Inside a thermoplastic composites hotbed

As production of the A350 XWB ramps up, so does manufacture of the thermoplastic fuselage clips the plane requires. HPC sees how it’s done.

When aerospace professionals talk about the potential of thermoplastics in commercial aircraft, the focus often turns to large primary structures and the feasibility of molding them from carbon fiber-reinforced polyetheretherketone (PEEK), polyetherketoneketone (PEKK), polyetherimide (PEI), polyphenylene sulfide (PPS) and similar highly engineered plastics.

Although commercial jet manufacturers Airbus (Toulouse, France) and The Boeing Co. (Chicago, Ill.) are indeed scrutinizing the potential for thermoplastic composites in everything from tail to wing to fuselage structures (for one successful venture, see “Thermoplastic composites gain leading edge on the A380,” under "Editor's Picks"), the truth is that thermoplastics have already earned a largely unheralded but significant place in structural applications — at high volumes — on commercial aircraft that are in production today. One of the best places to see such thermoplastics manufacturing in action is at a relatively new facility located a stone’s throw from the Nantes Atlantique Airport (Nantes, France) and owned and operated by aerospace production specialist Daher-Socata.

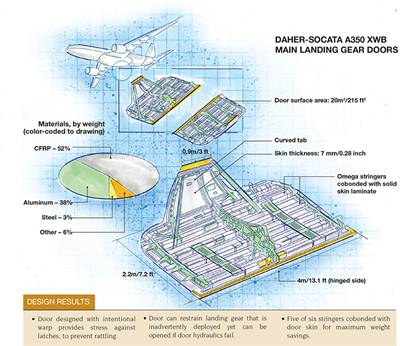

HPC was invited to visit the Daher-Socata plant in Nantes and a thermoset composites facility in Tarbes, France. HPC's report from the Tarbes plant (see "Main landing gear doors designed for all contingencies," under "Editor's Picks") focuses on the design and production of the main landing gear doors for the Airbus A350 XWB. The report from the Nantes plant, which follows here, focuses on the substantial thermoplastics research and development (R&D) and manufacturing that takes place there.

Even a cursory inspection of the Nantes operation turns up abundant evidence of a serious commitment to the material and to the technology used to manufacture it. This aerospace tier supplier has bet a sizable piece of its future on thermoplastic composites. And in 30 years, when the aerospace industry looks back on the evolution of thermoplastics in aircraft, it might well be that Daher-Socata will loom large among the handful of pioneers that gave genesis to the technology in the aerospace realm.

An aerospace hub

Daher-Socata is the aerospace and defense arm of the larger Daher Group (Marseille, France) and comprises several manufacturing facilities, most of which are in Europe, with the balance spread throughout the U.S., Mexico, Africa and Asia. Nantes is located about 240 miles/386 km southwest of Paris and just a few miles from France’s Atlantic coast. Nantes is notable, from an aerospace perspective, for its large Airbus facility, also adjacent to the airport and the focus of much of the energy of Daher-Socata and like companies that are sprinkled throughout the Pays de la Loire region in which Nantes is located.

Also part of the Airbus plant is the Technocampus EMC2, an aerospace and composites facility run collaboratively by Airbus and several partner firms, including Daher-Socata and mold tooling specialist Compose (Bellignat, France). There, they research and develop new materials, processes and technologies for aerospace applications. Daher-Socata has a presence at Technocampus EMC2, and the R&D done at that facility informs and guides much of the activity at the Daher-Socata manufacturing plant that HPC visited.

The products

Daher-Socata’s Nantes plant, established just three years ago, is relatively new among aerospace tier suppliers, but that newness has an upside: The plant features many of the most desired amenities in contemporary manufacturing facilities — high ceilings, ample lighting, clean floors, carefully marked and delineated walkways, well thought-out machinery and equipment layouts and management personnel who are ever-present and well-versed in the plant’s activities.

The Nantes facility, which employs about 250 people, is actually two plants in one. On one side, Daher-Socata manufactures thermoset composite structures, mainly wingskins and wing spars, for the ATR 72 twin-engine turboprop regional airliner manufactured by Toulouse-based ATR. On the other side, where most of the facility’s manufacturing activity is concentrated, the company fabricates thermoplastic composite parts for almost all of the craft in the Airbus family. Components here include the cockpit floor for Airbus Military’s (Madrid, Spain) A400M Atlas military airlifter (see fifth photo at left).

The 10,000m2 (107,639-ft2) space is organized in the shape of a large U. Production starts at the top right leg of the U, with raw material trimming, and progresses down to stamping, through the bottom of the U to machining and drilling, up the other side to quality control and, finally, progresses up the left leg of the U to the paint shop at its top.

The type of thermoplastic parts made here varies, ranging from moveable spars and ribs for the A320, A330, A380 and A350 XWB, as well as pylon components for the A320. The parts made in the highest volumes, however, are the myriad fuselage clips destined for the A350 XWB. These clips, which are used in fuselage sections 11 through 15, connect the fuselage shells to interior composite rib structures. The clips vary in size and shape, depending on the dimension, space and surfaces with which they are designed to mate. Some clips have a simple L-shape design, while others are more complex. All clips are roughly the same size — no more than 8 inches/203 mm in any one dimension.

Each A350 XWB requires approximately 8,000 such clips, of which Daher-Socata currently makes 1,000. Airbus has stated that it plans to produce as many as 10 A350 XWBs per month within four years of its entry into service, which is expected sometime in the second half of 2014. This means the Daher-Socata Nantes facility must eventually produce at least 15,000 clips per month. If, as rumored, Airbus adds another final assembly line (FAL) for the A350 XWB, the production rate could increase to 13 planes per month. That means Daher-Socata would have to manufacture almost 20,000 clips monthly — a figure that certainly qualifies as high volume in the aerospace composites market. Production capacity at the facility right now, for all products, is about 4,500 parts per month, but that is expected to increase soon as Daher-Socata adds new presses.

The tour

Sébastien Jamet, plant manager at the Daher-Socata facility, notes that the plant’s high-speed, high-volume operation depends heavily on well-developed process control, driven by automation and aimed at repeatability. At the heart of the plant are five manufacturing cells built around hydraulic thermostamping presses supplied by Pinette Emidecau Industries (Chalon sur Saône, France). Each cell features a robotic system for material handling, an infrared heater for material preheating and, of course, the Pinette Emidecau press.

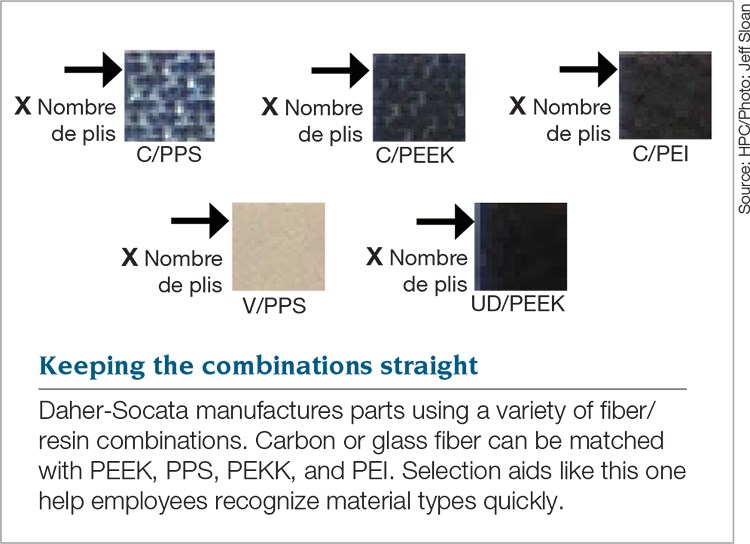

Jamet says every fiber/resin combination that Daher-Socata processes has a defined set of parameters that dictate how long it is preheated, how quickly the material must be transferred from the preheater to the mold and how long the press will hold the mold closed to shape the part. Control of this process, combined with a minimum of labor interaction, has helped the company meet its quality and throughput goals.

Almost all the thermoplastic material processed in the Nantes facility comes in the form of preconsolidated blanks, consisting of several layers of unidirectional or woven carbon fiber plies infused with any of a number of resin types the facility uses. PPS and PEEK are the high-end thermoplastics most often used.

Many of the PPS-based blanks that Daher-Socata consumes are supplied by TenCate Advanced Composites BV (Nijverdal, The Netherlands) under the Cetex brand, with the ply count and orientation specified by Daher-Socata. The TenCate blanks are delivered in 12-ft by 4-ft (3.7m by 1.2m) sheets and vary in thickness, depending on the part. Daher-Socata also manufactures its own blanks to incorporate PEEK and other resin types. The blank thickness at Daher-Socata ranges from 2 mm to 5 mm (0.08 inch to 0.2 inch).

A preconsolidated blank is first cut from the larger sheet and then enters a cell after an operator tapes it to a polyimide carrier film. The film helps position the blank within the preheater and the mold. Jamet points out that the carrier is heat tolerant and is easier to use and manipulate than a traditional metallic frame, to which the blank would be attached with screws or bolts. After the blank is positioned and taped to the film, robots take over the process.

Jamet notes, as he points out the operation of a typical cell that is manufacturing A350 XWB fuselage clips, that robotic automation and good process control have been a great asset to the plant’s operations. “The most important things are infrared temperature, tool temperature and good process control,” he explains. The first step is transfer of the blank and carrier to the infrared preheater. After heating, they go to press. Jamet notes, in particular, that a blank must be transferred from the infrared preheater to the tool in the press in less than four seconds. If the transfer time takes longer, part quality is at risk, so the carefully timed robotic movements ensure that transfers take place within the time constraints.

Daher-Socata, during HPC’s visit, was in the midst of installing one of three new Pinette Emidecau stamping-press cells, which will be devoted to A350 XWB clip production and promise to significantly boost throughput. This cell features infrared heating, two Fanuc (Echternach, Luxembourg) multiaxis robots and handles two molds. One robot will manage preheating and mold loading. While one mold is in the press, another robot will remove the finished part from the second mold and free it up for the next part. The preheater and mold temperatures, says Jamet, will be closely aligned in this cell.

All the clips Daher-Socata produces come out of the press still hot to the touch and feature sacrificial material along the edges for handling. After a part cools, it is transferred to the trimming/cutting station where the part takes its final net shape. Daher-Socata uses a CMS Industries (Zogno, Italy) machining center with an overhead gantry to do all trimming, routing and drilling. Trimmed parts are then sent to quality control where they are scanned for delaminations and voids in a wet-bath ultrasonic nondestructive testing regime.When asked what the reject rate is for Daher-Socata’s A350 XWB fuselage clips, Jamet’s reply was unexpected. “Zero,” he insisted, adding, “Today, we scan every part, but perhaps, one day, we will not.” He suggested, hopefully, that Airbus might be persuaded to let Daher-Socata verify product quality via sampling, but he admitted that the odds are long. “This is a big challenge for thermoplastics, because the aerospace industry is not used to sampling quality control.”

What the future may hold

Dominique Bailly, the R&T engineer at Daher-Socata and at Technocampus EMC2, leads an R&D team that does most of the company’s new process development for aerospace applications. As a result, he puts much thought into how thermoplastics might be used in future aircraft.

“Right now,” he says, “the main difficulty is raw material cost.” He notes, for example, PEEK and PEKK. PEEK is relatively expensive compared to PEKK, but PEKK requires lower process temperatures, which speeds production throughput. PEKK, on the other hand, doesn’t have the same mechanical performance as PEEK. This conundrum is a challenging one for aircraft manufacturers and their suppliers, like Daher-Socata, but Bailly says material suppliers are working aggressively on a solution, and Daher-Socata’s biggest suppliers, Cytec Industries (Woodland Park, N.J.) and TenCate, and other suppliers in Japan are also working on solutions. “I think you will see, within 10 years,” says Bailly, “a material will emerge that is between PEEK and PEKK — one that is cheaper and fast cycling,” and offers good mechanical performance.

Where might such a material be applied? Bailly suggests that a good place to start might be wing structures. “Wings are a good candidate because of fluids inside the wing that can be corrosive. Thermoplastics could be a good solution there.”

Whatever the future holds, the present for Daher-Socata Nantes is promising at what is likely the largest thermoplastic composites manufacturing facility in the world. An already robust and well-controlled manufacturing process appears poised to be not only better controlled, but even faster. It is, therefore likely that important thermoplastic lessons will be learned at this facility over the next several years as the A350 XWB enters production and as plane manufacturers look to add this versatile material to new aircraft.

Related Content

Plant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read More3D-woven composites find success in aerospace, space

CAMX 2024: Bally Ribbon Mills experts are displaying the company’s various joints, thermal protection system (TPS) technologies and other 3D woven composites for mission-critical applications.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreRead Next

Thermoplastic composites gain leading edge on the A380

Breakthrough manufacturing process produces lightweight, affordable glass-reinforced PPS J-nose on the worlds largest commercial aircraft wing.

Read MoreMain landing gear doors designed for all contingencies

For the Airbus XWB airliner, they must meet strict structural, aerodynamic, emergency and aesthetic requirements.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More