Aerospace growth climbs with carbon fiber

The business case for carbon fiber in narrowbodies has become a lot stronger now that these operational benefits are in evidence.

Just 10 years ago, three major suppliers of carbon fiber supplied 70% of the worldwide market. Today, the same three suppliers — Toray Industries Inc., Toho Tenax Inc. and Mitsubishi Rayon Co. Ltd. (MRC), all based in Tokyo, Japan — have a combined market share of 45% (excluding Toray’s recent acquisition of Zoltek Corporation, St. Louis, MO, US), with nearly 20 competitors vying for position. Notably, every player in this burgeoning sector of the composites market can point to massive expansion. Overall, there is now three times the capacity and three times the demand for carbon fiber, compared to 2005.

That growth has been reflected not only in the supply chain’s development but also in its value: Hexcel's share price, for example, in June 2005, stood at US$16.30, but by the same date in 2015, it was US$49.49. Hexcel manufactures everything from carbon fiber to finished aircraft structures, and it is in the aerospace industry that carbon fiber has seen massive increases in usage.

The Boeing Co.’s (Chicago, IL, US) 787 and the Airbus (Toulouse, France) A350 XWB and A380 widebody platforms accelerated composites use in aircraft — exceeding the airlines’ requirements for reduced fuel consumption and emissions, reduced maintenance and longer design life, fewer parts, and reduced tooling and assembly costs. Composite materials also deliver an enhanced passenger experience (by damping engine noise/vibration) and a cabin atmosphere less conducive to dehydration. For large, widebody aircraft, carbon fiber delivers a winning value proposition. Competition, legislation and the uncertainty of fuel pricing created the “perfect storm” necessary for technology adoption.

Over the next 20 years, nearly 9,000 new widebodied aircraft are due for delivery, and they will all use predominantly carbon fiber composites for their primary structures. Narrowbody aircraft orders are increasing in similar fashion, typically at a compound annual growth rate (CAGR) of more than 4%, driven by the growth of air travel in China, the Middle East and other emerging markets. Future Materials Group’s recent in-depth research into the specific opportunities for composites in the widebody and narrowbody commercial aircraft markets has underscored some challenges, but also prompted some intriguing conclusions.

For narrowbody aircraft, it might be assumed that carbon fiber demand would mirror that of the past 10 years and continue the widebody story. Yes, there are drivers for carbon fiber adoption for narrowbodies, but our research reveals that there also are barriers that make carbon fiber use less compelling. Narrowbody aircraft demand much higher build rates — often a problem for composites manufacturing processes — and fuel consumption is much less of a factor on short-haul trips. Plus, parts must be designed and built to specifications similar to those for widebodied aircraft, or damage tolerance, tending to increase laminate thicknesses beyond that needed for purely structural reasons. This increases weight and cost, reducing the benefits of carbon fiber.

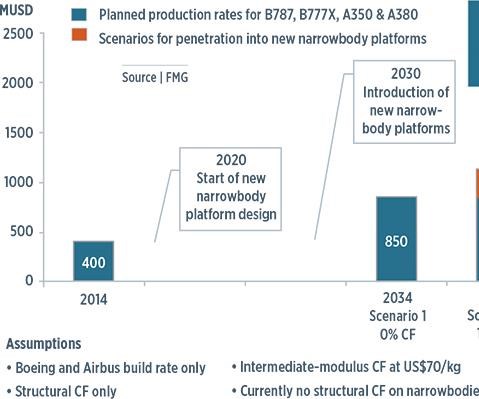

Industry projections point to nearly 27,000 new narrowbody aircraft deliveries by 2034. By 2030, many of the Boeing 737 and Airbus A320 planes delivered in the 1980s and 1990s will need replacement. New platform designs are in progress, but the level of carbon fiber use in them is unknown at present.

For the operators, however, our data point to emerging drivers that could radically alter the uptake of carbon fiber technology, and those data are based on the track record of quality and reliability that composites have established over the past 10 years. Boeing’s experience with composite floor beams in the Boeing 777 is a good example: In 565 aircraft, not one composite floor beam has been replaced in more than 10 years of commercial flight service. The Boeing 777 composite tail is 25% larger than the Boeing 767 aluminum tail, and yet the maintenance logs show a savings of more than one-third in labor hours. Similarly, Airbus claims that the high penetration of carbon fiber on the A350 XWB will reduce fatigue and corrosion-related maintenance by 60%.

The business case for carbon fiber in narrowbodies has become a lot stronger now that these operational benefits are in evidence. Metal producers are responding to the carbon fiber threat with new alloys and new technologies. Most of all, they are underlining their established position in the supply chain: The relatively low cost of manufacture, the good recyclability of metals, and the wealth of knowledge about metal properties and performance.

Previously, composites suppliers would not have been able to overcome these claims for metal. Although concerns about carbon fiber recyclability remain, carbon fiber’s enhanced durability can reduce some of the issues. At the design stage, stress analysis, finite element analysis, materials selection and mechanical performance are all fully available for composites. Improved fabrication processes are increasing throughput capacity and, thus, carbon fiber part costs are declining. Most of all, major aerospace producers have many years of closely working with the composites supply chain: The days of early adoption and high risk are over.

It is highly unlikely that carbon fiber will not be adopted for the new narrowbody platforms. The question is, how much? On a Boeing 787, 50% of the aircraft is composite, with 20% aluminum, 15% titanium, 10% steel and 5% other materials. If this mix is replicated in narrowbody aircraft, then by 2034 the total carbon fiber market would be more than US$2 billion annually (Scenario 4 in the chart on p. 6). This would necessitate installation of at least one new carbon fiber production line every year until 2034. In the worst case — no structural carbon fiber in any future narrowbody aircraft (Scenario 1) — growth in widebody production alone would more than double the carbon fiber market in 20 years. We anticipate a three-way battle between the airframe OEMs driving down cost and the carbon fiber suppliers and the metal suppliers fighting for market share. Ultimately, the airlines will be the final arbiter and likely to favor a high penetration of carbon fiber for its maintenance and passenger comfort benefits, pointing to Scenario 4 or, possibly, 3, if fiber/metal laminates are successful in narrowbody fuselages.

In summary, the aerospace market for carbon fiber is predictable, manageable and expanding. Demand comes from a relatively small number of large and highly professional manufacturers with long-term design and production cycles. Further, composite materials are an accepted solution to major lightweighting issues, and composite parts are recognized as robust and durable.

So where are the problems? Any increase in volume results in pricing pressure, and to the inevitable commoditization of carbon fiber. On the fiber supply side, market leaders will have to decide whether to protect market share by building capacity, adding value to processes or products, acquiring competitors — or all three.

In addition, the aircraft manufacturers themselves will see greater competition, especially in the narrowbody market, and will need to differentiate: Airframe suppliers in China and Russia are now emerging and with strong home markets could challenge the Boeing and Airbus dominance. Protecting margins in this environment will be challenging.

But the good news is that the quality and performance of carbon fiber structures will not only deliver reduced lifecycle costs, but also make it impossible for metals to regain their previous market share in aerospace.

Related Content

Cryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreNatural fiber composites: Growing to fit sustainability needs

Led by global and industry-wide sustainability goals, commercial interest in flax and hemp fiber-reinforced composites grows into higher-performance, higher-volume applications.

Read MorePlant tour: Teijin Carbon America Inc., Greenwood, S.C., U.S.

In 2018, Teijin broke ground on a facility that is reportedly the largest capacity carbon fiber line currently in existence. The line has been fully functional for nearly two years and has plenty of room for expansion.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRead Next

VIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More