Raising the bar on WPC durability

Wood plastic composites weather the recession and questions about their weatherability.

Much like their touted material properties, wood plastic composite (WPC) product lines are showing resilience in the face of the worst economic downturn in recent memory. Although growth in U.S. demand for decking of all types (decking accounts for about two-thirds of the WPC market) is expected to decline from 2.2 percent to about 1 percent annually through 2013, according to The Freedonia Group’s (Cleveland, Ohio) Wood & Competitive Decking report (issued in April 2009), demand for WPC decking is expected to rise 9.5 percent per year during that period to as high as 700 million lineal ft/yr (213.6 million m/yr). Fueling this trend, says Freedonia, is consumers’ attraction to alternative decking for its “long lifespans, minimal maintenance requirements and imperviousness to degradation caused by general wear and tear.”

Indeed, since a couple of engineers working at Mobil Corp. discovered a way of combining recycled polyethylene grocery bags and wood flour (founding, in the process, Winchester, Va.-based Trex Company, the first WPC board manufacturer, in 1996), durability and low maintenance have been the key selling points for wood-plastic composite deckboards, railings, fencing, windows and other goods. This advantage is crucial, because consumers usually pay 10 to 20 percent more for a WPC product than for a competitive product made from pressure-treated wood. As a result, WPCs have grown into a billion-dollar-plus industry, with more than 30 manufacturers competing in the North American market alone.

As many WPC products enter their second decade of service, however, their reputation for resilience and low maintenance faced a recent challenge, posing some questions for an industry looking to capitalize on and maintain its early success: WPC pioneer Trex settled a much-publicized lawsuit out of court in July of this year. The suit, filed by two consumers, alleged that a Trex decking product developed surface flaking and that Trex failed to provide adequate remedies. In a statement, Ron Kaplan, Trex president and CEO, said the settlement was a way to avoid costly and time-consuming litigation rather than an admission of the allegations.

Although the case offers little on which to evaluate the merits of the complaint or the product, it is a cautionary tale. Based on manufacturer claims, consumer expectations are high. “WPCs have been sold as products that are not going to change their appearance over time,” says Prof. Jeffery Morrell, of the Department of Wood Science, Oregon State University (Corvallis, Ore.). “If these products start to have weathering problems, the industry is going to have to change their marketing strategies.” Manufacturers and researchers aren’t idle. Current efforts to improve the durability of WPC products are focused on four main areas: colorfastness, scratch-resistance, stain-resistance and mold/mildew prevention. Another objective, related more to expanding sales and market share, is improving the stiffness of WPC boards.

Tackling moisture intrusion

Because WPCs are used almost exclusively outdoors, exposed to sunlight, rain, and freeze/thaw cycles, they are a worst-case scenario for designers during development, especially in regard to product service life. WPCs are a complex blend of a hygroscopic material (wood flour) with a hydrophobic material (plastic) and assorted pigments and additives. Wood filler, usually added in ratios of 40 to 60 percent of a given WPC formulation, adds stiffness and decreases the tendency of plastic to creep. At roughly $0.10/lb, wood flour also reduces the cost of a composite in comparison to all-plastic products. The type of wood flour (hardwood or softwood) can influence the weathering characteristics of the final composite, and each polymer has specific degradation traits. As much as 75 percent of all WPCs are made with polyethylene (PE). A small but growing number of manufacturers use polypropylene (PP) and polyvinyl chloride (PVC), polymers that are stronger and stiffer, but more difficult to process. Polypropylene and PVC, however, are more susceptible to surface oxidation than PE.

“WPCs are fairly moisture resistant, especially compared to wood, but they do absorb moisture over time” say Morrell, whose lab has conducted moisture cycling (wet/dry) studies on commercial WPC decking boards produced by Strandex Corp. (Madison, Wis.). The boards were approximately 60 percent wood and 40 percent high-density polyethylene (HDPE). The results showed an increase in moisture content after each cycle, with as much as 2.6 percent moisture content after four cycles. The results reflect increases in void volume as spaces open up between wood and plastic.

“WPCs are a hybrid species,” says Allen Zeilnik, senior consultant, Atlas Material Testing Technology LLC (Chicago, Ill.). “Polymers and bio-fibers each have their own separate degradation mechanisms.” Zeilnk says the degradation rates and mechanisms for most polymers, including PE and PVC, are mostly known, and largely a result of exposure to UV radiation. “As the polymer at the surface of the composite degrades, it exposes the ends of the fibers, which wick moisture deeper into the polymer material,” he explains. Much like a leaky faucet, the problem gets worse over time. Fibers swell with moisture then dry out and contract, leaving voids, which allow more moisture into the composite. These voids provide a moist environment favorable to growth of microbes, fungi, mold and mildew. “I’ve even seen WPCs with mushrooms growing on them,” reports Zelinik.

Decay of WPCs depends not only on formulation but geography, says Douglas Gardner, professor of wood science and technology at the AEWC Advanced Structures and Composites Center, University of Maine (Orono, Maine). For example, WPC decks in Florida showed evidence of red fungal fruiting bodies on surfaces within a few years after installation, implying the wood in the materials was still susceptible to bio-degradation. Similar observations have been reported in other tropical, humid environments, such as Hawaii.

Because water is transported into the composite via the wood fibers, one corrective is simply to decrease the amount of wood filler. Gardner reports that many commercial deckboards are formulated with 60 to 65 percent wood flour. “Sometimes the wood content has been too high in certain products,” says Gardner. The AEWC staff was able to decrease water uptake in a wood-filled polypropylene Z-section sheet piling (sea wall) by limiting the wood content to 50 percent. The piling, which is 14 percent stiffer than comparable vinyl pilings, has been under development at the AEWC for six years and is currently in field testing.

Another proposed line of defense against microbial attack on WPCs might be to use alternate types of wood flour. Morrell says tests show that one type of fungi, white rot fungi, prefers hardwood, one of the most common sources of wood flour used in WPCs. An alternative is to use western red cedar, a softwood that is classified as highly decay-resistant. There also has been some research into adding biocides, such as zinc borate, into WPC formulations. While borates work well to control fungal growth, they are less effective against mold and mildew. Correct Building Products LLC (Biddeford, Maine) has added a moldicide to its CX line of decking.

Building a better WPC board

Ultimately, the only sure way to prevent mold and fungal growth and improve the overall performance of WPCs is to preempt water intrusion. Toward that end, a number of companies have introduced, or are introducing, WPC products with co-extruded layers, coatings or other novel features intended to co-opt the benefits of wood composite technology but do a better job of keeping out moisture and improving weatherability.

Two such products have been in the market for several years now: the CX line from GAF Decking Systems’ (formerly Correct Building Products LLC, Biddeford, Maine), and AZEK Building Products Inc.’s (Moosic, Pa.) Deck Harvest Collection decking system. The CX line deck board consists of a co-extruded polypropylene cap layer and a WPC core. The polypropylene cap fully encapsulates wood fibers on the top and sides of the boards. GAF’s VP and general manager Martin Grohman says the cap layer effectively addresses three of the key consumer concerns about WPC products: color fading, mold and mildew growth and staining. The cap layer is extruded with enhanced UV-protection and antimicrobial additives that could not be added economically to the entire board. The CX line is available in six colors, ranging from mahogany at the dark end to sage on the light side, and comes with a limited 25-year warranty.

Deck Harvest Collection materials are manufactured using AZEK’s proprietary Procell cellular PVC technology, which the company acquired in the 2007 purchase of Procell Decking Systems. The boards do not contain wood fiber. Instead, they are made with flax or other agricultural fiber, added at a ratio of less than 10 percent, according to AZEK’s public relations advisor Maureen Murray. She says that flax, unlike wood, is essentially nondegradable. The flax not only strengthens the boards, but mitigates the effects of thermal expansion and contraction. “A lot of WPC decking can have gaps between deckboards as wide as 0.25-inch [6.35 mm], which we compare to bad teeth and is not aesthetically pleasing,” says Murray. “Our decks can be built with boards as close as 0.0625-inch [1.6 mm].” AZEK also produces trim and porch planks, using the Procell process. The Deck Harvest Collection offers a choice of six colors and comes with a limited lifetime warranty. “We think cellular PVC decking is the strongest contender yet to meet the high expectation the consumer’s have for the durability of composite and plastic decking and other products,” Murray says.

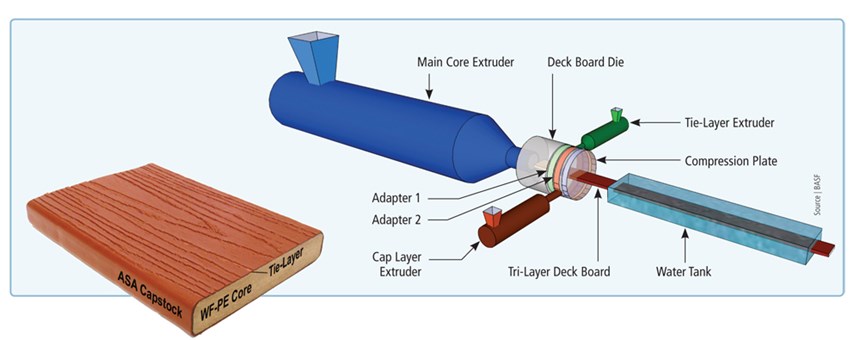

BASF Corporation - Building Systems (Wynadotte, Mich.) has partnered with Washington State University’s (Pullman, Wash.) Wood Materials Engineering Lab (WMEL) to develop a new, tri-extruded WPC deck board, with improved weatherability characteristics. BASF is working with a number of WPC manufacturers to commercialize the board, which consists of a WPC core made of HDPE and 48 to 68 percent pine wood flour, a tie layer of BASF’s Lurabond GA101, and a cap layer made of the company’s Luran S Q440 ASA polymer. Greg Anderson, BASF product technology manager, says the tri-extruded boards can be manufactured using a company’s existing extrusion equipment. The tri-extruded boards produced at Washington State were made using a main, 83-mm/3.3-inch twin-screw extruder to make the WPC core, and two smaller side extruders, a 25.4-mm/1-inch single-screw and a 35-mm/1.4-inch twin-screw, to extrude the tie and cap layers respectively. A die adaptor and compression plate were installed onto an existing deck board die to facilitate the co-extrusion of the tie-layer and cap.

“We were able to identify an interface material with extremely good adhesion to both the WPC core and the Luran capstock,” says Anderson. He says the tri-extrusion process is user-friendly and easy to monitor. “If the extruder were to run out of tie-layer material, the cap won’t stick to the core, so you’ll know immediately.” He claims the tri-ex board will offer a broader color palette, higher throughput and lower material cost, compared to cellular PVC boards.

A project involving Strandex Corp., Inhance Fluoro-Seal LLC (Houston, Texas), Composite Coatings Inc. (Sugar Grove, Ill.) and Washington State University’s WMEL has successfully proven the viability of painting WPCs, a feat once considered impossible. The project, begun about three years ago, used Inhance/Fluoro-Seal flouro-oxidation technology to pretreat and modify the surface of a WPC, making it polar enough to apply paint, ink or adhesive. WPC boards are fed through a chamber containing ambient air with a small amount of elemental fluorine gas. The fluorine strips the hydrogen off the backbone of the polymer, then oxygen quickly reacts with the carbon radicals to oxidize the surface, explains Kelly Williams, business development manager at Composite Coatings Inc., which specializes in applying coatings on a variety of synthetic materials. Because the pretreatment is permanent, the boards can be treated in one location and painted in another, although ideally pretreatment and painting would occur at the same facility. While the pretreated boards can be painted with any exterior-grade paint, Composite Coatings is offering a new, 100 percent solids, UV-curable coating engineered for exterior weathering durability. When the coating, trademarked InFin Advanced Coating Technology, is exposed to UV light, the polymer cures and crosslinks instantly, eliminating the need for drying systems, and it saves energy.

“There are two attributes to our coating that has builders and architects excited,” says Williams. “First, it is inherently repaintable, meaning scratches can be repainted, unlike with capstocked boards. Second, it is fully pigmentable, meaning a customer can paint a deck, rail or fence any color.” Williams says that the market for WPC product lines is often hindered because the customers find it difficult to find deck materials that match the color scheme on their homes. “If someone wants a Mediterranean pastel yellow deck with contrasting rails, we can offer it to them.”

The technology, both pretreatment and coating, is fully commercial and offered as a package. However, Lifetime Lumber (Carlsbad, Calif.) is currently using only the all-solids coating to paint its urethane-based composite boards (urethane does not need to be pretreated before it is painted). Williams says his company, in partnership with Inhance/Fluoro Seal, is looking at three business models for selling the technology: As a contracted, outsourced service (coated at the Composite Coatings plant), as a contracted in-house service (coated at the customer’s plant), and as a technology purchased and operated by the customer. Williams estimates the current outsourced cost (as a service) to pretreat and coat a WPC deck board at $0.25/ft² to $0.35/ft², which is an 8 to 15 percent increase over the cost of a typical WPC board selling in the $2/ft² range. Williams says, however, that most of that cost can be recouped by changing the WPC formulation and eliminating additives, such as pigments and biocides, which would be needed no longer. “The coating system we have is cost-competitive with capstock board, and can be even cheaper if the customers do it themselves.”

Elsewhere, research at UMaine’s AEWC has revealed the commercial potential of a foamed-styrene WPC. Professor Douglas Gardner says his staff began testing a styrene maleic anhydride polymer supplied by Nova Chemicals (Calgary, Alberta, Canada) to see if it would work as a WPC. The polymer had been used in the automotive industry for years. When wood flour was added to it in the extruder, it initiated foaming. “The finding was unexpected and extraordinary,” says Gardner, noting that hydroxyl groups on the wood react with maleic anhydride during the polymerization reaction to make water, which under heat, becomes steam that causes foaming. “We were able, with some formulation adjustments and technology, to control the reaction and create a foamed deck board,” says Gardner, who reports that the board is stiffer and lighter than a traditional polyolefin-based WPC board. He says that AEWC’s foamed styrene-wood deckboard technology is, to the best of his knowledge, unique. Gardner says the technology was close to commercialization when Nova Chemicals stopped making the polymer. “We’re still in the patent process, and trying to figure out the ramifications of Nova Chemicals’ withdrawal,” he says, pointing out, “There are other companies that make this polymer.”

The underlying force behind this flurry of commercial activity in the WPC industry is the quest for a more durable, higher quality product. It seems to be making considerable headway.

Related Content

Watch: A practical view of sustainability in composites product development

Markus Beer of Forward Engineering addresses definitions of sustainability, how to approach sustainability goals, the role of life cycle analysis (LCA) and social, environmental and governmental driving forces. Watch his “CW Tech Days: Sustainability” presentation.

Read MoreBio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreCirculinQ: Glass fiber, recycled plastic turn paving into climate solutions

Durable, modular paving system from recycled composite filters, collects, infiltrates stormwater to reduce flooding and recharge local aquifers.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreRead Next

Wood-Filled Composites Jump off the Deck

As the decking market matures, wood-filled thermoplastic producers target niche markets with enhanced products.

Read MoreComposites Do Wood One Better

Extruded wood-filled/thermoplastic composite materials experience explosive growth.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More