Glass fiber supply chain struggles amid pandemic, economic recovery

Transportation issues, rising demands and other factors have led to higher costs or delays for gun rovings and more. Suppliers and Gardner Intelligence share their perspectives.

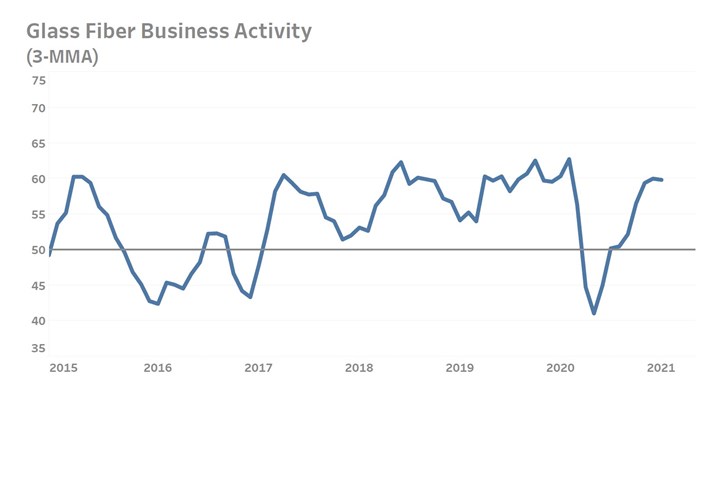

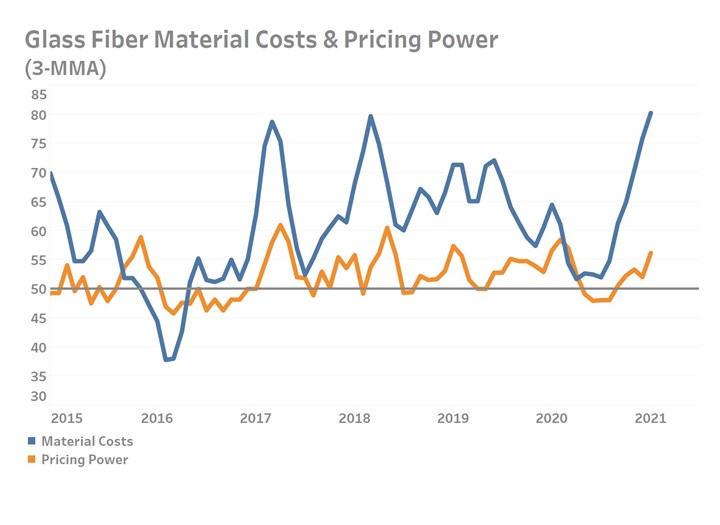

Fig. 1. Overall business activity of glass fiber manufacturers from 2015 to early 2021, based on data from Gardner Intelligence.

As the coronavirus pandemic enters its second year, and as the global economy slowly re-opens, the worldwide glass fiber supply chain is facing shortage of some products, caused by shipping delays and a fast-evolving demand environment. As a result, some glass fiber formats are in short supply, affecting the fabrication of composite parts and structures for the marine, recreational vehicles and some consumer markets.

As noted in CompositesWorld’s monthly Composites Fabricating Index reports by Gardner Intelligence Chief Economist Michael Guckes, even as production and new orders recover, supply chain challenges continue to persist across the entire composites (and manufacturing in general) market into the new year.

To learn more about reported shortages in the glass fiber supply chain in particular, CW editors checked in with Guckes and spoke to several sources along the glass fiber supply chain, including representatives of several glass fiber suppliers.

Many distributors and fabricators, especially in North America, have reported delays in receiving fiberglass products from suppliers, particularly for multi-end rovings (gun rovings, SMC rovings), chopped strand mat and woven rovings. Further, the product that they are receiving is likely at an increased cost.

According to Stefan Mohr, business director of global fibers for Johns Manville (Denver, Colo., U.S.), this is because a shortage is being experienced throughout the glass fiber supply chain. “All businesses are restarting globally, and we sense that the growth in Asia, especially for automotive and infrastructure projects, is exceptionally strong,” he says.

“At the moment, very few manufacturers in any industry are getting everything they want from suppliers,” notes Gerry Marino, general manager of sales and marketing at Electric Glass Fiber America (part of NEG Group, Shelby, N.C., U.S.).

Reasons for the shortage reportedly include rising demand in many markets and a supply chain that can’t keep up due to issues related to the pandemic, transportation delays and rising costs, and decreased Chinese exports.

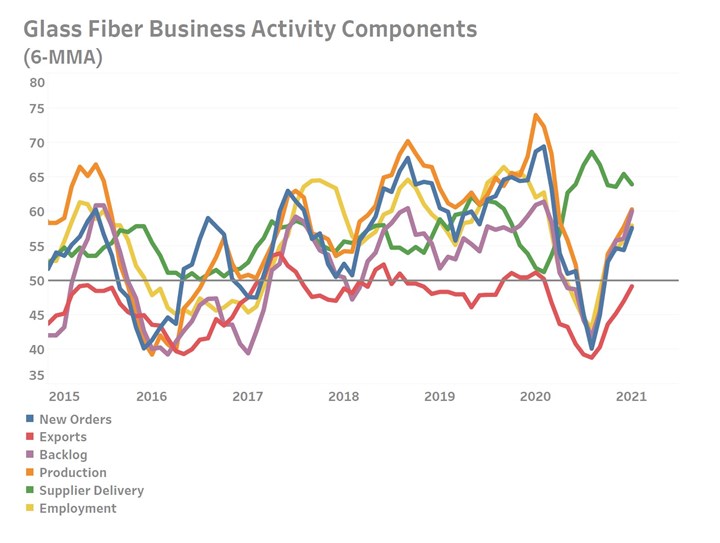

Fig. 2. Composite industry activity related to supplier deliveries and production for the glass fiber market. According to Chief Economist Michael Guckes, the height of the supplier deliveries line for early 2021 (shown in green) illustrates the growing proportion of fabricators who are experiencing slow order-to-fulfillment times from upstream suppliers.

Rising demand

In North America, thanks to the pandemic restricting travel and group recreational activities, consumer demand has seen a sharp increase for products such as boats and recreational vehicles, as well as home products like pools and spas. Many of these products are manufactured with gun rovings.

According to Mohr, there has also been increased demand for glass fiber products in the automotive market as automotive manufacturers came back online quickly and sought to refill their stock following the initial pandemic lockdowns during spring 2020. The rebound was apparent, as days of inventory on car lots for some models reached the single-digits, according to data obtained by Guckes.

According to Marino, Q3 and Q4 2020 saw “a much larger surge in demand than we expected,” particularly for chopped glass fiber strands used by customers in the automotive industry, and single-end rovings used in the wind industry.

“All the markets are recovering, some more so than others. In general, our industrial customers have recovered faster and to a greater degree than commercial aerospace, but everything is better,” adds Scott Northrup, VP of sales and marketing at AGY (Aiken, S.C., U.S.).

This growth in glass fiber demand is also strong in China but, reportedly, no substantial capacity has been added to fiberglass production over the past year, meaning that plants are at capacity with no short-term ability to increase production, though demand continues to increase.

Marcio Sandri, president, composites at Owens Corning (Toledo, Ohio, U.S.), adds that the increased demand in recreational vehicle and home improvement products came on top of rapid growth in the wind industry. “All this increased demand took place at a time when industry inventory was already reduced — given intended actions or supply chain issues,” he says.

Supply chain issues

Figure 2 shows Gardner Intelligence’s supplier delivery and fabricator production data for the glass fiber market. “Never before have we seen the kind of activity spread which currently exists between production and supplier delivery activity readings,” says Guckes. “After recovering to some degree from COVID-19’s initial shock in early 2020, conditions worsened in the fourth quarter. The implication from this is that serious problems still need to be answered; deliveries shouldn’t be this delayed given the modest rebound in production and new orders activity over the last six months.”

One factor, reported by suppliers, is their ability to come back online quickly. Karin Demez, product management lead for global fibers at Johns Manville, says, “We had to adapt to the collapsing demand in Q2 2020 and decreased production of glass fibers on our end. Then we had to make a 180-degree turn and ramp up production again.” According to Marino, much production capacity at NEG and other suppliers had to be idled for much of the second quarter of 2020. “Last summer began a restart period when automotive plants, followed by other markets, began to start up again,” he explains. “It’s been a slow, deliberate process to bring capacity back up.”

In addition, for more than two years, Chinese manufacturers of fiberglass products have reportedly been paying and absorbing most, if not all, of the 25% tariff to export to the U.S. However, as the Chinese economy recovers, domestic demand within China for fiberglass products has increased significantly. This has made the domestic market more valuable to Chinese producers than exporting product to the U.S. In addition, the Chinese yuan has significantly strengthened against the U.S. dollar since May 2020, while at the same time fiberglass manufacturers are experiencing inflation in prices of raw materials, energy, precious metals and transportation. The result, reportedly, is a 20% increase in the U.S. in the price of some glass fiber products from Chinese suppliers.

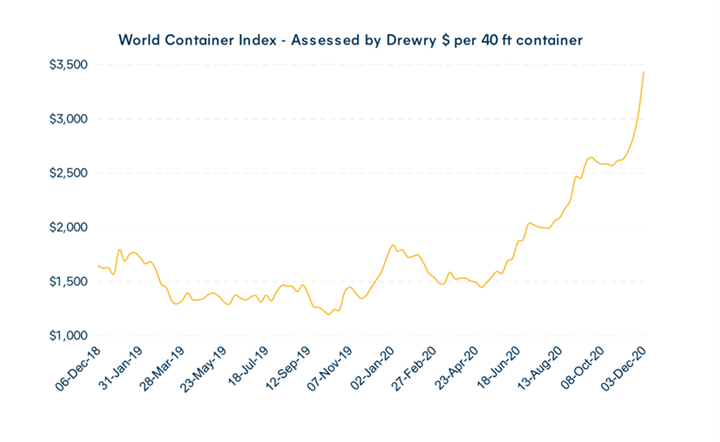

On top of this, there is a severe imbalance of shipping containers globally, caused by pandemic-induced labor shortages at major sea ports (see Fig. 3). As a result, containers are not emptied in a timely manner, which means empty containers are not available to the shipping supply chain. In some cases, the cost of container freight is reported to have more than doubled since June 2020. Within the U.S., domestic truck shipping has also reportedly risen in price due to lack of capacity and pandemic issues.

Fig. 3. According to a report from Hillebrand, container shipping rates have been surging on all east to west shipping routes since May 2020, and eastbound container freight rates have more than doubled since the beginning of the COVID-19 outbreak.

Transportation issues, of course, affect all markets, within the glass fiber supply chain and otherwise. For AGY, which manufactures in the U.S. and primarily produces glass fiber yarns, the rising costs to ship products to Europe and Asia has been the main issue. “Certain shipping lines have been consolidated, rescheduled or reconfigured, and it’s getting tougher and tougher to get the spaces on vessels to get our materials across the water,” Northrup says.

Sandri adds, “It’s widely known that in the composites industry, price hasn’t kept pace with inflation in many years. The cost of transportation and precious metal used in the production of fibers has increased substantially and there are additional expenses to follow pandemic protocols.”

Fig. 4. This chart tracks six of the business activity measures as provided by glass fiber fabricators. According to Guckes, the February 2021 numbers indicate backlogs are expanding as fast as nearly ever, employment is expanding, supplier deliveries are very slow and exports, production and new orders are outpacing most other manufacturing disciplines.

Moving forward

To return to a more normal supply chain involves many factors, including global vaccination distribution. No one is sure when more normal operations might resume, but estimates CW has heard from suppliers range from the second half of 2021, to the end of Q3, to a year from now.

Owens Corning’s Sandri predicts, “Given the overall shortage of inventory in the industry, increased demand, the required time to ramp up existing idle capacity, and the length of time needed to bring new capacity online, it is likely to be several quarters, possibly even a year, before business returns to normal for the glass fiber reinforcement industry.”

“I’m not sure how transportation issues are going to be alleviated, but especially not in the short-term, the next three to six months,” says Iain Montgomery, director of global business development at AGY. “I think in the longer term normal operations will come back, but I think until then it will be quite tight.”

Johns Manville’s Mohr adds, “We strongly believe that this is only a temporary situation. This is a stress-test for the whole organization as well as for the whole market, but we continue to go every extra mile to keep our customers running.”

Fig. 5. According to Guckes, prices seen by fabricators are rising, but are much lower than actual glass fiber material costs. In many cases, he says, this is caused by small manufacturers preferring to absorb rising material costs rather than pass them along to their customers.

Related Content

Bioabsorbable and degradable glass fibers, compostable composite parts

ABM Composite offers sustainable options and up to a 60% reduction in carbon footprint for glass fiber-reinforced composites.

Read MoreSyensqo becomes new Solvay specialty materials company

Syensqo represents what was Solvay Composite Materials, focused on delivering disruptive material technologies and supporting growing customer needs.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreSinonus launches energy-storing carbon fiber

Swedish deep-tech startup Sinonus is launching an energy-storing composite material to produce efficient structural batteries, IoT devices, drones, computers, larger vehicles and airplanes.

Read MoreRead Next

Supply chain challenges persist into the new year

Quickening expansion in new orders and production activity was counterbalanced by worsening contraction in export activity for the January Composites Index.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.jpg;width=70;height=70;mode=crop)