Life cycle assessment in the composites industry

As companies strive to meet zero-emissions goals, evaluating a product’s carbon footprint is vital. Life cycle assessment (LCA) is one tool composites industry OEMs and Tier suppliers are using to move toward sustainability targets.

Share

Life cycle assessments (LCA) are one tool OEMs, fabricators and suppliers can use to understand – and improve – the environmental impact of composite parts and materials. Examples shown include an LCA of IDI Composites’ Alluralite SMC and a demonstrator LCA for a composite boat. Source | Getty Images/Avient (background), IDI Composites (top left), Anthesis Group (bottom left)

As OEMs strive to meet their carbon neutrality and net-zero goals, “the first step is for them to explain their carbon footprint in concrete terms, to know where they are at this moment so they can reduce that number,” explains Markus Beer, group lead sustainability at automotive composites-focused consulting firm Forward Engineering GmbH (Munich, Germany). “LCA [life cycle assessment] is one tool to do that, and that’s why it’s getting so much attention now.”

Beer adds that, “OEMs need to have the data so they can reduce their footprint and meet their goals, and Tier suppliers are realizing that OEMs are going to need information from them, so they have to be ready to have the data ready themselves.”

What is an LCA?

Life cycle assessment (also called life cycle analysis) is a process for evaluating the environmental impact in multiple categories (resource depletion, water, global warming potential [GWP], etc.) of a product from raw materials and manufacture through to disposal at the end of its usable life.

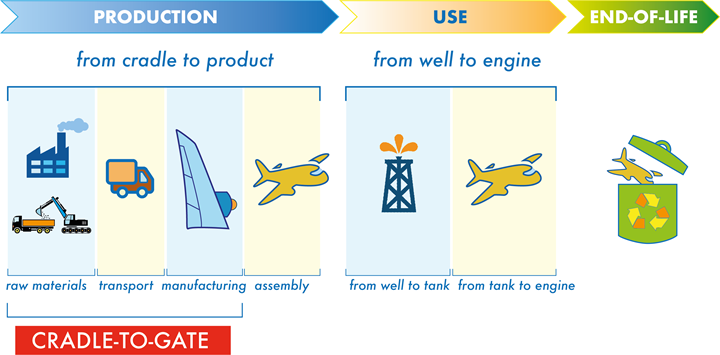

A cradle-to-gate or partial LCA (commonly performed by Tier suppliers) assesses impacts from the production of a product’s raw materials through manufacturing of the part, ending at the point the product is ready for use by the consumer; a cradle-to-grave or complete LCA (commonly performed by OEMs) assesses the product through its use and eventual disposal at its end of life (EOL).

A cradle-to-grave LCA evaluates a part’s environmental impact through production, use and end of life, while a cradle-to-gate LCA covers impact through manufacturing. Source | EuCIA

Either way, the goal is to quantify the carbon emissions of each step of the supply and value chain for a given product or process. Generally speaking, emissions are labeled by their scope. Scope 1 emissions are direct greenhouse gas (GHG) emissions, such as those associated with fuel-burning facility equipment like furnaces or boilers, or by gas-powered vehicles. Scope 2 emissions are indirect GHG emissions used by the company, such as those associated with electricity or heat for the facility. Scope 3 emissions are also indirect emissions, but those that result from assets not directly controlled by the company in question — including everything from production of raw materials, transportation and distribution, and any other emissions not covered by Scope 1 and 2.

LCA guidelines, standards

How are LCAs performed? While there is no global standard for conducting LCAs to date, there are several guidelines available with varying degrees of complexity and specificity, and for various regions. For example, ISO standards are widely used, primarily 14040 and 14044 — the former provides “principles and framework” and the latter provides “requirements and guidelines.”

The European Commission’s Joint Research Centre (JRC) developed the International Reference Life Cycle Data System (ILCD) and associated handbooks, which the European Commission claims provide “greater consistency and quality control” compared to the ISO standards. Most recently, in 2021, the JRC published new guidelines called the Product Environmental Footprint (PEF), which are under review and proposed to become mandatory for companies in the EU, potentially as early as 2024.

There are a variety of other LCA guidelines for specific industries (such as ISO 22526 for bio-based plastics) and specific regions (like Japan’s EcoLeaf program). While specific LCA methodologies differ, in general these studies are set up with more or less three components:

- A section defining the goals, scope and units used in the LCA

- A life cycle inventory (LCI) which quantifies the carbon footprint of input materials as well as output emissions and waste

- An impact assessment which translates the LCI into a measurable climate impact. Per ISO 14040, for example, these final impacts are given in terms of GWP, or carbon dioxide equivalent (CO2e).

Beer adds that the proposed PEF standards “act completely within the boundaries of today’s ISO 14040/14044, but make the currently vague boundary conditions clearer.” PEF results also include a score that combines a complete list of impact categories, versus ISO 14040/14044’s more limited GWP score. “We know from most OEMs that this is currently too complicated for the supply chain,” adds Beer, “and that everyone will stick with the known GWP values for the time being, because even these are not yet fully understood by most people. So, PEF both complicates some things but simplifies others.”

In addition, to facilitate LCA work, there are a variety of software tools that have been developed, which range in complexity, focus, the origins of the data used and output (more on these in the next section).

The rising demand for LCAs

So why are companies (in the composites industry and elsewhere) interested in LCAs now? First conducted in the 1960s, LCAs have waxed and waned in popularity over time depending on the concerns of the day. Today, OEMs are facing greater demand for transparency into the “sustainability” of their products, spurred by environmentally conscious consumers as well as proposed legislation like the EU’s PEF guidelines.

Adam Halsband, managing director at Forward Engineering North America, notes that over the past 2 years in North America, “LCAs are becoming a normal part of the design process now. You wouldn’t think of evaluating a part’s design without looking at costs, and now you’re also looking at GWP.”

As Beer explains, OEMs conducting LCAs need Scope 3 emissions data, which they obtain from gathering carbon emissions information from their own Tier manufacturers and suppliers downstream. “Some Tier 1s and 2s do LCAs for other reasons — for example, they may want to differentiate their products against other materials or against competitors’ products.”

“The value of LCA really exists in its ability to, as a manufacturer, model all of your variables and find the lowest impact solution,” Ollie Taylor, associate director at sustainability consulting firm Anthesis Group (London, U.K.), notes. “LCA isn’t purely about reporting. It’s much more about finding optimization and eco-design. It’s a decision support tool. The trouble with LCA is, of course, that it’s time-consuming. And it can be very complex.” Therefore, a number of tools are available today to simplify the process according to a company’s needs.

LCA tools and approaches

One option is to employ a third-party consulting firm (like Forward Engineering or Anthesis Group), in which case consultants will work with the company to define goals and parameters for the project, collect needed data and use their preferred or in-house software and databases to generate an impact report.

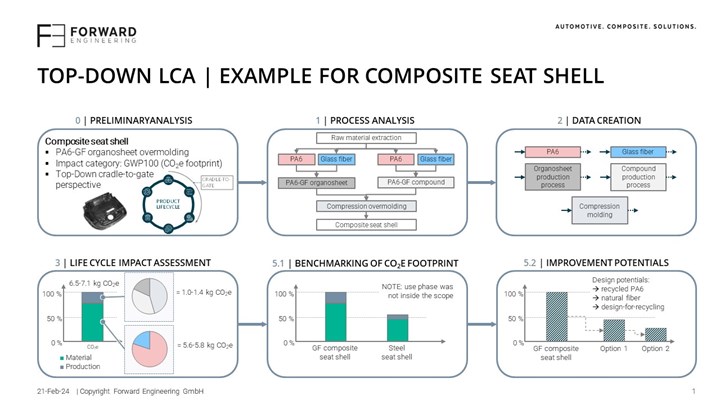

Beer says that this can be done in either a top-down or bottom-up approach. “Top-down is a quick method using datasets that are pulled from a database” like Forward Engineering’s in-house database or commercial databases, he explains. Databases generate carbon emissions calculations based on averages of data provided to the database creator by primary suppliers. Because the data is based on modeled averages and not the actual specific information from a product’s real-life supply chain, “the footprint it generates won’t be exact — you’ll get a range based on the information available, but you will get a feel for where you’re at. For our services, we say it’s about an 80% accuracy,” he says. “This might be a perfect fit for a first assessment, or if you’re in a development phase and don’t have all the details ready, especially in early concept phases where designs change daily and targeted material and process innovation are often not part of existing databases.”

An example LCA for a glass fiber-reinforced PA6 seat shell using a top-down, cradle-to-gate approach. In this type of approach, process and materials data (shown in boxes 1 and 2 above) are pulled from pre-existing databases rather than real-world studies. This approach results in an assessment (box 3) showing estimates of GWP or other environmental impact for the given material and process combination. Source | Forward Engineering

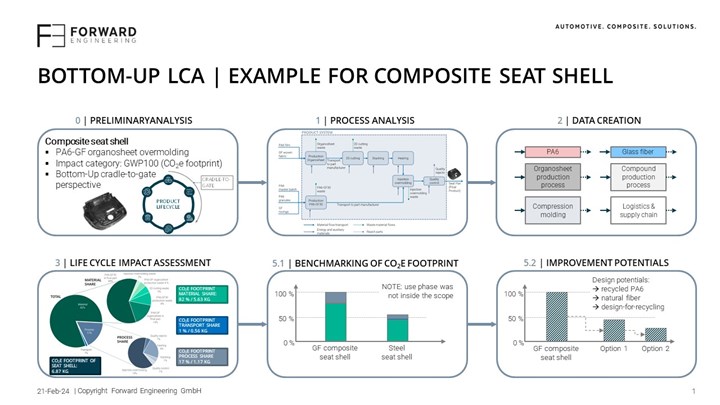

A bottom-up approach is more in-depth. “When your product has reached a point where the concept is ready, the processes are defined and the suppliers have been selected, then you might do a bottom-up LCA using specific data from your suppliers, and it takes more time and effort but you’ll get a more accurate result,” Beer says.

A bottom-up LCA approach to the same example part would use as much in-depth, real-world process and materials data as possible from actual suppliers (boxes 1 and 2) to produce the most accurate impact results and improvement potential. Source | Forward Engineering

Ultimately, Taylor contends, “Everyone in manufacturing needs to take a bottom-up approach and use LCA, because that’s where all your Scope 3 emissions generally live — and the products you make, the way you make them, the way you ship them and the way your customers use them.”

If a company wants to learn more about its carbon footprint data directly, there are now numerous software applications available — ranging in complexity, cost and target industry — that companies can use to conduct an LCA themselves.

“The tools have evolved over time,” Halsband says. “In the past, an LCA might take half a year and be very expensive, so for an industry like automotive, an OEM might say that’s not how we work, we need to have results immediately, and it can’t cost that much money. There are now new tools available to quickly and more cost-effectively evaluate carbon footprint.”

While not an exhaustive list, common LCA software platforms used by the composites industry include expert-level tools like LCA for Experts (formerly known as GaBi), from software and consulting services company Sphera (Chicago, Ill., U.S.); SimaPro, from PRé Sustainability (Amersfoort, Netherlands); and Umberto, from iPoint-systems GmbH (Hamburg, Germany).

There are also free, simplified tools available such as openLCA, from GreenDelta (Berlin, Germany); and Eco Impact Calculator, a composites-specific tool from the European Composites Industry Association (EuCIA, Brussels, Belgium).

Composites-specific LCA tools and data

Dr. Jaap van der Woude, chairman of the Sustainability Working Group at EuCIA, explains the background for creating the Eco Impact Calculator. “I had a long career with PPG’s fiberglass division in technology, and during that time I got a lot of customer questions about carbon footprint. In those days, companies were generally reluctant to share CO2 data, and in some cases the data that was out there, or the estimates that existed, were wrong. I was invited to work as a chair with the German composites federation, which had a working group on sustainability, and the first step was really just to describe what sustainability means for composites.” These discussions led to the recognition that LCA would be increasingly important across the composites supply and value chain for evaluating — and ultimately improving — carbon footprint for materials and end-use products.

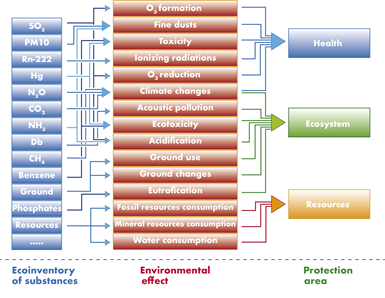

The ILCD protocol’s input and output categories (left in blue) are evaluated by a variety of environmental impacts (middle, red) using an LCA tool, to produce results in various protection areas (far right). Source | EuCIA

He continues, “The driver [for creating the Eco Impact Calculator] was the need for data, especially back then [in 2016] to allow comparison of the manufacture of composite parts with other materials and processes. We wanted to create a composites-specific tool that calculates cradle-to-gate environmental footprint data based on average values, so you don’t need to have the actual data on raw materials or processes. We had a strong intention to make it easy to use, providing very quick results, to make it accessible to all people in companies, academic institutions, etc.”

The Eco Impact Calculator’s materials and process LCI data come from a combination of industry associations, manufacturers and Ecoinvent, processed by partner EY (New York, N.Y., U.S.). This is updated regularly as new data becomes available.

The tool enables companies to calculate relevant impact factors (GWP or GHG, CED, ILCD, etc.) and provides a Simapro 9.3.0.3 svc file that can be used to calculate a more thorough cradle-to-grave LCA. “If you want to compare material to material, this will be the right tool to start with, as it gives a good average-based calculation,” van der Woude notes.

End market-specific tools

Furthermore, as more companies in more markets become interested in LCA, some companies are developing more streamlined versions specific to those industry applications. Anthesis Group’s Taylor says, “We’re seeing a transition to more specialized LCA platforms that address very specific industries, because it removes a lot of the complexity that exists within a traditional LCA.”

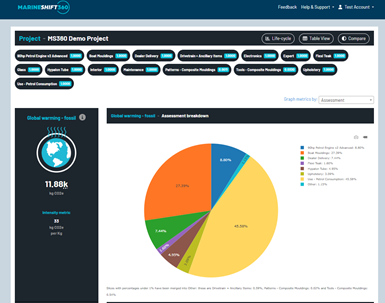

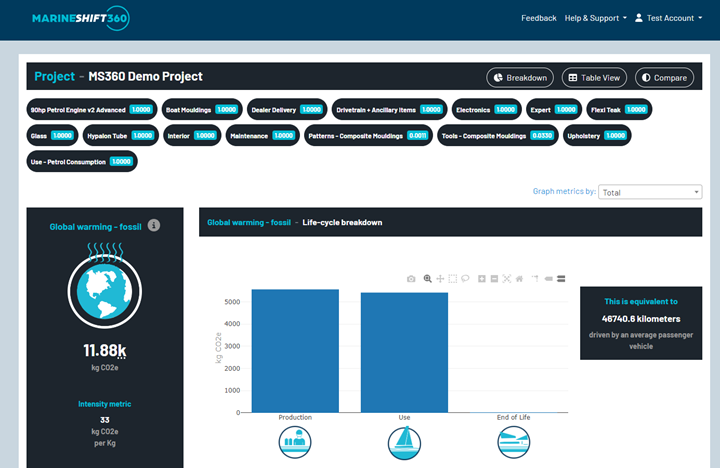

For example, Marineshift360 is a tool developed by 11th Hour Racing Team, with software development and technical support from Anthesis Group.

“I spend a lot of time using SimaPro for the client work [Anthesis does], and it’s an amazingly flexible LCA tool, but it’s really complex to use and you need a high level of training and understanding to use it,” Taylor says. “Whereas MarineShift360 was created to be a very simplified tool, focused specifically on composites manufacturing and specifically for marine vessels.”

MarineShift360’s data comes in part from primary industry data that Anthesis Group collected, and in part from Ecoinvent — a widely used LCA database that contains models and primary data from a variety of manufacturing industries.

The software is available for free with limited functionality, or as a subscription. It “allows users to do more frequent LCA work themselves, rather than do the longer term, consultant work done in SimaPro — so it’s especially helpful for R&D work where the materials and processes are changed more frequently,” Taylor says.

Challenge: Increasing data availability

One challenge to conducting accurate LCAs is availability of data from suppliers. Today, many suppliers are beginning to run their own LCA studies to contribute more accurate and meaningful data that upstream manufacturers can use to track Scope 3 emissions. Often, this looks like suppliers reporting that they’ve conducted LCAs or publishing the reports publicly (see recent announcements from Toray Advanced Composites on its thermoplastic composite materials, Fairmat on its recycled carbon fiber products and carbon fiber supplier Teijin).

In December 2023, polymer formulator Avient Corp. (Cleveland, Ohio, U.S.) approached this same challenge by launching a software tool called the Product Carbon Footprint (PCF) Calculator, certified by TÜV Rheinland, to evaluate the carbon footprint specifically of Avient’s material solutions. Following ISO 14067:2018, PCF offers cradle-to-gate emissions data, in terms of CO2e, specific to Avient materials that can contribute to upstream Scope 3 emissions. The Avient team will use this tool to generate PCF reports for customers on request.

Dr. Ley Richardson, global technology director for Advanced Composites and Fiber-Line at Avient Corp., says the PCF Calculator “aims to empower companies to assess the environmental impacts of their products.” Having accurate data on these materials enables these companies to “gain a competitive advantage by actively managing and reducing their carbon footprint, meeting consumer preferences for environmentally responsible products.”

Industry organizations are also playing a role in helping to add transparent data to databases and companies seeking it. For example, the American Composites Manufacturers’ Association (ACMA, Arlington, Va., U.S.) has publicly published LCI reports that it has conducted with member companies and a consulting firm on polymer composites in general, and more specifically on vinyl ester, polyurethane precursors and pultrusion. ACMA’s sustainability website notes that the organization will soon release a tool called LCA + EPDgenerator to enable companies to “reliably and cost effectively produce verified LCA and EPD [environmental product declarations] for composite products” as well as additional research reports.

LCA in use: OEMs and Tier suppliers

In practice, OEMs, composites fabricators and various suppliers conduct LCAs using any of the above tools and methodologies for a variety of reasons, from evaluating their own materials choices during the design phase, or finding ways to improve the carbon footprint of manufacturing to meet an internal ESG strategy or external certifications or other pressures.

Some companies choose to report some level of carbon footprint information to consumers, to, for example, show the relative sustainability of their products, or to add transparency to their operations and efforts toward more stringent climate goals.

In marine, for example, 11th Hour Racing routinely includes carbon footprint data for both the manufacture and use of its racing boats within its regular reports (see the latest 2019-2023 campaign report). Another company illustrating this is Greenboats (Bremen, Germany), a boatbuilder and fabricator that manufactures its structures from flax fiber and bio-based epoxy, which published a report detailing the results of an LCA the company conducted with Anthesis Group using MarineShift360 on its largely flax fiber/bio-based Flax27 Daysailer boat.

According to the report, “Publishing our LCA finding is the first step in encouraging wider industry transparency.” Along with high-level carbon footprint data related to materials, manufacturing method, water and energy consumption, Greenboats also outlined ways in which the company might be able to further reduce its carbon footprint to scale up Flax27 production, such as reusing high-carbon footprint molds and working with suppliers on availability of resins with a higher bio content.

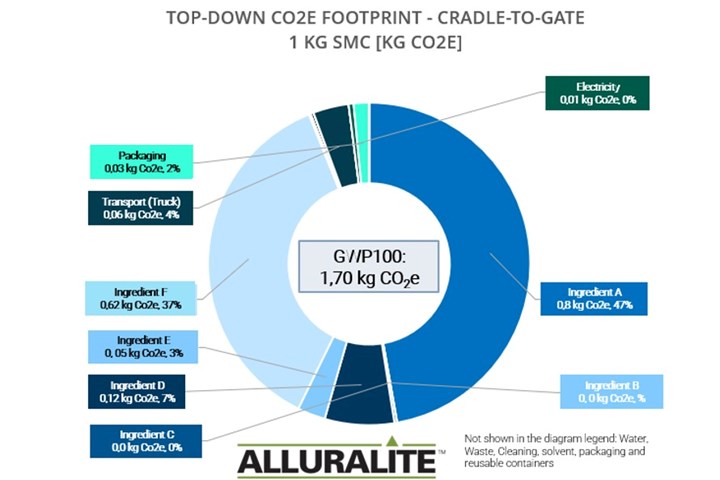

From a supplier perspective, one example is IDI Composites International (Noblesville, Ind., U.S.), a company specializing in formulation and manufacturing of thermoset sheet molding compound (SMC) and bulk molding compound (BMC), which began conducting LCAs for several of its materials in 2022 after receiving requests from OEM customers.

“The materials engineer from a major automotive OEM handed me an Excel spreadsheet with sustainability data they were looking for on all of their raw materials [including our SMC], including things like water consumption, surface area of the facility and electrical consumption. Shortly after that, we began to hear from other OEMs, asking for similar but slightly different data,” explains Eric Haiss, global director of automotive business development at IDI.

IDI began working with Forward Engineering in early 2022. The process began with training and educational sessions for employees at IDI’s six global manufacturing facilities, followed by in-depth data collection and analysis. “Forward Engineering provided a template for us to work with regarding what information we needed to gather, and they visited each of our global facilities, did a walk-through and asked for detailed records on energy consumption and gas consumption and waste streams — all of the things that go into that carbon footprint,” Haiss says. IDI and Forward also collaborated extensively with IDI’s raw materials suppliers to gather needed data.

For these initial LCAs, IDI conducted cradle-to-gate analyses of two of its products: Alluralite standard-density Class A SMC used in many automotive applications, and Fortium structural SMC, which contains a high fiberglass content to meet higher performance needs.

What approach did IDI use? “We used a top-down LCA approach [as a starting point],” Haiss explains. “Because we produce only BMC and SMC across all of our facilities, we were able to take facility inputs such as electricity, natural gas, etc. as well as waste streams, and then allocate [these values] across the SMC or BMC that we produce in each facility.”

What were the results? “The carbon footprint was good,” Haiss says. “We also learned how important the raw materials are. Depending on the formulation, raw materials are 94% of our overall carbon footprint. In comparison, transportation, packaging and the energy needed for us to make the SMC material are pretty small. From that standpoint, we now know that our most effective path to reduce the carbon footprint is to collaborate with our suppliers and find ways to reduce the footprint of the raw materials.”

An initial LCA of IDI Composites’ Alluralite low-density Class A SMC breaks down environmental impact of each material, as well as the electricity needed to produce the part, transportation and packaging. Using this information, IDI began working with suppliers on ways to lower the footprint of certain materials. Source | IDI Composites

How does a material like SMC compare with metal? “Density isn’t considered in an LCA like this. This is the carbon footprint per kilogram of material,” Haiss says. “Steel competes well with SMC on a per kilogram basis, but in an actual application steel has significantly higher density, so SMC competes well in terms of carbon footprint on an actual part.”

One way glass fiber suppliers, such as those IDI works with, are working to improve the carbon footprint of their materials is by switching to renewable energy sources for the production of fiberglass. “One supplier, for example, has switched to renewable energy sources in Europe almost exclusively, and they’re working on similar projects in other parts of the world,” Haiss notes. Some fiberglass suppliers are also beginning to use post-industrial scrap as feedstock for manufacturing their products. Similarly, many resin suppliers are also using recycled content such as post-consumer waste, or bio-based versus petroleum-based materials as the basis for certain products.

Haiss notes that, especially for markets like automotive, there is increased demand to switch to bio-based or recycled material content within SMC and BMC materials, and also to provide solutions for recycling manufacturing waste. IDI is working on these areas, as well as formulating materials with resins that enable easier separation (and therefore recycling) of an SMC or BMC part at its EOL, and building a new manufacturing facility in Noblesville that uses more energy-efficient machinery.

Since IDI’s initial LCAs were performed, Haiss adds, “We’ve had more and more customers asking us for LCA for the materials they’re using. So we developed tools that allow us to calculate LCAs internally if the customers accept that, or if they need something more in-depth we’ll work with Forward Engineering and do a third-party, ISO-compliant LCA for them. And we’re continuing to work on next steps on how to improve our own carbon footprint, and how to educate the market.”

Challenges and potential

As additional research, regulations and tools continue to be developed, Anthesis Group’s Taylor cautions that understanding the reason behind conducting an LCA remains vital. “Because we don’t have one common way of doing LCA at a global level, companies can manipulate LCA results to support whatever case they want to make,” he says.

One way to combat using LCAs for data manipulation or greenwashing is increased data availability from suppliers. “As more companies publish data, the more accurate the numbers will be, and the more critical review we can have of what it all amounts to,” Taylor says. Common guidelines and legislation will also help, “but regulations are slow. I see legislation hitting people in the pocket in probably 10 years.”

On the other hand, using data through LCA work can also help determine whether a particular sustainability-related solution actually reduces the carbon footprint or not. For example, IDI’s Haiss notes that the company developed a process more than a decade ago to reuse manufacturing waste as a filler in BMC. “The recycling process worked but took a lot of energy, so you’re actually displacing low-carbon footprint calcium carbonate filler with a recycled SMC filler that has a higher carbon footprint.” IDI is working with its partners to evaluate more efficient reuse and recycling approaches.

Ongoing research

Aiming to solve these challenges and others, a variety of companies, academic institutions and organizations (such as ACMA, the National Composites Centre and others) continue to work on new tools and methodologies for more accurate analysis; other research uses LCA to help determine the environmental impact of processes and materials on a wider scale than one particular company or application.

Numerous papers have been published detailing specific studies. For example, a paper published in a 2023 issue of The International Journal of Life Cycle Assessment, by researchers from the University of Surrey’s (Guildford, U.K.) Centre for Environment and Sustainability details a project using LCA (and also life cycle costing) to compare the environmental (and financial) impacts of a carbon fiber composite and an aluminum aircraft door design. The researchers’ conclusions were that the high energy consumption needed to produce carbon fiber composites compared to aluminum made aluminum seem like the more environmentally friendly option, but that the positive effects of lightweighting the aircraft door, as well as improvements in EOL/recycling scenarios for carbon fiber, could make carbon fiber more competitive.

In automotive, one example is work published in 2021 by researchers primarily from the Università Politecnica delle Marche (Ancona, Italy) with academic partners and industry partner HP Composites (Ascoli Piceno, Italy). The project involved a cradle-to-gate analysis (using SimaPro software and Ecoinvent data) of a carbon fiber/epoxy sports car fender design manufactured by one of several common methods: autoclave, pressure bag molding, compression resin transfer molding (RTM), high-pressure RTM or low-pressure RTM. The purpose being to evaluate the environmental footprint of these processes, the researchers compared all of the resulting data.

The RTM processes were found to have the lowest carbon footprints, with prepregging and mold manufacturing in the autoclave and pressure bag molding processes contributing the highest environmental impacts. In all cases, raw materials manufacture had the highest impact compared to parts manufacturing.

IDI Composites, hoping to show to customers that SMC and BMC can compete with metals and thermoplastics environmentally, is also currently working on research efforts with Forward Engineering. Begun in December 2023, the project involves an application-specific, cradle-to-grave LCA for a pickup box application IDI has designed based on blended customer criteria. That pickup box will then be modeled in IDI’s SMC, aluminum, steel and thermoplastic organosheet. Forward Engineering is conducting LCAs on all four designs, with the goal of presenting the data publicly to potential customers.

“It’s great for material suppliers to be able to talk about carbon footprint on a per kilogram of material basis, but how do you translate that metric to an OEM, or to a consumer buying a vehicle? The market needs to understand it as an application-specific thing,” Halsband explains.

In an era where data and digitization are a growing focus for all manufacturers, LCA is a tool that allows them to use data specifically for achieving environmental and sustainability goals, and enabling that within their supply chains. Taylor adds, “If you don’t have the data, you’re shooting in the dark. LCA is a core tool that allows you to measure the data, simulate what can change and then set a path of travel that reduces your impact. In the last 2 years, there’s been much more awareness within our client base that they need to start doing this if they’re serious about reducing their impact on the world, and I think it’s only going to keep growing.”

Related Content

Cryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreBio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreRead Next

Watch: A practical view of sustainability in composites product development

Markus Beer of Forward Engineering addresses definitions of sustainability, how to approach sustainability goals, the role of life cycle analysis (LCA) and social, environmental and governmental driving forces. Watch his “CW Tech Days: Sustainability” presentation.

Read MoreHeartland completes first industrial hemp fiber life cycle assessment

Life cycle assessment (LCA) studies Heartland’s Imperium Filler natural fiber additive as a carbon-negative replacement for mineral fillers commonly used in plastics.

Read MoreDemonstrator project targets circularity solutions in carbon fiber composite sports equipment

The Carbon Fibre Circular Alliance (CFCA) brought together OEMs and technical partners to reclaim short carbon fibers from end-of-life sports equipment, realign into continuous prepreg tapes and remanufacture into new equipment.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg)