Supply and demand: Advanced fibers

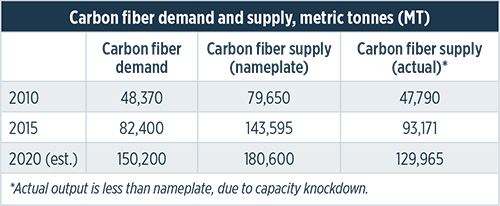

Demand for advanced fiber, virgin and reclaimed, is on an upswing after a dip during the recent recession. Fiber suppliers are gearing up to meet an expected increase in demand as manufacturers in a number of composites end-markets scale up or start up part development and production programs

Historically, markets for carbon fiber have gone through boom/bust cycles, making it difficult for fiber manufacturers to predict capacity needs. During the recent and deep recession which some say has not yet really ended, carbon fiber demand dipped, as economies in the US and the European Union slowed significantly, but recovery and growth have been the norm since. Fiber demand is now up and continuing to rise. Carbon fiber producers are avidly looking for signals from a variety of end-markets about when and where growth will occur.

Military aircraft applications — at one time, the groundbreaking arena for carbon fiber use in composites — have become a niche application, greatly overshadowed by civilian implementation. Not surprisingly, the wider aerospace market, particularly in the commercial air carrier realm, remains a fixed value in this equation. But the still great impact of aerospace has steadily eroded as applications collectively referred to as “industrial” have flourished and, as a result, contributed to a rapid rise in overall market demand for carbon fiber.

That said, future industrial sector sizes and their relative values have often defied efforts to pin them down. Are automotive carbon composites, finally, about to take off? Will carbon fiber find greater use in the wind energy sector, as turbine manufacturers seek to lightweight ever-longer rotor blades? Is the oil and gas industry on the cusp of expansion? Is there a low-cost, non-PAN precursor on the horizon? These questions have dogged panelists at a variety of trade events and teased out a variety of answers that for some time, fell short of consensus.

What seemed certain as 2015 closed out is that automotive and fast-growing energy and industrial segments are competing for fiber. As a result, the current market for carbon fiber is strong and it appears that the demand is established. Every carbon fiber producer is currently expanding fiber production, and many are moving to produce both high-end, small-tow as well as industrial large-tow fibers as new fiber manufacturers come into view.

Market overview

At CompositesWorld’s recent Carbon Fiber conference (Knoxville, TN, US) in December 2015, market researcher Chris Red, principal at Composites Forecasts and Consulting LLC (Mesa, AZ, US), offered some hard numbers culled from recent research, considering the carbon fiber industry in three sectors: aerospace, consumer/recreational and industrial (which includes automotive and energy). As has been the case for several years now, he said, the vast majority (75%) of the world’s carbon fiber is consumed by the industrial sector and, going forward, this is where most carbon fiber growth will occur. Although aerospace remains an important sector, with the Boeing 787, the Airbus A350 XWB and the F-35 Lightning II in production, and with the 777X wing program near production, there is no large aerocomposites program on the horizon to spur substantial carbon fiber manufacturing expansion. The next major programs — beyond the horizon — are replacements for the Airbus A320 and the Boeing 737. These are expected in the 2025-2030 timeframe and although it is likely their wings will be carbon fiber composites, it remains to be seen whether carbon fiber will be chosen for the fuselages. The question, says Red, is whether or not, in 10 years, composite fuselage fabrication processes will be sufficiently fast enough to meet single-aisle aircraft program throughput requirements. Also unknown is if a single-aisle aircraft fuselage made with carbon fiber can efficiently withstand the runway rash and other impacts that a smaller (compared to the 787 and A350 XWB) plane must endure.

Red predicts that the automotive market is poised to become the carbon fiber juggernaut for which composites industry proponents have long hoped. Consensus at the conference was that automotive OEMs will likely take a material-agnostic, all-of-the-above approach to vehicle development, employing a mix of steel, aluminum and composites, applied as mechanical requirements demand and as cost allows.

Additionally, pressure vessels for storage and transport of compressed and liquefied natural gas in automotive and fleet applications is expected to drive substantial carbon fiber growth, particularly in Asia, South America and parts of Europe.

Although carbon fiber in forecast to grow steadily in the wind energy sector (8% CAGR), that rate will run slightly lower than the average for the entire carbon fiber industry (10.2% CAGR). This could change, however, given that the US Congress, on Dec. 16, passed a new budget plan that includes renewal of the renewable energy production tax credit (PTC) for five years. This unprecedented window of PTC stability might spur a new and substantial wave of wind turbine installations in the US, particularly at a time when offshore wind farms are, after protracted legal battles, showing signs that they will now pass from potential to practical realities.

Looking ahead, Red’s figures indicate that, in about 2020, carbon fiber demand will exceed supply. This likely will spur some level of carbon fiber manufacturing expansion in the 2018-2019 timeframe.

Supplier focus

The largest fiber producer, Toray Industries Inc. (Tokyo, Japan), has a multi-year contract in place with The Boeing Co. (Seattle, WA, US) to supply carbon fiber/epoxy prepregs for the 787 Dreamliner program, and a contract expansion was recently announced, under which the company also will supply carbon prepregs to Boeing for its 777X program. Total value of the combined supply agreement reportedly exceeds ¥1 trillion (US$8.3 billion).

Toray believes that carbon fiber demand is growing at a rate of 15% per year. Accordingly, it has expanded all of its production facilities, in Japan, the US, France and South Korea, over the past two years. Toray’s total nameplate capacity is expected to reach 27,100 MT by mid-2015. That expansion includes an announced US$1 billion investment in a new carbon fiber plant in Moore, SC, US, that will provide additional fiber capacity targeted to aerospace and automotive applications. To facilitate the latter, Toray announced in late 2013 that it had purchased Zoltek Corporation (St. Louis, MO, US), making Zoltek a wholly owned subsidiary. The acquisition provides Toray a means to produce and market industrial-grade large-tow fiber in addition to its aerospace-grade small-tow fiber. The fiber giant also is expanding into automotive part production, having purchased a stake in carbon composite automotive part producer Plasan Carbon Composites (Wixom, MI, US) in mid-2013. At about the same time, Toray also acquired Dome Carbon Magic Co. Ltd. (Maibara-shi, Japan) and a 75% interest in that company’s Dome Composites (Thailand) production division in Sriracha, Thailand. Under the names Toray Carbon Magic Co. Ltd. and Carbon Magic (Thailand) the two locations will produce carbon fiber-reinforced composite automotive parts to meet increased demand in Japan and Thailand.

SGL Carbon SE (Wiesbaden, Germany), by contrast, is expanding its presence in the aerospace market after scoring an unprecedented success with carbon fiber in the automotive sector through its partnership with automaker BMW Group (Munich, Germany) in a joint venture dubbed SGL Automotive Carbon Fibers (SGL ACF). Formed in 2009 to produce industrial-grade carbon fiber exclusively for BMW’s plug-in electric and hybrid-electric models, the i3 and i8, and, now, for BMW 7-Series cars, built a production plant in record time in Moses Lake, WA, US, an area served by hydroelectrically-produced power. In the short time since the plant began production in mid-2011, two expansions have already taken place. Production capacity, for the 6 lines at the facility, is currently 9,000 MT.

Wiesbaden-based SGL Carbon opened an aerospace-grade carbon fiber pilot plant at the company’s central research facility in Meitingen, Germany, in mid-2011. SGL then acquired a majority stake in Portuguese acrylic manufacturer FISIPE SA in mid-2012, expanding its European production network for precursor. In addition to its partnership with BMW, SGL also produces carbon fiber in Germany and Scotland, and owns the Carbon Fiber Technology production facility in Evanston, WY, US.

Hexcel (Stamford, CT, US) announced in late 2014 that it will build new precursor and carbon fiber lines at a site in Roussillon, France, to supplement its fiber production in Spain and Salt Lake City, UT, US, and existing precursor lines in Decatur, AL, US. The announced expansions will bring the company’s total capacity to approximately 9,500 MT when online; current production is approximately 7,300 MT.

Mitsubishi Rayon Co. Ltd. (Tokyo, Japan) announced in June 2014 a doubling of capacity at its former Grafil Inc. carbon fiber plant in Sacramento, CA, US, now part of Mitsubishi Rayon Carbon Fiber and Composites Inc. (Irvine, CA, US). Nameplate production in Sacramento will be 4,000 MT per year by mid-2016, and will supplement expanded production at Mitsubishi’s plant in Otake, Japan, which came online in 2011. The Otake facility produces PAN-based 60K Pyrofil P330 fibers for industrial applications. Mitsubishi also supplies the PAN precursor for SGL ACF’s Moses Lake fiber facility. Consistent with the activities of other fiber producers, Mitsubishi Rayon in July 2014 acquired a 51% stake in Wethje Holding GmbH (Hengersberg, Germany), a producer of carbon fiber-reinforced polymer (CFRP) automotive parts.

Toho Tenax Europe GmbH (Wuppertal, Germany) has a capacity of approximately 11,500 MT at the end of 2015, although announcements of an expansion may be on the horizon.

Cytec Carbon Fibers LLC, formertly Cytec Industries Inc. (West Paterson, NJ, US), completed in 2014 a new US plant that now yields small-tow (3K-24K) fiber.

Taipei, Taiwan-based Formosa Plastics Corporation also has been expanding over the past several years, with nameplate production now at 8,750 MT. In 2014, Formosa Plastics introduced a new fiber, TC55, with a reported tensile strength of 4,413 MPa and tensile modulus of 379 GPa.

Newer players are also enjoying success. Since its inception less than a decade ago, and first acrylic precursor-based commercial carbon fiber line startup in 2010, AKSACA Carbon Fibers (Istanbul, Turkey) with a current capacity of approximately 3,600 MT of fiber per year on two lines in Turkey is aggressively pursuing carbon opportunities in many sectors, including wind, infrastructure and automotive. After forming a strategic partnership with the Dow Chemical Co. (Midland, MI, US) in 2012, called DowAksa USA, the new joint entity is developing a broad range of products for automotive in particular, and has a development agreement with Ford Motor Co. In late 2014, the company hosted an event in Atlanta, GA, US to announce its intention to build a US-based carbon fiber plant within the next several years. This follows an earlier announcement in 2013 that DowAksa Ileri Kompozit Malzemeler Ltd. Sti will build a fiber plant in Russia, with US$1 billion quoted as the investment amount for the Russian and US-based facilities combined. DowAksa says it intends to capture a significant piece of the industrial carbon fiber market.

Hyosung Corp. (Gyeonggido, South Korea) began fiber production in mid-2013, and is on course to manufacture 8,000 MT by 2020, estimates one carbon fiber market expert. Its “high-strength” Tansome industrial-grade fiber product achieves a tensile modulus of 5.5 GPa and a tensile modulus of 290 GPa.

In mid-2011, SABIC (Riyadh, Saudi Arabia) announced that it had signed a technology agreement with acrylic manufacturer Montefibre SpA (Milan, Italy), granting SABIC and its affiliates an extensive international license on carbon fiber technology developed by Montefibre. However, SABIC has since exited the fiber market.

Other market entrants include Dalian Xingke Carbon Fiber Co. Ltd. (Dalian City, China) and Yingyou Group Corp. (Lianyungang, China), and at least three other China-based entities, in Shandong, Zhejiang and Guangxi provinces, are reported to be developing carbon fiber production. Kemrock Industries & Exports Ltd. (Vadodara, India) began fiber production several years ago, with a current plant capacity of approximately 2,500 MT. Russia’s Composite Holding Co. together with state-owned Rosatom produces fiber under the company name Alabuga Fibre LLC in the Republic of Tatarstan. Estimated plant capacity is 1,700 MT.

Demand for other advanced fibers is increasing as well. Continued security concerns have stimulated growth in the armor market, prompting increased production of aramid and polyethylene fibers. DuPont Protection Technologies (Richmond, VA, US) increased production of its DuPont Kevlar aramid fiber by more than 25%, with a US$500 million capacity expansion — reportedly the largest expansion in Kevlar history. Competitor TEIJIN ARAMID BV (Arnhem, The Netherlands), now produces four brands of aramid fiber — Twaron, Technora, Sulfron and Teijinconex. It also expanded its Twaron capacity by 15-20% from its base of 23,000 MT per year in Emmen and Delfzijl, in The Netherlands.

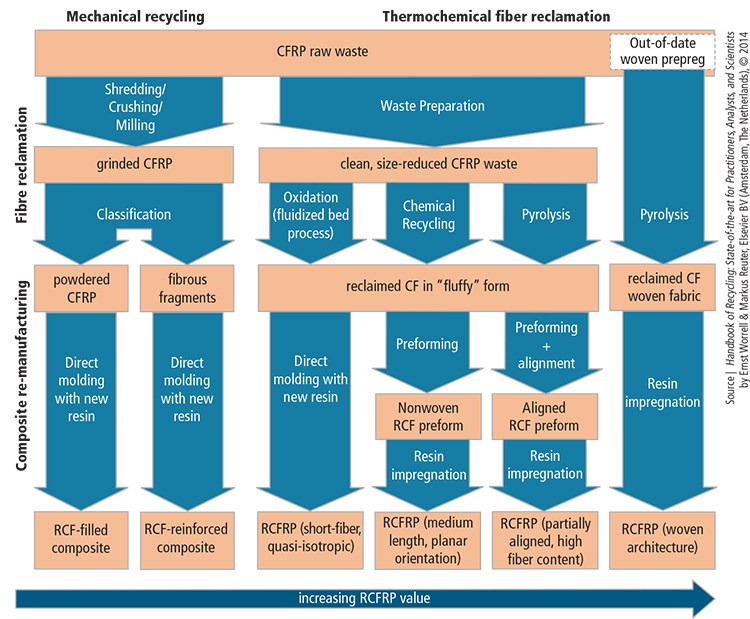

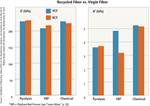

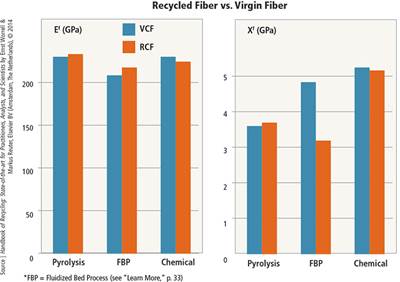

A growing trend is advanced fiber recycling, particularly in the case of carbon fiber. Its high value translates to a potentially significant demand for reclaimed fibers, especially for recovered high-strength, high-modulus aerospace-grade fibers, which retain good properties even when chopped. A number of firms — chief among them Carbon Conversions Inc. (formerly MIT-RCF, Lake City, SC, US), Adherent Technologies Inc. (Albuquerque, NM, US) and ELG Carbon Fibre Ltd. (Coseley, Dudley, UK) — are advancing technologies to reclaim fiber that can be reintroduced into the value chain as short, chopped fiber for use in thermoplastic composites, or longer fibers formed into mat products. One Boeing researcher has reported that recovered aerospace short fibers exceed the mechanical properties of virgin chopped industrial fibers, making them attractive for reuse. Airbus is also actively investigating uses for recycled carbon from its aerospace manufacturing.

Read more about recycled carbon fiber and its potential (and many say, absolutely necessary and pivotal) place in the composite materials supply chain by clicking on the following CompositesWorld feature articles:

“Recycled carbon fiber update: Closing the CFRP lifecycle loop.”

“Recycled carbon fiber update: The supply side.”

“Recycled carbon fiber: Comparing cost and properties.”

Related Content

Composites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreHonda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreECOHYDRO project to enable recyclable composites for hydrogen storage

With the involvement of two schools from the Institut Mines-Télécom, the 4-year project aims to improve the intrinsic properties of a composite material based on Elium via four concrete demonstrators.

Read MoreComposites end markets: Pressure vessels (2024)

The market for pressure vessels used to store zero-emission fuels is rapidly growing, with ongoing developments and commercialization of Type 3, 4 and 5 tanks.

Read MoreRead Next

Recycled carbon fiber update: Closing the CFRP lifecycle loop

Commercial production of recycled carbon fiber currently outpaces applications for it, but materials characterization and new technology demonstrations promise to close the gap.

Read MoreRecycled carbon fiber: Comparing cost and properties

Alex Edge, sales and business development manager for recycler ELG Carbon Fibre (Coseley, U.K.), says his company’s recycled carbon fiber (RCF) products can offer from 30 to 40 percent cost savings vs. virgin carbon fiber (VCF). Tim Rademacker, a managing director at competitor CFK Valley Recycling (Stade, Germany) cites savings of 20 to 30 percent.

Read More