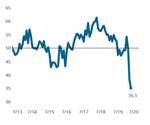

Composite Index reports slowing decline in business conditions since COVID-19

Registering at 42.3 in May, the Composites Index signals decelerating contraction and improved component readings.

Composites Index: The Composites Index indicated that the industry experienced a slowing contraction in May. All components of the Index registered improved readings with supplier deliveries signaling a return to more frequent deliveries and reduced upstream disruption from COVID-19.

The Composites Index improved by more than 7 points in May to register 42.3 after setting an all-time low in April. For the first time since the government curtailed normal business operations to prevent the spread of COVID-19, all components of the Index moved towards more ‘normal’ levels. This turnaround was led by new orders and production, both of which reported gains from the prior month of more than 12 points. Excluding supplier deliveries, all components moved higher from their prior month readings although each remained below a reading of 50. The change in the direction of the readings is indicative of a slowing contraction, meaning that while conditions deteriorated further in the latest month, they did so at a much slower rate compared to the prior month.

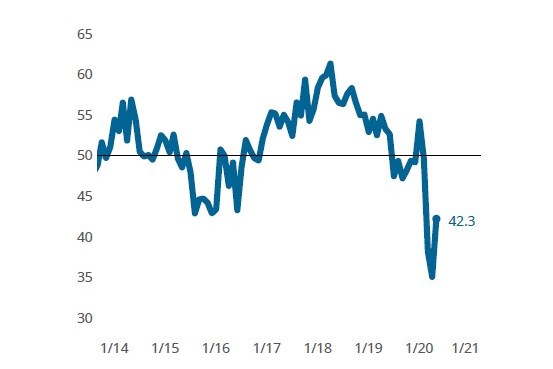

Survey indicates profit compression as material prices increase and finished goods prices contract: Despite the recent and sharp contraction in new orders for composites goods, surveyed fabricators continue to report rising material prices while also a slight contraction in their own pricing power. This combination of forces implies that profit margins are being compressed.

The supplier delivery reading fell slightly in May which may indicate a turning point in the unprecedented disruption that affected upstream production and slowed deliveries earlier in the year. By the nature of how this question is asked, quickening supplier deliveries lower the Index’s reading. Despite the recent and significant contraction in new orders, prices for upstream materials continue to increase while May saw weakening prices for finished composites products. The last time that prices received for finished composite goods contracted was in 4Q2016. This combination of results imply growing pressure on profit margins for the industry.

Related Content

-

Overall composites index contracting faster than previous month

New orders, production and prices components all improved over October, though the GBI is still seeing contraction.

-

GBI: Composites Fabricating contracted in April

The Gardner Business Index closed April down 1.1 points, continuing its journey from expansion in February, to flat in March and ultimately contracting in April.

-

Composites GBI shows faster activity contraction

The total index reading backed down in May from its anticipated expansion, contracting again to land at 46.8.

.jpg;width=70;height=70;mode=crop)