Gardner Business Index at 51.9 in August 2016

New orders, production and key target markets are up.

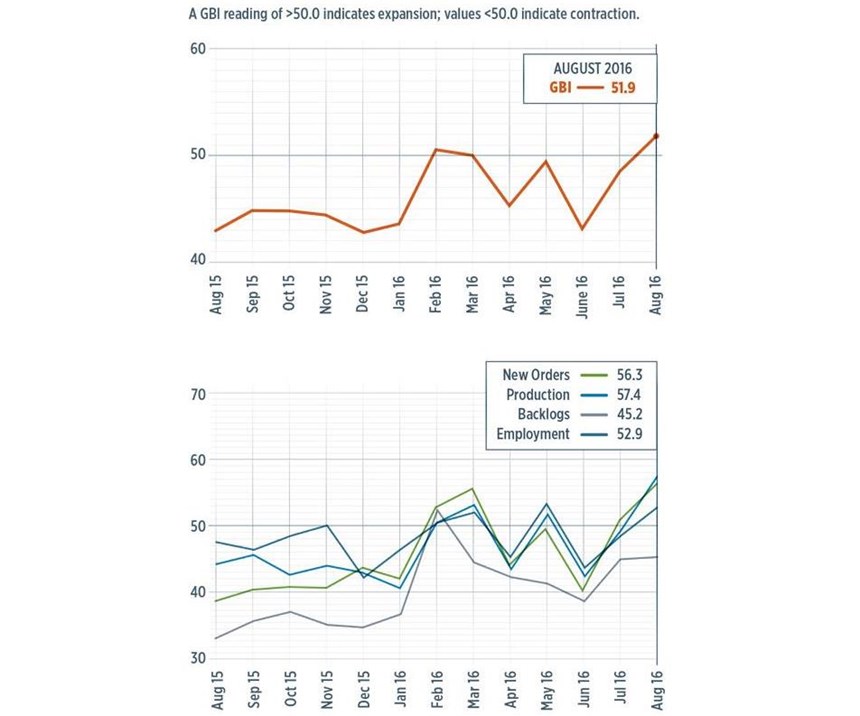

With a reading of 51.9, the Gardner Business Index showed in August that the US composites industry had expanded for the first time since February of this year. Also, in August the Index reached its highest level since March 2015, jumping signifi- cantly from 43.3, the level recorded just two months previously, in June.

New orders grew for the second month in a row. That subindex reached in August its second highest level since June 2014. Production increased for the first time since May. August’s was by far the highest level for the production subindex since March 2015. And other than one month, the backlog subindex, as August closed out, had contracted since December 2014. That said, the backlog subindex had shown dramatic improvement since January of this year. Employment increased in August. Its subindex had bounced, alternating between growth and contrac- tion since February. Exports continued to contract in August. However, the trend in that subindex had been positive since November 2015. Supplier deliveries lengthened for the fourth time in five months.

Material prices increased for the seventh month in a row. The rate of increase accelerated in August, pushing the subindex to its highest level since July 2015 and its second highest level since November 2014. Prices received increased for the first time since August 2015. In August, that subindex jumped sharply from the number recorded in July. Similarly, the future business expecta- tions subindex increased dramatically in the space of a month. In the case of the latter, the number rose to its highest level since October 2015.

The US aerospace industry grew for the fifth time in seven months. And, in one of the other two months, it was flat. In August, the aerospace subindex was 57.4, which was its highest level since March and second highest since May 2012. The US automotive industry grew for the first time since October 2015. The power generation industry appears to have been quite strong in the past four months. Although not as strong, the computer/ electronics industry has grown every month but one in 2016.

Future capital spending plans for the coming 12 months were above average in August, and that was the case for the first time since August 2015. Compared with the figure recorded at that earlier date, future spending plans in August 2016 were down 2.2%. However, at the end of August, future capital spending plans had increased compared with one year earlier in four of the previous six months. Although the annual rate of change continued to contract, it did so at a decelerating rate from February through August. This indicated that the weakest part of the capital equipment cycle was likely in the past.

Related Content

-

Pull-wound carbon fiber poles enable lightweight, compact, rigid emergency stretcher

Based on military feedback, Epsilon Composite developed an optimized, foldable stretcher that combines telescopic pull-wound carbon fiber tubes.

-

Orbital Composites wins AFWERX award for Starfighter drone fleet

Under the TACFI contract, Orbital is implementing the AMCM process to build 3D printed composite multi-mission UAS aircraft, surpassing $10 million in government awards.

-

Milliken & Co. partners with MMI Textiles to offer Tegris thermoplastic

The commercial market partnership enables easier access to the Tegris thermoplastic composite fabric for defense customers in the quantities that they require.

.JPG;width=70;height=70;mode=crop)