The next-generation single-aisle: Implications for the composites industry

While the world continues to wait for new single-aisle program announcements from Airbus and Boeing, it’s clear composites will play a role in their fabrication. But in what ways, and what capacity?

Airbus A320 hangar. Source | Airbus

In a 2007 interview with Design News, Dr. Alan Miller, at the time the director of technology integration for the Boeing 787 program, commented on the challenges the aerospace industry faced in composites adoption. “We have had no applications [before the Dreamliner] with high volumes. The composites industry has never had to deal with this before. That was a mountain we had to climb.”

The 787 was a step-change in composites use for commercial aircraft. The aerostructure design, which was about 50% composite, surpassed any other large commercial aircraft at the time. As a result, the 787’s production required significant investment in carbon fiber and part manufacturing capabilities. It also paved the way for greater adoption in new programs, such as the 777X, A350 and A220.

Despite widespread adoption of composites, the two most widely produced aircraft in the industry, the Airbus A320 and Boeing 737 families, contain comparatively little composites. The 737 MAX, the latest iteration of the Boeing 737 that first entered service in 1968, contains only about 10% composites in the aerostructure. The A320 contains about 15%. Together, these aircraft account for nearly 60% of available seat miles flown globally. Incorporating more composites into their design remains a massive opportunity for the aerospace and composites industries, but also a considerable challenge compared to today’s twin-aisle programs (such as the 787 or A350) or the smaller A220 single-aisle program, which contains 46% composites.

At Counterpoint Market Intelligence (Cambridgeshire, U.K.), we believe the next new aircraft programs from Boeing and Airbus will be single-aisle aircraft. Those programs will almost certainly feature more composites than the current generation. And while twin-aisle aircraft are typically produced at rates of 5-15 per month, a new single-aisle design will require processes capable of reaching up to 100 aircraft per month. Such a shift has the potential to be yet another step-change for both the aerospace and composites industries — all of which has implications on the design of the aircraft, the timing of its introduction and the technology required. It appears the composites industry has another hill to climb.

Design: Worth the weight

Many conversations around composites versus metallics focus on weight savings; the lightweight properties are seen as the main driver of fuel savings for the aircraft. The true benefit of composites, however, is more nuanced. Composites can often enable greater design freedom and aerodynamic benefits, which outpace weight savings alone.

Figure 1. The 787 features a longer, thinner wing than the 767. Source | Counterpoint Market Intelligence

Fig. 1 illustrates a 767-300 in blue, a mostly metallic design that entered service in the 1980s. Overlaid in gray is a 787-8, which has a roughly similar length and seating capacity. Notably, the 787 wing extends significantly longer than the older 767 design. If we examined the cross-sectional thickness of the wing, we would find the 787 to be about 10% thinner on average. That longer, thinner wing reduces drag on the aircraft, resulting in a more aerodynamically efficient design.

Composites enable this design through their combination of strength, stiffness and lightweight characteristics. Combined with improved engines, this design provides the 787 with a much lower fuel burn per seat kilometer. The 787, in fact, has a 30% heavier empty weight (excluding engines) than the 767. Yet despite the weight, it can still achieve substantial fuel savings and nearly twice the range due to its more efficient geometry.

The 777X adopted a similar strategy with its composite wing, extending the span of the wing from 64.8 meters for the 777-300ER to 71.8 meters for the 777-9. According to Boeing, this results in about a 10% reduction in fuel burn. The longer wings are so effective, that the design can justify folding wingtips to ensure the aircraft stays within the same aerodrome code as existing 777 aircraft and can access existing airport gates.

Some high-level calculations can provide insight into the trade-offs for these programs (Fig. 2). If we consider an Airbus A321neo, which has a 20% lower wing weight due to composite materials but the same geometry as current designs, our calculations estimate a 1.5-2% decrease in fuel burn for a typical mission. Suppose instead, we replace the wing with an all-composite design that weighs the same as the metallic wing, but has a longer span and thinner cross-section. If such a wing were to raise the average cruise lift-to-drag ratio from 18 to 19, we estimate this would equate to a 5-7% decrease in fuel burn despite offering no weight savings. These aerodynamic improvements have a greater impact than the weight savings, but they can only be achieved by a shift to composites.

As a result, we at Counterpoint believe that the next generation of single-aisle aircraft will almost certainly have a composite wing. The potential fuel savings are far too great to consider a metallic structure.

Figure 2. Indicative fuel burn improvements. Aerodynamic changes using composies can have a greater impact than weight savings alone. Source | Counterpoint Market Intelligence

For the fuselage, however, the trade-off is not as clear. The fuselage itself does not have any aerodynamic benefits like the wing. Composites tend to have greater benefits on widebody aircraft where the fuselage walls are comparatively thicker. The more frequent takeoff and landing cycles of narrowbody aircraft often necessitate extra material, which reduces the benefit of switching to composites. We estimate that a 20% reduction in fuselage weight using composites would result in a 1.5% drop in fuel consumption. With the impact of climate change, every drop of fuel savings certainly matters. But the use of composites in the fuselage has other drawbacks, both in cost and manufacturability. Whether or not the OEMs choose a composite fuselage likely comes down to two interlinked factors: timing and technology.

Timing: When tomorrow becomes today

Perhaps the greatest unknown for the next-generation single-aisle is its arrival date. Boeing’s 737 MAX program entered into service in 2017. Airbus’s A320neo has been in service since 2016 and the A321XLR variant is forecast to be delivered later this year.

The A321neo (along with the LR and XLR variants) has been an issue for Boeing for several years; the aircraft satisfies a key need in terms of range, capacity and economics for many airlines. Despite Boeing’s attempts to compete using the MAX, the Airbus models outperform in terms of range. At the end of March 2024, Airbus had a backlog of 7,177 A320 family aircraft, 4,947 of those being A321. The entire Boeing 737 family, by way of comparison, had 4,828 aircraft in backlog.

Prior to the pandemic, Boeing’s solution to Airbus’ challenge was the “new midsize airplane” (NMA), sometimes referred to as the middle-of-the-market aircraft or 797. That aircraft was understood to be a small twin-aisle, but the program was ultimately shelved following the pandemic and challenges with the 737 MAX. For Boeing, a new single-aisle offers an opportunity to better compete with Airbus’ offerings — particularly the A321XLR. As the 737 is based on a design originating from the 1960s, a clean-sheet approach could offer significant improvements, even compared to the latest models.

However, in November 2022, Boeing CEO David Calhoun stated that he did not expect a new program until the mid-2030s, stating “I don’t think we are even going to get to the drawing board this decade.” For a 2035 entry into service, industry would expect a new program announcement around 2028, giving about four years until the start of the next program.

Moreover, in March this year, Calhoun announced he will be stepping down at the end of 2024 along with the chair of the board of directors. While there’s no guarantee of a shift in strategy, it is possible that Boeing could re-evaluate its product decisions and move forward plans for a new aircraft by a few years. And although Boeing may not have immediate plans for a new program, we understand that R&D programs continue to ensure the company is prepared.

For Airbus, industry commentary has traditionally stated that Airbus is likely to wait for Boeing to announce a decision before announcing one of its own. More recently, however, we believe Airbus’ decision is increasingly decoupled from Boeing, and it is likely to move forward with its own agenda. For instance, the company has been invested for almost a decade in its Wing of Tomorrow (WOT) program. These developments could translate into a rewinged A320neo family of aircraft, which we believe would be a likely response to any new single-aisle program from Boeing.

The aerospace supply base appears eager for a next-generation aircraft. The industry itself has faced low profitability for several years, and new programs create an opportunity for differentiation and growth. Beyond the economics, many suppliers have underutilized engineering talent, and a new program can help reinvigorate its workforce.

Technology: Scaling up

At its peak in 2019, Boeing 787 production reached 14 per month. Airbus is planning to raise A350 rates 12 per month in 2028. For the A320 family, however, the rates are much higher. Airbus has announced plans to increase production of the A320neo family of aircraft to 75 per month by 2026.

Such high production rates present many challenges for composites. 787 aerostructures are made using automated tape layup (ATL) of carbon fiber prepreg, which requires an autoclave. The cure time for the 787 center wing box, for example, is 8-9 hours. At a very high production rate, those parts would require a very large capital outlay for autoclaves, plus the factory space to support that much work-in-progress material.

Out-of-autoclave (OOA) solutions exist, and this forms much of the research behind WOT and similar programs. There are few examples, however, at the scale of this aircraft and its rate of production. The A220, which is smaller than the A320, features an all-composite wing that relies on resin infusion. Although the original intention of the program was to produce the wing without an autoclave, an autoclave is still required for final curing due to imperfections with the infusion process. We anticipate that, for these aircraft to be produced economically, OOA processes would be necessary for the wing.

For the fuselage, technology development remains active. As part of Clean Sky 2/Clean Aviation, the EU currently has the MultiFunctional Fuselage Demonstrator (MFFD) program, which showcases several novel thermoplastic composite technologies. A composite fuselage is also featured in the HondaJet HA-380 Echelon — which aims for certification in 2028 — that enables the aircraft to fly at higher altitudes and burn less fuel. Notably, this design features thermoplastics, with Spirit AeroSystems and GKN Aerospace helping to pioneer many of the processes used for that aircraft. If this program proves successful — both from a quality and production economics standpoint — this could bolster further confidence in the use of thermoplastic composite aerostructures.

The further into the future Airbus and Boeing push these new programs, the more likely we believe thermoplastic composites — including a fuselage — are to be included in the design of this aircraft. If Boeing announces plans for an aircraft in the first half of the 2030s, we believe it will most likely have a composite wing and aluminum fuselage. Alternately, if this happens toward the end of next decade, it is more likely to feature a composite fuselage and thermoplastic technology.

The next mountain to climb

Figure 3. Annual carbon fiber demand. A composite single-aisle could be one of the largest drivers of carbon fiber demand in the aerospace industry. Source | Counterpart Market Intelligence

For the composites industry, the implications of two large-scale single-aisle programs could be significant (Fig. 3). Assuming two fully ramped-up composite-wing single-aisle programs delivering 100 aircraft each per month (or 200 in total), we estimate demand for more than 10,000 metric tonnes of carbon fiber per year. With the fuselage included, this rises to more than 13,000 metric tonnes. This represents more than 90% of current aerospace carbon fiber demand by volume and nearly 10% of the 130,000+ metric tonnes of carbon fiber consumed across all segments each year. However, the dollar value of this increase in carbon fiber would be much higher than the 10% because the carbon fiber consumed by aerospace represents a significantly higher portion of the overall value of the carbon fiber industry.

To give a sense of scale within aerospace, however, our most optimistic urban air mobility (UAM) forecast of 10,000 units per year predicts only 4,000 metric tonnes of carbon fiber required for the entire industry. So, while UAM has been hyped up as the next frontier for composites in aerospace, our analysis suggests that the next single-aisle program will have a far greater impact on the composites industry.

Beyond meeting the materials production requirements, the greatest challenge for the industry will be achieving quality and consistent production rates at a viable cost for composite parts. Despite advancements in automation, much of today’s aerostructures activity remains labor-intensive. Composites, in particular, require skilled labor. To meet the rate challenges presented by these aircraft, aerospace composite technology must evolve from a craft industry to one predominated by more automated and high-rate processes.

Achieving this adoption of composites in the next airframes requires new technology, an advanced supply chain and leadership from the OEMs. This next mountain to climb in aerospace composites is not just about a ramp-up — it’s an opportunity to redefine the boundaries of aerospace and composites production technology.

About the Authors

Collin Heller

Collin is vice president of Counterpoint Market Intelligence (Cambridgeshire, U.K.) where he provides market intelligence on aerospace supply chains. Prior to Counterpoint, Heller worked as a strategy consultant in the aviation, aerospace and raw materials industries. He has supported several M&A transactions within the composites industry.

Richard Apps

Richard co-founded Counterpoint Market Intelligence in 2004 as a source of rigorous analysis for the aerospace and defense industry. Prior to this, Apps worked at GKN on strategic planning, business development and the evaluation of acquisitions. He also managed GKN’s industrial offset commitments in Kuwait and prior to that he was the group strategic planning manager for Westland Group. He managed R&D projects at BICC (now Balfour Beatty) and was a production controller at Marconi Avionics (now part of BAE Systems).

Related Content

Reducing accidental separator inclusion in prepreg layup

ST Engineering MRAS discusses the importance of addressing human factors to reduce separator inclusion in bonded structures.

Read MoreThe evolution, transformation of DEA from lab measurements to industrial optimization

Over the years, dielectric analysis (DEA) has evolved from a lab measurement technique to a technology that improves efficiency and quality in composites production on the shop floor.

Read MoreComposites opportunities in eVTOLs

As eVTOL OEMs seek to advance program certification, production scale-up and lightweighting, AAM’s penetration into the composites market is moving on an upward trajectory.

Read MoreHow AI is improving composites operations and factory sustainability

Workforce pain points and various logistical challenges are putting operations resilience and flexibility to the test, but Industry 4.0 advancements could be the key to composites manufacturers’ transformation.

Read MoreRead Next

Large, high-volume, infused composite structures on the aerospace horizon

Infused carbon fiber composite structures are not new, but they have never been built at the rates anticipated for next-generation, single-aisle aircraft. It is a daunting prospect — but a feasible one.

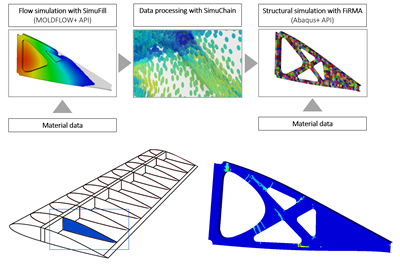

Read MoreImproving carbon fiber SMC simulation for aerospace parts

Simutence and Engenuity demonstrate a virtual process chain enabling evaluation of process-induced fiber orientations for improved structural simulation and failure load prediction of a composite wing rib.

Read MoreComposites end markets: Aerospace (2023)

With COVID in the past and passengers flying again, commercial aircraft production is ramping up. The aerocomposites supply chain is busy developing new M&P for an approaching next-generation aircraft program.

Read More