Riding the rollercoaster that is the aerospace industry

The Boeing’s 787 and the Airbus A350 XWB plunged the commercial aerospace supply chain into a period of instability from which it has only just emerged. The next generation of commercial aircraft production promises to be just as tumultuous.

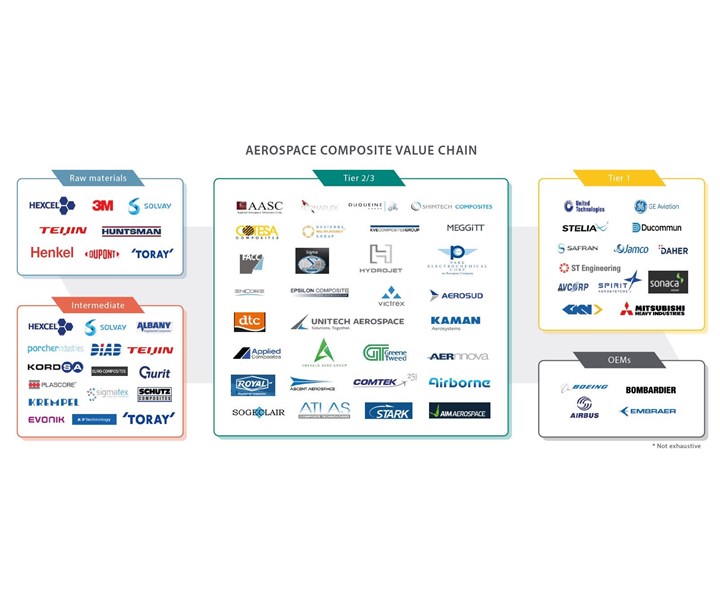

Source | FMG

Between 2010 and 2015, the supply chain for the commercial aerospace industry underwent a transformation that had profound impacts on the business models and profitability of OEMs and their tier suppliers. New models were launched, new technologies were harnessed — principally the extensive use of composites — and new ways of doing things were trialed.

Over this period, the build rates of the two major OEMs — Airbus (Toulouse, France) and Boeing (Chicago, Ill., U.S.) — increased at a compound annual growth rate (CAGR) of 7%. In order to cope, their suppliers had to make large capital investments in equipment and ramp-up production correspondingly.

In this business environment, the OEMs became more reliant on their Tier 1s. In the cases of the composites-intensive 787 Dreamliner and A350 XWB, Boeing and Airbus deemed a high degree of outsourcing necessary to get access to the most advanced composites technologies and to mitigate the risks associated with these projects. To reduce risks further, the OEMs also looked to keep their suppliers on a tight leash.

For the Dreamliner, Boeing came up with the idea of the risk-sharing partnership, which turned suppliers to the program into stakeholders. Through these partnerships, Boeing essentially asked its suppliers to soak up the research and development (R&D) investment for their work, and to wait until the plane wascertified and delivered to customers before they got paid.

These partnerships substantially reduced Boeing’s up-front investment and its exposure to delay risks, and incentivized Boeing's suppliers to keep the program running to budget and deadlines. For the suppliers, they make more money the more planes Boeing sells, and retain the intellectual property rights to their technologies — making it more difficult for Boeing to abandon them in future.

These developments led to growing revenues for OEMs and Tiers 1s, but their profitability was volatile.

The Dreamliner program ran significantly over time and over budget, suggesting that Boeing’s risk-sharing strategy did not work as intended. Lower tier companies and intermediate composite material providers, by contrast, were better able to resist supply chain pressures.

The situation has since stabilized and OEMs and tiers are now reporting higher levels of profitability. Indeed, across more than thirty OEMs and suppliers analyzed by Future Materials Group (FMG, Cambridge, U.K.), earnings before interest and taxes (EBIT) have increased by an average of 4%. Build rates have dropped slightly, but the CAGR of 4.4% predicted for the next 20 years remains healthy. There is growing confidence in composites and processes for their conversion into parts. Further, the high numbers of mergers and acquisitions (M&A) in the global aerospace industry point to overall health in the industry — in fact, the ratio of its enterprise value (EV) to its earnings before interest, taxes, depreciation & amortization (EBITDA) rose from 9.9x in 2015 to 14.2x in 2018.

Boeing and Airbus improved their EBIT by 4% and 3%, respectively, between 2013 and 2018, deploying a number of strategies to achieve this. Boeing’s Partnership for Success exerted a great deal of pressure on its supply chains to cut costs. The company entered into the stable and profitable maintenance, repair and overhaul (MRO) market, and have brought certain operations in-house through joint ventures (JVs) and acquisitions. In October 2018, for instance, Boeing entered into a JV with global seat manufacturer Adient Plc (Plymouth, Mich., U.S.) to form Adient Aerospace, and bought KLX Aerospace Solutions (Hialeah Gardens, Fla., U.S.), a supplier of aviation parts, services, composites and chemicals. Further, through the increasing use of digital technologies across their supply chains, both OEMs have achieved better transparency in terms of logistics and have improved the efficiency of their production processes.

The Tier 1s, meanwhile, have emerged from the transition in a wide variety of forms, and remain the preferred partners of the OEMs. They range from composites specialists to diversified metal and composite assemblers, and their annual revenues vary from around $132 million (Avcorp; Delta, British Columbia, Canada) to the $100 billion that will be generated by Raytheon Technologies Corp, which will be formed through the merger of Raytheon Co. (Waltham, Mass., U.S.) and United Technologies Corp. (Farmington, Conn., U.S.). The large Tier 1s are active in all aerospace segments, from defense to structural commercial aviation, interiors and aeroengines, while others, such as Premium Aerotec (Augsburg, Germany) or Sonaca (Gosselies, Belgium), focus primarily on single segments. Most of these Tier 1s have strategic relationships with a single OEM, but supply several as secondary partners.

Some Tier 1s have taken advantage of the change and have grown significantly through acquisitions. This strategy has increased their profits, given them a larger balance sheet and, through the exploitation of economies of scale, improved their ability to cope with the major capital investments (automation equipment, for example) that were required of them. These acquisitions also enhance their bargaining positions with OEMs; for example, post-merger, Raytheon Technologies Corp.’s turnover will be similar to that of Boeing’s. Some have expanded the scope of their responsibilities to include the qualification of processes and materials; for instance, Spirit AeroSystems (Wichita, Kan., U.S.) could be in charge of the process design and material qualification for Boeing’s new narrow-body fuselage. Many have also diversified their activities. In October 2018, for instance, engine manufacturer Safran (Paris, France) bought interiors Tier 1 Zodiac (Plaisir, France).

Other smaller, more specialized Tier 1s (such as Avcorp, Ducommun, Premium Aerotec) have had more of a difficult time, with significant variation in their annual profits. Premium Aerotec, for example, reported its lowest EBIT of –38% in 2013 and its maximum, of 3.5%, in 2015. This decreased again, to –10%, in 2017.

This period of relative stability may not last very long, however, as there are further changes on the horizon.

The Asian market will become increasingly important; Airbus forecasts that the continent will receive 42% of all passenger aircraft deliveries over the next 20 years. This could lead to the development of new OEMs there.

The established OEMs, meanwhile, are beginning to reveal glimpses of their plans for the future. At the 2019 Paris Air Show, for instance, Airbus launched the A321 XLR — currently the longest-range single-aisle plane available — which may eat into potential market for Boeing's yet-to-be-confirmed New Midsize Airplane (NMA).

For its part, Boeing received a big order for its 737 MAX at the Paris Air Show from International Airlines Group, which had previously been an exclusive Airbus single-aisle operator. Even so, the 737 MAX is yet to re-enter service after being grounded over safety concerns in March 2019. Further, the 737 is an older platform than the A320, and cannot be modified to create an equivalent to the A321 XLR. Will this put pressure on Boeing to accelerate plans for its replacement?

Regardless, any new narrow-body platforms will be built from a mix of metals and composites, with the latter's share increasing as production technologies have matured. It seems highly likely that these platforms will feature CFRP wings and fuselages, which will have a profound impact on the demand for carbon fiber and the composites supply chain as a whole. It also seems likely that the use of thermoplastic composites will increase significantly as well, given the level of investment in this technology made by suppliers of composites to the aerospace industry.

These changes will create new opportunities, but also new risks. The supply chain will have to adapt accordingly.

Related Content

Reducing accidental separator inclusion in prepreg layup

ST Engineering MRAS discusses the importance of addressing human factors to reduce separator inclusion in bonded structures.

Read MoreHow AI is improving composites operations and factory sustainability

Workforce pain points and various logistical challenges are putting operations resilience and flexibility to the test, but Industry 4.0 advancements could be the key to composites manufacturers’ transformation.

Read MoreComposites opportunities in eVTOLs

As eVTOL OEMs seek to advance program certification, production scale-up and lightweighting, AAM’s penetration into the composites market is moving on an upward trajectory.

Read MoreThe evolution, transformation of DEA from lab measurements to industrial optimization

Over the years, dielectric analysis (DEA) has evolved from a lab measurement technique to a technology that improves efficiency and quality in composites production on the shop floor.

Read MoreRead Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More