Report addresses advancements, challenges in hydrogen value chain

IDTechEx gives an overview of the solutions that currently exist for hydrogen storage and distribution, and how these two components are vital to ensuring the full potential of this rapidly growing sector.

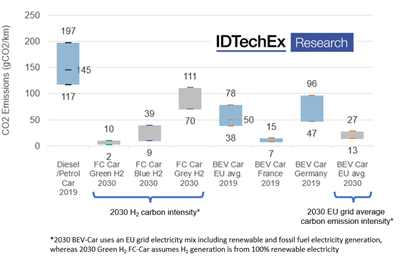

While much focus in the rapidly growing hydrogen sector has been placed on the upstream development of low-carbon hydrogen production sites and downstream advancements in fuel cell technologies and industrial use cases, the midstream infrastructure needed to store and transport hydrogen has often received less consideration. A new market report released by research and consultancy firm IDTechEx (Cambridge, U.K.) titled “Hydrogen Economy 2023-2033: Production, Storage, Distribution & Applications,” delves deeper into the subject of hydrogen storage and distribution technologies, a critical link to bridge the gap between hydrogen production and consumption.

Despite its impressive gravimetric energy density, one of the main challenges with hydrogen cited by IDTechEx is the complexity of its storage and transportation. This stems from its extremely low density at ambient conditions leading to low volumetric energy density. Consequently, significant compression (100 to 700 bar) or liquefaction at an extreme boiling point of -253°C is necessary to enhance its volumetric energy density for storing and transporting adequate amounts.

Although mature, incumbent compressed gas and cryogenic liquid storage methods have significant disadvantages. These methods are energy-intensive, diminishing the hydrogen's net energy content. Compression consumes 10-30% of the original energy, while liquefaction can use up to 30-40%, with the added burden of requiring a separate liquefaction plant, entailing considerable capital investment. Such inefficiencies hinder some applications, such as fuel cell electric vehicle (FCEV) mobility and energy storage, by sharply lowering the overall energy efficiency. Safety risks with compressed gas storage and boil-off issues with liquid H2 storage lead to hydrogen loss, further exacerbating the challenges (read about how Cryomotive’s cryo-compressed hydrogen solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses). Collectively, these factors make domestic and international transport of hydrogen expensive and inefficient.

Globally, hydrogen pipelines do exist, totaling an estimated 5,000 kilometers, but their reach is largely restricted to specific regions like parts of Texas and Louisiana around the Gulf Coast or areas in France, Belgium, Netherlands and Germany. Typically operated by industrial gas giants like Air Products, Linde and Air Liquide, these pipelines serve industrial facilities such as refineries within a limited range of production sites. This confinement emphasizes the pressing need to expand pipeline networks to connect varying regions of production and consumption more widely.

Hydrogen storage options, use cases

Many solutions are available, but the optimal choice depends on storage size and application. Compressed gas and LH2 storage tanks will likely continue to serve stationary storage applications, such as hydrogen refueling stations. Liquid hydrogen spheres may be used to store large quantities at production sites and import/export terminals. Established players like Tenaris (compressed gas storage), Chart Industries (LH2 tanks) and McDermott CB&I (LH2 spherical vessels) already supply these well-commercialized solutions.

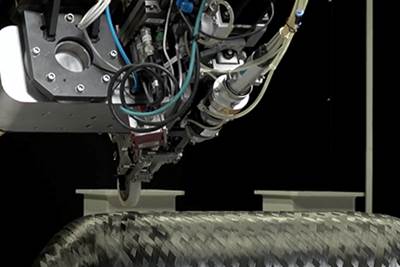

Compressed hydrogen tanks, especially Type III and IV composite tanks, are gaining traction in the FCEV market, as they are most suitable to store hydrogen on-board of a vehicle. Many FCEVs, such as the Hyundai Nexo and Toyota Mirai, use Type IV tanks storing hydrogen at 700 bar. Compressed storage is expected to persist in many FCEV segments, dominating light-duty ones. However, LH2 tanks present the advantage of higher capacities, which could be beneficial for the heavy-duty segments. Hence, some companies, like Daimler Truck, are trialing the use of LH2.

Storage systems using metal hydrides show promise for stationary applications similar to existing compressed and LH2 systems. These systems, which operate at much lower pressures (10-50 bar) and use pressure cycling for adsorption/release, may be more suitable for hydrogen energy storage applications due to reduced energy consumption and, thus, improved round-trip efficiency. Companies like GKN Hydrogen are progressing towards commercialization, having demonstrated its systems in off-grid energy storage and residential combined heat and power. Many more companies are developing systems based on metal hydrides.

The global embrace of hydrogen storage and distribution technologies will expand as production and end-use sites increase.

Underground hydrogen storage, using reservoirs like salt caverns, builds on established natural gas storage methods. Integration of such facilities into hydrogen pipeline networks is planned by operators like Uniper and Gasunie in the coming years. Underground storage is expected to play a key role in seasonal hydrogen storage to supply sectors in times of lower demand, like natural gas storage. Underground facilities may also be used by industrial projects as a buffer reserve of hydrogen — HYBRIT, a sustainable steelmaking project in Sweden, is testing such a concept using a lined rock cavern (LRC). However, regulation and long project development times remain key challenges for this storage type.

Hydrogen distribution options, use cases

Currently, compressed and LH2 trailers supply smaller scale applications like refueling stations or pilot projects. IDTechEx reports that this trend is likely to continue as large-scale transportation where continuous hydrogen supplies are needed may not be viable with these methods. Many types of vessels could be used in terms of compressed gas transport, from Type I to IV, developed by companies like Hexagon Purus (read “Hexagon Purus Westminster: Experience, growth, new developments in hydrogen storage”). Other companies, such as Lifte H2, are using trailer concepts to develop mobile refuelers, which can compensate for the lack of a hydrogen refueling station.

Large-scale and longer distance transport will necessitate pipelines, either running directly from production to end-use sites or feeding into pipeline networks. New construction is planned, with some projects like the HyNet North West Hydrogen Pipeline already underway. Repurposing natural gas pipelines is a possibility but requires extensive simulation, testing and risk evaluation to identify suitable pipelines. For example, the European Hydrogen Backbone initiative is developing a large-scale pipeline network, with more than 30 operators participating; many of the pipelines that will be used are planned to be repurposed from existing networks. Blending hydrogen into natural gas is also a popular topic as it is a way of partially decarbonizing the heating and power sector, with projects like HyDeploy proving a blend of 20 vol% being safe in existing pipelines. However, a higher percentage of hydrogen blends will require the modification of many appliances and equipment in the residential and industrial sectors.

International long-distance transport may involve LH2 or conversion to hydrogen carriers like ammonia or liquid organic hydrogen carriers (LOHC). LH2 transport was demonstrated by the Suiso Frontier vessel (built by Kawasaki Heavy Industries) in the HESC project, transporting hydrogen from Australia to Japan. However, this pathway may be less viable compared to carriers due to the technical and commercial difficulties of dealing with LH2.

Future insights

The global embrace of hydrogen storage and distribution technologies will expand as production and end-use sites increase. This represents an opportunity for product supply, project development and R&D to innovate and refine existing methods. IDTechEx projects the global low-carbon hydrogen production market to reach $130 billion by 2033, expecting substantial growth in transport and storage solutions. Its new report offers an exhaustive overview of the value chain, including technological analyses, comparisons, commercial activities, innovations and market trends.

Related Content

ECOHYDRO project to enable recyclable composites for hydrogen storage

With the involvement of two schools from the Institut Mines-Télécom, the 4-year project aims to improve the intrinsic properties of a composite material based on Elium via four concrete demonstrators.

Read MorePolar Technology develops innovative solutions for hydrogen storage

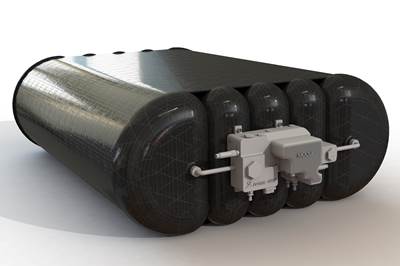

Conformable “Hydrogen in a Box” prototype for compressed gas storage has been tested to 350 and 700 bar, liquid hydrogen storage is being evaluated.

Read MoreComposites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreHexagon Purus Westminster: Experience, growth, new developments in hydrogen storage

Hexagon Purus scales production of Type 4 composite tanks, discusses growth, recyclability, sensors and carbon fiber supply and sustainability.

Read MoreRead Next

THOR project develops mass-producible CFRTP hydrogen tanks

The three-year project, concluded in 2022 and aided by partners spanning the entire hydrogen storage supply chain, tested and produced 15 thermoplastic tanks, with the goal of achieving broader market introduction.

Read MorePolar Technology, Moog Controls to develop H2 storage solution

“Hydrogen in a Box,” is an integrated hydrogen storage and management solution that will enable efficient packaging of Type III and Type IV vessels.

Read MoreIDTechEx outlook suggests hydrogen fuel prices, volume are affecting fuel cell vehicle rollout

Report on the current state of FCEV development studies the great lengths made by Toyota, Hyundai and Honda to build industry momentum, and the current state of green hydrogen’s expense and volume production.

Read More