Study suggests U.S. AAM market could reach $115 billion by 2035

Deloitte, Aerospace Industries Association report indicates a defined national strategy is required to transform the U.S. commercial aircraft sector.

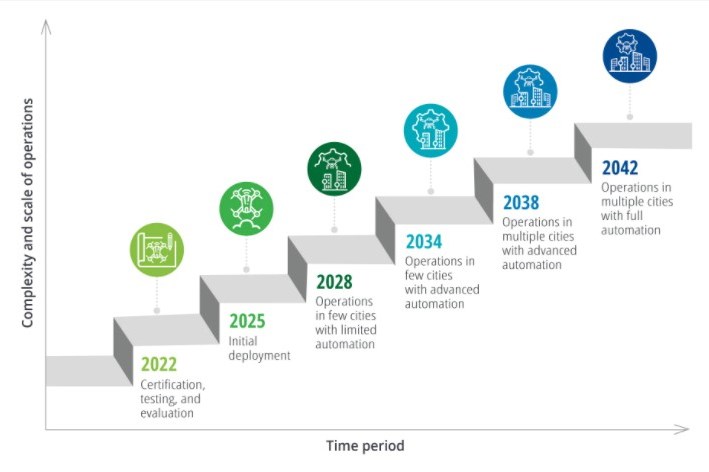

A natural progression of operationalizing AAM. All photo credit: Deloitte and AIA 2021 Advanced Air Mobility Survey

The market for advanced air mobility (AAM) in the United States is estimated to reach $115 billion annually by 2035, potentially creating more than 280,000 jobs, according to a report released on Jan. 26 by the Aerospace Industries Association (AIA, Arlington, Va., U.S.) and Deloitte (New York, N.Y., U.S.).

The report, “Advanced Air Mobility: Can the U.S. Afford to Lose the Race?” discusses how U.S. aerospace and defense (A&D) companies are poised to lead the nascent global industry, which is predicted to become mainstream in the 2030s. The report also provides a framework to guide U.S. efforts related to the possible economic and national security benefits of adopting this advanced mode of transportation.

Advanced air mobility, the next disruption in aerospace

AAM promises to transform how people and goods are transported through new, community-friendly and cost-effective electric-powered air taxis and cargo shuttles. As part of this transformation, electric vertical takeoff and landing (eVTOL) aircraft are expected to be deployed in both rural and urban environments in the U.S. and other countries from 2025 onwards.

“Our industry is on the cusp of the next great step in aviation technology,” says Eric Fanning, AIA president and CEO. “By establishing a national strategy in AAM, we have the potential to give the U.S. a major competitive advantage in the global market and realize new national security benefits, including new ways to transport our troops and cargo. U.S. leadership in this emerging aviation technology is essential to bolstering our economy and innovation.”

According to AIA and Deloitte, the global race for AAM leadership is intensifying, and the U.S. faces strong competition from China, Germany and South Korea. The race carries high stakes for the U.S. economy with a potential of $20 billion in AAM exports by 2035, according to the study.

“The deployment of AAM will require a sustained, collaborative approach between the private and public sectors to push for eVTOL aircraft to be widely accepted and adopted, sooner rather than later,” says Robin Lineberger, Deloitte Global and U.S. A&D leader. “With the market poised to grow sevenfold between 2025 and 2035, it’s important for U.S. policymakers and industries to cooperate now to ensure American leadership in this transformative emerging sector.”

The report also offers insights into how the U.S. can achieve and sustain a leadership position in AAM and provides recommendations on how to fill the current gaps. Three major focus areas are identified to consider:

- Creating a clear and conducive policy environment that fosters public-private partnerships, streamlines vehicle testing and certification and seamlessly integrates AAM into the existing airspace system.

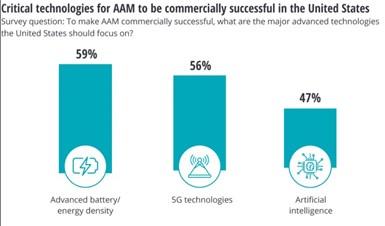

- Leading in key technologies and capabilities by focusing R&D in key areas, including developing advanced battery/energy density, artificial intelligence and 5G technologies and developing the right engineering talent for the future in the U.S.

- Developing and scaling the market with U.S. government investments and support to help build physical infrastructure such as vertiports or retrofit existing aerospace infrastructure and position the industry for exports.

The study concludes that, through a mix of balanced regulation and substantial investment in research, advanced technologies, physical infrastructure and talent, the U.S. could be uniquely poised to lead in this new aerospace market.

Study methodology

Deloitte and AIA conducted a series of executive interviews with more than 50 senior American aerospace and automotive industry leaders to examine the global race in the space and to identify key steps and conditions to consider for the U.S. to achieve leadership in AAM. Deloitte also conducted an executive survey with responses from 102 senior industry and policy executives in the U.S. to study the market potential for AAM and analyze the principal technologies required for developing AAM products and services.

Read Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More