777X: Bigger-than-expected carbon fiber impact

Guest blogger Chris Red, principle of Composites Forecasts & Consulting, has crunched the numbers and reports that Boeing's new 777X is on pace to consume substantially more composite materials than initially anticipated.

Editor's note: Chris Red, principle of Composites Forecasts and Consulting LLC, is CW's guest blogger this week, commenting on the estimated volume of composites to be applied to Boeing's new 777X commercial jet. You can also see Red in person at CW's Carbon Fiber conference (Nov. 9-11, Scottsdale, Arizona), where he will speak during the pre-conference seminar, presenting "2016 Global Outlook for CFRP and Carbon Fibers," his well-researched and much-relied-on assessment of global carbon fiber supply and demand. Click here for more information about the conference.

Over the past few years, I have expressed the opinion that the production of commercial aircraft will taper off beginning in 2019. This opinion was based on a number of factors, including:

- Slower demand growth for new aircraft in the developing economies of Asia and South America;

- The expectation for another significant economy crisis impacting the demand for aircraft;

- Another major global conflict within the next five years;

- Expanded combined with changing demands for business travel;

- Anticipation that commercial lending rates would rise and impact the costs of buying new airplanes;

- If fuel prices remain low, aircraft operators may find it more economical to maintain and overhaul their existing fleet.

The math doesn’t lie. Commercial transport OEMs hold record-setting order backlogs. As a result, there is a great deal of discussion as to how best to manage necessary delivery rate increases. Unless a large number of firm aircraft orders (not counting options) are lost or deferred, I am going to have to raise my composites demand forecasts. The cautious optimism that is creeping back into my 10-year outlooks will push the compound average annual growth rate (CAGR) for composites structures manufacturing from 8% (the old forecast) up a few percentages.

I have been revising CFC’s forecast for the 2016-2025 time period. During my research, I recently learned a few things about the Boeing B777X program. For those not totally up-to-speed with this evolution of the B777 family, Boeing is designing two derivatives the B777-8 and the B777-9.

Much of the airframe for the -8 and -9 will be substantially the same as their predecessors’. The major structural differences between the “old” (B777 first entered service in 1995) and the new models are the wings and the engines. New engines, enhanced wing performance, and lower weight will enable the B777X to reduce its fuel and other operating costs. At the same time, the B777-9 is poised to compete with some customers for A380 and B747 programs.

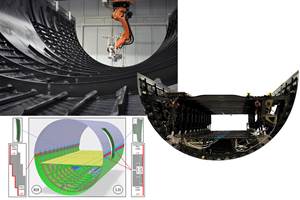

To help mitigate some of the development risks and utilize all of the lessons learned from the B787 program, Boeing announced quite a while ago that the B777X program incorporates a scaled-up composite wing – with a twist. The B777X wing is larger than its predecessors’. In order to make sure that the new aircraft will be able to operate at existing airports without requiring modifications to the airports, the new wing features folding wing tips measuring nearly 12ft/3.5m long.

B777X Wing Pushes Aspect Ratio and Breaks Record

The wingspan for the new B777-8 and -9 aircraft is larger than any previous Boeing jetliner and represents another major milestone for composites in the aerospace industry. Deliveries of these two new transports are scheduled to start around 2018-2019. Already Boeing has taken orders for more than 300 aircraft. Boeing has made significant progress in building its Composite Wing Center in Everett, WA – which will be responsible for fabricating and assembling the new wings. It is the scale of these wings that is truly impressive. While I don’t have specific figures for the final configurations, some estimation indicates that the each wing for the new planes will consume about as much or more CFRP materials than an entire B787 (with an airframe consisting of 50% CFRP by mass). The current-generation B777s feature composites across nearly 12% of its airframe mass. Adding all the components that will transfer over to the new B777 versions to the new wing is expected to drive up total composites demand estimates on the -8 and -9 to nearly 62,000 lb/28,130 kg compared to around 15,000 lb/6,805 kg. As a result, CFRP now represents roughly 30% of the mass of the airframe.

New Wing Sustains CFRP Aerostructures Growth for a Few More Years

In looking at the publicly announced orders for the -8 and -9 and the production rate history for the current B777s, Boeing should be able to sustain similar delivery rates (80 and 100 aircraft per year) for 5 or 6 years – even if sales are slow. In terms of the impact on raw materials and manufacturing supply chains, the new B777X program will be nearly as significant as the much-lauded B787 and Airbus A350 programs. At the Tier supplier level, the program is expected to represent roughly $2.0-2.5B/year in composites manufacturing business.

Running some of these hypothetical numbers truly shocked me awake. As I make further updates to the commercial transport forecasting database, the B777X program now will have an even greater impact the previously indicated. Some of the exercises here can also be applied to notional estimates for future single-aisle developments. The net results of this new data and growing production forecasts will likely sustain growth in CFRP demand in this aerospace sector at more than 10% CAGR through the early part of the next decade.

Red publishes all of his blogs on the Composites Forecasts & Consulting site: www.compositesforecasts.com.

Related Content

A new era for ceramic matrix composites

CMC is expanding, with new fiber production in Europe, faster processes and higher temperature materials enabling applications for industry, hypersonics and New Space.

Read MoreCombining multifunctional thermoplastic composites, additive manufacturing for next-gen airframe structures

The DOMMINIO project combines AFP with 3D printed gyroid cores, embedded SHM sensors and smart materials for induction-driven disassembly of parts at end of life.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreNext-generation airship design enabled by modern composites

LTA Research’s proof-of-concept Pathfinder 1 modernizes a fully rigid airship design with a largely carbon fiber composite frame. R&D has already begun on higher volume, more automated manufacturing for the future.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More