U.S. DOE releases annual wind market reports

The U.S. Department of Energy reports 7,599 megawatts of land-based wind installed in 2018, and 25,824 megawatts of offshore wind in various stages of development.

The U.S. Department of Energy (DOE; Washington, D.C.) has released annual market reports documenting data and trends in wind installations, technologies, costs, prices and performance through the end of 2018 for three sectors: utility-scale land-based, offshore and distributed wind.

According to the reports, 7,599 megawatts of utility-scale land-based wind installations were instituted in 2018, and the sector was strengthened by accompanying record low costs and prices. The U.S. distributed wind sector is reported to now stand at 1,127 megawatts from over 83,000 wind turbines across all 50 states. In addition, the U.S. offshore wind industry is reported to have a pipeline of 25,824 megawatts in various stages of development.

The 2018 Wind Technologies Market Report, prepared by DOE’s Lawrence Berkeley National Laboratory, reported the following:

- The U.S. wind industry installed 7,588 megawatts of capacity in 2018, bringing total utility-scale wind capacity to over 96 gigawatts.

- Wind industry employment is at an all-time high, supporting 114,000 jobs.

- In total, 41 states operated utility-scale wind projects. Texas leads the nation with nearly 25 gigawatts of wind capacity, while California, Iowa, Kansas and Oklahoma have more than 5 gigawatts.

- Wind energy provides 6.5% of the nation’s electricity, more than 10% of total generation in 14 states, and more than 30% in Iowa, Kansas and Oklahoma.

- The trend of installing wind turbines that are larger and more powerful continued in 2018.

- The price of wind energy being sold in long-term contracts is at an all-time low. Wind power purchase agreement (PPA) prices are below 2 cents per kilowatt-hour, driven by a combination of higher capacity factors, declining turbine prices and operating costs, low interest rates and the production tax credit.

The 2018 Distributed Wind Market Report, prepared by DOE’s Pacific Northwest National Laboratory, reports the following:

- U.S. wind turbines in distributed applications reached a cumulative installed capacity of 1,127 megawatts in 2018. This capacity comes from over 83,000 turbines installed across all 50 states, Puerto Rico, the U.S. Virgin Islands and Guam.

- The trend of using larger wind turbines in distributed applications continued in 2018. The average capacity of large-scale turbines installed in distributed applications in 2018 was 2.1 megawatts — almost double the capacity of turbines used in 2003.

- Commercial and industrial distributed wind projects increased in 2018, representing 29% of total project capacity. Distributed wind for utility customers remained the most prevalent use, representing 47% of capacity in 2018.

- Of small wind turbines (nameplate capacity up to 100 kilowatts) deployed in the United States, very small turbines — less than 1 kilowatt— are contributing an increasingly larger percentage of both the total number of turbines (99%) and capacity (47%) of small wind projects. These systems are often used for battery charging and are sometimes integrated with solar PV panels to power remote infrastructure.

The 2018 Offshore Wind Technologies Market Report, prepared by DOE’s National Renewable Energy Laboratory, found the following:

- The U.S. offshore wind project development pipeline grew to a potential generating capacity of 25,824 megawatts across 13 states, including the Block Island Wind Farm commissioned in 2016.

- Projects totaling 21,225 megawatts have exclusive site control, meaning the developer has a lease or other contract to develop the site. Most of these projects are on the Eastern seaboard, with one in the Great Lakes.

- California and Hawaii have several early-stage floating offshore wind projects in the planning phase.

- The Department of the Interior’s Bureau of Ocean Energy Management (BOEM) auctions for three lease areas off the coast of Massachusetts brought in winning bids of $135 million — more than three times the value of previous BOEM auctions — indicating strong interest and confidence in the U.S. offshore wind market.

- Offtake prices for the first commercial-scale U.S. offshore wind project — Vineyard Wind off the coast of Massachusetts — came in lower than expected at $65–$75 per megawatt-hour.

- Technology trends toward larger turbines continued, with offshore turbines installed globally in 2018 averaging 5.5 megawatts, and turbines with capacities of 10–12 megawatts coming to market in the next couple years.

Find the market reports on the DOE’s website.

Related Content

NCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

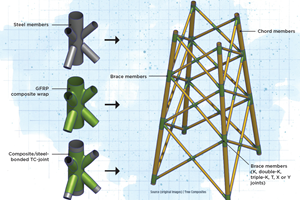

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreHonda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreRead Next

CFRP planing head: 50% less mass, 1.5 times faster rotation

Novel, modular design minimizes weight for high-precision cutting tools with faster production speeds.

Read MorePlant tour: A&P, Cincinnati, OH

A&P has made a name for itself as a braider, but the depth and breadth of its technical aptitude comes into sharp focus with a peek behind usually closed doors.

Read MoreVIDEO: High-rate composites production for aerospace

Westlake Epoxy’s process on display at CAMX 2024 reduces cycle time from hours to just 15 minutes.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)