Automating wind blade manufacture

Recent technology announcements portend a new era of more efficient blade production.

Unprecedented wind energy growth — nearly 30 percent per annum over the past five years — is pressuring wind blade manufacturers to turn out more blades, more quickly, at a lower cost. Many manufacturers have opened new plants. According to estimates by the American Wind Energy Assn. (AWEA, Washington, D.C.), 30 new blade and component facilities were announced during 2008 in the U.S. alone. Existing plants also have increased throughput by maximizing efficiency. But all would likely agree that the industry stands at a tipping point where automated production is a must if wind turbine rotor blade manufacturers are to meet future production demands (see, for example, our “Market Outlook” feature, on p. 30). “There is great potential for dramatic improvement in the way wind blades are built,” says Juan Solano, director of commercial sales for automated machinery manufacturer MTorres (Torres de Elorz, Spain, and Santa Ana, Calif.), noting that the time has come for the industry to automate blademaking processes. “Current labor-intensive strategies,” he contends, “just don’t make financial sense.”

Richard Curless, chief technology officer for MAG Industrial Automation Systems (Erlanger, Ky.) agrees, pointing out that the size and weight of wind blade parts present significant manufacturing challenges, while the market demands not only that more kW be harvested with every turbine but also that more turbines be put in service per time frame: “Simply put,” he says, “the industry needs a means to build a massive number of massive parts, quickly.”

MTorres and MAG are at the forefront of what Solano predicts will be a wider movement toward wind blade automation: “We won’t be the only ones developing this.” The two companies recently offered previews of forthcoming automated systems for blade manufacturing — MTorres announced its effort at the JEC Composites Show in Paris (March 24-26), and MAG went public with its concept at the AWEA’s Windpower 2009 Conference and Exhibition, held May 4-7 in Chicago.

Adapting aerospace automation

MTorres began R&D in the realm of automated wind blade production during the late 1990s. Its recently unveiled development project was conceived in partnership with wind turbine manufacturer Gamesa Corp. (Madrid, Spain).

“There are obvious commonalities between aerospace and wind blades — it’s only now that our aerospace machine technology has allowed us a clear path to move into blade manufacture,” says MTorres’ VP and head of aerospace automation Luis Ozco. “The main driver is cost — in order to keep the cost of wind energy competitive, blade manufacturers can’t pay the same price as an aerospace OEM for parts. We had to find a highly productive solution.”

Solano describes their efforts to date as a classic “chicken-and-egg” situation. “Companies are at a point where they have to produce 3,000 blades a year, or more, yet in most cases, the parts aren’t designed to be easily fabricated via automation. The blade, in this case one of Gamesa’s components, first has to be redesigned for the automation to really be effective.” Accordingly, says Ozco, “We’ve made strides in two directions: better automation methods and design changes in the blades themselves.”

While blade automation likely will involve many different pieces of equipment. MTorres is focusing first on the laminating process, and how best to convert one of its existing tape laying and/or fiber placement machine heads to lay dry reinforcing material, since for this project, Solano explains, prepreg tapes or tows aren’t an option because of material cost. “We are currently experimenting with various head types and sizes that can rapidly lay down multiple dry ‘tows’ narrow enough to be steered to conform to the curvatures presented by the blade shells.” He explains that the dry unidirectional or woven reinforcing strips would be sprayed with tackifier or have a similar type of surface treatment during placement so that they would stay in position until they can be vacuum-bagged, resin-infused and cured.

Ozco goes on to predict that the machine will be a gantry-type system, with the lamination head connected to a vertical column that can move along the gantry cross-beam as the gantry moves along the length of the blade skin mold. The head itself would have six axes of motion in order to accurately locate the different strips according to the predefined trajectory.

An “ambitious” target lay down rate of 2,000 lb/907 kg of material per hour will be necessary to hit the cost target and complete one blade every eight hours, says the company. MTorres’ placement-head concept reportedly is able to cut and add strips on the fly at full speed, minimizing machine stops and, therefore, maximizing production rates. Additionally the cutting system is capable of orienting the cut angles, which will reduce scrap. Application tolerances of ±5 mm/±0.2 inch will be achieved by means of NC servomotors that control each individual strip.

The blade redesign portion of the project centers on the root area, the most complex and thickest laminate in the blade structure. While details are proprietary, the companies are grappling with a split root design that would allow easier manufacture of the entire blade in two halves, says Ozco. “The root, because of the greater amount of material there, particularly needs high laydown rates.”

Machine-specific software development also is part of the collaboration project. It will be based on MTorres’ existing Tor-Fiber proprietary programming suite. Solano explains that both the blade design file and the programming software file are generated in CATIA (supplied by Dassault Systèmes, Suresnes, France) and downloaded to the lamination machine’s controller, where the software will determine the ply parameters, cuts and acceptable gaps between plies and, subsequently, generate the CNC machine code.

“The concept is good,” Solano contends. “We’ve already run trials of the laminating machine head on a small scale and are fully confident that such a machine can successfully meet the ambitious targets established by Gamesa and MTorres. But there are challenges — the dry material changes things.”

On the positive side, he points out that other aspects of blade assembly automation, such as assembly jigs and adhesive application methods for bonding shell halves together, are readily available: “We’ve developed that technology already.” The company hints that it is conceptualizing and developing equipment for an entirely automated blade manufacturing plant that, perhaps, could be located in the United States. Production could start as early as 2011.

More systems on the way

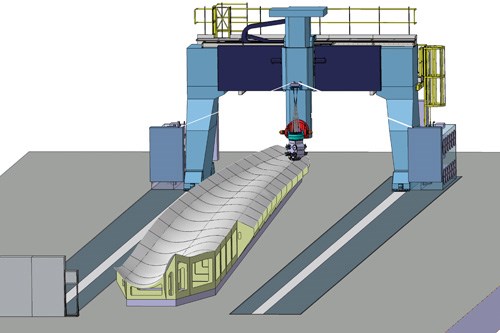

In contrast to the MTorres system, MAG’s automated blade manufacturing concept is not designed with a specific blade manufacturer in mind. The latter’s new Rapid Material Placement System (RMPS) concept is an integrated CNC-automated cell, capable of spraying in-mold coatings, dispensing and laying up woven or unidirectional glass or carbon reinforcements and applying adhesives. “Our new systems,” claims MAG’s Curless, “can reduce labor content by two-thirds, double throughput, and produce a consistently high-quality product from the start of a shift to the end.”

The RMPS features a floor rail-mounted gantry system (see rendering) with multiaxis end effectors capable of manipulating spray heads and adhesive applicators, as well as unspooling and placing materials. Bulk supply systems for gel coat and adhesives are carried on the moveable carriage that supports the end effectors.

After application of a gel coat via a spray head, a ply generator with a ten-roll magazine of material cuts and dispenses the plies to a layup end effector on the gantry. As the reinforcement is paid out onto the mold, a pair of articulating power brushes smooths it onto the tool surface. The CNC-controlled system is powered with programmable drives and servomotors. Offline programming software created by MAG develops the CNC code from imported CAD blade data. According to Curless, the layup system is mechanically repeatable to ±0.08 inch/±2 mm, with an application tolerance of ±0.2 inch/±5 mm: “Materials can be layed down at a rate of 10 ft/sec (3 m/sec) to create blade skins, spar caps or shear webs, with integrated laser- and vision-based wrinkle detection capability in the longitudinal or crossply directions.”

MAG contends that two such systems adjacent to one another can each produce a 146-ft/45m blade shell half in less than two hours and, depending on the laminate schedule, could reduce manual layup time by almost 85 percent.

Another new MAG blade manufacturing concept is the 5-axis Agile Gantry Multi-Processing System. With an unlimited x-axis range, 130 ft/min (40 m/min) traverse speed, automatic tool changer and five servo-controlled axes, the CNC machine tool platform is targeted to reducing the time and labor needed for tedious coating, blade machining and finishing work. A modular rail system creates any x-axis length required, with the rail system below the factory floor, above it, or elevated to create a high-rail configuration. The gantry cross-rail provides 18 ft/5.5m of x-axis travel and 8.2 ft/2.5m or more of z-axis reach. Servo-controlled rotary a and c axes (spindle tilt and wrist roll) provide ±100° and ±200° of movement, respectively. The maximum feed rate for the linear x, y, and z axes is up to 40,000 mm/min (0.004 to 1,574 ipm), and up to 3,600°/min in the rotary axes, notes Curless. A high-capacity vacuum system with spindle shroud is available to capture dust and chips, and a drum-type tool changer holds 16 tools for automatic tool changes. Designed for five-sided part access, the gantry can support applications and processes that include cutting tools, spray heads, water-jet cutters, chopper guns and finishing tools. It can be used to produce complex mold geometries in high-density foam, apply coatings or trim and finish contoured blade parts.

MAG also is introducing a new (pat. pend.) quick-cure mold system using tooling it will build from customer-supplied CAD blade-profile data. While system details are scarce, Curless says that infusion can be accomplished in an hour, regardless of laminate thickness, followed by a two-hour cure, which is about half the normal time. The infusion/cure system will include process control metrics for resin metering, temperature controls and methods for detecting blocked channels.

Other equipment for blade manufacture includes a new five-axis machining system for drilling, milling and sawing of the composite blade root area. MAG also offers metal machining equipment that enables “multitasking” finishing capability for all of the numerous metal components of a wind turbine, reports Curless. One is the Universal Machining Center, a machine that can operate from a horizontal or a vertical orientation. Designed for large and complex metal components, it has five-side machining with automatically interchangeable 5-axis heads.

“Great risk and time are involved when parts weighing up to 80,000 lb (36,290 kg) are transferred from one machine to another to produce different features on different surfaces. Such transfers often degrade overall part accuracy, too, as tiny setup errors stack up each time the part is refixtured,” says Curless. “It’s all about one-stop processing, and it’s accomplished with multitasking machine tools: machines able to perform normally dissimilar operations, such as milling, turning, drilling, tapping, perimeter scalloping, boring, hobbing and grinding, in one location and at different orientations,” he reports. The components produced on such machines would include rotors/shafts, gear case assemblies, planetary carriers, hubs, rotor bearings, couplings, pinions, cylinder brackets, yaw beams and rotary crowns. MAG has supplied multitasking metal machining systems to Dowding Industries (Eaton Rapids, Mich.), a successful producer of wind turbine components.

More automation on the horizon

As this issue of CT went to press, two additional concepts for automating wind blade production surfaced at the Windpower 2009 show in Chicago. Automated fiber and tape placement manufacturer Ingersoll Machine Tools (Rockford, Ill.) announced the Wind Blade Composite Deposition system. Like the MTorres and MAG systems, Ingersoll’s in the conceptual stage, but the company is said to be working toward building a machine and proving the technology. Another exhibitor, Danobat Machine Tool Co. Inc. (Elk Grove Village, Ill. and Elgoibar, Spain), announced a prospective gantry-based automated blade manufacturing system that reportedly will handle gel coat application, fabric layup, adhesive application, edge trimming and surface grinding, and will provide part measuring and inspection capabilities.

As progress is made toward realizing these technologies and more details about their functionality become available, CT will update the developments.

Additional coverage of composites in the wind energy market in this issue includes:

The American Wind Energy Assn.'s (Washington, D.C.) show confirmed wind energy’s status as a recession-proof market for composites, but blade manufacturers were put on notice about the need to automate.

"Market Outlook: Offshore wind — How big will blades get?"

Explosive growth in offshore wind farms will push the limits of blade engineering as manufacturers pursue massive designs that will harvest more megawatts.

"Engineering insights: Challenge of engineering retrofit blades"

Related Content

Recycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreComposites end markets: Pressure vessels (2024)

The market for pressure vessels used to store zero-emission fuels is rapidly growing, with ongoing developments and commercialization of Type 3, 4 and 5 tanks.

Read MoreComposites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreMingYang reveals 18-MW offshore wind turbine model with 140-meter-long blades

The Chinese wind turbine manufacturer surpasses its 16-MW platform, optimizes wind farm construction costs for 1-GW wind farms.

Read MoreRead Next

Wind turbine blades: Big and getting bigger

Two decades of technical and market development has made this once marginal application a global giant and one of the world’s largest markets for composites.

Read MoreWind Blade Manufacturing: Cost-efficient materials-based strategies

The wind blade’s four key elements — the root, the spar, the aerodynamic shell or fairing, and the surfacing system — have present unique manufacturing challenges that must be met with carefully selected composite material systems and molding strategies.

Read MoreBig Blades Cut Wind Energy Cost

Rapid growth rate of composite-intensive conversion systems drives market competition and innovation.

Read More

.jpg;maxWidth=300;quality=90)