“I want to say one word to you. Just one word . . . plastics.”

In the 1967 movie, The Graduate, college graduate Benjamin (Dustin Hoffman) is offered by his father’s friend Mr. McGuire this advice in what is now one of the most famous lines in cinematic history.

By plastics, of course, he meant unreinforced thermoplastics, and in 1967, they were being injection molded, extruded and blowmolded. And he was right. That year, this segment of the plastics manufacturing industry was on the verge of a decades-long expansion that continues to this day.

What Mr. McGuire did not reference in that oft-quoted line was thermoplastic composites, and he definitely did not envision unidirectional (UD) thermoplastic tapes. But he could have. In the late 1960s and through the 1970s and 1980s, thermoplastic tapes were being used to manufacture a variety of composite parts and structures, particularly in military and defense applications.

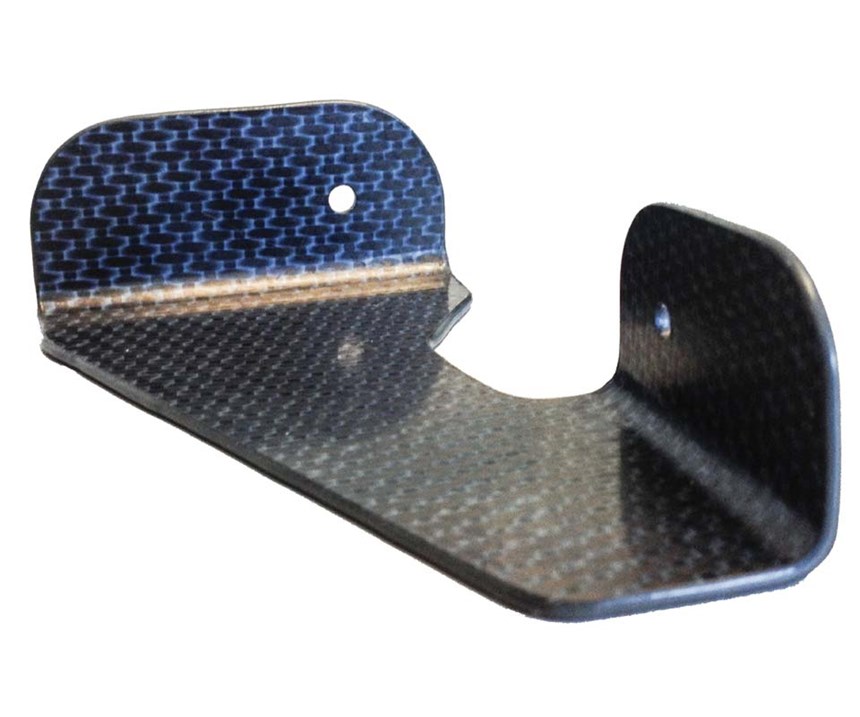

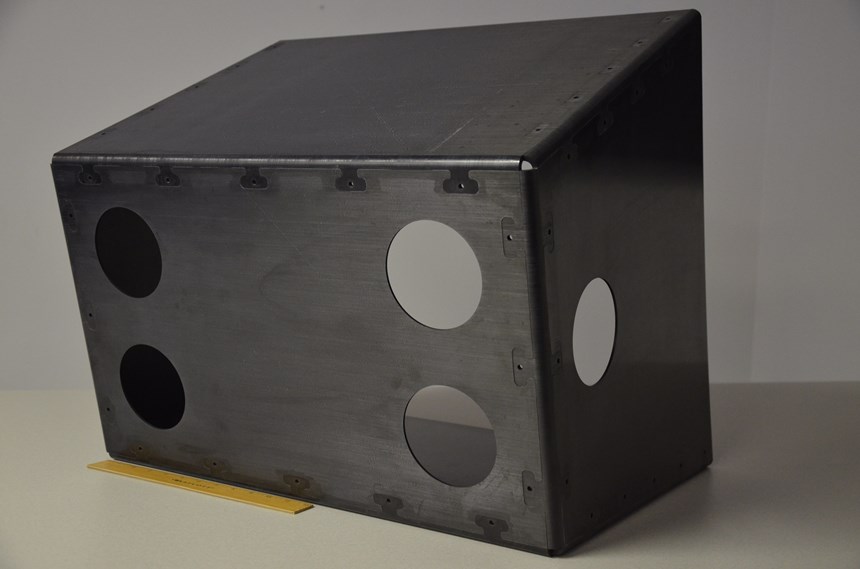

The appeal of thermoplastic tapes was not hard to see. Being UD, they could be applied to meet almost any mechanical force. They were melt-processible and could be consolidated easily and quickly via stampforming (that is, out of the autoclave) or compression molding (Fig. 1 and Fig. 2). They offered toughness properties that could not be matched by thermosets, and, unlike thermoset prepregs, they could be stored indefinitely at room temperature.

However, as defense spending waned in the 1990s, particularly in the United States, so did interest in and application of thermoplastic tapes. Suppliers such as DuPont, Phillips Petroleum, Exxon, BASF and Imperial Chemical Industries (ICI), which had invested heavily in thermoplastics tape development, got out of the business. This is not to say that thermoplastics tape development ceased, but it slowed significantly in a time when development of thermoset composites, in general, including thermoset tapes, was accelerating. This led eventually to the application of the latter in large aerospace structures in the Boeing 787, Airbus A350 XWB and other commercial aircraft.

Fast forward to 2018. The commercial aerospace world is looking to the future, and the next major aircraft program expected to consume large quantities of composite materials, in all likelihood, will be Boeing’s new Middle of the Market (MOM) aircraft, designed to replace its 757. Also on the horizon are redesigns of the Boeing 737 and Airbus A320, the narrowbody workhorses that are the backbone of the global commercial aerospace industry.

The material and process economics that justified use of composites on the 787 and the A350 XWB are not the same as those for the MOM, 737 and A320. The biggest difference is rate. The 737 and the A320, in particular, are as close as the commercial aerospace sector gets right now to a commodity, which means the faster they can be made, the more profitable they are for OEMs.

And with a targeted rate of 60 per month or more for the 737 and A320 (and whatever replaces them), that’s two planes a day, every day. Thermoset composites, cured in an autoclave, are currently not a good fit for such a high-volume environment. And that’s where thermoplastic tapes come back into the picture; they offer cycle time, materials storage, toughness, and recyclability advantages that cannot be matched by thermosets.

They already are used today to make smaller parts and substructures, including clips and brackets to connect fuselage skins to stringers and frames (Daher-Socata plant tour). And they are employed on a number of structures for smaller aircraft, including tail planes, wings and other parts for business jets. Further, the oil and gas industry has embraced thermoplastics because of their toughness and corrosion resistance, and the automotive industry is drawn to their adaptability to high-volume manufacturing and recyclability. The biggest question facing those who would use thermoplastics in commercial airframes is, Are they viable in highly loaded aircraft structures?

Scott Unger, chief technology officer at thermoplastics specialist TenCate Advanced Composites USA Inc. (Morgan Hill, CA, US), who has worked with thermoplastics for more than 30 years, says, “The growth of thermoplastics is at an inflexion point. The ability to get out of the autoclave, reduce costs and ease parts assembly are big drivers.”

The current state of the material and process art

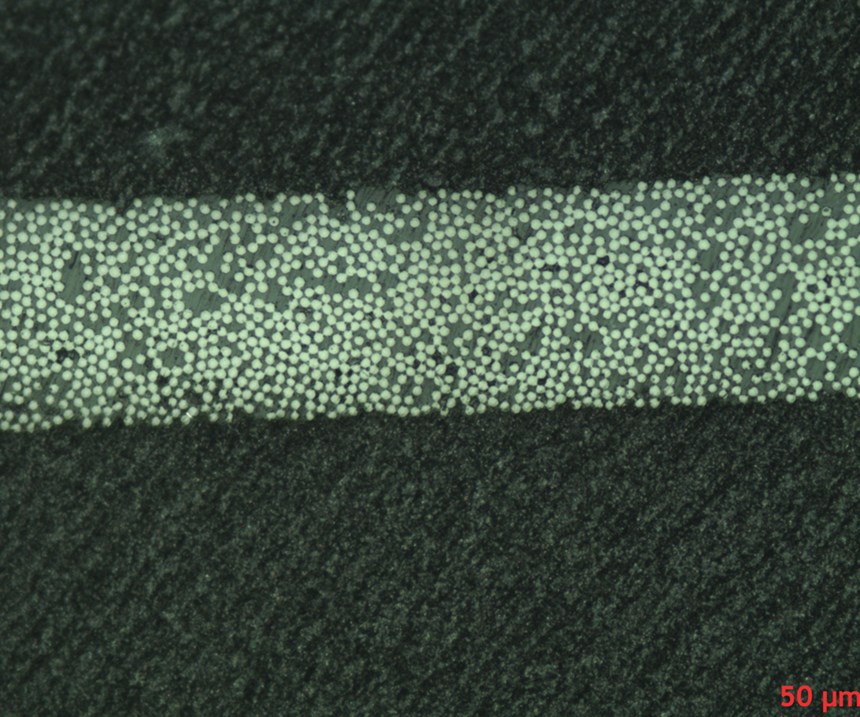

Thermoplastic tapes, for the purposes of this article, consist of unidirectionally aligned carbon fiber tows in widths of up to 12 inches/305 mm, prepregged with a thermoplastic resin (see opening photo). The resins most commonly used in aerospace and other high-performance applications are the following high-performance thermoplastics: polyetheretherketone (PEEK), polyetherketoneketone (PEKK), polyaryletherketone (PAEK), polyetherimide (PEI) and polyphenylene sulfide (PPS). Some manufacturers offer tapes prepregged with commodity thermoplastic resins, such as polyamide (PA), polypropylene (PP) and others, but these are generally considered unsuitable for large aerostructures.

For the aerospace industry, the materials that hold the most promise are PEEK and PEKK. “In general, both polymers provide excellent high-temperature performance, good toughness and chemical solvent resistance, along with low moisture absorption,” says Mike Buck, product manager, thermoplastics, at prepreg supplier Barrday Corp. (Millbury, MA, US). “PEKK also offers a higher Tg for improved temperature resistance and a lower melt temperature for processing.”

Arnt Offringa, director, R&D, at aerospace manufacturer GKN Aerospace Fokker (Hoogeveen, The Netherlands), says PEKK’s ability to deliver performance on a par with PEEK, but process at a lower melt temperature, makes it the prime candidate for future growth in commercial airframe applications.

Thermoplastic resins typically are applied to the fiber via solvent-based or water-based powder application. The prepreg method used affects the interface properties with the fiber, and the water-based process creates a smoother surface than the solvent-based process. The fiber volume fraction of most thermoplastic tapes ranges from 40-60%, with aerospace-grade materials in the 50-60% range.

“Sixty percent fiber volume is important if mechanical properties are the primary focus and you have a production process with a longer cycle time and plenty of flexibility for pressure and temperature,” says Buck. “Higher speed or lower pressure processes, such as AFP/ATL, out-of-autoclave/oven processing, etc., would benefit from higher resin contents.”

Tapes can be slit to create narrower tapes, or tows. Tapes also can be cut, like thermoset prepregs, to prescribed shapes to create blanks. Thermoplastics tapes do not have backing paper like thermoset tapes do.

The use of thermoplastics changes considerably the manufacturing steps to make finished parts. The most important difference is that a thermoplastic, by nature, is solid at room temperature and must be heated to melt temperature for forming. As noted, PEKK has a higher Tg than PEEK (160°C vs. 140°C); PEEK has a higher melt temperature than PEKK (390°C vs. 340°C).

Jim Pratte, technical fellow, composite materials research and innovation group at Solvay Composite Materials (Alpharetta, GA, US), says material use depends on the application, noting that PEKK is a co-polymer that can be tailored for different temperatures and crystallinity rates, while PEEK has an extensive database and crystallizes faster.

Such temperature requirements immediately vault these materials beyond the temperatures required to cure epoxy or any other thermoset material. The most commonly used process to manufacture parts from thermoplastic tapes today is stampforming, where tapes, cut to a prescribed shape and then stacked, are inserted into a preheating oven to be softened and preconsolidated. This stackup is then transferred to a forming press, which usually consists of a matched metal tool that fully consolidates and cools the tapes under high pressure (250-500 psi).

“Generally, I have found that processing of thermoplastics often requires a ‘backwards’ type of thought process vs. processing thermosets,” says Buck. “For example, with thermoplastics, you typically don’t want to consolidate the part in the mold, but instead form a pre-heated, pre-consolidated laminate, and then use the tool to cool the pre-heated part.”

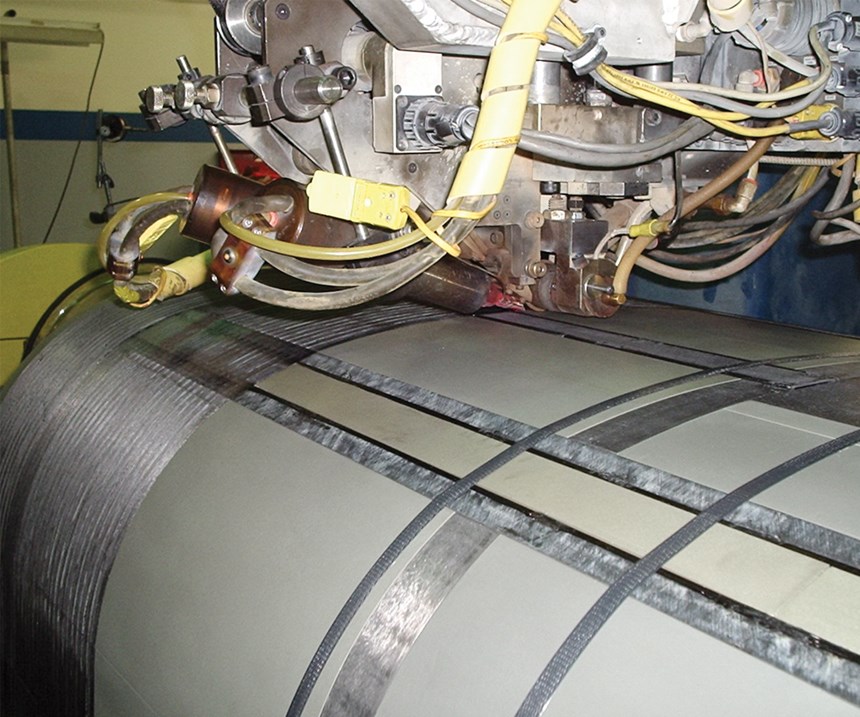

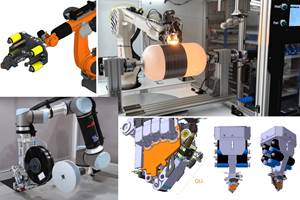

Less common, and still under development, is in-situ consolidation (Fig. 3), where slit tapes (tows) are placed on a tool via automated fiber placement (AFP) or automated tape laying (ATL). In this system, a high-intensity laser, hot gas or flame at the tape head heats the resin to melt temperature to soften it, while the end-effector applies pressure to consolidate the plies. Ultimately, such a system would perform full consolidation in-situ, but is still being developed for demonstration. For now, further consolidation (autoclave or similar) is required to achieve porosity targets.

Pierre-Yves Quéfélec, global and defense business unit head at Porcher Industries (Eclose-Badinières, France), which specializes in AFP of thermoplastic tapes, says the company works with machinery manufacturer Coriolis Composites (Queven, France) and is targeting <0.5% porosity. “An autoclave is still needed for this,” he says, “but we are starting to reach this level with oven cure, depending on the quality of the AFP. The high viscosity of thermoplastics is a challenge, as is the homogeneity and consistency of the impregnation.”

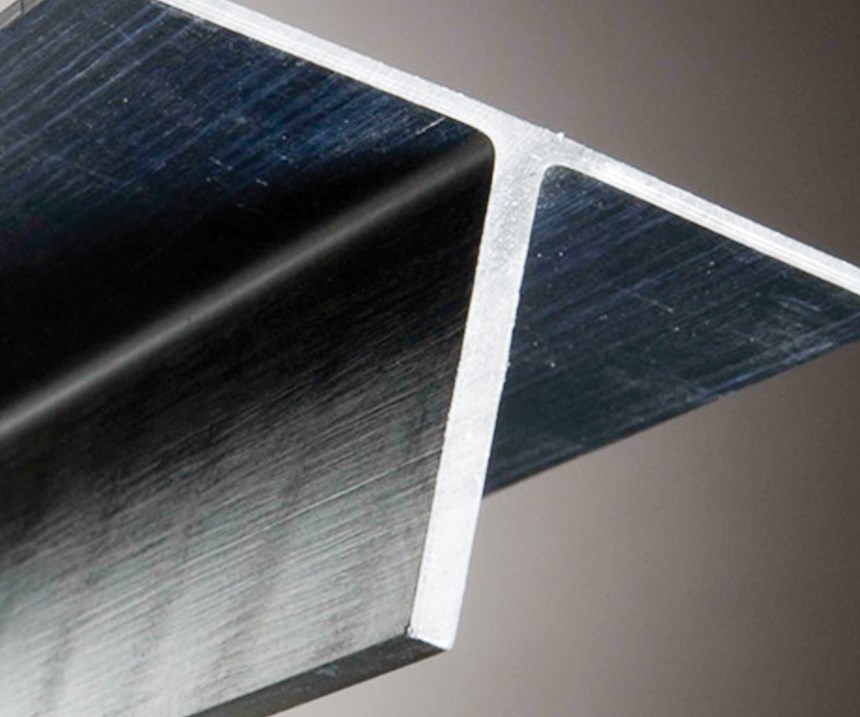

Although it is not widely used today, the most promising process in work toward the <0.5% porosity target is possibly continuous compression molding (CCM, see Fig. 4). Here, continuous tapes are passed through forming tools that heat and shape the material and create, effectively, a range of shapes, including T, C, H, hat and Omega profiles and others. This process has particular promise for the manufacture of stringers and frames for commercial aircraft.

As noted, autoclave cure is an option, and for some, a necessity, to ensure minimal porosity. Offringa notes that Fokker prefers the autoclave because it facilitates resin flow through the fiber and helps maintain process control and consistent part quality. The time required to consolidate a thermoplastic component in an autoclave is usually 3-4 hours — significantly less time than required to cure and consolidate thermoset materials.

Solvay’s Pratte says achieving porosity targets is not difficult with most of the thermoplastics processes used today. “Time and temperature takes most of the voids out,” he says. The only process that struggles, he says, is in-situ ATL/AFP, because the timescale — the amount of time spent applying pressure at temperature and consolidating the tape — is limited. “The key point here is not so much porosity as wetout of the filaments with polymer in the tape. You might have some porosity in the tape, but you cannot have dry fibers as the in-situ process timescale and conditions will not compensate for that.”

Advantages

Thermoplastics in general, and PEEK and PEKK in particular, are difficult to dislike. As already noted, they offer mechanical performance characteristics similar to epoxy, but they are generally tougher than epoxy. Further, they also do not exotherm, and they resist corrosion, wear and fire very well.

Thermoplastics also avoid the storage and out-time limits of thermoset prepreg — not a trivial matter considering the expense of investment in freezers, and the task of managing prepreg expiration dates to determine which rolls of prepreg to use when. Indeed, the cost of disposing of/recycling expired material can add considerably to the cost of manufacturing parts with thermoset prepreg.

Further, because they do not cure and crosslink, “Thermoplastic composites can be remelted/reprocessed,” notes Buck. That makes them relatively easy to recycle. “Recycling is a big driver in automotive because volumes are so much larger and the economics are so much more challenging,” notes Solvay’s Pratte. “If you can’t recycle materials, it’s going to be that much more of a barrier to adoption.” Although it’s particularly important to automakers, recycling is becoming an increasingly vital consideration in aerocomposites manufacturing as well, as aircraft OEMs, too, contemplate lifecycle management (LCM) and product end-of-life issues.

Thermoplastics also enable part bonding in a way that is not possible with thermosets. They offer the potential for welding/fusing parts together, which could negate the need for adhesives in some applications.”

GKN Aerospace Fokker is famous for its use of thermoplastics welding, and Offringa says there is a need to develop a variety of welding techniques, including resistance welding, induction welding and conduction welding. Porcher’s Quéfélec points out that AFP/ATL is a form of continuous welding and reports that many of his customers are looking to use welding to join smaller thermoplastic parts into larger structures.

As composites use increases in aerospace and automotive, the demand for automation will increase. This represents a real opportunity for thermoplastic tapes. “In my opinion, this is an area where thermoplastics will shine,” says Buck.

Disadvantages (aka, opportunities)

For all their advantages, thermoplastic tapes lack the maturity of thermoset tapes and, therefore, present some challenges. Web Industries (Marlborough, MA, US), which slits and formats thermoset and thermoplastic tapes, sees these challenges. Grand Hou, director of research and technology at Web, says a thermoplastic resin, because of its toughness, is more difficult to slit and meet tolerance requirements. The material, he says, is also springy, so it requires a different winding pattern with different winding control than those used with thermosets.

Jim Powers, business development manager at Web, notes that thermoset tapes are available in widths of up to 60 inches/1,524 mm and can go thousands of feet without a defect, while thermoplastic tapes typically top out at 12 inches and show as many as 30 defects in just 700 ft. “Thermosets went through the same development curve,” says Hou. “We are probably closer than we realize [to major quality improvement]. And as soon as there is a large program using thermoplastic composites, then you will see tremendous improvement in quality.”

The other challenge posed by the resin is its application. Thermoset tapes are typically prepregged using resin in film form, which allows prepreggers to apply resin precisely and uniformly, with minimal thickness variation. Thermoplastics, by contrast, rely on a powder-based application process that is more difficult to control and can create resin-rich and dry areas. Such non-uniformity can lead to problematic interply porosity.

Web’s Powers says solvent-based resins tend to have a rougher surface and generate more gaps, while water-based systems tend to be flatter, with minimal gauge variation and a smoother surface. “Rougher solvent-based materials offer more surface area,” he notes, “but from a spooling standpoint, water-based systems run quicker and provide better rolls.”

Another variable is the fact that at room temperature, thermoplastic tapes are characterized by an unusual boardiness, which produces a stiff, occasionally uneven tape that is prone to producing gaps and splits. The boardiness also can cause material waviness, which may lead to some tape width inconsistency. This causes subsequent problems during tape slitting, which relies on consistent tape widths to stay within specifications.

Further, unlike a thermoset prepreg, which has tack at room temperature that facilitates ply-to-ply adhesion during layup, a thermoplastic is dry and tackless. Additional means are required to eliminate ply-to-ply slippage, such as spot welding.

Automation may be one area where thermoplastic tapes’ boardiness is not necessarily a problem, however. “People used to complain that it was stiff and boardy for hand layup,” says Solvay’s Pratte, “but in automated equipment, stiff and boardy is an asset.”

David Leach, director of business development at aerospace thermoplastics composites fabricator ATC Manufacturing (Post Falls, ID, US), admits that thermoplastic tapes are “typically not as consistent as thermoset materials, and that is certainly an area where we would like to see improvement.” Leach also notes that uneven resin application can produce regions of resin richness, which can be both helpful and detrimental. He also echoes Web’s point that the lengths between defects in thermoplastic tapes is relatively short and that slit tape width is less consistent. That consistency, says Leach, will be mandatory as automation increases.

TenCate’s Unger says high tape integrity is paramount to facilitate increased thermoplastics use and to make up for limitations in manufacturing processes. In particular, Unger points to AFP/ATL, which, because of its layer-by-layer processing, introduces potential for interply porosity. As proof of tape integrity, Unger references a micrograph of TenCate thermoplastic tape (Fig. 5, above), which shows uniform ply thickness and resin homogeneity. He says the key point is that high-quality tapes, with low void content, are an enabler of fast, automated processing of high-quality composites. Tapes with high levels of voids will require longer consolidation cycles to produce high-quality parts.

Finally, there is the question of cost. PEEK and PEKK currently are more expensive than the epoxies with which they compete, but that is expected to change. “Cost is predicted to go down as volume increases,” says Offringa, “if it grows strongly, as expected, with the increased application in highly loaded primary structures.” (See CW story on thermoplastic composites in primary structures.) ATC’s Leach agrees, noting that, although thermoplastic tapes have enjoyed decades of use, volume remained small. “OEMs have a lot of experience with composites and tend to favor tapes,” he says. “The big driver for conversion from thermoset to thermoplastic is cost. How can we make thermoplastic parts affordable?”

Porcher’s Quéfélec agrees. “The whole value chain ... has to re-challenge the business case. High cost hurts competitiveness, compared to thermosets. TRL [technological readiness level] lags, but it is catching up.”

Barrday’s Buck puts it simply: “The thermoplastics industry could use a polymer with PEKK/PEEK capabilities, but at the price of PPS.”

Going forward

These real and potential flaws — lack of tack, gaps, waviness, non-uniformity — engender downstream challenges that, although manageable, make thermoplastic tapes more difficult to process than competitive alternatives. This, in turn, has slowed their adoption in high-performance applications. The advantages they offer, however, are real, and that has spurred much investment in research and development of technologies and processes to help push this material into larger structural parts. “The basic innovations have been done over the last two decades,” says TenCate’s Unger. “The major innovation going forward will be process and automation maturity and the expansion of part fabrication infrastructure.”

On the manufacturing side, the Thermoplastic Affordable Primary Aircraft Structure (TAPAS) consortium, led by GKN Aerospace Fokker, is developing for Airbus a thermoplastic aircraft fuselage structure and a thermoplastic torsion box (for tail and wing structures). Under assessment is a TenCate UD tape comprising Hexcel (Stamford, CT, US) AS4 carbon fiber and a PEKK matrix from Arkema (Colombes, France). TAPAS work was divided into two programs, TAPAS I and TAPAS II, with the latter nearing conclusion. Offringa says the TAPAS work has proven the potential of thermoplastic tapes, particularly in fuselage skins, engine pylons, small wings and tail structures. “Materials are being qualified, processes are being qualified. These are not huge parts per se, but parts that increase the size and volume,” he says. Looking further ahead, he says, “A breakthrough is possible at one of the OEMs to decide to really move into a significantly larger thermoplastic part.”

Solvay’s Pratte agrees: “Small parts have taken off and built the confidence and maturity. Customers are starting to look at it for larger parts.” To help drive that effort, Solvay and GKN Aerospace Fokker announced in early 2017 that they will cooperate on thermoplastic composites development, and Solvay will become a preferred supplier to the aerospace fabricator.

The Fundacion para la Investigacion, Desarrollo y Aplicaciones de Materiales Compuestos (FIDAMC, Madrid, Spain), also is assessing application of thermoplastic tapes via out-of-autoclave in-situ fiber placement to manufacture wing and fuselage structures. Fernando Rodríguez Lence, FIDAMC’s senior composites expert, says tape quality is a major limitation, forcing slower laydown rates to compensate for tape flaws and achieve consolidation targets: “I trust that our material suppliers are going to improve tape quality, boosting properties to be similar to autoclaved parts, and solving the need for post-processing.”

If, as is widely assumed, either Boeing or Airbus makes the decision to fabricate primary structures using thermoplastic tapes, it is likely that resources will quickly be deployed to iron out tape quality issues. Indeed, much of the tape development done during the past 10-15 years has been initiated and funded by material suppliers and fabricators. Such work has been promising, but limited. The effort and money that comes with an OEM commitment would change the thermoplastic tapes landscape considerably.

So, for that 2018 college graduate contemplating his or her future, there is new advice: “I want to say two words to you. Just two words … thermoplastic tapes.”

Related Content

Bio-based, fire-resistant composites become mainstream

Projects use Duplicor prepreg panels with highest Euroclass B fire performance without fire retardants for reduced weight, CO2 footprint in sustainable yet affordable roofs, high-rise façades and modular housing.

Read MoreThe next evolution in AFP

Automated fiber placement develops into more compact, flexible, modular and digitized systems with multi-material and process capabilities.

Read MoreComposites end markets: Electronics (2024)

Increasingly, prototype and production-ready smart devices featuring thermoplastic composite cases and other components provide lightweight, optimized sustainable alternatives to metal.

Read MoreLife cycle assessment in the composites industry

As companies strive to meet zero-emissions goals, evaluating a product’s carbon footprint is vital. Life cycle assessment (LCA) is one tool composites industry OEMs and Tier suppliers are using to move toward sustainability targets.

Read MoreRead Next

Plant Tour: Fokker Aerostructures: Hoogeveen, Netherlands

This Dutch aerospace supplier leverages its founder’s pioneering spirit from a century ago to lead the way, today, in thermoplastic aerocomposites.

Read MoreInside a thermoplastic composites hotbed

As production of the A350 XWB ramps up, so does manufacture of the thermoplastic fuselage clips the plane requires. HPC sees how it’s done.

Read MoreAerospace-grade compression molding

Continuous Compression Molding process produces structures 30 percent lighter than aluminum at costs that have both Airbus and Boeing sold.

Read More