Carbon fiber composites are valued for their potential to provide more sustainable transportation solutions with lower carbon emissions during use, yet the production and end-of-life phases of their lifecycle reveal a higher environmental impact than the metals they typically replace. Current carbon fiber composite production methods result in significant waste, little of which is recycled today. This will soon to be joined by high volumes of end-of-life products and today these waste streams would mostly end up in landfills. As carbon fiber composites use continues to grow and sustainability strategies push for “zero-waste-to-landfill,” routes to reclaiming and reusing this expensive resource are becoming more critical. It’s not an easy business to develop, but a small number of companies around the world have set out to tackle the technical and commercial challenges involved in establishing carbon fiber recycling operations. Among these companies is ELG Carbon Fibre (Coseley, U.K.), which runs a 1,500-metric tonne capacity plant in the U.K. and is now gearing up for global expansion.

ELG's first Technical Workshop, held at the University of Warwick (Coventry, U.K.) in 2018, brought together a number of the company’s academic partners and customers to share the latest research findings, to exchange experiences and to discuss knowledge gaps and potential road blocks to market growth.

"There is extensive, ongoing research into recycled carbon fiber but the individual projects tend to be siloed,” notes Frazer Barnes, managing director of ELG Carbon Fibre. “We want to share the breadth of technical work and practical knowledge we now have available to build confidence in the marketplace."

Why use recycled carbon fiber?

ELG sets out three main drivers for use of recycled carbon fiber (rCF): cost, security of supply and environmental sustainability.

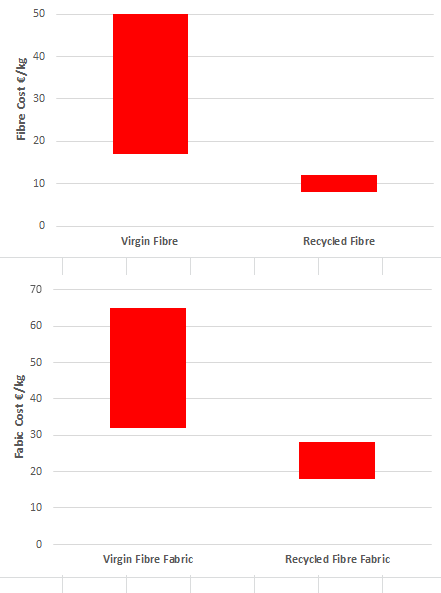

The cost proposition centers on making lightweight carbon fiber composites more affordable. ELG’s reclaimed carbon fibers are said to have similar mechanical properties to the original fibers, usually retaining at least 90 percent of their tensile strength with no change in modulus. The fiber price is typically 40 percent less than industrial grades of virgin fiber. Recycled fiber can therefore provide similar weight-saving benefits to virgin fiber at substantially reduced part cost, making it attractive for automotive lightweighting applications. Depending on the design, the weight of a 100 percent rCF composite part is typically about 5 percent more than the weight of a virgin carbon fiber part, while hybrid composite designs comprising approximately 10 percent virgin carbon fiber and 90 percent rCF deliver the same weight savings but at significantly lower cost (Fig. 1). In injection molded parts, using rCF reinforced thermoplastics provides the same performance benefits as virgin carbon fiber, and there is no weight penalty.

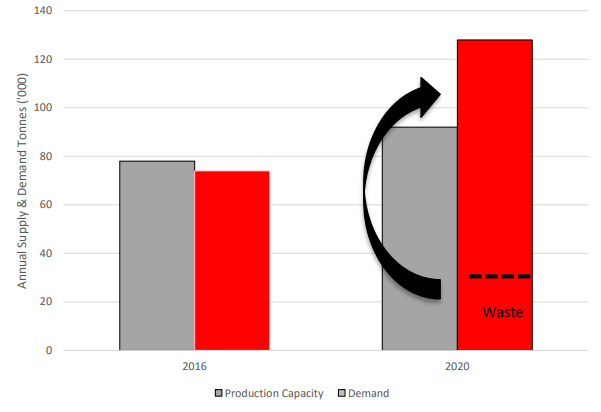

The use of rCF could also mitigate any shortage in virgin fiber supply (Fig. 2). As carbon fiber demand increases, manufacturers are scheduling capacity expansions, but some analysts predict a gap between supply and demand of about 24,000 tonnes by 2022. With current composites manufacturing techniques, waste can amount to around 30% of production volumes, resulting in approximately 24,000 MT of carbon fiber waste globally from manufacturing operations each year. By 2021, this figure could grow to about 32,000 MT. Currently, less than 1,000 MT of this waste is recycled, and high volumes of end-of-life product are set to soon join the waste stream. ELG anticipates that the first high-volume, end-of-life waste will come from the wind energy and aerospace sectors, where the first turbine blades and commercial aircraft containing significant amounts of carbon fiber are nearing the end of their design life. Fiber recovered from waste could fill the supply gap and potentially be used to help grow the overall carbon fiber market.

The third driver for use of rCF relates to legislation and the reduced environmental impact of recycled fiber compared with virgin. As governments around the world take action to minimize landfilling, the disposal of carbon fiber waste via this route is subject to increasing onerous regulation and cost. Legislation such as Europe's End-of Life Vehicle Directive is also setting recycling and reuse targets for end-of-life products. Recycled carbon fiber can help the composites industry reduce waste bound for landfills and boost reuse levels (Fig. 3).

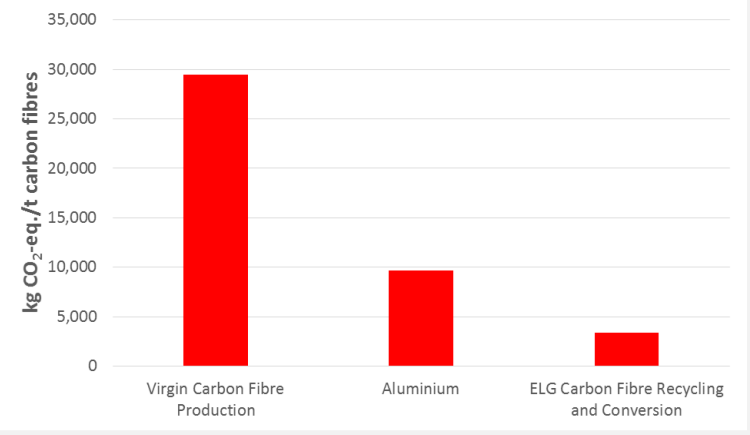

Recycled fiber also improves the lifecycle analysis (LCA) of carbon fiber composite parts. According to an LCA on ELG rCF conducted by Fraunhofer Institute for Environmental, Safety and Energy Technology (UMSICHT, Oberhausen, Germany), recycled carbon fiber has significantly less global warming potential than virgin fiber. The energy-intensive production stage is an important factor in this: Carbon fiber waste can be recovered and converted to new products using less than 10 percent of the energy required to produce the original fiber, according to the analysis. The study determined total greenhouse gas (GHG) emissions for virgin carbon fiber totals 29.45 metric tonnes CO2 per tonne of CF, compared to 4.65 metric tonnes CO2 per tonne rCF produced by production of recycled fiber. In addition, per metric tonne of material, less GHG emissions are emitted by rCF than by primary aluminum (8.2 metric tonnes), and recycled aluminum and rCF have very similar global warming footprints. Since the study was conducted in 2015, ELG has further reduced energy consumption in carbon fiber production by 30%,and is set to make another reduction in energy consumption in 2019. The advantages of rCF are expected to further improve as economies of scale and process design improvements are implemented in expansion projects. rCF products can also be recycled.

As LCAs gain importance in the materials selection process, the use of rCF (even in conjunction with virgin fiber) makes for a stronger argument for switching to composites from metals. In automotive applications, for example, incorporation of rCF could significantly reduce the “break-even” mileage at which the composite design starts to deliver a better LCA than steel.

A new market for a new material

Over the past five years, ELG has introduced its Carbiso range of products, targeting automotive and other high-volume manufacturing sectors. It has taken time to get to this point, involving significant investment in industrialization of the reclaiming process, development of conversion technologies, materials and performance characterization, and applications development. ELG attributes this progress to the backing of metals recycling specialist ELG Haniel GmbH (Duisburg, Germany), which acquired the Coseley operation (Milled Carbon Ltd) in September 2011.

ELG believes it has successfully solved the challenge of reclaiming high-quality fiber, cost effectively and on an industrial scale, via its modified pyrolysis process. The furnace at its U.K. site can process up to 5 metric tonnes of material per day. In order to ensure products deliver a consistent level of performance, the company tests fiber properties on receipt and when recovered, followed by classification of the recycled fibers depending on the type of waste and their mechanical properties. Quality management systems ensure that waste is fully traceable through the subsequent processes. But this is only part of the story. The conversion of the reclaimed fiber into useable products, at industrial-scale quantities, has been a huge learning curve, resulting in a long product development line. The recycled fibers emerge in the form of a “fluffy” 3D structure of entangled, short, unsized fibers of variable length, which cannot be processed in the same way as virgin fiber. Milled fiber formed an initial base for ELG's business, but the company commenced additional product development programs in 2013, targeting products for cost-effective, high-volume manufacturing processes. Its portfolio now comprises milled fibers (80-100 micrometers in length) suitable for coatings and compounds, chopped and pelletized fibers (3-100 millimeters) for thermoset and thermoplastic molding compounds, and, its staple automotive line — nonwoven mats (fiber length 60-90 millimeters, 100-500 grams per square meter). These are available in widths up to 2.7 meters and are suitable for compression molding and the manufacture of intermediate products such as prepreg and sheet molding compound (SMC). ELG also produces hybrid mats, in which the recycled fiber is commingled thermoplastic fibers designed for fast press molding applications.

The biggest challenge, according to ELG, has been the ongoing process of applications development. "Recycled carbon fiber is not a straight substitution for virgin fiber," explains Frazer Barnes, who joined the company in 2014. "We're making a very different product form, which requires different processes, and different design. We're not trying to substitute an existing material; we're trying to create a market for a new material."

Helping customers learn how to use these new materials is a substantial part of ELG’s activities. This requires demonstrating the material’s properties and how it can be processed, as well as providing design data for customers. Barnes says joint development work with customers is essential to furthering ELG’s vision of rCF becoming an important part of a multimaterial solution for automotive lightweighting, especially where high-rate manufacturing processes such as injection and compression molding can be used. The company is involved in various automotive R&D projects in Asia and the U.S., but Europe is moving faster, with a number of automotive OEMs and Tier 1 suppliers now running prototype and low-volume production programs. All of these activities are building a foundation of economic and technical performance data and valuable processing experience that can be shared with other potential adopters of rCF.

Rethinking automotive manufacturing

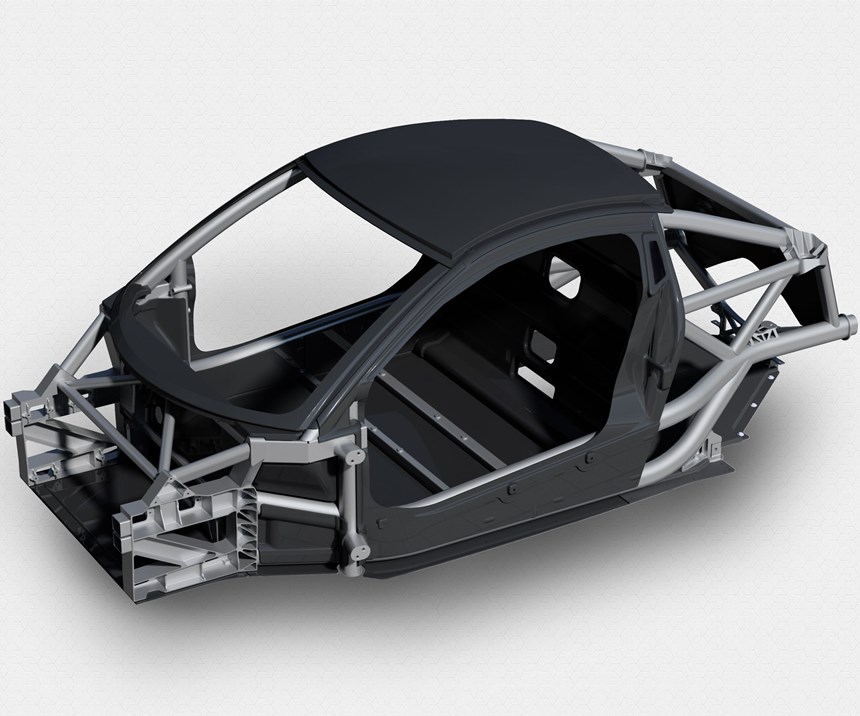

Gordon Murray Design (Shalford, U.K.) was an early adopter of ELG’s rCF. The company was established in 2007 to develop iStream, a re-think of the traditional automotive manufacturing process designed to make lightweight composites design affordable for mainstream vehicles.

The iStream architecture starts with a frame consisting of simple, low-cost tubular metal members (the iFrame), to which components such as the powertrain, suspension, seats and crash structures are attached. The frame is stabilized by bonding in 14 to 20 rigid composite sandwich panels (iPanels), depending on the type and size of the vehicle, which typically serve as the inner floor, side walls and front and rear bulkheads. According to Gordon Murray Design, this iStream structure delivers valuable weight savings over the conventional stamped steel manufacturing process — up to 200 kilograms on a typical super-mini – at an approximately 80 percent reduction in capital investment. Annual production volumes of 1,000-350,000 units are said to be achievable. The non-structural bodywork can be manufactured from any material — plastic, composite, aluminum or even steel if desired.

The composite sandwich panels are produced using a low-cost, automated wet compression molding process. The skins comprise one or more layers of nonwoven reinforcement mat around a recycled paper core. The stacked materials are sprayed with thermoset resin by robot before pressing at 80-130°C. A net-shaped composite sandwich panel can be produced in a press time of 100 seconds.

Originally, the composite panels were manufactured using glass fiber reinforcement. The potential for further weight reduction using carbon fiber, together with its strong marketing appeal, led to the introduction of iStream Carbon in October 2015, in which the glass fiber is replaced with carbon fiber. Virgin carbon fiber proved far too expensive for the iStream business case, and Gordon Murray Design saw ELG's rCF as a route to achieving the necessary cost reduction. A two-year research program funded by Innovate UK (the U.K. government's innovation agency) followed, which demonstrated the applicability of ELG's nonwoven mat for the iStream process.

At the start of this project, the biggest concern regarding rCF for Andy Smith, Gordon Murray Design’s director of research & development, related to control of the waste feedstock for the recycling process (which could potentially include many different grades of carbon fiber) to ensure consistent mechanical properties in the nonwoven. ELG's subsequent refinement of its supplier base and implementation of fiber classification procedures resolved this issue.

From a practical point of view, Smith was uncertain if the recycled nonwoven would be robust enough for handling and processing, how well it would infuse, and whether the needed fiber volume fraction (FVF) would be achievable. For the glass fiber iStream panels, an FVF of about 40 percent was obtained, but with the rCF the figure was below 20 percent — although the rCF panels were still said to outperform the glass iPanels overall. Improving FVF was a major focus of the research program, and Gordon Murray Design continues to pursue this with ELG.

"We can easily manufacture carbon fiber panels that outperform the glass fiber panels, and for current projects these work fine," says Smith. "But I'd like to explore the potential for further lightweighting by making the panels even stronger and stiffer, and one of the challenges involves improving fiber volume fraction."

One barrier to obtaining higher FVF stems from the degree of z-direction fiber in the nonwoven resulting from the carding process used to manufacture it. "This means the material is quite lofty," Smith explains. "In some respects this is good, because you get some through-thickness strength improvements, but it makes it difficult to achieve high fiber volume fractions. There is a limit to how much you can compress that nonwoven layer to increase fiber volume fraction before you start to break fibers."

Carding also leads to a slight alignment of the fibers in the processing direction. Smith acknowledges that this is not a major issue, although a completely quasi-isotropic material would be preferable.

It is not possible to produce a Class A surface finish on the panels using the Gordon Murray Design process, but since they are purely structural and not visible, this is not important. In fact, Smith finds that the appearance of the rCF nonwoven appeals to some customers, which could lead to applications in visual panels. He is also interested in the potential of rCF prepreg products, which ELG is currently investigating. Gordon Murray Design has prepregged the material for a show car and found that it worked very well.

Going forward, Smith is positive about the prospects for rCF in the automotive market, assuming performance, supply and cost requirements are met. “It's a material we at Gordon Murray Design want to use," he confirms. "I think it's got a good future and it certainly seems to be gaining traction, and that comes from demonstrating the mechanical properties that people need, and can understand and design with. One common concern in committing to this material is guarantee of supply, but as long as that supply is there, and cost stays well below that of virgin fiber, companies will look to use it.”

Moving forward

Recently, partnerships between ELG and Boeing Co. (Chicago, Ill., U.S.) and Mitsubishi Corp. (MC, Tokyo, Japan) has expanded the company’s ability to grow into further markets. In December 2018, Boeing and ELG signed a five-year agreement whereby Boeing will supply cured and uncured carbon fiber composites to ELG for conversion into secondary manufacturing products. Also in December, ELG announced that Mitsubishi Corp. has entered a shareholder agreement for 25 percent of shares in the company. Mitsubishi Corp. will be able to use its global network to promote the sales and marketing of ELG’s rCF.

In ensuring the company has sufficient capacity for growing demand, preparation is key. Adding capacity at the existing U.K. site takes nine to 12 months. A new facility can be brought online in about half the time required for a virgin carbon fiber plant and at significantly lower investment, offering greater flexibility to react to the demands of emerging markets.

ELG’s U.K. site will reach capacity during 2019 and the company expects to announce expansion plans soon. “We're working on an expansion project in the U.S., and we’re in the early stages of projects in other parts of the world," Barnes confirms. "We expect that those plans will be firmed up by the end of this year. Our goal is to have the first expansion plant online in 2021."

Alongside this expansion program, ELG is also pursuing its “second generation” R&D strategy, which the company's Technical Workshop brought focus to. “Seeing all the different R&D programs we’ve been working on brought together gave context to our overall R&D strategy," says Barnes. "We came away with three key R&D areas to focus on going forward."

One of these is aligned products. The FVF that is currently achievable with ELG's nonwoven mats depends on pressure and realistically is limited to 40-45 percent. Nonwovens with aligned discontinuous fibers result in higher FVFs and reduced fiber breakage during molding, leading to much improved mechanical properties. An FVF of 60 percent has been achieved with an aligned rCF product form, but processing pressures of up to 100 bar were required. Higher pressures mean higher cost, and work is now focused on achieving better alignment at lower molding pressures.

Fiber surface treatment is another important topic. While ELG has a good understanding of rCF's interface with numerous polymers, ongoing projects are developing fiber sizings to improve fiber handling, wettability and fiber/matrix adhesion.

The third area of focus involves determining the long-term performance of the rCF materials in terms of fatigue and environmental effects. This builds on existing work, which has demonstrated good fatigue performance and environmental resistance but which needs to be extended across the product range.

Barnes emphasizes that there is no doubt that sustainability is starting to become a more important consideration for customers. This bodes well for the rCF market. "We feel that the industry is now really picking up and growth is accelerating," he says. "Levels of activity and the number of customers buying product are increasing month on month. According to our analyses, in five years the potential market demand will grow very heavily, and we see our business growing several times over in that time."

Related Content

ECOHYDRO project to enable recyclable composites for hydrogen storage

With the involvement of two schools from the Institut Mines-Télécom, the 4-year project aims to improve the intrinsic properties of a composite material based on Elium via four concrete demonstrators.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreUpdate: THOR project for industrialized, recyclable thermoplastic composite tanks for hydrogen storage

A look into the tape/liner materials, LATW/recycling processes, design software and new equipment toward commercialization of Type 4.5 tanks.

Read MoreNCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More