Core for composites: Winds of change

Core materials suppliers lean into the bracing breeze of big-blade challenges raised by the burgeoning wind energy industry.

The use of core material in composite applications is nothing new. Foam, balsa and honeycomb core have been mainstays of sandwich construction in boat hulls and decks for more than three decades, and can be found in hundreds of parts used in construction, energy, infrastructure and transportation applications. The last five years, however, have seen explosive growth in wind turbine blade manufacturing, which promises to make unprecedented use of core in a variety of sandwich constructions. The expansion of this market — and the influence it exerts — is changing how core is made and applied in composites construction. In response, core manufacturers and kitters are working to develop new core materials that meet wind’s demand for strength, light weight and low cost.

The appeal of core is well known. In all its forms, it offers low density and, therefore, low mass, and does so at relatively low cost. In a sandwich construction — core material faced on each side with a reinforcing glass/resin skin offers greater mechanical strength and stiffness, pound-for-pound, than any other structural option, regardless of the materials used. Further, the great variety of available core material types, ranging from balsa to foams to honeycombs, provides a broad spectrum of material densities, geometries, processing options, costs and physical attributes.

Faced with the task of producing ever longer, larger and, often, heavier turbine blades that must provide many years of service, wind blade manufacturers are becoming very particular about product quality. After picking from amongst all the core possibilities during successive design-and-build cycles for their composite wind blades, blade makers have developed some preferences for certain materials and have shown a growing tendency to prefer core suppliers who can meet increasingly tight product specifications.

Core consumer number one?

Until the effects of the recent recession set in, the wind energy sector grew steadily for five years at rates much higher than gross domestic product (GDP) growth. Much of that growth occurred in the U.S. and was spurred on, in part, by price volatility in the energy markets (see “Wind economics by the numbers”), and by government incentives.

Although the recession has slowed wind-energy activity, most projections show that the wind-blade manufacturing segment promises to be among the largest — if not the largest — in the composites industry within five years. In a June 2008 report in CT on composites in wind blades, Chris Red, vice president at research firm Composite Market Reports (Gilbert, Ariz., U.S.), estimated that in 2017 global wind blade production will be 140,000 units for turbines that range from 0.75-MW to more than 2.5-MW capacity.

All of this growth prompted much blade-building activity, beginning in 2006. LM Wind Power (formerly LM Glasfiber, Kolding, Denmark), Vestas Wind Systems AS (Randers, Denmark), Siemens AG (Erlangen, Germany), TPI Composites Inc. (Scottsdale, Ariz., U.S.), Gamesa (Madrid, Spain) and other wind turbine manufacturers announced substantial facility expansions throughout the world to produce turbines, nacelles and blades.

This explosive growth, as wonderful as it has been for the wind energy and composites industries, has had consequences. Among the most important is that as more turbines are installed, they are expected to stand and rotate in the wind for as long as 25 years with very little maintenance. This obligation requires construction of blades that must meet increasingly demanding standards for precision, weight and quality consistency — standards that barely existed a decade ago, but now are de facto across the industry. “Wind has gone from taking a socks-and-sandals-and-ponytails approach, to a serious energy-providing industry focused on consistency and quality,” says Peter George, head of business development at resin, core materials and tooling supplier Gurit UK (Isle of Wight, U.K.).

As it stands, the wind blade market appears set to become the number one consumer of core material in the composites industry, and as the needs of this market evolve, so will the demands on core technology.

Core competencies

Some have characterized the evolution of the wind energy industry as a migration away from a boatbuilding mentality (fragmented, project-based, mostly low-volume) to a hybrid of automotive and aerospace (high-volume, high-performance, high-quality). This evolution has put pressure on the blade manufacturing supply chain, not the least of which is the link provided by core suppliers. Indeed, the types and quality of core materials specified today for wind blades and the quality control specifications issued by wind blade manufacturers both signal that the wind industry is serious about producing consistently high-quality product.

Blade manufacturers are, like all composites processors, balancing many variables against each other, each picking and choosing different combinations to meet cost and performance goals. Core type affects several metrics: thickness of sandwich construction, mechanical strength of sandwich construction, blade durability and blade cost. Some core types offer better mechanical strength, but are costly. Others are economical, but lack mechanical strength, in which case a thicker sandwich might be needed to meet a specific requirement. Some cores are only suitable for flat surfaces, while others, such as honeycombs, don’t lend themselves easily to infusion.

Further, blade manufacturers are relying increasingly on CAD/CAM, finite element analysis (FEA) and simulation to understand what materials work best where in a blade, so they can optimize material use to match requirements at different locations along the blade’s length. Some manufacturers favor balsa over foam, while others prefer foam or, more increasingly, a combination of different cores. Ultimately, says Don Marriott, vice president, advanced engineering at core kitter Creative Foam Composite Systems LLC (Fenton, Mich. and Longmont, Colo., U.S.), “If they establish a blade design that works, it’s almost impossible to change that.”

Each wind energy company has its own unique blade design, which is usually subcontracted to blade manufacturers. Often, several blade manufactures are involved in providing an identical blade to a single wind energy company on a global basis. It is the global nature of wind energy, as much as the volume of production, that requires the use of multiple blade manufacturers by a single wind energy company. The materials used in each blade design are considered proprietary and a closely held secret. Still, material variation from manufacturer to manufacturer is not substantial, so it is possible to get a general sense of what type of core material is used, and where, and how this use might be changing. One thing is clear, however: Wind blades have become much more hybridized over the last five years, meaning that choice of core material type can vary significantly within a single design, depending on material, weight, structural, production and cost requirements at different locations along the blade shell and within the shear web. For suppliers, that has implications in terms of the product variety they offer. “It’s important not to be narrow-minded about material choice,” says Gurit’s George. “We see a need to optimize the best material for the best application.”

Current core concepts

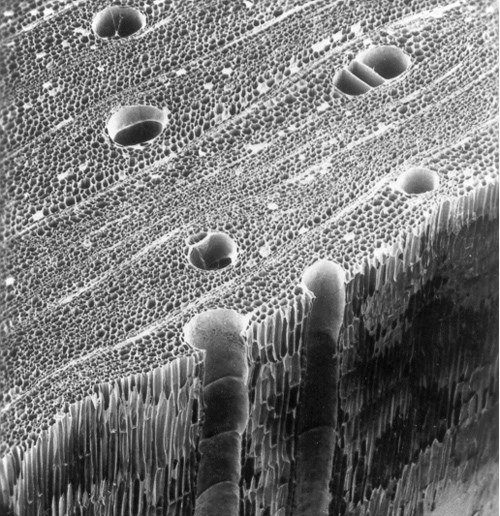

The last few years have seen four core material types emerge as the most widely used in wind energy applications: end-grain balsa, styrene acrylonitrile (SAN) foam, polyvinyl chloride (PVC) foam and polyethylene terephthalate (PET) foam. End-grain balsa is popular, first, because it is inexpensive; second, because its end-grain “honeycomb” structure provides robust mechanical properties — 5-lb/ft³ to 15-lb/ft³ density; and third, because it is derived from a sustainable and renewable resource, the fast-growing balsa tree. In hybrid blade construction, because of its higher strength and stiffness, it is most often used in the root section (approximately the first 10m/33 ft of a 40m/131-ft blade), although it can be used throughout the entire length of the blade.

Balsa’s mechanical properties are derived mainly from its end-grain structure, but if used throughout the blade, its higher density can introduce a weight penalty when compared to foam cores. Although the density of the lumber within a sheet of balsa may vary, the average density of a sheet is held within tight tolerances. However, when it comes to infusion, balsa’s end-grain structure can boost resin uptake, adding weight to the blade. As with all cores, balsa and foam must be scored or segmented to create hinges that allow it to conform to curved surfaces. This scoring creates gaps, or kerfs, in the surface of the core where one segment angles away from another. The kerfs may help facilitate resin flow, but also fill with resin, which adds weight. Fortunately, in the infusion process the kerfs fill with resin, eliminating unwanted voids in the core structure.

Jack Lugus, marketing director at core material supplier Nida-Core (Port St. Lucie, Fla., U.S.), contends that the cost of resin itself has become a major concern of wind blade manufacturers. “The biggest problem in our industry is resin pricing,” he says. “Anything that allows price reduction in sandwich construction provides a major advantage.”

Core made of SAN and PVC is less dense than balsa (about 4 lb/ft³), but also tends to be more expensive. Both SAN and PVC are thermoset formulations that provide structural support, but would have to be about twice as thick as balsa to match balsa’s higher physical properties. As a result, foams tend to be used in areas that benefit from weight savings, but still require some strength and stiffness — primarily the middle 20m/66 ft or so of the blade shell, and in the shear web.

In infusion processes, use of any core type requires careful management of resin flow to ensure wetout. This can include machining of flow channels and other mechanical structures in the surface of the core to facilitate resin transport and to make sure resin flow fronts move evenly over the core surface on both sides of the core. One of the drawbacks of PVC is that it can outgas during the cure process when overlaid by prepreg, which can lead to delamination of the sandwich construction. Like balsa, SAN and PVC must be scored or segmented to conform to tooling surfaces and thus add weight via increased resin uptake in the kerfs.

Coming core competitor

Among the newest players in the foam core market is PET, which is in the high-potential, early-development phase of its wind energy maturation. PET is attractive for a number reasons, owing to the fact that, unlike PVC, it is a thermoplastic and, therefore:

- It is recyclable and is made with recycled content (typically, from waste PET bottles).

- It is manufactured via the extrusion process and thus provides more consistent density control and mechanical properties.

- It does not outgas when in contact with prepreg during cure.

- It is thermocuttable via either a hotwire or laser process, a fact that permits development of novel surfaces.

- It is remeltable, and therefore, can be fused with most facesheet laminates during heated cure, without use of an adhesive.

- It is, for the same reason, thermoformable and, thus, can be preformed to specified shapes/dimensions without the need for scoring or segmentation. (This formability, it must be noted, is a potential benefit of PET. The material is not widely preformed for wind-blade applications.)

As a structural foam, PET requires a slightly higher density to match the mechanical strength and stiffness of SAN and PVC, and a substantially higher density to match balsa. “From a strictly mechanical or physical relationship, PET requires a greater density of material to match PVC,” comments Joe Pantalone, market manager at 3A Composites (formerly Alcan Composites, Northvale, N.J. and Sins, Switzerland; for background on the name change, see our news item in “Composites Watch,” p. 18 of the 2010 June issue). Pantalone says his company introduced PET to the wind industry a few years ago, and points out that broad adoption of the material in the wind industry took a few years because material selection for existing blade designs is generally fixed and, therefore, new materials for blade designs need to go through a rigorous evaluation process. For this reason, PET is employed primarily in semistructural applications, in the last 10m/33 ft (the tip) of a wind blade shell.

But PET is said to have the potential, following a few more developmental iterations, to find significantly greater use in turbine blade construction. “It’s just a matter of time before PET is made more robust,” claims Gurit’s George.

There is at least one material type working the fertile ground between balsa and traditional core. WebCore Technologies LLC (Miamisburg, Ohio, U.S.) introduced to the market two years ago a core material positioned to offer the mechanical and cost benefits of balsa, with the weight benefits of a foam. WebCore’s TYCOR W comprises closed-cell polyurethane “sticks” helically wound with glass fiber tows, with the space between tows variable and dependent on the application — the closer the spacing, the greater the strength and stiffness. The sticks are assembled and held together with fiberglass surface veils, creating 4 ft by 8 ft (1.2m by 2.4m) sheets of core.

Because it is not a structural foam, the low-density polyurethane acts only as a carrier for the wound glass fiber, which — after resin infusion and cure — is the material’s primary source of strength and stiffness. Moreover, the material is inherently flexible and, thus, requires no scoring or kerfing. Scott Campbell, director of sales engineering at WebCore, says TYCOR ranges from 12 to 78 mm thick (0.47 to 3.1 inches) and can match balsa’s mechanical performance at the same price, with substantial weight and resin savings. He adds that TYCOR also can be used in the middle section of the blade shell, as well as in the shear web, where SAN and PVC traditionally take precedence. WebCore has an established customer — a well-known, but unidentified blade maker — that has used TYCOR successfully in place of balsa on all of its wind blades for the last two years. Campbell claims another manufacturer is in the process of qualifying TYCOR for its blades.

In all cases, no matter the material type, core material suppliers contacted for this story say the wind industry has realized that construction of a quality blade requires careful and tight control of the quality of raw materials. The industry has adopted more automotive-like (some say aerospace-like) quality standards, with some even using the PPAP (production part approval process) currently used by some in the automotive industry. Further, blade manufacturers are demanding that all suppliers, including core manufacturers, back up claims that their materials meet customer product specifications with adequate documentation, and then be accountable for results. “We even had one customer suggest that we be able to trace our balsa back to the tree in Ecuador it was harvested from,” says Pantalone.

Core kit quality

Nowhere is the demand for precision and quality greater than in the core kitting industry. Kitters are companies that take delivery of core material in sheet form — balsa, foam — for a given blade manufacturer and machine it to specific sizes and dimensions, and then organize the cut pieces into sets, according to placement location within a mold.

Although kitting has been practiced for years in composite boat construction, Creative Foam’s Marriott contends that blade makers are demanding increasingly tighter core machining tolerances. The core material must be cut precisely so that when placed in the mold, the core sections not only have shapes and thicknesses within specification, but also have minimal gaps between them — within 2-mm (0.079-inch) tolerance throughout the blade. This, as noted earlier, keeps gaps from becoming resin traps and prevents “race tracking” of the resin during infusion. It also makes the blade’s finished weight more consistent and predictable, and enables the blade manufacturer to more closely calculate resin requirements.

Control of gap size and consistency is important, WebCore’s Campbell explains, because when it comes to actually erecting a turbine, all three blades must be as close to the same weight as possible. An unbalanced blade set introduces unexpected stress during operation that will shorten the system’s service life. Therefore, ballast often is used to make blade weights match. “Without ballast, I don’t know that this means they can grab any three blades for a tower,” says Campbell, “but that’s the direction this technology is headed.”

Campbell points out that his comparatively large TYCOR sheet size reduces the number of gaps in his customer’s blades, minimizing resin consumption and, thereby, brings greater consistency to the infusion process. Because of this, he says, the blade maker is seeing its blades cluster closer to the target design weight.

The core of the issue

Gurit’s George observes that blade manufacturing has become an increasingly demanding pursuit. Blade makers must produce large-structures via high-volume manufacturing processes, with heavy emphasis on repeatability and consistency. As a result, George says he sees evidence that the blade-making industry is developing a tier structure similar to that of the auto industry. “The serialization of blades leads to all sorts of specialization,” he contends.

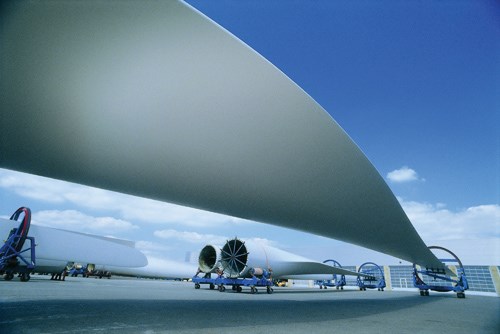

Further, blade evolution is, obviously, trending toward larger sizes, particularly as wind turbines are located offshore. Although standard blades of 40m/131 ft are still suitable for 2-MW to 2.5-MW turbines in onshore applications, blade lengths already extend from 70m to as long as 90m (230 ft to 295 ft) on the water for 5-MW to 6-MW turbines. To withstand the torsional and bending loads that they experience in an environment not conducive to easy or frequent maintenance, structures of this size must be of higher quality and take advantage of lightweight materials in a way that their land-based cousins do not.

What this means for core material use is still being determined by blade manufacturers. It is likely that larger blades will make use of current core technology, but in thicker sandwich constructions that will meet higher mechanical requirements. But new materials that exhibit a strength-to-weight ratio greater than anything currently on the market — and do so affordably — could find a place.

“All manufacturers of core have to be awake to the possibility of change in terms of how materials are used,” warns Gurit’s George, noting that larger blades have their own unique characteristics and failure modes that must be addressed. A core supplier can no longer be just a core expert. “A holistic understanding of wind blade design is necessary for a good understanding of how this market is evolving.”

Related Content

Adhesives, material solutions promote end market versatility

CAMX 2023: Rudolph Bros. and Co. highlights its role as a prominent specialty chemical distributor and solutions provider with a display of high-performance adhesives, sealants, materials and more from well-known manufacturers.

Read MoreHenkel releases digital tool for end-to-end product transparency

Quick and comprehensive carbon footprint reporting for about 58,000 of Henkel’s adhesives, sealants and functional coatings has been certified by TÜV Rheinland.

Read MoreBelzona composite wrap restores corroded carbon steel pipeline

Two-part epoxy paste, epoxy structural adhesive, composite wrap and anti-corrosion coating prevent environmental and economic loss for customer.

Read MorePittsburgh engineers receive $259K DARPA award for mussel-inspired underwater adhesion

The proposed META GLUE takes inspiration from hydrogels, liquid crystal elastomers and mussels’ natural bioadhesives to develop highly architected synthetic systems.

Read MoreRead Next

Armacell extends PET foam core operations to China.

Armacell’s fourth PET foam extrusion line globally is designed to meet growing demand for PET foams across the Chinese composite market.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More