2014 JEC Europe Review

The composites world met again in Paris, vibrant, stronger, and more forward-looking than ever before.

The 2014 edition of JEC Europe (March 11-13, Paris, France) was the biggest and busiest iteration of the show yet, with more than 1,200 exhibitors and, according to show organizer JEC Group (Paris, France), 32,000 attendees passing through the doors. Spread for the first time across two floors at the Paris Expo’s Porte de Versailles exhibition center, the event proved, again, the dynamism, creativity and ingenuity of the composites industry. (JEC is considering adding a third floor in 2015.) The CT staff was there in force and returned with the following report of the event’s news, (CT staffers also reviewed new products that made their debuts in Paris. See the “New Products” listed here.)

The shape of things to come

Clear from the first day were several trends that show all the earmarks of transforming the way composites industry suppliers and parts fabricators approach their common goals in the future. Many of them show great promise for composites in automotive applications — in particular, those reinforced with carbon fiber. Significant among the trends and trendsetters were the following:

Snap-cure resins

A molding system is only as fast as its resin, and it was clear at the JEC show that materials suppliers are getting that message. The biggest news came from Dow Automotive Systems (Schwalbach, Germany and Auburn Hills, Mich.), which leapt into the fast-cure epoxy market with the introduction of its trademarked VORAFORCE 5300. Designed specifically for use in RTM and aimed at the automotive market, the material offers a sub-90-second cycle time.

Dr. Rainer Koeniger, senior R&D manager, Automotive Composites, at Dow Europe GmbH (Freienbach, Germany) and Peter Cate, global strategic marketing manager, Composite Structures, at Dow Automotive Systems (Staines-upon-Thames, U.K.), reported that the resin’s extremely low viscosity (15 mPa/s) gives it good “persistent flow” throughout the preform and helps reduce press tonnage requirements. They also reported that the resin offers mechanical performance on par with competitive epoxies, and thermal performance of about 120°C/248°F. Its internal mold release eliminates the need for an external mold release and associated costs. Notably, VORAFORCE 5300 is classified as nontoxic, according to REACH 2015 and the VDA-278 test shows volatile emissions are close to zero, an important factor for applications adjacent to the vehicle passenger compartment.

Koeniger and Cate noted that Dow believes a cycle time of about 60 seconds is possible, and pointed out specifically that Dow defines cycle time as preform insert to press open.

Dow has optimized the resin for use with DowAksa Ileri Kompozit Malzemeler Ltd. Sti carbon fibers using a RTM system developed by KraussMaffei Technologies GmbH (Munich, Germany), but Koeniger and Cate said it is compatible with all fiber brands and types of RTM equipment. (Read about more these and other Dow new products at JEC Europe here.)

Also aimed at automotive production, Momentive Specialty Chemicals’ (Columbus, N.Y.) EPIKOTE 05475, introduced in 2013, was on exhibit. The fast-cure, low-viscosity epoxy, for use in compression molding, infusion, pultrusion and RTM processes, offers a cure time of about 90 seconds, and Momentive officials said the company has been working with the Senlis, France-based Technical Center for the Mechanical Industry (CETIM) to develop applications, including exterior body panels, suspension arms and a crash box. The latter was on display in the Momentive stand (see photo, at left) and is targeted to automotive OEMs. Momentive says volumes up to 1,000 units per day are possible with EPIKOTE 05475.

Henkel AG & Co. KGaA (Toulouse, France and Bay Point, Calif.), Cytec Industries (Woodland Park, N.J.), Huntsman Advanced Materials (The Woodlands, Texas) and Bayer MaterialScience AG (Levekusen, Germany) also were on hand with thermoset materials in the same cycle-time range, for RTM, pultrusion, infusion and compression molding processes — all with the auto industry’s part-per-minute production standard in mind.

Thermoplastic-friendly carbon fiber

SGL Carbon SE (Wiesbaden, Germany) and Toho Tenax Europe GmbH (Wuppertal, Germany and Rockwood, Tenn.) each introduced at JEC Europe a new carbon fiber sizing optimized for thermoplastic resins. Toho Tenax VP of sales Greg Olson said his company’s sizing is formulated for use with PEEK (polyetheretherketone) in aerocomposites, but he added that Toho Tenax also is looking at applications in the oil and gas and medical sectors. The new sizing, he notes, does not burn off during processing and is compatible with weaving or braiding. The company is working on additional sizings for use with other thermoplastics.

The snap-cure and carbon fiber/thermoplastics trends made it all the more noteworthy that Paul Mackenzie, VP of research and technology at U.S.-based aerospace carbon fiber and prepreg supplier Hexcel (Stamford, Conn.), introduced a new high-modulus carbon fiber (HexTow HM63), a new epoxy (HexPly M92) and, notably, a new snap-cure prepreg epoxy targeted toward automotive applications. Characterized as a response to thermoplastics’ incursions into automotive molding, the latter, called HexPly M77, reportedly offers a two-minute cure. (Detailed data for Hexcel’s new materials are available here).

With interest in carbon fiber/thermoplastic applications so high, pre-show rumors of yet another new PAN-based carbon fiber manufacturer piqued CT’s interest. The rumors proved untrue, but HPC found that the subject of the rumors, UHT Unitech LLC (Zhongli, Taiwan), established in 2011, offers not a new fiber but a graphitization service for composites fabricators who purchase T700-grade PAN-carbon fiber from existing manufacturers. Unitech’s president, Ben Wang, gave a presentation at JEC, describing the company’s business model. Briefly, Wang’s process unspools PAN carbon fiber (3K to 48K) purchased from other sources, burns off the factory-applied sizing, then graphitizes it in Unitech’s patented 2000°C/3632°F microwave ovens, reapplies fiber sizing (Wang says he specializes in sizings compatible with thermoplastic resins for sporting goods and industrial applications) and re-spools the product. The result? Wang quips that “no one believes it” but he he can deliver the equivalent of T800 or T1000 fiber at 15 to 30 percent lower cost, because the microwave technology reportedly consumes 30 percent less energy and processes fiber 50 percent faster than conventional graphitization ovens. Further, he claims his process generates no water or air pollution. Most intriguing, he says test results indicate that his UT800 and UT1000 products perform as well as those now on the market. He also emphasized that he’s not planning to engage in spinning or carbonization of raw PAN fiber and is willing to partner with other carbon fiber manufacturers interested in adapting his microwave process.

Currently capable of producing 300 metric tonnes of T800 and T1000 fiber per year, Wang claims he’s working with interested parties both inside and outside Taiwan. And he says his technical team also works with customers to use his fiber, formulating both prepregs and injection-moldable thermoplastic compounds.

Turnkey system integration

This third trend defined the proverbial handwriting on the wall: Touch labor is out, automation is in, and suppliers are uniting to offer OEMs complete manufacturing systems. Several consortiums introduced or emphasized turnkey composite part manufacturing cells. Each emphasized that merely selling equipment is a strategy long out of date.

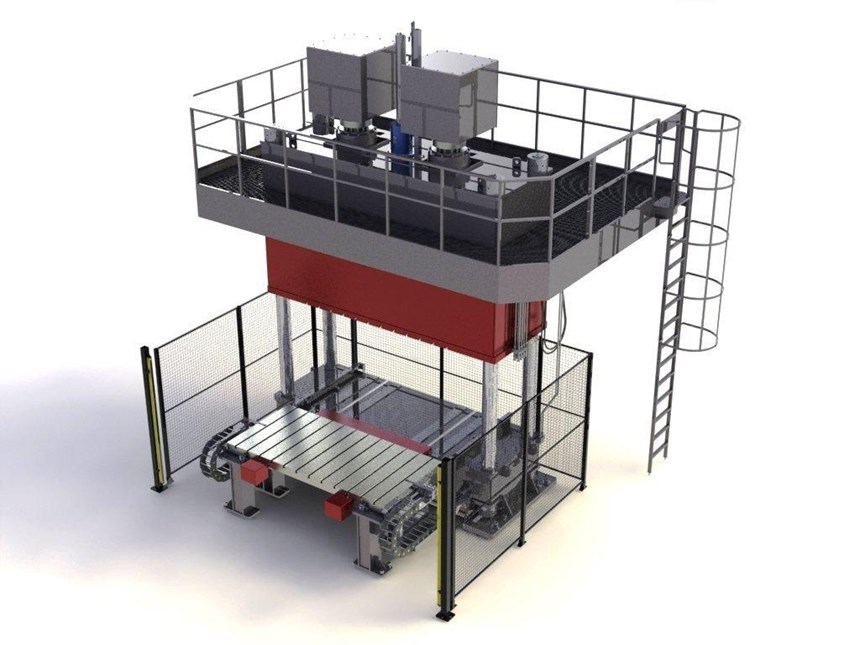

A preshow announcement by molding machinery supplier Pinette Emidecau Industries (Chalon-sur-Saône, France) requested CT’s presence at its press conference Tuesday, March 11, to hear about a new consortium made up of four companies combining technologies to provide global solutions for automated and high-speed RTM production technology. What wasn’t revealed until that morning was that after 10 years of close collaboration, the four had incorporated a new multinational company, Global RTM, to focus on marketing a complete high-pressure resin transfer molding (HP-RTM) production line. Focused, for now, in the aerocomposites market, says Pinette’s president Jérôme Hubert, who will also head Global RTM, the system eventually will be adapted to the automotive market as well.

Headquartered in Bellignat, France, Global RTM will build and market turnkey production systems, drawing on the expertise of three other France-based partners, toolmaker Compose (Bellignat), injection systems specialist Isojet Equipements (Lyon) and process control/monitoring specialist S.I.S.E. (Oyonnax). GLOBAL RTM will operate out of two assembly plants, one in France (Chalon-sur-Saône), the other in Germany (Zernien). Ownership, respectively, will be shared between Pinette and Isojet (33 percent each), Compose (24 percent) and S.I.S.E. (10 percent).

According to Hubert, Global RTM develops the general lay-out of the full RTM line, which integrates ply preparation, preforming, tool preparation, injection and forming, postcuring and finishing, for shop floor product flow inside the customer plant. GLOBAL RTM provides engineering, prototype and run trials to support the customer on product and tool development. Core system modules are built at each partner’s center, then the complete cell is integrated, tested and commissioned in one of the GLOBAL RTM facilities. Customer benefits include a single contact for all activities. The goal is to supply systems capable of up to 150,000 parts per year. Although thermoset composites are in the sights now, Hubert says Global RTM intends to develop systems for thermoplastic composites as well, and is awaiting development of an appropriate resins system. In terms of a timetable, Hubert expect Global RTM to be able, in the next three years, to enter the automotive market.

Fives Cincinnati (Hebron, Ky.) also announced an entire manufacturing system, developed since Five’s much publicized acquisition of Hebron-based MAG Americas and designed expressly for autocomposites. It comprises two manufacturing cells: The first, a Cincinnati Small Flat Tape Layer HV, which features a tape layer with integrated ply cutters that provides net- or near net-shaped and kitted stacks of carbon or glass fiber fabrics. The second, a Cincinnati Form & Cure HV cell, features a conveyor that receives the kitted stacks and places them in a compression press supplied by Continental Structural Plastics (Auburn Hills, Mich.). Fives also is working with Cytec Industries (Woodland Park, N.J.), which is prepregging a PPG Industries Inc. (Cheswick, Pa.) E-glass with a Reichhold LLC2 (Durham, N.C.) vinyl ester. At showtime, the system had already produced a car hood inner liner with a fiber volume fraction of 65 percent. Fives officials claimed that two-minute cycle times are within reach and that the company also wants to trial a glass/vinyl ester prepreg supplied by Mitsubishi Chemical Composites America Inc. (Chesapeake, Va.).

ENGEL AUSTRIA GmbH (Schwertberg, Austria) spotlighted a nearly mass-production-ready, “geometrically optimized and stress-resistant” composite automotive brake pedal (see photo, at left), produced in collaboration with automotive manufacturer ZF-Friedrichshafen AG (Friedrichshafen, Germany). The carbon fiber is from Zoltek Corporation (St. Louis, Mo.) and woven by Chomarat (Le Cheylard, France, and Anderson, S.C.)

The pedal features a layered thermoplastic fabric structure adapted by ZF to the component geometry. This reportedly enabled a weight reduction of about 30 percent compared to steel brake pedals, without reducing the part’s load-bearing capacity. ENGEL’s organomelt method, which enables a one-shot process, involves heating of fabrics woven from thermoplastic fibers in an infrared (IR) oven, preforming them in an injection mold, and then overmolding them with polyamide resin immediately afterwards. The manufacturing cell integrates a vertical ENGEL insert 200 injection molding machine, an IR oven, a shuttle system and an ENGEL multiaxis robot. The IR oven, developed by ENGEL, enables rapid heating of thick-walled semifinished products. It and the robot are fully integrated into the injection molding machine's control unit. As a result, all of the system's components access the same database, increasing process reliability and shortening cycle times.

The process is the result of efforts at ENGEL’s Technology Centre for Lightweight Composites (St. Valentin, Austria). There, ENGEL created a machine platform for fiber-reinforced composite technologies and applications. Intensive work with partner companies and institutes has resulted in a highly automated injection molding solution for processing semifinished thermoplastic products (fabrics, tapes) and reactive technologies, using thermoplastic and thermoset systems.

Similarly, turnkey systems were touted by Krauss-Maffei, Dieffenbacher North America Inc. (Eppingen, Germany), and Roctool Inc. (Paris, France), each working in collaboration with other suppliers to meet automotive industry demands for the speed, consistency, repeatability and quality they can maintain with legacy metals and metal-forming processes.

Passenger protection cells

This fourth trend could be the tip of the proverbial auto industry iceberg — but without the Titanic overtones. Taking a page from Formula 1 race car designers, whose carbon fiber composite safety cells for drivers are well established on the world’s racing circuits, automotive composites fabricators determined collectively that the best way to alert auto OEMs to their molding proficiencies would be displaying carbon fiber composite passenger protection cells (“tubs” for short), either for real (typically high-end sports) cars or as capability demonstrators. CT staffers counted no fewer than 10 tubs on display.

Among them was an impressive display by composites fabricator Mubea Carbo Tech (Salzburg, Austria) of a carbon fiber monocoque cell. Already the manufacturer of tubs for the McLaren MP4-12C supercar, the Porsche 918 Spyder and the Volkswagen XL1, the company has recently opened a second, highly automated production facility in Žebrák, Czech Republic, which, it says, can deliver 50,000 carbon fiber/epoxy parts per year via HP-RTM. (Mubea Carbo Tech also mints carbon composite auto wheels. See the “Extended out-time polyurethanes” subhead, below.)

Elsewhere, E700 series carbon fiber prepreg from TenCate Advanced Composites (Nijverdal, The Netherlands) was used by the Adler Group (Naples, Italy) to manufacture another tub monocoque on display, this one for Alfa Romeo’s 4C (see second photo from top, at left). The car is manufactured in Modena, Italy, and 3,500 vehicles will be rolled out annually. Carbon fiber composites represent 25 percent of the car’s overall volume and the monocoque weighs a mere 65 kg/143 lb.

Taking a different approach, Axon Automotive Ltd. (Wollaston, U.K.), a subsidiary of Far Composites (Nottingham, U.K.), showed a carbon fiber monocoque that won the 2012 JEC Innovation Award as a composite automotive Body in Black (BiB) system. Its patented AXONTEX technology uses carbon fiber braids over a flexible foam core and resin infusion under vacuum pressure. Axon claims low tooling and part cost, yet maintains that its process can manufacture shapes with high complexity. This technology already is finding application in bespoke, lightweight wheelchairs where the ability to tailor the shape and location of wheel axles and seat beams improves comfort, minimizes energy expenditure and reduces stresses on the body. Working with Liverpool, U.K.-based Da Vinci Mobility, Far Composites’ goal is to adapt the AXONTEX technology into a novel forming process to produce very light, customized wheelchairs at an affordable price by eliminating one-off tooling.

The other tub

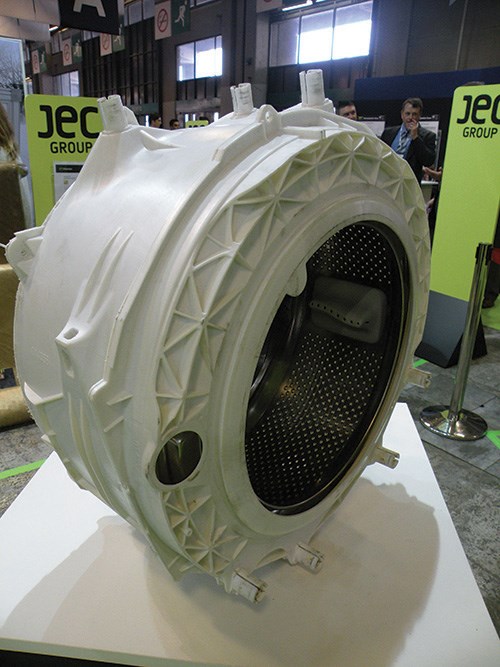

Winners and also-rans in JEC Innovation Awards display are often crowd pleasers, but what caught CT’s attention in particular was a glass fiber-reinforced polypropylene washing machine tub. Molded by Polyplastic Group (Moscow, Russia), the tub cleaned up in the 2014 JEC Europe Innovation Awards’ Consumer Goods category. Polyplastic selected a polypropylene (PP) reinforced with PERFORMAX 249 chopped glass fiber supplied by Owens Corning Composite Solutions Business (Ried im Innkreis, Austria, and Toledo, Ohio) business unit in Gous-Khroustalny, Russia.

Developed for a leading European appliance OEM that sought these benefits for its machines sold into the Russian market, the new tub retained the 30 percent glass content of a previous but unsatisfying tub design — the PERFORMAX 249 fiber was credited with enabling improved flow during the injection molding process and promoting better fiber/resin adhesion, resulting in 15 percent higher strength and stiffness. This, in turn, enabled a design with thinner (and ess weighty) but still hydrolysis-resistant walls, 30 percent more wash capacity (5 kg to 7 kg or 11 lb to 15.4 lb), without increasing the tub size. Additionally, the lighter assembly enabled the OEM to increase spin cycle speed to 1,500 rpm compared to the norm of 1,000 rpm.

The OEM sees a large potential for this type of high-performance development, not only in Russia — the fourth largest market in Europe for household appliances — but in Europe overall, projecting annual growth of 15 percent thanks to demand for higher efficiency/higher value white goods.

Styrene-free thermosets

In the wake of recent government scrutiny of styrene in the U.S, Reichhold Inc. (Research Triangle Park, N.C.) said it has cracked the styrene-replacement code for vinyl ester, introducing at JEC a new product called ADVALITE. Technically a vinyl “hybrid,” it offers no-VOC performance without the use of reactive diluents, which effectively eliminates the “ester” label. The products include ADVALITE vinyl hybrid liquid and ADVALITE vinyl hybrid hot-melt prepreg resins. Reportedly, both products exhibit good mechanical properties and temperature resistance as high as 200ºC/392°F. The resins are cured using standard free-radical inhibitors and initiators. This, it is said, results in significant processing advantages when compared to epoxy resins. The low exotherm of the resins allows for rapid curing of thick laminates without cracking. ADVALITE liquid resins can be used in resin transfer molding (RTM), infusion, filament winding, liquid molding and pultrusion processes. The ADVALITE hot-melt prepreg resins can be directly coated or applied as an adhesive film for fiber impregnation. Reichhold says the materials have 3.5 to 4 percent elongation on some parts.

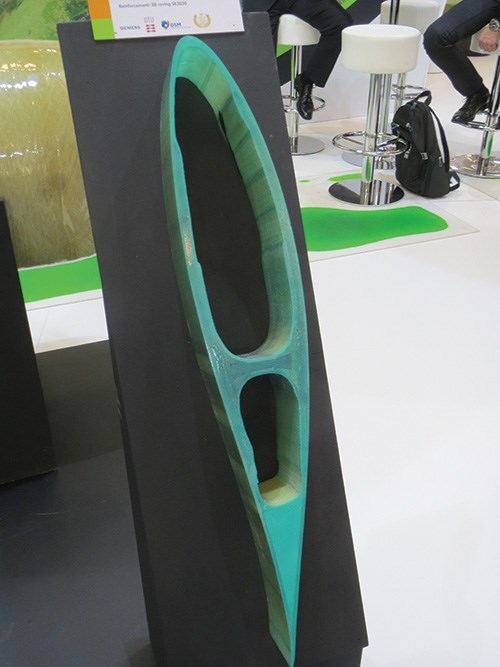

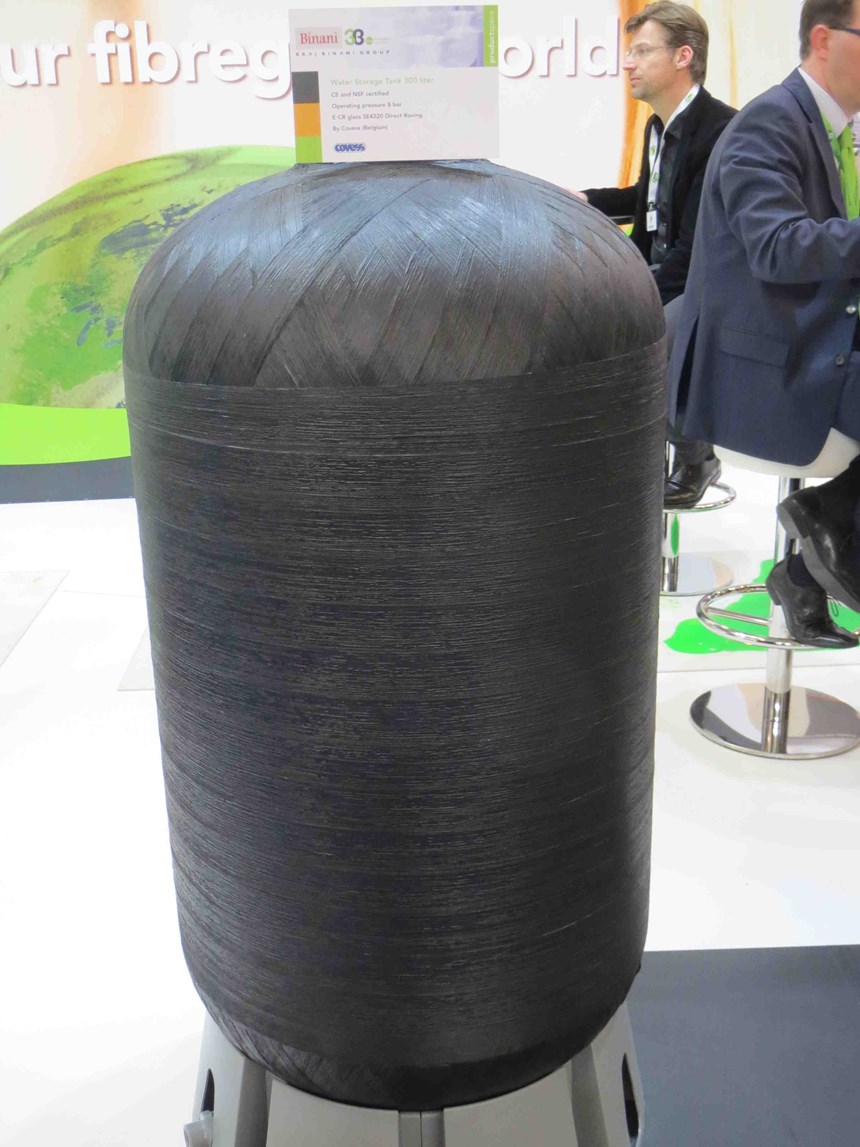

3B – the fibreglass company (Battice, Belgium) collected a JEC Innovation Award for its new SE3030 glass roving, which features a sizing optimized for use with DSM Composite Resins’ (Schaffhausen, Switzerland) Beyone 201-A-01, a styrene- and cobalt-free vinyl ester resin that features 40 percent bio content. The two companies are working with Siemens Wind Energy (Hamburg, Germany) and DTU Wind Energy (Roskilde, Denmark) to evaluate the fiber/sizing/resin combination for use in wind blades. In particular, said 3B officials at the show, they want to compare the composite with epoxy-based systems. Initial tests show that the SE3030/Beyone 201-A-01 combination offers good tensile and shear strength with reduced post-cure time and temperature thresholds. The result could be faster cycle times for wind blade manufacture. (Read more about the status of styrene and cobalt as resin constituents in “Styrene and cobalt: Headed for the exit?” under “Editor’s Picks.”)

Cytec Industrial Materials (Woodland Park, N.J.) claimed what it called “the industry's first application of a volatile-organic compound (VOC)-free thermoset vinyl ester resin woven glass-reinforced prepreg” in the composite battery pack for the General Motors (GM, Detroit, Mich.) Chevy Spark electric vehicle (EV). Working with GM, molder Continental Structural Plastics sought a materials solution form Cytec for the battery pack that would meet formidable processing and performance requirements: 30° offset-barrier, side-impact, and rear-barrier crash; 50 G impulse shock (x, y and z); post-crash package integrity; fire-resistance testing; 3m/10-ft drop testing (bottom/end); 1m/3.3-ft water-submersion test; and vibration/shock testing. Cytec’s solution, MTM 23, a tailored, self-releasing, rapid-cure vinyl ester prepreg system made with Reichhold’s new ADVALITE vinyl ester, enables CSP to compression mold battery pack parts 40 percent lighter than metal alternatives in less than 10 minutes at a 150°C/302°F cure. Cytec claims, however, that MTM 23 can rapid-cure in less than three minutes.

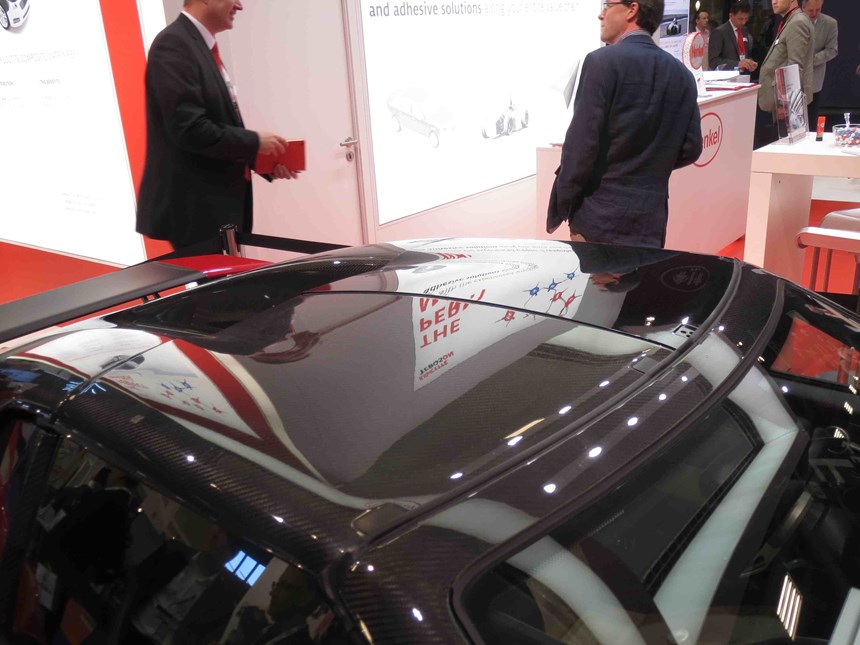

Extended out-time polyurethanes

Another recent trend, that of delaying the reaction time of polyurethane (PUR) resins to permit injection of larger and more complex parts, was revisited at JEC Europe 2014. A noteworthy illustration was the roof on the R1 Roadster, a sporty two-seat sports car on display by manufacturer Roding Automobile GmbH (Roding, Germany). Comprising two rectangular sections, each measuring 772 by 585 by 2 mm (30.4 by 23 by 0.08 inches) and weighing 2.57 kg/5.7 lb, the roof panels are made via a high-pressure RTM (HP-RTM) in a process developed by Henkel, Dieffenbacher, and KraussMaffei (Munich, Germany). The matrix resin is Henkel’s Loctite MAX 3 PUR, a three-component formula (resin, hardener and release agent). The surface PUR is provided by Rühl Puromer GmbH (Friedrichsdorf, Germany). (Read more about delayed-onset cure in polyurethanes in “Processing within the PUR cure window” under “Editor’s Picks.”)

Mubea Carbo Tech illustrated another use of delayed-reaction PUR in its high-end carbon fiber composite and carbon fiber/aluminum automobile wheels, minted in an RTM process. The company says that it uses a “very complex” set of RTM tools for the all-carbon-fiber version. Compared to an 11 kg/24-lb high-end aluminum wheel, the 9-kg/20-lb aluminum/carbon fiber hybrid version yields a weight savings of almost 20 percent, and almost 30 percent is saved with the 8 kg/17 lb all-carbon fiber wheel, the latter measuring 20 inches/508 mm in diameter with a 9.0-inch/229-mm rim. Mubea Carbo Tech says the global market for carbon composite wheels is estimated at roughly 1 million units per year, with a rising trend. The company’s Salzburg production facility is currently targeting a fraction of that: 20,000 units per year.

PUR also advanced in the infrastructure market. Dow (Horgen, Switzerland and Coreggio, Italy) showcased its VORAFORCE TW 1100 series PUR for filament wound composite utility poles, formulated to enable fast winding speed and optimal viscosity to avoid dripping during processing. “With polyurethane, we want a controlled, slow increase in viscosity so that the resin stays liquid until the winding stops, at which point we want a reasonably paced cure,” explained Dow research scientist Paolo Diena. “We have now managed the catalysts to do this very effectively.”

On display were wound sections of a 110-kV electrical power transmission pole. “We have supplied polyurethane for smaller filament wound 10 KV poles,” Diena notes, “but the higher voltage versions are much longer and must combine multiple sections. We took on the challenge to achieve the longer open time to allow these longer sections.” The PUR composite poles reportedly outperform both concrete and polyester-composite poles in durability, electrical insulation and crack resistance, even in severe weather conditions (e.g., typhoons). Compared to concrete, the polyurethane filament wound poles are lighter and easier to install. Compared to polyester, the more expensive PUR offers the potential to match performance with less material and easier process and post-process operations, resulting in a more cost-effective pole. And Dow has developed an ultraviolet (UV) radiation-resistant finishing system that can add a final protective layer in a one-step winding process.

Suppliers engaging in manufacturing

Several composite materials suppliers boldly expanded their reach into part design and manufacturing in Paris. Visitors to Gurit UK (Zurich, Switzerland and Isle of Wight, U.K.) exhibit, for example, viewed a full size section of the New Bus for London, a mass-transit concept manufactured by Gurit Automotive for coachbuilder and low-floor bus pioneer Wrightbus (Ballymena, Northern Ireland). Notably, Gurit’s Engineered Structures team was on hand to tout similar capabilities in design, engineering, materials science, prototyping and manufacturing and emphasized to visitors the availability of these skills to help them realize advanced composite structures. The team emphasized its November 2013 announcement that Gurit will soon open a new facility in Hungary that will produce finished parts to support the growth of its mass transportation and automotive businesses. Alongside these markets, Gurit said it is continuing to market its engineering capabilities in other markets including ocean energy (tidal and ocean current turbine design and construction, as well as industrial and architectural applications. Gurit also displayed new prepregs and core materials (find out more here).

Although it was overshadowed by news of its flourishing partnership with BMW AG in series production of the carbon fiber composite passenger cell for BMW’s i3 commuter car, the SGL Group reiterated its late 2013 revelation of its joint venture with electronics giant Samsung (Seoul, South Korea) to develop carbon fiber parts for wind energy and electronics applications. The JV’s first components were on view at JEC Europe — carbon fiber cassette support bars used by Samsung in its manufacturing plant for transport of LCD screens. The company is targeting automotive applications and products for the Samsung joint venture. Also in automotive, SGL emphasized a carbon fiber strut brace for the BMW M3 and M4, made with 24K tow braided by Kümpers (Rheine, Germany) and molded via RTM by Benteler (Salzburg, Austria).

(See CT’s recent commentary on the growing phenomenon of suppliers engaging in part manufacturing in the two-part series titled “Why are suppliers morphing into fabricators?” under “Editor’s Picks.”)

Groundbreaking applications

Cannon USA Inc. (Borromeo, Italy) revealed that its Hanau, Germany based Cannon Deutschland unit was the machinery supplier behind the Benteler Automobiltechnik GmbH (Schwandorf, Germany)/SGL Group joint venture Benteler/SGL Automotive Composites’ joint production of some of the carbon composite parts for BMW AG’s (Munich, Germany) i3 commuter car and i8 sports car. Cannon said its contributions to Benteler/SGL’s (Reid im Innkreis, Austria) fully-automatic production plant include one ESTRIM high-pressure dosing unit for epoxy resin, two 1,000-ton presses; five handling robots for the manipulation of carbon reinforcements and finished parts, and all the electronic controls, safety devices and chemical storage facilities.

The ESTRIM unit features high-pressure impingement-type mixing heads that enable the use of fast-reacting resins. Its LLD distribution method deposits a uniform liquid “ribbon” of formulated resin over the reinforcement. This combination prevents inmold flow of the reacting resin coming from the mixing head, drastically curtailing counter-pressure generated during injection. As a result, low-tonnage clamping presses can be used (limiting both captial investment and energy cost), yet the process reportedly enables part cure within three minutes.

TenCate Advanced Composites shared a JEC 2014 Innovation Award in the Aircraft Interiors category for the Titanium Seat, built for OEM by Expliseat (Raispal, France) with partners Hexcel, RocTool, and A&P Technology Inc. (Cincinnati, Ohio). The first composite aircraft seat to pass dynamic 16G crash tests, it weighs only 4 kg/8.8 lb per passenger — half the weight of its nearest competitor. Remarkably, potential reductions in fuel consumption are estimated at €200,000 to €400,000 ($274,370 to $548,775) per year, per aircraft. Its composite/titanium structure and simple assembly reportedly makes it the market’s top-performing seat.

TenCate worked closely with Expliseat’s team to establish the best resin/fiber combination for optimal mechanical performance, while adhering to stringent FST requirements. TenCate Cetex TC1100 thermoplastic resin was combined with Hexcel’s compatible HexTow AS4 12K fiber.

Titanium Seat award co-winner RocTool supplied its 3iTech induction heating technology for the Expliseat project, in which inductor coils are directly integrated into a steel tools for compression molding processes. At a JEC press conference on the JEC show floor, March 12, RocTool CEO Alexandre Guichard and CTO José Feigenblum showcased other parts mass-produced with the technology and updated CT on its continuing efforts to commercialize it. Guichard displayed a back cover molded for Motorola Mobility’s (USA) MotoX smartphone. The cover is produced in a four-cavity mold at a rate of 15,000 parts per day by Taichung, Taiwan-based partners Complam and Ju Teng, a global manufacturer and RocTool licensee. A polycarbonate (PC) composite reinforced with thermoplastic polyester (PET) fiber, the cover features a high-quality surface finish. Another Motorola back cover, the Ultra, employs a 3-D unibody molded from the same composite but with DuPont Protection Solutions (Richmond, Va.) Kevlar (aramid) fiber added. The covers earned a JEC Innovation Award in the Mobile Devices category.

Guichard noted that electronic applications currently account for 60 percent of RocTool’s business and reiterated the company’s aspiration to place 3iTech systems with 30 major brands of the same stature as Motorola. Toward that end, RocTool recently opened a subsidiary in Taiwan, and, at the show, announced two new subsidiaries in Japan and Germany. Guichard emphasized the company’s global aspirations: France, he said, now accounts for only 5 percent of its business: “We are 95 percent international.”

Guichard also announced that RocTool had recently received a capital infusion of €3.6 million from investors and changed its strategy, going directly to the OEM, rather than approaching molders — a strategy change adopted by more than one exhibitor at the show. He also pointed out that 3iTech is “not, theoretically, limited by part size.” The system reportedly can be adapted easily for tools large enough tomold an automobile hood. Further, RocTool maintains that the timeframe, from licensing to production, can be as low as six months for simple, single-site installations, and licensees have access to long-term support worldwide.

RocTool also called attention to a “100 percent ecological” luggage shell that features flax fiber reinforcement. Feigenblum credited a 10-bar/145-psi vacuum bagging system for much of the success, noting that it is ideal for natural fiber-reinforced composites, and said the 3iTech heating and cooling system prevents degassing. Guicard also revealed that 3iTech technology recently broke a world record time by heating a mold from 60°C to 160°C in 5.3 seconds.

Used in transport interiors since the 1970s, honeycomb-cored sandwich are used in luggage bins, lavatories, galleys, tables, trays, partitions, doors and trolley carts as well as shaped sidewall and overhead panels. SMTC (Bouffere, France), a manufacturer of composites-intensive transportation interiors since 1983, announced its launch of DYNATECH thermoplastic sandwich panels, based on its acquisition of Foamed In-situ Thermoformable Sandwich technology from FITS Technology (Driebergen, The Netherlands), headed by inventor and CEO Martin de Groot. (Background on FITS sandwich technology is available in “Thermoformable Composite Panels, Part II” under “Editor’s Picks.”)

SMTC’s automated panel-making process enables polyetherimide (PEI) to be foamed in situ as a core (with a vertical cell structure) and then receive fiber-reinforced PEI skins that are “welded” onto the core, in an inline process. Reportedly, the resulting panels are easily thermoformed into shapes and angles and then edge-sealed.

The concept of a lightweight foam-cored panel made using a belt press and reinforced thermoplastic faceskins was patented by DuPont in 1990, based on its polyetherketoneketone (PEKK) polymer. CT’s sister publication High-Performance Composites reported on Stork Fokker’s (Hoogeveen, The Netherlands) use of carbon fiber/PEI skins on Nomex honeycomb for the Gulfstream (Savannah, Ga.) G650 business jet’s load floors (see “Thermoplastic composites: Inside story”, under “Editor’s Picks”). And SABIC (Pittsfield, Mass.) has been marketing its Ultem PEI foam for applications like aircraft baggage bins since 2008. What differentiates DYNATECH, according to SMTC, is that all of the pieces have been put together, including core, skins, thermoforming shapes, edge-finishing, insert installation and, now, automation of panel manufacturing through SMTC’s commercialization of the product. Also, SMTC is an established supplier of interiors to airframers and their suppliers, including Bombardier, Alstom, Sogerma and Zodiac Aerospace. Because SMTC has supplier relationships already in place, the company contends that fact gives it unique knowledge of the customers’ cost and performance targets. Interestingly, a representative from interiors giant Zodiac Aerospace was at the JEC Europe 2014 press conference, and SMTC said it has already discussed qualification with several OEMs.

Notably, DYNATECH panels require no potting. FITS inventor de Groot asserts that 25 percent of a Nomex honeycomb panel’s weight comes from potting, exterior decorative layers (e.g., Declar) and connections. That contributes to what SMTC asserts are 20 to 40 percent weight savings and 10 to 30 percent cost savings compared to other types of aircraft interior panels. Although PEI foam core is higher in density than, for example, Nomex honeycomb, SMTC and de Groot claim the finished structural panels can be made much thinner. That alone is expected to hold appeal for transportation OEMs looking to maximize interior space. Also, aircraft OEMs are requesting “multifunctional” interiors, with walls, ceilings and bins integrated into other functional systems, such as ventilation, lighting and electrical power. It might be possible to embed a variety of structural components and/or functional elements (e.g., fiber optics) within DYNATECH's core, De Groot suggests. The panels also can be folded and thermoformed, a fact that presents unique design advantages.

Arkema Inc. (King of Prussia, Pa.) made waves at the show with the introduction of Elium liquid acrylic thermoplastic. It is transformed using the same processes as composite thermosets, but results in parts with thermoplastic polymer chains. Elium resins are said to polymerize quickly and can be used to design structural parts as well as aesthetic elements in automotive, transportation, wind power, sports, and building and construction applications.

Arkema told CT that Elium is engineered for reactive closed-mold processes, including resin transfer molding (RTM), infusion and the Flex Molding Process, developed by Magnum Venus Products (Kent Wash.). Further, they require activation with peroxide — Arkema recommends its Luperox initiators, but specific recommendations are provided based on the selected manufacturing process. Although conventional thermoplastic manufacturing processes, such as injection molding and extrusion, are not designed to use Elium in its virgin liquid form, Arkema says these process methods can be used in the reprocessing of recycled and reclaimed material.

Arkema officials at the show claimed that Elium offers impact properties equal to or better than epoxy, but admitted that it has thermal properties a little short of those associated with epoxies. Moreover, sizing is an important factor when using Elium, and Arkema says it is developing compatible sizings in collaboration with carbon fiber manufacturer Toray Industries Inc. (Tokyo, Japan), glass fiber manufacturer 3B – The Fibreglass Co. and fabric weaver Chomarat.

Although the wind energy industry plateaued in some regions during 2013, 2014 is shaping up to be a return to growth, particularly in China, North America and South America. Exhibitors came to JEC Europe with several new technologies designed to make wind blade manufacturing faster and more consistent and repeatable.

Momentive Specialty Chemicals reported that it expects 16 GW of new wind installations globally in 2014 and said the trend toward longer blades is putting more capital expense pressure on manufacturers. Accordingly, wind blade manufacturers will have to increase processing speed to help offset the difference. One area of concern is the adhesive bonding of blade shell halves. New at the show was Momentive’s contribution to the solution, its EPIKOTE MGS BP535 bonding paste for wind blades. It reportedly reaches minimum Tg two hours faster and offers four times the dynamic fatigue performance of competing adhesives. It’s also rubber-toughened, which raises its strain and energy-release thresholds compared to Momentive’s benchmark BP135G3 system.

Wind blade manufacture was also a target market for materials supplier Sicomin Epoxy Systems (Chateauneuf les Martigues, France). Celebrating its 30th anniversary in business, the company announced that it had recently expanded its headquarters near Marseille to 4,000m2 (about 43,060 ft2) and will add a 3,000m2 (almost 32,290 ft2) manufacturing and storage facility this year to support production on a larger scale. However, Sicomin said it will maintain its expertise in developing novel solutions for niche applications. Sicomin will continue, for example, its work as “the original formulator” of structural foaming epoxies used where rigid foam or honeycomb are not well-suited. One application is in wind blades, where parts with complex geometry can be produced without the time and expense of CNC-machining rigid cores, which can accumulate large quantities of waste. Sicomin offers a range of multiple-density foaming systems and numerous hardeners, which enables the bonding of blade skins made of epoxy, polyester or vinyl ester resins.

Sicomin also revealed that its fire-retardant self-extinguishing epoxies were recently accredited with the ASTM E-84 Class A standard for the Civil Engineering industry and the Federal Aviation Register (FAR) 25-853 Standard and Heat Release Rate certification for the aerospace industry. These products are suitable for infusion, prepreg layup, epoxy foaming and coating processes because they produce high-performance laminates that exhibit low-smoke behavior when exposed to flame.

FORMAX (Leicester, U.K.), a manufacturer of carbon fiber, glass and other and specialty composite reinforcements, followed up a preshow revelation that it will build a new production facility at its U.K. headquarters dedicated to weaving and assembling carbon fiber multiaxial fabrics for high-volume automotive applications with additional details: The 50,000-ft2 (4,645m2) plant will house a new Malitronic multiaxial textile line, supplied by Karl Mayer Textilmaschinenfabrik GmbH (Chemnitz, Germany). The machine is reportedly 20 to 25 percent faster than its predecessor and has a production width of 1,600 mm/63 inches. FORMAX anticipated at the show that the line would be commissioned in March of this year. (See a FORMAX new product offering here.)

Core materials source EconCore (Leuven, Belgium) introduced its ThermHex continuous thermoplastic honeycomb production process and touted recent licensing agreements. The patented ThermHex technology reportedly enables fabrication of cost-efficient products molded from a wide variety of polymers — including polypropylene (PP), polyester (PET), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), polyamie (PA), polyphenylene sulfide (PPS) and many others — with a variety of honeycomb core cell sizes, densities and thicknesses. The process also enables inline lamination of faceskins. EconCore also is exploring new material combinations such as thermoplastic cores with aluminum or steel faceskins, targeted for interior and exterior cladding, visual communication boards and transportation applications.

EconCore reported on the activities of several licensees. Itochu (Tokyo, Japan), for example, is working with ThermHex in collaboration with Toray Industries to develop applications using its NANOALLOY technology (For more about NANOALLOY technology, see “Toray licenses polyamide honeycomb technology” under “Editor’s Picks.”) Another licensee, Renolit GOR (Buriasco, Italy), exhibited its GORCELL honeycomb products at the show, which are sold into building, furniture and automotive end-uses. Additional licensees include Coroplast (Chicago, Ill.), Gifu Plastics (Gifu, Japan), Karton (Pordenone, Italy) and Röplast (Eskişehir, Turkey). EconCore says it supports these and other customers and licensees in their application development and integration of its technologies into their production processes. The company also is developing high-performance PA honeycombs combined with glass and carbon fiber composite skins as well as ultralight panels that feature PP honeycomb between natural fiber-reinforced composite skins, targeted to automotive interior applications.

Related Content

Heat-activated foaming core rapidly achieves net-shape 3D parts

CAMX 2024: L&L Products exhibits its InsituCore foaming core structural technology, which can be used to create foam core composites minus machining or presses, as well as the Phaster A K-700, a rapid-cure adhesive.

Read MoreFilm adhesive enables high-temperature bonding

CAMX 2024: Aeroadhere FAE-350-1, Park Aerospace’s curing modified epoxy, offers high toughness with elevated temperature performance when used in primary and secondary aerospace structures.

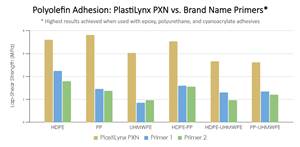

Read MoreXlynX’s PlastiLynx PXN crosslinking primer enhances polymer adhesion

PFAS-free diazirine primer makes surfaces receptive to all manner of adhesives, including epoxies and polyurethanes, outperforming alternative options by 150-350%.

Read MoreSyensqo introduces AeroPaste 1003 aerospace adhesive

Two-part room-temperature paste increases high-rate assembly and joining efficiencies when bonding metallic and composite parts.

Read MoreRead Next

Processing within the PUR cure window

Composite Spray Molding enables volume production of fiber-reinforced polyurethane sandwich structures for auto interiors. Are Class A exterior parts next?

Read MoreStyrene & cobalt: Headed for the exit?

Fair or not, styrene and cobalt are now considered harmful to humans. Here's an update on the impact this issue poses for the composites industry and what resin and additive manufacturers are doing about it.

Read MoreThermoformable Composite Panels, Part II

Preconsolidated sheet stock for load-bearing applications features continuous fiber - not only glass, but carbon and aramid as well.

Read More

.jpg;maxWidth=300;quality=90)