Annual report finds U.S. offshore wind nearly doubled in 2022

Key report findings from the Business Network for Offshore Wind note that investments in U.S. market tripled in size to $9.8 billion, despite economic headwinds.

Photo Credit: Unsplash/Mitchell Orr

Demand for offshore wind in the U.S. nearly doubled in 2022 and investments in the market tripled, marking not only a transformative year, but an inflection point when the industry began its transition to commercial-scale operations. The Business Network for Offshore Wind (Baltimore, Md., U.S.), a non-profit representing more than 500 businesses working to accelerate offshore wind development and build its supply chain in the U.S., released its annual U.S. Offshore Wind Market Report that analyzes the growth of the offshore wind industry in 2022 and breaks down the challenges and opportunities the industry will face in the year ahead.

Key findings from the 2023 report include:

- Offshore wind-related contracts grew by 36% in 2022 with a majority awarded to U.S. companies, according to analysis by the Network. Over the year, 664 new organizations registered with the Network’s Supply Chain Connect registry, representing a 27% increase.

- Long-term state offshore wind targets increased 79% last year, as California laid down an industry marker by calling for 25 gigawatts (GW) of offshore wind generation, and Louisiana, New Jersey and Rhode Island announced new state goals.

- The U.S. offshore wind market saw $9.8 billion in new investments in 2022, more than triple the year prior. While this growth was primarily driven by lease auction fees, more than $4.4 billion was directed to port infrastructure, supply chain development and transmission. The Network has identified $17 billion in new investments driven by offshore wind activity in the U.S. since 2014.

- The current U.S. administration remains on track to hit self-defined targets to lease seven new areas and perform 16 project environmental reviews, but currently announced completion dates suggest the industry will fall short of installing 30 GW of offshore wind by 2030. Rapid development of lease areas in the New York Bight could close that gap.

“From surging investments to cutting-edge floating turbine technology on the West Coast, passage of the landmark Inflation Reduction Act and federal regulatory efforts that bring more certainty to permitting, 2022 kicked the American offshore wind industry into full throttle,” Liz Burdock, president and CEO of Business Network for Offshore Wind, says. “A visible pipeline of projects has emerged with half a dozen projects finalizing environmental review and another 11.4 GW of new areas leased for future development. But this progress has not been without speed bumps. As the industry makes the transition from demonstration to commercialization amid global economic uncertainty, we must double down on a national industrial strategy, building up an offshore wind supply chain and manufacturing base in the U.S.”

The report also includes a forecast of what the offshore wind industry can expect in 2023:

- The U.S. offshore wind industry will move from demonstration to commercialization. In 2023, the American market will transition from demonstration to commercialization with the first two commercial-scale projects, Vineyard Wind and South Fork Wind, set to begin foundation and turbine installation and producing electricity.

- States will buy at least 25% more offshore wind power. The U.S. market moves into a year where four states — Massachusetts, New Jersey, New York and Rhode Island — will all conduct or finalize new rounds of offshore wind procurement and increase the amount of offshore wind with financial backing by at least 25%.

- The Inflation Reduction Act will drive alternative uses of offshore wind power. While the U.S. offshore wind market will continue to be dominated by state electricity demands, new market opportunities are emerging globally that harness offshore wind’s power output for alternative uses, including green hydrogen production, green ammonia production and carbon sequestration activities. The first major U.S. announcement pairing green hydrogen and offshore wind occurred last year in Louisiana.

- New construction on wind turbine installation vessels. With a glaring market need, federal funding available, increased confidence in the U.S. permitting system and multiple designs with financial backing on paper, one or two more U.S.-market wind turbine installation vessels (WTIV) concepts could begin construction this year.

- Additional project delays and contract negotiations. As more projects near financial close, the industry can expect to see additional delays or other attempts to renegotiate contract terms as was seen in Massachusetts.

To request a copy of the full 2023 U.S. Offshore Wind Market Report or for more information and to arrange an interview, contact Melinda Skea at melinda@offshorewindus.org or 202-709-9793.

Related Content

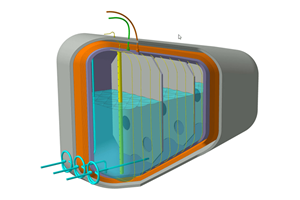

Infinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreCollins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreNCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

Read MoreRead Next

U.S. DOE announces $30 million wind turbine materials, manufacturing funding opportunity

Funding opportunity seeks to increase cost efficiency of wind power generation through R&D projects for lightweight composite materials, streamlined 3D printing processes.

Read MoreSiemens Gamesa to establish offshore wind turbine nacelle facility in New York

Second U.S. facility and several new supplier facilities are intended to build economic, employment and environmental sustainability in the U.S.

Read MoreCFRP planing head: 50% less mass, 1.5 times faster rotation

Novel, modular design minimizes weight for high-precision cutting tools with faster production speeds.

Read More

.jpg;maxWidth=300;quality=90)