Wind blade manufacture: Opportunities and limits

At CompositesWorld's 2011 Wind & Ocean Energy Seminar, held April 13-14 in Portland, Maine, Stephen Nolet, principal engineer/director of innovation at TPI Composites Inc. (Scottsdale, Ariz.) briefed the audience on TPI’s view of blade design and manufacture.

Wind turbine blade manufacturers are famously tight-lipped about the composite materials and manufacturing strategies they use, so when a member of this club gets up at a conference and talks frankly about them people sit up and take notice.

This was the case at CompositesWorld’s 2011 Wind & Ocean Energy Seminar, held April 13-14 in Portland, Maine, when Stephen Nolet, principal engineer/director of innovation at TPI Composites Inc. (Scottsdale, Ariz.) briefed the audience on TPI’s view of blade design and manufacture. His presentation covered a lot of ground. He started by focusing on the wind energy industry’s cost sensitivity. Despite the attention paid to the cost of oil, he said wind’s toughest competitor is natural gas — now one of the world’s cheapest energy sources. The pressure is on the wind industry to produce electricity at competitive prices. As the cost of wind energy decreases, the demand for natural gas decreases. That, in turn, reduces the cost of natural gas, which puts more pressure on the wind industry. “The cost of energy ... will make our industry sustainable,” he said. “My job is to bring the cost of blades down.”

Nolet also reviewed some of the physical limits of wind turbines and wind energy. The square/cube law, for one, says that a turbine’s power output is proportional to the square of its blade length, thus making long blades appealing. However, a blade’s volume and weight are proportional to the cube of its length. So the price of a turbine climbs faster than its power output as its size increases. The variable in this equation is material type (i.e., carbon fiber vs. glass fiber), the choice of which can reduce blade weight, enabling longer, more efficient blades.

The Betz Limit stipulates that no turbine can capture more than 59.3 percent of the kinetic energy in wind — primarily because a minimum amount of wind passes through the blade envelope without turning the blades. Most turbines, Nolet said, have a capacity factor rated at 49 percent; the industry is targeting 53 percent.

A third limit is economic. The wind does not always blow, which leads to a statistic called utilization percentage. Onshore wind turbines, Nolet said, have a utilization factor of 30 to 35 percent. Offshore, where laminar airflow is relatively close to the water’s surface, utilization can easily exceed 45 percent. Further, most wind turbines are designed for 3m/sec wind, are rated at 7m/sec, and cut out at 25m/sec. “This gives us a small window of usable wind,” he noted.

Nolet unveiled the Advanced Manufacturing Innovation Initiative (AMII), TPI’s three-year effort to address these limits collaboratively with Sandia National Laboratories (Albuquerque, N.M.) and Iowa State University’s Office of Energy Independence. Now 18 months along, the AMII effort focuses on “creation of sustainable U.S.-based wind turbine blade manufacturing jobs through the implementation of production technologies that result in measurable increases in productivity, cycle time, quality and process robustness.” At TPI, this will be done mainly through the application of automation, with two goals: improve labor productivity and reduce cycle time, each by 35 percent. Areas of focus include factory modeling, nondestructive inspection (NDI), kitting, material transfer, layup, processing, assembly, sanding, drilling, and cutting.

NDI technologies will include pulse echo, ultrasonic and noncontact air-couple and laser shearography systems, with an eye on development of portable systems for in-the-field applications. TPI also is assessing the use, for example, of five ganged, ceiling-mounted laser projectors over a 46.2m/139.8-ft blade mold, to identify ply locations, bonding adhesive outlines and shear web location.

About the use of automated tape laying (ATL) and fiber placement (AFP) systems for blade layup, Nolet was pessimistic. Systems he’s seen — even those designed for wind blade production — are “too expensive and too slow.” Currently, he said, TPI manually places material into a mold at a rate of 1,500 kg/hr (3,307 lb/hr) — a speed unmatched by current equipment. Further, he said, automation must meet a cost-of-finished-goods basis of $5/lb to $10/lb of material — significantly less than the $200/lb to $700/lb cost basis for aerospace-grade products fabricated today by ATL and AFP.

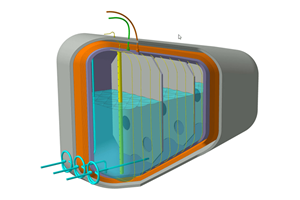

The most promising automation application, said Nolet, might be spar caps. Relatively flat, long and of continuous thickness, they are amenable to both high-speed fiber placement and resin infusion. In this arena, TPI has worked with NEPTCO (Pawtucket, R.I.), which supplied pultruded rods of unidirectional E-glass bonded to one side of a carrier sheet to bolster structural support. Nolet said a 9m/29.5-ft spar cap made using these plies, measuring 40-mm/1.6-inch thick, was infused in just 45 seconds and offers impressive mechanical properties. TPI aims to migrate this material technology into larger blade applications, although Nolet did not rule out increased use of pre-impregnated carbon fiber in spar caps.

A significant labor savings opportunity, said Nolet, is in postmold trimming, sanding and cutting, which account for more than 50 percent of the total labor cost to produce a blade at TPI. The AMII program is studying the use of six-axis articulating robotics to perform these operations. “I don’t think anyone would wish our children to grow up as blade finishers,” Nolet quipped. “I’d much rather train-up our finishers for working automated systems.”

Related Content

Recycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreCollins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreHexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More