Gurit announces strategic alignment to preserve wind leadership, accelerate growth in other markets

While expected wind business revenue did not materialize for Q3 2024, Gurit is actively implementing measures to diversify its portfolio and position it for a wind sale increase in 2025.

On Oct. 30, Gurit (Zurich, Switzerland) reports its unaudited net sales results for the first 9 months of 2024 at CHF 315.1 million (~$364 million), which is a decrease of -7.3% at constant exchange rates or -10.6% in reported CHF compared to 2023. Acknowledging that wind markets do not currently meet expectations, Gurit has initiated a corporate strategy update and is implementing measures to benefit profitably from the wind market and to rebalance its portfolio. Mitja Schulz, CEO of Gurit, is leaving the company. The board of directors has appointed Javier Perez Freije as CEO ad interim with immediate effect.

Q3 2024 revenue was impacted across all wind business units through low demand; anticipated activity increase did not fully materialize. Despite these developments, Gurit believes that next year’s wind sales will increase. The company has strengthened its position in this sector with a major strategic Western wind OEM, though notes that some market players are attempting to leverage China’s overcapacity, particularly to benefit from cheaper carbon fibers. Consequently, Gurit is advancing with strategic initiatives to protect wind business margins, setting it for sustainable growth in the long-term.

Marine and industrial markets kept performing as expected, and Gurit anticipates an accelerated growth trajectory in the short term.

Wind materials achieved net sales of CHF 210.7 million (~$243 million) for the first 9 months of 2024. This represents a decrease of -6.1% at constant exchange rates compared to the first 9 months of 2023, with lower blade volumes and core kits prices seen on a year-over-year comparison. Per a long-term agreement with a Western customer, Gurit expects a market share increase in 2025. This includes core kits using Gurit’s newly developed Opticore technology, helping customers to optimize blade design and reduce blade weight. Structural Profiles has shipped the expected volumes from all three sites.

While ongoing growth is expected for high-performing glass fiber blade root products, the carbon fiber planks market sees customers turn to China, impacting future market share of Western producers.

Manufacturing solutions recorded net sales of CHF 27.8 million (~$32 million), which represents a decline of -26.2% at constant exchange rates compared to the first 9 months of 2023. While Q3 was characterized by low demand across all wind customers, Q4 is expected to see a much stronger order book. Gurit says it could successfully secure a long-term contract for molds and equipment with a turbine OEM, which will ensure a stable revenue stream for its new plant in Chennai and strengthen the company’s position in the Indian wind market

Marine and industrial reported net sales of CHF 76.7 million (~$88.5 million) for the first 9 months of 2024. This represents a decrease of -1.5% at constant exchange rates compared to 2023. After a slow Q1, the marine markets improved as anticipated throughout Q3, with good progress made in the industrial markets with PET. Compared to last year, a decline in the agriculture segment impacted Q3 revenues. Gurit remains focused on leveraging its core competencies in recycled PET foam to capitalize new business opportunities and drive further growth.

Streamlining wind operations

As a result of Gurit’s strategic realignment, which will provide the group with a stronger positioning across multiple markets and ensure long-term competitiveness in its wind business, Gurit’s board and management are taking actions to right-size the wind business and to focus on accelerating growth in attractive areas. Gurit is confident that these proactive moves will enable to effectively capitalize on its core competencies in performance materials and increase value to customers and shareholders.

To drive these initiatives, Gurit is in the process of undertaking the following strategic actions:

- Right-sizing wind operation and capitalizing on key competitive advantages.

- Driving organizational efficiency and reducing indirect costs across the company.

- Accelerating growth in multiple industrial segments, leveraging significant opportunities driven by increasing energy efficiency and sustainability requirements of customers.

These measures are expected to result in restructuring expenses, mostly in 2024, and are to be implemented in the coming months.

Gurit reiterates its latest full-year 2024 guidance. The company expects full year sales to be around CHF 435 million (~$502 million) and confirms the 5-8% adjusted operating profit margin.

Related Content

Polar Technology develops innovative solutions for hydrogen storage

Conformable “Hydrogen in a Box” prototype for compressed gas storage has been tested to 350 and 700 bar, liquid hydrogen storage is being evaluated.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

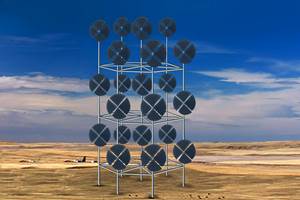

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreHexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreRead Next

MingYang completes 20-MW offshore wind turbine installation

The MySE18.X-20MW, located in China, becomes the largest single-capacity offshore wind turbine on the market.

Read MoreBlueWind secures contract with GE Vernova to manufacture wind turbine nacelle covers

With more than 2,000 2X nacelle covers manufactured, the company expands its supply with the WT20 model

Read MoreGurit supports composites-focused wind projects, ferry development

Gurit announces an EcoVadis Gold rating, a collaboration on Hong Kong high-speed passenger ferries and work with the OptiCore Innovation Project.

Read More