Gurit sees solid profitability improvement in first half of 2023

Compared to 2022, an increase of 12.8% in unaudited net sales is led by positive sales in Composite Materials, Kitting and Manufacturing Solutions, as well as a noticeable uptick in wind, marine and industrial markets.

Gurit (Zurich, Switzerland) has reported unaudited net sales for the first half of 2023 at CHF 244.6 million ($278.2 million), which is an increase of 12.8% at constant exchange rates or 4.2% in reported Swiss Francs compared to the first half of 2022. Furthermore, Gurit has acquired the remaining 40% share of the Structural Profiles business and announced an organizational change in its Board of Directors.

Excluding acquisition effects, total group sales grew by 8.6% at constant exchange rates. The Western Wind market shows cautious signs of recovery — Gurit’s customers are ordering new blade molds which the company expects to translate into material sales in due course, while the Chinese Wind market performs solidly, albeit remaining very competitive. Marine and other industrial markets continue to experience strong growth with an increase in demand for PET structural foam for industrial applications, particularly in Europe and North America.

Composite Materials achieved net sales of CHF 160.8 million ($182.9 million) for the first half of 2023. This represents an increase of 21% at constant exchange rates compared to the first half of 2022. Excluding acquisitions, Composite Materials sales increased 6.1% at constant exchange rates driven by market share gains with recycled PET in all Western material markets based on the successful ramp up of our Mexican and Indian manufacturing sites.

Kitting recorded net sales of CHF 71.1 million ($80.9 million) for the first half of 2023. This is an increase of 10.4% at constant exchange rates compared to the first half of the prior year. The year-on-year increase is due to new projects with Western customers, primarily in India and North America. Kitting sales are expected to receive additional momentum once new blade molds come online for Western wind customers. The European Kitting footprint has been successfully adjusted, with the relocation of operations from Denmark to Spain and Turkey.

Manufacturing Solutions saw an increase of its first half of 2023 net sales by 5.1% at constant exchange rates compared to prior year to CHF 30.7 million ($34.9 million). The mold mix significantly changed in 2023 versus 2022 with many more mold systems sold to Western customers as they tool up for the next generation of bigger wind turbines.

Visit this link for a complete table of key financial figures.

Gurit reached an operating profit of CHF 13 million ($14.8 million) with an operating profit margin of 5.3%. Excluding divestment effects, restructuring and impairment charges, the adjusted operating profit significantly improved to CHF 13.6 million ($15.5 million) with an adjusted operating profit margin of 5.6%, compared to CHF 4.6 million ($5.2 million) or 2.0% in the first half of the prior year.

The adjusted operating profit margin has improved to above 10% in the businesses without the Structural Profiles business acquired in 2022, which ran a sizeable loss in its Danish operations, while the Indian site will ramp up during the second half of 2023. The profit improvement stems mainly from a more favorable product mix in the Manufacturing Solutions business, better performance in the newly set up PET operations and cost saving measures undertaken in 2022 and 2023. Earnings per share are CHF 1.54 ($1.75) in H1 2023 (H1 2022: CHF 3.61 ($4.11) which includes CHF 3.91 ($4.45) gain per share from the sales of the Aerospace business).

Gurit says it significantly improved the cash flow generation from operating activities to CHF 12.5 million ($14.2 million) compared to CHF -13.1 million (-$14.9 million) in the first half of the previous year. This increase is due to a higher operating profit in 2023 and many working capital improvements made in H2 2022 and 2023. Capital expenditures amounted to CHF 5.5 million ($6.3 million) during H1 2023 compared to CHF 6.7 million ($7.6 million) for the first half of the previous year. Major growth capacity investments particularly in structural profiles, were made at the now fully operational site in Chennai, India. Gurit could also significantly reduce the net debt by CHF 26.2 million ($29.9 million) from CHF 104.2 million ($118.6 million) in June 2022 to CHF 78.0 million ($88.8 million) in June 2023.

After a better-than-expected first half performance, Gurit anticipates the good business environment in marine and industrial to continue, while the company expects short-term uncertainties to remain in wind. The company has raised the adjusted operating profit guidance for the full year of 2023 on the operating profit margin from a range of 2-5% so far to 3-6% and expects net sales in the range of CHF 460-490 million ($523-$557 million).

Structural Profiles business

Gurit acquired 60% of Fiberline Composites A/S in May 2022. Since this first acquisition step, the company has added a setup of the business in India, as part of its Chennai campus. This operation will go in full ramp-up in H2 2023. The existing Danish operation has been hurt by high cost and low customer demand in 2022 and markedly in 2023 and creates a significant loss in H1 2023 and the entire year.

In order to accelerate the improvement in the Danish operations, Gurit signed a share purchase agreement with the Thorning family over the residual 40% of the shares this month (earlier than originally anticipated) to gain full control over the business.

Organizational change in the Board of Directors

Effective Aug. 8, Rudolf Hadorn has resigned from the Board of Directors of Gurit for private reasons. He will fully dedicate himself to pursue his various private business activities. The Board of Directors thanks Hadorn for the almost 16 years of service as a CEO and member of the Board of Directors and wishes him all the best. Board member Philippe Royer was elected by the Board of Directors as chairman of Gurit until the next Annual General Meeting in 2024.

Gurit obtains A-rating for ESG performance

Gurit’s Sustainability performance has been awarded with an A-rating from MSCI for the first time in July 2023, ranking Gurit within the top tier of all rated companies in the specialty chemicals sector. It indicates the company’s practices of managing ESG risks and opportunities are well-aligned with shareholder interests and is an important recognition of Gurit’s execution of its sustainability strategy.

Read Next

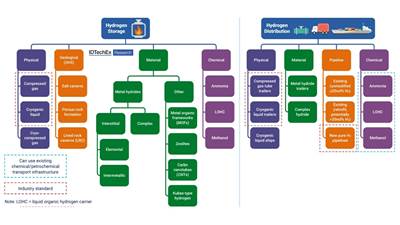

Report addresses advancements, challenges in hydrogen value chain

IDTechEx gives an overview of the solutions that currently exist for hydrogen storage and distribution, and how these two components are vital to ensuring the full potential of this rapidly growing sector.

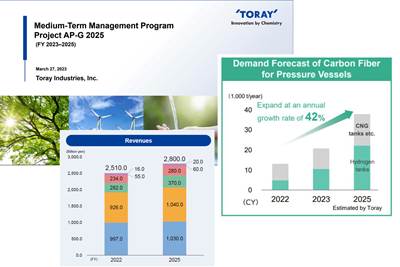

Read MoreToray announces growth, investment in carbon fiber composite materials

As part of its 2023-2025 management strategy, Toray projects 42% growth for pressure vessels, 30% growth in carbon fiber composite materials revenue and a doubling of capital investment.

Read MoreRUAG International reports positive business growth in 2022

Annual financial results describe full order books, three successfully sold business units and an increase in revenue, largely due to the New Space economy, signaling a positive outlook for 2023 and beyond.

Read More