Aerospace still matters

CW columnist Dale Brosius is the head of his own consulting company, which serves clients in the composites industry worldwide. Here, he comments on the still prominent role the aerospace industry will have in the automotive industry's integration of composites into its manufacturing mix.

In November, I bemoaned the fact that the carbon fibers used today for aerospace applications are the same types used 20 years ago, and that little innovation in reinforcements for this market has occurred in two decades. Although much of that is attributable to the expense and time necessary to qualify a new material, other aspects of advanced composites in aerospace continue to move forward, but much of the progress has taken place away from the spotlight. If one reviewed composites industry press coverage over the past couple of years, it would be easy to conclude that the future of advanced composites is in industrial applications, most notably as a significant enabler of lightweight automobile structures, consumer electronics and wind turbines. Aerospace composites are getting a progressively smaller share of “air time,” so to speak.

A year ago, I cited Chrysler’s (FCA US LLC, Auburn Hills, MI, US) Francois Castaing, who notably said in 1985: “Steel is for cars, aluminum is for airplanes, and plastics are for toys.” Today, “plastic” composites are well established in airplanes, and aluminum is growing exponentially in cars, with advanced composites knocking on the door to supplant aluminum there as well. And steel? It’s unclear what markets offer upside for this legendary material, as even bridges and buildings are seeing increasing substitution by composite materials. That’s a story for another day.

It’s easy to take aerospace composites for granted: There’s not much metal left to replace in certain applications: Satellites, UAVs and helicopters are composites-intensive already, and I’m not convinced military aircraft will creep much beyond the 35-45% content level. Titanium is too critical to those designs, and that market doesn’t move fast where change is concerned. Production volumes can increase — UAVs, in particular, will add some tonnage, but the UAV segment won’t have as big an impact on aerospace composites as commercial aircraft. And the recent history of that segment, notably the Airbus A380, the Boeing 787 and the Airbus A350 XWB, suggests that composites have conquered this arena as well. That said, the battle for material supremacy in this segment is far from over. Although the most recently certified aircraft have high levels of advanced composites content, the redesigned Boeing 777, the 777X, will have carbon fiber wings but retain an aluminum fuselage. Single-aisle upgrades, including the Airbus A320neo and Boeing 737 MAX, are still aluminum-intensive, extending their lives without significant use of advanced composites in primary structure. Full redesigns have been pushed back. Metals suppliers are fighting back against composites, with new alloys, including aluminum-lithium. It is unclear what materials will prevail in this major aerospace sector.

There is one undeniable fact: Decades of investment in aerospace applications of advanced composites have enabled the current revolution in industrial composites, and will continue to do so. Carbon fiber is an obvious example — the aerospace industry has driven the development of most grades of this versatile reinforcement, and aerospace demand (largely defense-based) has fostered initial capacity and consistent quality. Early adopters in the sporting goods and industrial markets were able to tap into those benefits. Similarly, high-strength fibers, with 700 ksi (4,800 Mpa) tensile strength, are the material of choice for Type IV compressed natural gas and hydrogen storage cylinders. Downstream products, such as prepregs and carbon fabrics, developed initially for aerospace, are now used in multiple industrial markets, processed by autoclave and out-of-autoclave methods. Starting with Formula 1 racers, then migrating to supercars and sports cars, carbon composites have most recently found their way into commuter vehicles, such as the BMW i3. The automotive industry can thank aerospace for leading the way.

Core cross-cutting technologies, including nondestructive methods for detecting porosity in molded parts, and joining of composites to metal, have been led by the aerospace market. Applications of key design and simulation tools to composites, including CATIA, ABAQUS and Fibersim, owe their development and reputation to their pioneering use in aerospace, where they continue to be refined. These technologies will play a big role in driving down development cycle times and confirming quality of automotive structures, wind turbine blades and much more.

For composites to make further inroads into commercial aircraft, the industry must drive costs out and part production capacity up. Increased emphasis on out-of-autoclave approaches is one strategy in the battle against metals. Others strategies — structural optimization (moving away from “black metal” designs), parts consolidation, and joining components with adhesives instead of fasteners (click on “Building TRUST in bonded primary structures,” under "Editor's Picks," at top right) — will yield a more competitive landscape. And, like the innovations that came before, the industrial composites market will leverage this new aerospace technology, to yield the same.

Related Content

Syensqo launches Swyft-Ply brand for electronics, smart devices

Multifunctional composites leverage traditional advanced material benefits while meeting specific industry manufacturing and performance requirements.

Read MoreTeijin lightweight materials enable VAIO portable displays

Teijin's Tenax TPCL and Panlite Sheet materials allow for the creation of complex, three-dimensional shapes in a single molding step.

Read MoreCarbon Mobile carbon fiber powers handheld gaming platform

HyRECM technology effectively stabilizes carbon fiber’s electrical and antenna properties, enabling development of next-gen electronics, such as the Snapdragon G3x Gen 2.

Read MoreExel secures design patent extension for pultruded fiberglass radomes

Technique for antenna radomes forms “functional zones” inside composite material, enhancing existing 5G technology performance, application potential.

Read MoreRead Next

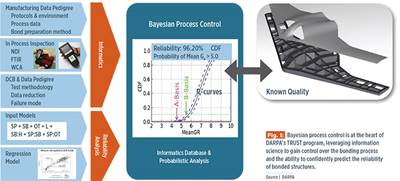

Building TRUST in bonded primary structures

A DARPA program aims for certification via Bayesian process control system for the factory floor, bounding uncertainty and predicting reliability in real-time.

Read MoreVIDEO: High-rate composites production for aerospace

Westlake Epoxy’s process on display at CAMX 2024 reduces cycle time from hours to just 15 minutes.

Read MoreCFRP planing head: 50% less mass, 1.5 times faster rotation

Novel, modular design minimizes weight for high-precision cutting tools with faster production speeds.

Read More

.jpg;maxWidth=300;quality=90)