Composites Germany survey offers more positive composite industry assessment

Compared to mid-2020, first signs of recovery and a more positive outlook on current business situations suggest expectations for fulfilling future developments and applications are looking up.

Figure 1. Composites Index: current general business situation.

Composites Germany (Berlin, Germany), a trade association with an aim to strengthen the German composite industry, has recently made the results of its 16th Composites Market Survey available, which identifies the latest key performance indicators (KPIs) for the fiber-reinforced plastic (FRP) market.

The survey also covered all member companies of the three major umbrella organizations of Composites Germany, including Industrievereinigung Verstärkte Kunststoffe (AVK, Frankfurt, Germany), Leichtbau Baden-Württemberg (Stuttgart, Germany) and the VDMA Working Group (Frankfurt, Germany). As before, to ensure a smooth comparison with the previous surveys, Composites Germany notes that questions in this half-year survey have been left unchanged. Once again, the data obtained in the survey was largely qualitative and related to current and future market developments.

Assessment of current business situation is more positive

Following an extremely negative assessment of the prevailing business situation in the last survey, the latest survey is looking considerably brighter. A highly positive trend is emerging for all three regions surveyed (worldwide, Europe and Germany). Whereas in last year’s survey an average of 85% described the prevailing business situation as either negative or even very negative, the most recent survey shows that, on average, 50% of all respondents are currently seeing the situation as fairly positive or very positive (see Fig. 1).

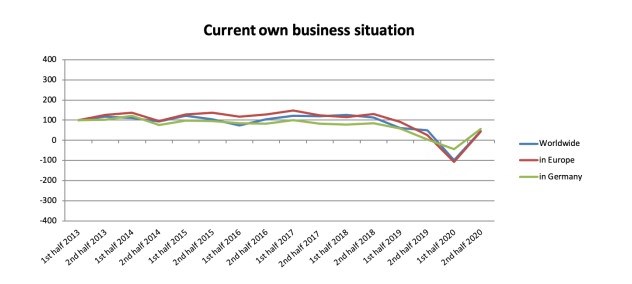

Moreover, this more optimistic assessment applies not only to the general business situation, but also to the respondents’ own businesses (see Fig. 2).

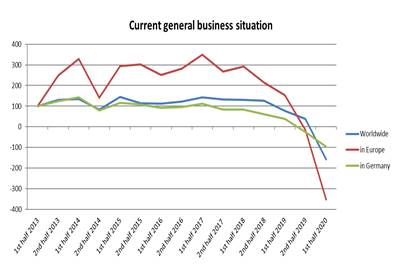

Fig. 2. Composites Index: own current business situation.

Despite the ongoing COVID-19 pandemic and its numerous challenges, as well as additional negative variables such as Brexit, the mood among respondents has noticeably improved. The decisive factor was probably the situation in the second half of 2020, when the economic slump was less severe than originally feared. Trade and industry have been impacted by restrictions to very different degrees. The construction sector, which is important for the composites industry, is currently not affected by cutbacks. The transport sector is also starting to recover in numerous areas, such as automotive and transport applications. Although the structural transformation is still by far from complete, the industry is now beginning to face up to its challenges in a way that is even visible from outside; the only industry that is still unable to return to its previous level seems to be aviation. Another reason may also be the relaxation of international trade relations that is becoming apparent in many places.

Future expectations positive

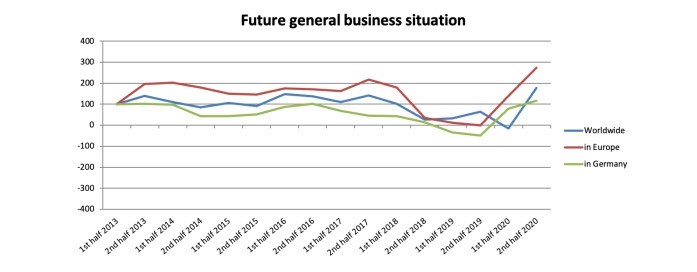

A consistently positive picture emerges when respondents are asked about their expectations for future business developments. For all three regions surveyed, the respondents’ expectations on the future business situation are considerably more positive now, and have even reached their highest values since these surveys were started (see Fig. 3).

Fig. 3. Assessment of general business situation in the future.

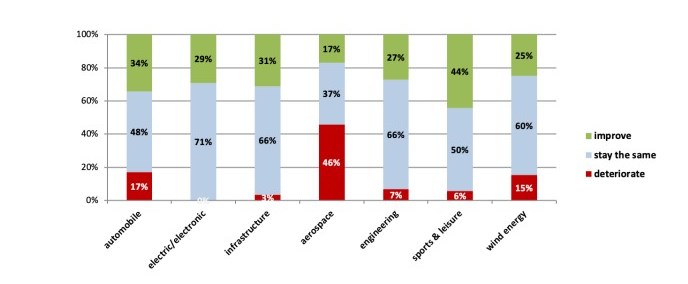

Varied expectations for application industries

Expectations on selected application industries vary substantially. Significant declines are expected, above all, in automotive, aviation and wind energy (see Fig. 4). Yet it is also worth noting that considerably fewer respondents are expecting declines than last time. Whereas, in the last survey, 71% were expecting to see the situation get worse in aviation, this value has now dropped to a “mere” 46%. In the automotive sector, this number has dropped from 45% (first half of 2020) to only 17%.

Fig. 4. Assessment of the development of selected areas of application.

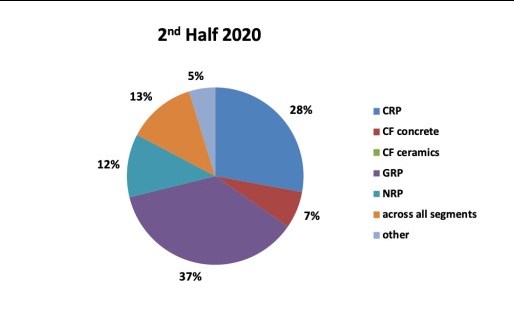

GRP continues to be growth driver

As before, the current survey shows Germany, Europe and Asia as the global regions expected to deliver the most important growth stimuli for the composites segment. Expectations on Asia may continue to rise, while Germany and Europe are losing ground. Where materials are concerned, Composites Germany reports seeing a continuation of the ongoing paradigm shift. Whereas, in the first 13 surveys, respondents always believed that the composites segment would receive its main growth stimuli from CRP as a material, this is now the third consecutive survey where respondents have mentioned glass fiber-reinforced polymers (GRP) as the most important material (see Fig. 5).

Fig. 5. Growth drivers: materials.

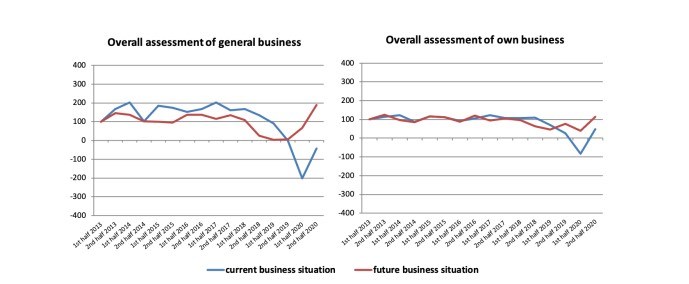

Composites Index is now positive

The significantly more positive assessment in so many areas is not completely surprising, as there are some first signs of recovery in many places and/or fewer drastic cuts than was still feared in mid-2020. Countless discussions with industry representatives, particularly in the second half of 2020, suggested a generally more positive mood. Nevertheless, the clear-cut assessment of both the current business situation and the outlook for the future comes as a surprise. The Composites Development Index has turned positive in all areas and reached new heights, particularly with regard to expectations for the future. (See Fig. 6).

Fig. 6. Composites Development Index.

It remains to be seen whether these high expectations will be fulfilled, and there is still a lot of uncertainty about future developments. The focus is still on the ongoing COVID-19 situation, which no one is realistically able to predict. The start of vaccination programs, and the apparent slowdown of the pandemic in many countries are prompting many market players to be more optimistic about the future. Also, numerous government support projects are being rolled out with a view to mitigating the negative impact, and there is a visible relaxation of economic and political trade relations between China and the United States. Moreover, economic tensions between Russia, the EU and the United States seem to be easing off somewhat at the moment, although there is still a great need to resolve political issues and to take action at the political level.

One major challenge in international trade, particularly for the EU, continues to be Brexit, of which the full scale is yet to be seen. In the automotive sector there is currently a paradigms shift in many areas, particularly among German OEMs. The structural challenges are now clearly being addressed. Meanwhile, aviation, an important sector for the composites industry, seems to be unable to return to its previous level, either now or in the medium term. Construction — currently the biggest market segment for the use of composite components — appears to be rather “unimpressed” by today’s challenges. This seems to be partly due to its generally slower responses to macro-economic changes compared with, for example, the transport sector.

Like so many other sectors of industry, the composites market had to contend with a major decline last year. Nevertheless, the current outlook is giving rise to optimism that this decline can be swiftly mitigated in many areas of application.

The next Composites Market Survey will be published in August 2021.

Read Next

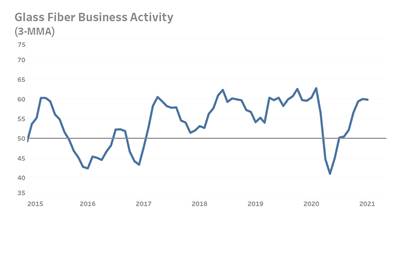

Glass fiber supply chain struggles amid pandemic, economic recovery

Transportation issues, rising demands and other factors have led to higher costs or delays for gun rovings and more. Suppliers and Gardner Intelligence share their perspectives.

Read MoreComposites Germany releases composites market survey

This is the fifteenth member survey from Composites Germany that identifies up-to-date key performance indicators (KPIs) for the fiber-reinforced plastics market.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More