Offshore wind: How big will blades get?

Explosive growth in offshore wind farms will push the limits of blade engineering as manufacturers pursue massive designs that will harvest more megawatts.

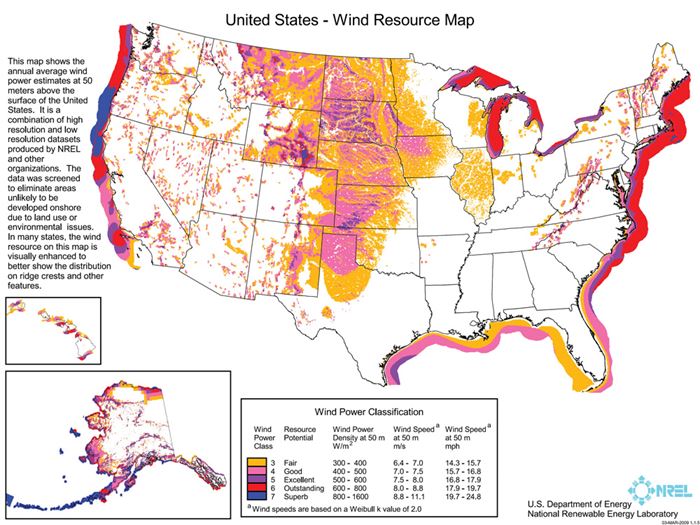

2008 was another banner year for the wind energy industry. Recent data suggest that global installation of new wind turbines last year exceeded 28,000 megawatts (MW) of rated capacity (roughly 19,000 turbines), worth approximately $48.9 billion USD (€36.5 billion). Over the past decade, wind truly has been embraced in the electric power market. In 2002, new wind turbines accounted for only 1 percent of new electrical generating capacity in the United States. Today, the figure is closer to one-third of all new installed capacity. In Europe, the region that leads the world in wind energy development, 43 percent of all new electric power installations during 2008 were wind farms. According to the Global Wind Energy Council (GWEC, Brussels, Belgium), the world has more than 120 gigawatts (GW) of capacity. This accounts for about 260 terrawatt hours (TW-hr) of electricity each year, preventing an estimated 158 million metric tonnes (348.3 billion lb) of CO2 from entering the atmosphere. Although the current economic crisis has hampered some financing of new wind farms, the wind industry still is expected to continue growing (see “Market Forecast 2009-2013,” the first chart at right). In fact, several companies project that their turbine sales will rise 20 percent or more this year compared to 2008.

A significant subset of the wind farm figures is the number that are and will be located offshore. Although offshore installations make up a comparatively small part of the total, growth offshore has been dramatic. In 2007, 210 MW of turbines were installed offshore, bringing the total offshore production capacity to 1,080 MW, all of which is currently located in Europe. During 2008, 128 turbines rated at 358 MW were installed — an increase of 70 percent. The number of new turbines put into operation by the end of this year is expected to be 131 units rated at 388 MW. However, there is ongoing construction at 17 offshore sites that represents more than 2,600 MW of capacity, and there are currently an additional 22 proposed offshore projects that could be operational by 2015, representing about 3,000 new turbines rated at 12,055 MW of additional capacity.

The growing offshore market for wind

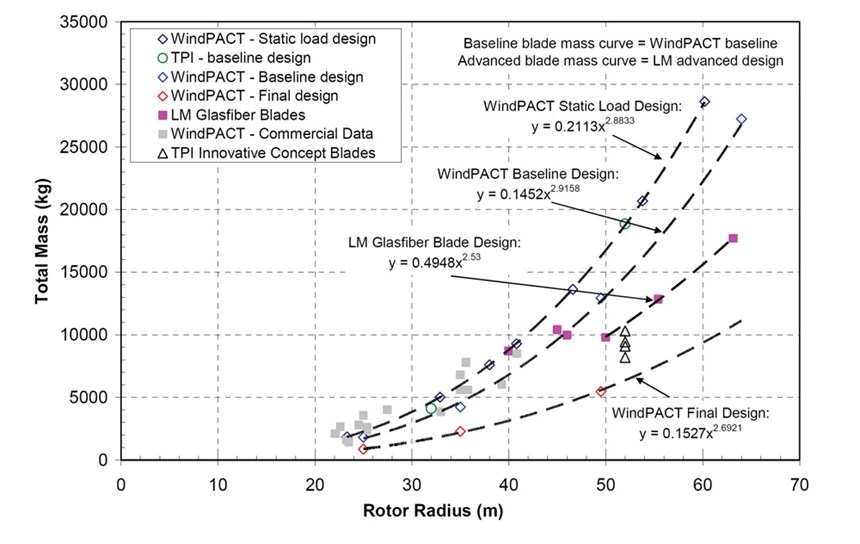

Despite its comparatively small impact, thus far, the importance of the offshore segment within the wind industry should not be understated. Not only are the wind speeds offshore typically greater, but the turbines are able to produce electricity about 50 percent of the time, compared to the 20 to 30 percent typical of onshore farms. Greater and more predictable wind resources directly equate to lower cost of energy production.By looking at the U.S. Wind Resource Map (chart #2, at right), we can see the significance of offshore development. Although the central states region is referred to frequently as the Saudi Arabia of wind, nearly three-quarters of the U.S. population lives on the coasts. Bringing that land-based wind power to the population centers on the East and West Coasts will be a major challenge — one already under discussion by the Obama Administration, which has proposed a massive upgrade to the U.S. power grid to manage power transport. Just off the U.S. coastline, however, there is a great deal of wind that can be harvested, and much of it is located fairly close to the major population centers. If the U.S. is to achieve the Department of Energy’s goal of generating 20 percent of U.S. electricity from wind by 2030, a considerable portion of this capacity will have to be generated offshore. The America Wind Energy Assn. (Washington, D.C.) predicts that offshore turbines will make up almost one-quarter of this capacity, roughly 18,000 turbines. Construction on the first two proposed projects in the U.S., the 90- to 120-turbine (300 MW) Buzzards Bay Wind Farm off the coast of Massachusetts and the 130-turbine (420 MW) Cape Wind Delaware Offshore Wind Project, could begin before the end of this decade.

The situation in Europe is even more pointed: The European Union’s development goals for wind energy rely heavily on the success of large offshore turbines. Of the offshore wind farms under construction or in planning stages, only 1,430 MW are located off the European coast — less than one-tenth of the total capacity. By 2020, it is possible that offshore wind could account for as much as one-third of the region’s generating capacity, representing an increase of more than a factor of 20, compared to today.

Going to greater lengths

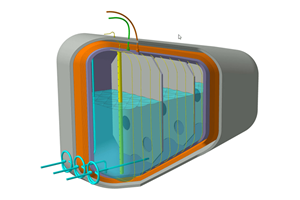

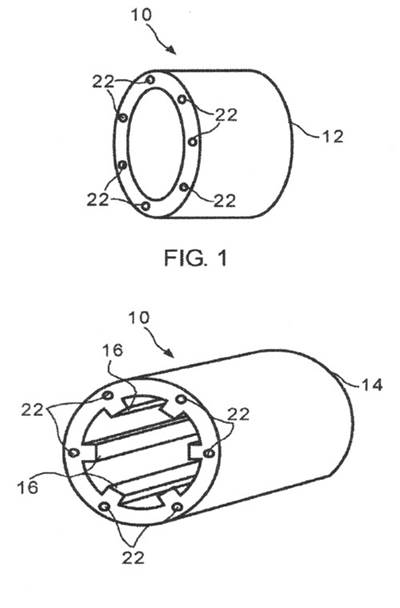

One of the distinguishing characteristics of these offshore turbines is their size. Although the average wind turbine is now rated at about 1.5 MW, the smallest units that have been employed in offshore farms are 2 MW. The offshore wind farms that are currently under construction employ the largest turbine systems in production — 5.0 to 6.1 MW — supplied by REpower Systems AG (Hamburg, Germany), Enercon GmbH (Aurich, Germany) and Multibrid GmbH (Bremerhaven, Germany). The rotor diameters for these turbines measure up to 126m/413 ft. Already under development at Clipper Windpower (Carpinteria, Calif.) are systems rated at 7.5 MW.Although the challenges of building ever larger composite wind turbines and blades and the technologies it will take to meet them are still being identified (for example, see p. 27, this issue), the wind industry is already looking at taking things even further. Projects such as the European Union-funded UPWIND program, centered at the Risø National Laboratory (Roskilde, Denmark) and supported by 40 companies, is looking to establish the fundamentals of scaling turbines to as large as 20 MW. Considering the size and cost constraints for transporting them over land, these turbines are envisioned primarily for offshore farms.Those who supply the composite structures for these massive turbines will require significant technology advancements to turn such visions into reality.

The importance of wind turbine blade construction to the composites industry has been well chronicled within the pages of CT. Despite the growing impact of the economic crisis on wind farm financing and construction, the global output of wind turbines and composite blades has been within 3 percent of my admittedly bullish forecast in June 2008 (click on “Wind turbine blades: Big and getting bigger,” under "Editor's Picks," at right). In all, composite blade shipments represented the sale and production of about 570 million lb (256,261 metric tonnes) of product, worth an estimated $5.76 billion (€4.24 billion) during 2008. About 20 percent of that total was for turbine systems rated at greater than 2.5 MW. Production of the large turbine blades for offshore wind farms could represent about one-half (by weight) of the blade market.

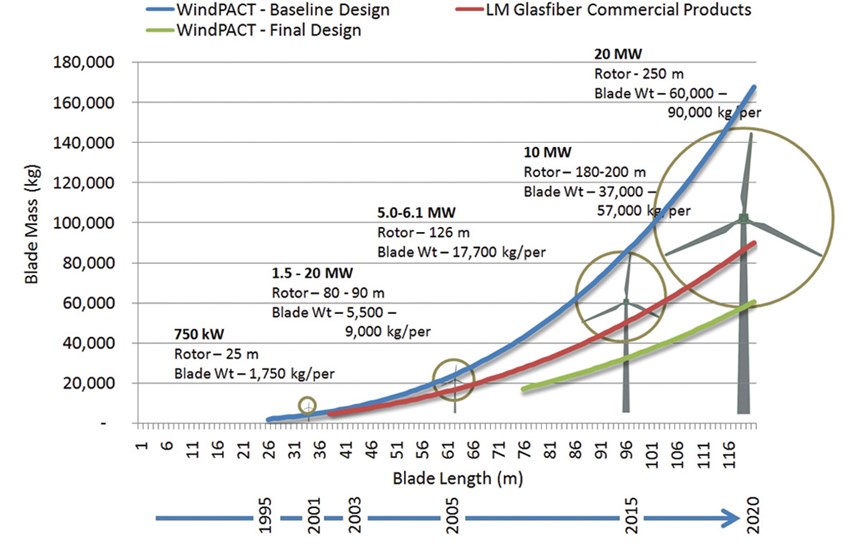

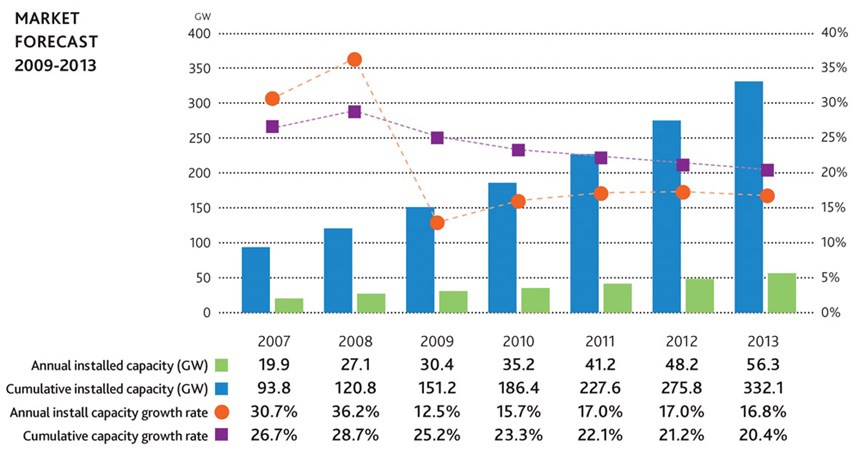

The trend is clear: The wind industry will continue to push the bounds of its abilities and explore new avenues to build larger blades. For larger wind turbines, the potential power that a turbine can generate scales with the square of the rotor diameter. Though its power capacity increases to the square of its diameter, the traditional metrics indicate that volume and mass should scale to the third power of rotor diameter. Innovation in the design and construction of blades, however, has enabled manufacturers to do more with less. LM Glasfiber’s (Lunderskov, Denmark) most advanced blades — the company’s first serial product to include some carbon-fiber reinforcement — weigh about 30 percent less than their exclusively glass fiber/unsaturated polyester predecessors (represented by the “WindPACT Baseline” design in the two charts at right). Further improvements have been identified through the National Renewable Energy Laboratory’s (NREL, Golden, Colo.) WindPACT technology government/industry research program. Using additional carbon fiber in blades that measure 50m/164 ft or greater could reduce blade mass by about one-third compared to the state of the art, as demonstrated in LM Glasfiber’s latest blade models (shown in the “WindPACT Final Design” trend line in the last two charts at right).

It may be optimistic to predict that 8- to 10-MW wind turbines will be technically and economically viable by 2015, and it’s difficult to imagine a 20-MW turbine. The largest blade made to date measures 61.5m/202 ft and weighs 17,770 kg (39,176 lb), with a rotor diameter of 126m/413.4 ft and overall rotor weight of ~54,600 kg (about 120,320 lb). If we apply some scaling principles and assume that additional technology advances will make such an undertaking economically attractive, an 85m to 95m (278.9-ft to 311.7-ft) blade for an 8- to 10-MW system would weigh, at a minimum, 37,000 kg (81,550 lb). Similarly, a single 20-MW turbine’s 120m/393.7-ft blade would weigh closer to 60,500 kg (133,340 lb) — with the result that a single blade for a 20-MW turbine weigh more than the entire rotor used on today’s largest turbines.

Current design methods and available components and materials do not allow for upscaling the size of the blades (or other turbine components) to this degree. As the blades grow beyond the current state of the art, gravity loads on the blades increase and are expected to have a greater effect than the wind loads, leading to further weight gain. The optimal wind turbine dimensions (or selection of design parameters) are currently the subject of great investigation. Based on the limited evidence available at this time, it is unlikely that a universal design solution can be created that would meet expectations in all the individual operating environments. Critical issues that need to be addressed for these next-generation large wind turbine blades include development of innovative materials with sufficiently high stiffness and strength (both static and fatigue); reconsideration of the structural design of rotors; and incorporation of damage-tolerant design, integrated health monitoring systems and “smart” structure technologies. Additionally, designers will need to ensure that both material systems and manufacturing processes are cost-effective and that there are viable strategies for end-of-life decommissioning and recycling of retired blades.

Although it is difficult to contemplate all of the challenges that will be encountered as companies begin to define the engineering requirements needed to go this far, outlining the “size” of the challenge sheds some light on possible avenues for advancement. The demand for offshore turbines forecasted in the 2015 to 2020 time frame would be sufficient to support the installation of between 100 and 350 turbines, rated at 8 to 10 MW, annually — about one turbine each working day. Using a rough figure of 37,000 kg (81,571 lb) per blade, each blade half-shell would weigh ~16,100 kg (~35,475 lb), and the spar might add 4,800 kg (10,580 lb). As envisioned, one set of turbine components would need to be completed every four or five days, a little more than one blade per day. At this rate our notional blade factory would need to operate three shifts each day and be able to sustain manufacturing productivity on the order of about 1,500 kg (3,307 lb) of finished composite structures per hour.

Whether or not this per-hour figure is attainable is debatable, but it highlights a salient point for any company looking at large offshore turbine applications: All successful solutions will have to focus on productivity.

Although there has been some development of robotic tape laying equipment with the ability to deposit more than 100 kg/220.5 lb of prepreg per hour, blades longer than 80m/262.5 ft would require an order-of-magnitude improvement in production rates. Lower rates in individual blades could be sustainable if the manufacturer adds additional production cells, but long out-time may become a critical constraint with the use of prepreg systems. Moreover, prepreg systems also would have to be further optimized for use with tape-laying machines. An alternative is infusion processing, already practiced by some blade manufacturers. Development of automated preforming for advanced infusion processes offers the potential to address some of the challenges. In either case, building blades in segments could help break the sizeable challenge into more management components, both for manufacturers and those who must transport finished blades to wind farm construction sites. However, segmenting the blades necessarily adds additional weight and creates an altogether new design problem: determining the most economically and functionally efficient method for joining the segments.

Suffice it to say that the undeniably bright future we see for wind energy offers the composites industry a wealth of opportunities and a host of engineering challenges in equal measure.

Additional coverage of composites in the wind energy market in this issue include:

"Windpower 2009 Highlights"

The American Wind Energy Assn.'s (Washington, D.C.) show confirmed wind energy’s status as a recession-proof market for composites, but blade manufacturers were put on notice about the need to automate.

"Work in Progress: Automating wind blade manufacture"

Recent technology announcements portend a new era of more efficient blade production.

"Engineering insights: Challenged to engineer retrofit blades"

Myriad interrelated design factors are considered in new blades for turbines originally built for high-wind regimes.

Related Content

Hexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreCollins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreNCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

Read MoreRead Next

Wind Blade Manufacturing, Part I: M and P innovations optimize production

As demand for wind turbines reaches unprecedented levels, rotor blade manufacturers explore new production strategies, including automation and blade segmentation.

Read MoreWind Blade Manufacturing: Are thermoplastic composites the future?

In a market dominated by thermoset composites, some wind turbine blade manufacturers are actively pursuing new composite blade designs featuring faster-processing reinforced thermoplastics.

Read MoreBig Blades Cut Wind Energy Cost

Rapid growth rate of composite-intensive conversion systems drives market competition and innovation.

Read More