Composites activity expansion quickens in October

Seasonal shipping rush sends supplier delivery reading higher, marking the first time since mid-2019 that the Index reported two consecutive months of expanding business activity.

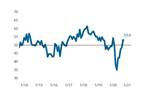

Composites Fabricating Business Index: Overall activity registered 52.5, down slightly from the prior month. Strong seasonal shipping demand in the fourth quarter may result in yet slower delivery times which will further inflate the overall Index.

The Composites Index registered at 52.5 in October, down only slightly from the prior month. The latest reading — driven by expanding activity for new orders, employment and production —marks the first time since mid-2019 that the Index reported two consecutive months of expanding business activity. Further, slowing supplier deliveries inflated the overall Index; excluding supplier deliveries in this calculation, for example, would have resulted in a reduced index reading of 50.7. As described in past reports, a slowdown in supplier deliveries during normal economic conditions is often caused by strong upstream demand for the intermediate products needed by fabricators. The increased demand swells backlogs and lengthens the time between order and delivery. In the current environment, however, the slowing of deliveries and subsequent rise in the supplier delivery reading has been a result of disrupted supply chains caused by efforts to slow the spread of COVID-19.

Fourth quarter new orders activity offsetting weak export demand: New order activity in the second half of the year through October has been essential for the overall rebound in the composites industry. The expansion in domestic orders has helped to offset continued weakness in export activity.

When COVID-19 was first declared a national pandemic in March, fabricators of all sizes immediately began reporting greatly distressed business conditions and continued to do so through the second quarter. Starting in the third quarter, however, overall business conditions began diverging along company size as small firms between 1-19 and 20-49 employees in size began experienced expanding new orders activity. Conversely, firms falling under 50-99 and 250+ employee size categories have reported worsening new orders activity in the three months ending October.

Related Content

-

Composites industry activity meaningfully slowed contraction in March

The GBI: Composites Fabricating still contracted in March, though it landed just one point shy of 50, which could eventually lead it into expansion territory.

-

Composites industry index was flat for March

The GBI: Composites Fabricating closed March flat, losing 1.3 of the 3.1 points gained in February.

-

Composites GBI shows faster activity contraction

The total index reading backed down in May from its anticipated expansion, contracting again to land at 46.8.

.jpg;width=70;height=70;mode=crop)