Aviation Outlook: Composites in rotorcraft reaching new altitudes

One of the earliest markets for advanced composites, helicopter manufacture is and will continue to be a stronghold for industry growth.

It is undeniable that commercial transport jets are undergoing an “extreme makeover” in advanced composites. Composite materials account for roughly half of the structural weight on Boeing’s new 787 Dreamliner and Airbus Industries’ materializing A350 XWB. That’s more than double the percentage on commercial jets introduced just 10 years ago and triple that of predecessors brought to market during the early 1990s. While this is rightly considered a revolution, it tends to overshadow the equally significant but much earlier transformation of primary and secondary structures in the helicopter industry. While the Boeing 777 and Airbus A340 programs were “aggressively” adopting composites for 10 to 15 percent of their structural weight, the airframes of some commercial helicopters were already half composite, and those of many military rotorcraft were almost entirely composite (see Fig. 1).

Measuring the performance impact

This earlier incorporation of composites in helicopter design was prompted by their unequivocally positive effect on key performance measures and overall system productivity. Rotorcraft productivity can be defined as the sum of acquisition costs and operating/ownership costs divided by the product of aircraft speed and useful load. The use of high-performance composite structures enables helicopter manufacturers to advantageously address at least three of these factors. Weight reduction enables greater speed and increased load-carrying capacity. Lower aircraft weight also reduces fuel burn, with a corresponding drop in overall operating costs. Advanced composites also exhibit greater fatigue and corrosion resistance compared to metals, and their frequency-tuning and vibration-damping properties can be harnessed to reduce aircraft maintenance and repair costs. For military operators, composites also provide improved ballistic protection to safeguard soldiers, pilots and sensitive equipment from ballistic threats. The composite rotor blades of the U.S. Army’s Apache Longbow, for example, combine all these benefits: the blades reportedly can withstand not only rifle fire but also the explosive impact of rocket-propelled grenades.

These proven performance and cost benefits guarantee continued use of composite materials on new civil and military rotorcraft and virtually ensure expanded application well into the future. This trend, fueled by a robust replacement market for existing civil and military helicopters and an expanding market for new rotorcraft, has driven demand for composite helicopter aerostructures up more than 75 percent (in terms of weight volume) since 2003.

Defining the rotorcraft market

Looking forward a decade or so, rotorcraft manufacturers expect to deliver approximately 21,900 new helicopters to customers around the world. This total includes the heavier, more capable class of turbine-powered helicopters and their smaller piston-powered counterparts. During 2007, 15 OEMs in the turbine-powered class, which includes more than 50 rotorcraft models, turned out about 910 helicopters. This figure is likely to grow in 2008 by about 9 percent. The three leading companies in terms of turbine-powered unit production are EADS Eurocopter (Marignane, France), Sikorsky Aircraft Corp. (Stratford, Conn.) and Bell Helicopter Textron (Ft. Worth, Texas). Piston-powered rotorcraft, built by the likes of Enstrom Helicopter Corp. (Menominee, Mich.), Robinson Helicopter Co. (Torrance, Calif.) and Schweizer Aircraft Corp. (a Sikorsky subsidiary in Horseheads, N.Y.), represent a similar number of unit deliveries during 2007 and 2008. Despite the near parity in annual unit deliveries, turbine helicopters account for more than 95 percent of the total demand for composite materials and structures in the global rotorcraft industry. Considering the prominent role that composites play in the construction of turbine-powered helicopters, of which the Sikorsky UH-60 Black Hawk, Bell’s UH-1Y/AH-1Z, and Eurocopter’s EC-145 and Tiger are good examples, it should come as no surprise that these three firms are the leading consumers of composite materials in the helicopter industry (see Fig. 3).

Between 2008 and 2012, approximately 5,750 new turbine helicopters are expected to be delivered to customers worldwide — nearly 2,000 more than during the preceding five years. These deliveries represent aircraft sales worth about $85 billion (USD), not including engines or maintenance. To keep pace with growing build rates, helicopter OEMs and their subcontractors collectively manufactured 1.1 million lb (nearly 500 metric tonnes) of composite primary and secondary structures in 2007. Because unit deliveries will grow 25 percent annually between 2008 and 2012, and because the product mix will continue to evolve, the composite structures market for helicopters is expected to expand by ~40 percent, reaching an annual volume of 1.86 million lb (844 metric tonnes) by 2012 (Fig. 4).

To put these totals in perspective, commercial long-haul and regional fixed-winged transport aircraft pro-grams required the production of an estimated 5.17 million lb (2,345 metric tonnes) of composite structures (not including interior components) in 2007. Similarly, the projected demand within the general and experimental aircraft market totaled approximately 2.19 million lb (993 metric tonnes) of composite structures. During this same period, business jet production required 860,000 lb (390 metric tonnes) of primary and secondary composite aerostructures and military fighters and trainers incorporated an additional 883,000 lb (400 metric tonnes).

In the following five-year time frame (2013-2017), unit deliveries for the entire spectrum of turbine helicopters (commercial and military) is expected to stabilize at between 1,250 and 1,300 aircraft per year. A phaseout of legacy products in favor of newer, more capable and more composite-intensive models, such as Bell’s model 407 and V-22, Sikorsky’s CH-53K, and the NH90 from NH Industries (Aix en Provence, Cedex, France), will drive annual composite helicopter aerostructure demand up another 6 percent.

Replacing wounded war birds

The major driver behind expected growth now and for the next several years will be the need to replace the U.S. Army’s war-weary fleet. Speaking at Aviation Week’s 2007 A&D Programs conference late in October 2007, Brigadier General Steven Mundt, director of the Army Aviation Task Force, said the service is not allowed to include estimated aircraft losses in its regular procurement requests to U.S. lawmakers in Washington, D.C. As a result, it takes approximately 18 to 30 months to get replacement vehicles back into the hands of war fighters. For some systems (e.g., the CH-47 and AH-64D helicopters), said Mundt, the process has taken more than five years. Accordingly, the Army’s rotorcraft fleet is unlikely to return to the readiness level maintained before the start of combat operations in Afghanistan and Iraq until three or four years after the withdrawal of U.S. forces from these regions.

Looking at future Army needs, Mundt gave a brief history lesson to illustrate that long-term military helicopter requirements will remain high. Over the past 60 years, he said, the “operational tempo” or frequency of deployment of combat/peacekeeping troops by the Army has steadily increased — especially during the past two decades. Since 1989, the Army has deployed troops outside the U.S. more than 30 times, including three times to major “theater wars.” In the previous 40 years, troops were deployed about 20 times, twice to major conflicts (see Fig. 2). “Conflict will continue into the future,” he stated, contending that “operational demand will persist regardless of the upcoming change in Presidential administrations.” While Mundt was speaking directly to the Army’s situation, the U.S. Navy, Marine Corps and Air Force as well as the militaries of partner nations also see similar wear-and-tear increases in their helicopter fleets.

In light of this trend and growing military requirements in several other countries (including but not limited to China, India, Saudi Arabia and South Korea), most helicopter airframe and engine manufacturers are dramatically adjusting their 10-year production estimates. What began as 50/50 splits between military and commercial output, in terms of unit deliveries, has shifted to nearly 60 percent military during the past two years. Turbine engine manufacturer Rolls-Royce Plc (Derby, U.K.), for example, added roughly 2,750 new and upgraded helicopters to its 2007 10-year military helicopter market forecast compared to the same study released the year prior.

The military’s increased share of the overall market, however, in no way discounts the strong demand from civilian helicopter operators: Rolls-Royce raised its forecast for civil helicopter engine deliveries by about 17 percent through 2016. Rival engine manufacturer Honeywell Aerospace (Phoenix, Ariz.) is more aggressively optimistic, forecasting that civil rotor-craft deliveries will grow roughly 25 percent over the next decade. Overall, demand is such that delivery slots for many of the most popular programs are sold out for the next two years of production.

Surveiling the horizon

Most of the above-mentioned demand for advanced composites is based on rotorcraft already in production or entering production. Observing that a number of the military airframes already are composed of as much as 90 percent composites, it might be argued that the demand for advanced composites in helicopters has hit a quasi-“glass ceiling” and will henceforth track closely with expected unit production volumes. While this argument has some validity from a purely statistical viewpoint, it does not take into account a number of radical new programs that, through creative design and engineering, intend to make much sought-after leaps in rotorcraft performance capabilities and operating efficiencies.

The U.S. Department of Defense (DoD), for example, is rapidly defining its next-generation rotorcraft in an effort to improve the operating cost structure of the U.S. military’s helicopter fleets. In 2013, the Marine Corp is expected to begin taking delivery of the new Sikorsky CH-53K, which will provide the backbone of the Marines’ heavy-lift helicopter fleet. Designed to replace the smaller CH-53E that is currently in service, the CH-53K features Sikorsky’s performance-enhancing fourth generation anhedral composite rotors and a hybrid composite/metal fuselage, enabling the aircraft to lift roughly 36,000 lb (16.3 metric tonnes) of cargo. While the aircraft’s design and manufacturing details are still carefully guarded, estimates are that advanced composites will make up more than 80 percent of its structural weight. Initial operating capability is expected in 2015, with four aircraft per detachment. The Marine Corps is expected to purchase 156 CH-53Ks between 2013 and 2021 at a total cost of more than $14 billion.

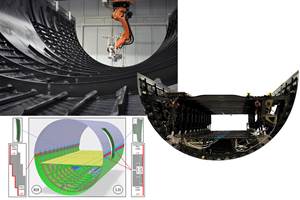

In May 2007, Sikorsky announced the selection of Aurora Flight Sciences (Manassas, Va.), EDO Corp. (New York, N.Y.), GKN Aerospace (East Cowes, Isle of Wight, U.K.), and Spirit AeroSystems (Wichita, Kan.) to build the CH-53K’s composite primary and secondary structures. Aurora will design and build the main rotor pylons at its facilities in Virginia and West Virginia. EDO will design and build the tail rotor pylon and sponsons. Composites fabrication will be conducted predominantly in Salt Lake City, Utah, with several parts resin transfer molded in Walpole, Mass. GKN will conduct fuselage aft transition work in Nashville, Tenn. and St. Louis, Mo. Spirit AeroSystems will build the aircraft’s cockpit and cabin in Wichita.

Carrying more over greater distances

Increasingly, military planners are looking for ways to airlift troops and equipment into areas without the benefit of runways. For DoD planners in particular, such transport operations might have to cover greater distances because they lack access to “friendly” air bases near target zones. To deal with this scenario, the U.S. Army is leading the Joint Heavy Lift (JHL) program, which is poised to redefine the term “heavy lift” helicopter in much the same way the Airbus A380 changed the scale of jumbo jets. The program is targeting a rotorcraft that can transport a heavier payload — 58,000 lb (26.3 metric tonnes) — considerably farther than any conventional helicopter. The Army is already funding several competitive JHL concept definition projects: Boeing Integrated Defense Systems (St. Louis, Mo.) is working on an advanced tandem-rotor helicopter, which shares many similarities to the 1970s-era XCH-62 program. Frontier Aircraft (Lake Forest, Calif.) is developing a patented Optimum-Speed Tiltrotor (OSTR). Sikorsky is developing two designs based on its X2 Technology. Bell is promoting its Quad TiltRotor (QTR) concept.

As currently envisioned, Bell’s QTR would be roughly the same size as a C-130 military transport airplane, with a gross weight of around 130,000 lb (59 metric tonnes). To get this big bird in the air, Bell will use four prop rotors powered by yet to be built 12,000-plus-hp engines. To keep the aircraft’s structural weight to an absolute minimum, Bell envisions building the airframe primarily from “thick” (greater than 0.375 inch/9.52 mm) monolithic, unitized composite laminates. Critical to the success of the concept, these thick structures will present a significant developmental challenge over the next five to seven years. Given the proposed size of the JHL, the tonnage of composites structures per aircraft easily could be equivalent to Boeing’s 787, Airbus’ A350 XWB, and future twin-aisle commercial jet transport planes.

Replacing many with few

As U.S. military services look for ways to reduce the number of unique helicopter platforms they operate, they are borrowing the philosophy behind the development of Lockheed Martin’s F-35 Joint Strike Fighter. The Joint Replacement Aircraft (JRA), for example, represents the Army’s next-generation concepts for a single rotorcraft platform with variants capable of combat, transport, utility and search-and-rescue missions. As currently envisioned, the JRA would replace the UH-1 Huey, Cobra, all variants of the UH-60 and SH-60, and the AH-64 Apache, starting sometime between 2025 and 2030. To meet this schedule, development and design work likely would begin in earnest within the next decade.

Considering that about 19,000 AH-64s, UH-60s and AH-1/UH-1s (not including civil variants) have been delivered to military customers around the world and that an additional 3,200 deliveries are anticipated over the next decade, the JRA could become the largest helicopter production program in history. If some of the helicopter models that the JRA intends to replace are used as a size benchmark, it is realistic to expect that each JRA aircraft would incorporate at least 3,000 lb/1,361 kg of composite structures — about three times as much as a Boeing 737 single-aisle transport. Assuming a 30-year production run — long enough to replace the existing fleets of Hueys, Cobras, Black Hawks, and Apaches — the JRA production team will need to produce about 740 helicopters per year. During this period, JRA’s production could require more than 66 million lb (about 29,940 metric tonnes) of composite structures valued in excess of $33 billion (in fiscal year 2006 dollars) — an amount equivalent to all the composite materials likely to be used in the production of the world’s commercial and regional winged transports between 2008 and 2012.

Flying faster, farther, longer

Many of the emerging concepts for JRA and other future military helicopters also are targeting top speeds, flight ranges and loiter times well beyond the capabilities of today’s most advanced rotorcraft. Some unusual development programs already are demonstrating these new capabilities.

Probably the most conventional looking of the concepts, Boeing’s svelte, unmanned A-160 Hummingbird, is currently being developed to fulfill surveillance, reconnaissance, target acquisition and troop resupply roles for U.S. military services. Funded under a Defense Advanced Research Projects Admin. (DARPA) contract, the 35-ft/10.7m long A-160 is designed to fly more than 24 hours continuously with a range of 2,500 nautical miles without refueling. While not very fast, the A-160 can achieve flight altitudes of up to 30,000 ft/9,144m — about 50 percent higher than any existing helicopter can achieve. Despite the loss of its flight-test aircraft in December, support for the program remains strong; prior to crashing, the Hummingbird had successfully completed 12 hours of continuous flight, smashing previous helicopter endurance records.

The key to the Hummingbird’s performance is the ability to adjust the 36-ft/11m diameter rotor’s rotational speed at different altitudes and cruising speeds. A significant departure from conventional rotor systems, which tend to have a fixed rotor speed regardless of altitude, the optimum speed rotor enables the operator to reduce fuel consumption by 50 to 60 percent. The primary technologies that enable the A-160 to deliver such revolutionary performance are its advanced carbon fiber-reinforced polymer rotor design, couples with the A-160’s optimum speed rotor technology would be severely limited. Physically, the rotor blades are tapered, and each blade’s cross section and stiffness varies from root to tip.

The top cruise speeds of helicopters in service today, roughly 150 to 170 knots, are only incrementally better than they were decades ago, due to fundamental limits inherent in conventional rotor system design. Several radical helicopter configurations have been proposed to circumvent these limitations. Sikorsky’s X-2 demonstrator, for example, is designed to produce top speeds of 250 knots, using coaxial main rotors — two rotors, mounted one above the other, that revolve in opposite directions on the same axis. Although the technology is being developed for the JHL, it could be very attractive for future JRA requirements. Distinctly different, Spain’s El Instituto Nacional de Técnica Aeroespacial’s Helicopter Adaptive Aircraft (HADA) program and Piasecki Aircraft’s (Philadelphia, Pa.) X-49A vectored-thrust ducted propeller (VTDP), or “ring tail” program, both feature “pusher” systems in addition to the main rotor. The combination is expected to drive helicopter airspeeds up 35 to 40 percent, compared with today’s helicopters. In each, lightweight composite materials are a critical enabler.

Piasecki’s X-49, also referred to as the YSH-60F, is based on a heavily modified Sikorsky Black Hawk. Company representatives report that the most significant modification is the VTDP auxiliary thrust unit that replaces the tail rotor. The thruster, a ducted fan, is made in large part of composite material and weighs only 220 lb/100 kg more than the entire Seahawk tail it replaces. According to Piasecki, “The H-60 [composite] tail boom design is so robust that no strengthening was required for the fan.” Additional features include two fixed wings borrowed from an Aerostar FJ-100 business jet. During the next phase of the program’s development, Piasecki intends to install a 600-hp secondary power unit, which will drive the VTDP in addition to providing the aircraft’s auxiliary power unit as well. Additional composite components will include a disc-shaped rotor head fairing and several other refinements designed to reduce aerodynamic drag by about 30 percent.

Sikorsky plans to begin X-2 flight-testing this year, and HADA’s prime contractor, Aries Complex (Madrid, Spain), hopes to fly a hybrid rotorcraft/fixed-wing sometime next year. Piasecki, on the other hand, marked the first flight of its X-49 on June 29, 2007. To date, it has accumulated more than 24 flights with more than 20 hours in the air and has nearly completed Phase 1 of its test program.

Fulfilling future promise

Only time will tell which of these new composites concepts actually will enter production in military and/or commercial markets. But it is certain that as the current fleet of rotorcraft evolves and more radical designs inevitably replace them, composite materials will remain a constant in the development equation. Historically, the high value placed on weight reduction in helicopter design enabled the rotorcraft industry to outpace winged aircraft in terms of composite usage as measured by its percentage of airframe weight. In the same way, pressure on rotorcraft OEMs and their subcontractors to reduce fuel and life cycle costs, improve operational readiness and extend service life will propel composites innovation. Helicopter manufacturing will maintain its status as a strong growth sector within the overall composites industry.

Related Content

Welding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

Read MorePlant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MorePlant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More