures, thermal management and the raw material demands for battery cells. Despite cell-to-pack trends reducing the material intensity per vehicle in many cases, IDTechEx predicts a seven-fold increase in battery pack materials outside the cells in 2031 compared to 2021’s value.

Conclusively, it has become well accepted that EVs will play a major role in the future of transportation and rely on many different materials for the combustion engine vehicles they replace. According to IDTechEx, now is the time to prioritize material developments and strategies to take advantage of this rapidly growing market.

Related Content

Seat frame demonstrates next-generation autocomposites design

Light weight, simplified/cost-effective manufacturing, passenger comfort and safety informed materials and process innovations and won awards for the 2022 Toyota Tundra‘s second-row seat frame.

Read MoreAutomotive chassis components lighten up with composites

Composite and hybrid components reduce mass, increase functionality on electric and conventional passenger vehicles.

Read MoreExel Composites supplies fiberglass profiles for Foton electric buses

Partnership with Chinese automotive manufacturer will see the implementation of pultruded profiles in various bus models, backed by weight savings, complex geometries and long life.

Read MoreSMC composites progress BinC solar electric vehicles

In an interview with one of Aptera’s co-founders, CW sheds light on the inspiration behind the crowd-funded solar electric vehicle, its body in carbon (BinC) and how composite materials are playing a role in its design.

Read MoreRead Next

Designing a versatile, multi-material EV battery enclosure

Continental Structural Plastics has developed one-piece, compression-molded composite covers, an innovative fastening system and a range of material options to meet OEM needs.

Read MoreCosiMo: Smart thermoplastic RTM process demonstrated for battery box cover challenge simulator

Project uses network of DEA, temperature/pressure and ultrasonic sensors plus digital simulation and AI modeling to monitor and optimize injection of caprolactam into complex glass fiber preform and in-situ polymerization of PA6.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More