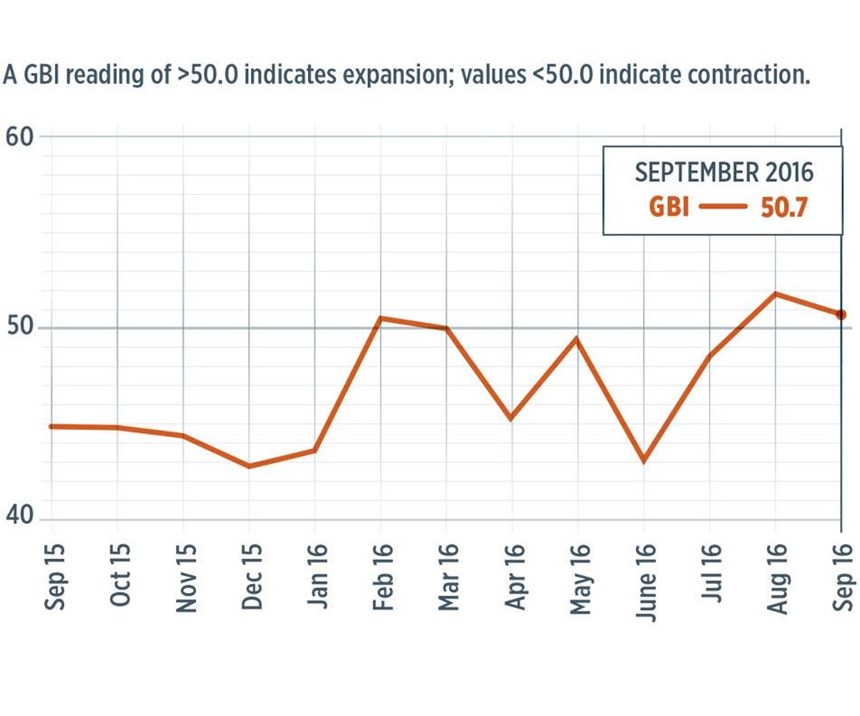

Gardner Business Index at 50.7 in September

As third-quarter 2016 closes out, new orders and employment go up.

With a reading of 50.7, the Gardner Business Index showed that the US composites industry, in September, had expanded for the second straight month. The growth was slightly slower, however, than that seen in August.

New orders grew for the third month in a row, although the rate of growth dipped a little bit in September. Nevertheless, the new orders subindex was at its second highest level since June 2015. Production increased for the second consecutive month. Although the production growth rate slowed in September, it still was reasonably strong. With the exception of one month, the backlog subindex had contracted since December 2014. However, the backlog subindex has shown comparatively dramatic improvement since January of this year. Employment increased in both August and September. This subindex had been alternating between growth and contraction since February. Exports continued to contract in September, and the rate of contraction accelerated somewhat during August and September. However, the overall trend in that subindex since November 2015 appeared to remain positive. In September, supplier deliveries lengthened for the fifth time in six months.

Material prices increased for the eighth month in a row. The rate of increase decelerated slightly in September compared with August. However, the index remained near the highest level it has reached since the summer of 2015. Prices received, as September closed out, had decreased every month but one since August 2015. Also, the future business expectations subindex decreased marginally in September. That said, the overall trend in the subindex had been up since January.

Among the target markets for US composites manufacturers, the aerospace industry contracted for the second time in four months. The level of the aerospace subindex in September was at its lowest since January. It has been a much rougher go for the automotive industry recently. The automotive subindex in September had contracted every month but one since November 2015. Also, another manufacturing subindex, which is mostly consumer goods, expanded in September for the first time since March.

In preparation for the September Gardner Business Index survey, a change was made in the options available to manufacturers asked about their future capital spending plans. The survey gave respondents the additional option of selecting zero (US$0) for future spending plans. This represents a new lowest option, replacing the previous low, which was a range from US$0 to US$125,000. For that reason, it is not possible to compare September’s value to that recorded in previous months.

Related Content

-

Glass fiber-reinforced Akulon RePurposed recyclate enables Ahrend sustainable office chair

Envalior 30% glass fiber-reinforced Akulon RePurposed material helps Ahrend achieve lighter task chair with closed-loop value chain and reduced emissions.

-

Cycle Inspect, UNSW investigate carbon fiber bicycle damage

The collaborative research initiative will explore the prevalence and impact of structural damage in carbon fiber bicycles currently in use by the general public, assessing the magnitude of the issue and raising awareness.

-

Time Bicycles to modernize composite bicycle manufacturing

With the aid of KraussMaffei, Clemson University and SC Fraunhofer USA Alliance, Time anticipates a transition to HP-RTM for more efficient carbon fiber bike frame manufacture, plus a new facility in South Carolina.

.JPG;width=70;height=70;mode=crop)