This is going to be big: Automotive composites forecast

A company by the name of Global Market Insights Inc. contacted me recently, alerting me to the presence of a new forecast report for automotive composites.

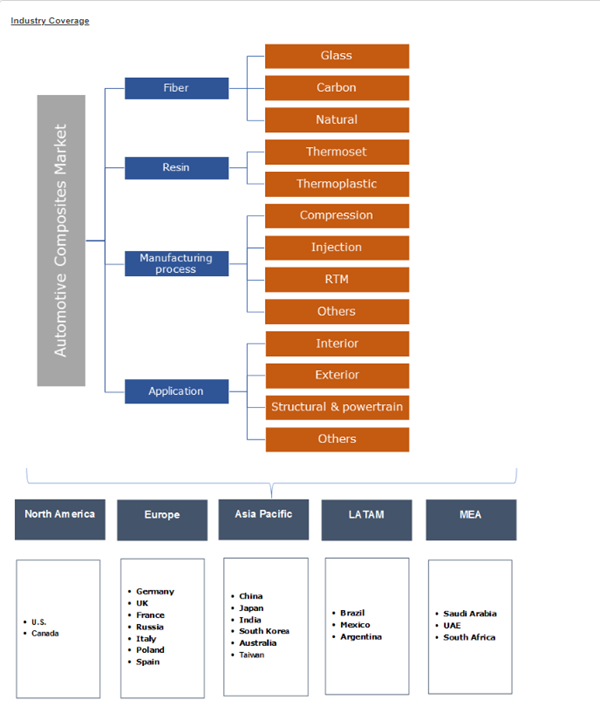

A company by the name of Global Market Insights Inc. (Selbyville, DE, US) contacted me recently, alerting me to the presence of a new forecast report for automotive composites. Their report, with the lengthy title “Automotive Composites Market Industry Size By Fiber (Glass, Carbon, Natural), By Resin (Thermoset, Thermoplastic), By Manufacturing Process (Compression, Injection, Resin Transfer Moulding (RTM)), By Application (Interior, Exterior, Structural) Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Russia, Italy, Poland, Spain, China, India, Japan, South Korea, Australia, Taiwan, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa), Growth Potential, Price Trends, Competitive Market Share & Forecast, 2017 – 2024” dated January 15, 2018, forecasts that the market for automotive composites will surpass $24 billion USD by the year 2024.

According to the report’s authors team lead, Amulya Agarwal, an engineer with experience in chemicals and materials, the global automotive composites market demand is expected to top 4,000,000 tons by 2024, driven by continuously growing efforts by vehicle manufacturers across the globe to reduce overall vehicle weight. Of course, the big conundrum is that while composites can reduce carbon emissions by improving fuel efficiency through lower vehicle weight, the cost question, lagging design tools process integration are holding back industry growth.

That said, the report points out that the majority of auto OEMs in Europe and North America have carried out extensive vehicle weight reduction plans, owing to stringent environmental regulations. Moreover, US National Highway Traffic Safety Administration (NHTSA), in association with the Environmental Protection Agency (EPA) has launched a national program for significant reduction in carbon emissions and improvement of fuel efficiency of heavy-duty, commercial vehicles. These regulations are expected to induce significant growth in the automotive composites market size.

Rising usage of carbon fibers as reinforcement for plastic matrices is also gaining momentum in the automotive composites market. Carbon composites possess higher stiffness and more potential for weight reduction as compared to its glass or natural fiber parts. Industry participants are focusing on developing low-cost carbon fiber composites through recycling strategies, creating opportunities for automotive composite growth over the next eight years (here’s just one example: https://www.compositesworld.com/news/elg-carbon-fibre-and-sanko-gosei-formalize-partnership). Hybrid composites structures developed by combining of glass and carbon fiber is another innovation that has gained popularity in the automobile industry. Shifting preference towards these hybrid composites can be attributed to benefits such as higher compressive strength coupled with lower cost.

The fiberglass automotive composites market accounted for over $9 billion USD in 2016, says the report, and is anticipated to continue its dominance over the forecast timeframe. The substantial revenue generation is attributed to its advantages including part consolidation and resistance to heat and chemicals. Natural fibers will show over 7.5% CAGR from 2017 to 2024 say the authors owing to their high usage in interior vehicle applications and some semi-structural parts. This shifting preference is attributable to lightweighting capabilities, lower cost and recyclability as compared to counterpart materials.

Thermoset resins are expected to generate a demand of over 2,500,000 million tons and capture over 55% of the automotive composites market revenue share through 2024, thanks to established properties and ease of manufacturing. Thermoplastic resins are likely to witness over 6.5% CAGR owing to their rising adoption due to reforming abilities and higher impact resistance as compared to thermosets.

In terms of processes, the report forecasts that compression molding is expected to dominate the revenue share, surpassing $9 billion USD over the next eight years. Resin transfer molding (RTM) is likely to exhibit around 7% CAGR till 2024 owing to regular innovations in this process over the past years. Moreover, it is increasingly being used by the manufacturers to create low cost products, further propelling industry growth. Automotive composites in structural and powertrain application will exhibit around 7% CAGR owing to high usage of glass and carbon fibers in structural components.

The report predicts that Asia-Pacific automotive composites is expected to capture over 45% revenue share through 2024. The presence of numerous vehicle manufacturers across the regions coupled with continuously rising vehicle production, especially in emerging countries including India and China, will primarily support anticipated growth. Europe will grow around 6% CAGR owing to extensive usage of composites due to stringent regulations regarding carbon emissions from vehicles. Rising R&D investments along with established automobile industry will further propel the regional growth over the forecast timeframe.

To read the report excerpts, or to order a copy, the group’s web site can be accessed here: https://www.gminsights.com/pressrelease/automotive-composites-market.

Related Content

Composite wrap system combats corrosion in industrial tank repair

A fiberglass and carbon fiber composite wrap system enabled an Australian nickel mine to quickly repair a stainless steel ammonium sulphate feed tank and protect against future corrosion.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRobotized system makes overmolding mobile, flexible

Anybrid’s ROBIN demonstrates inline/offline functionalization of profiles, 3D-printed panels and bio-based materials for more efficient, sustainable composite parts.

Read MoreOwens Corning initiates review of strategic alternatives for glass fiber business

Owens Corning considers alternative options like a potential sale or spin-off as part of its transformative move to strengthen its position in building and construction materials.

Read MoreRead Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More