In-house prepregging: Cost/benefit calculus

Scaled-down systems are flexible enough for R&D and production, but can they earn their keep?

The first prepreg machine was developed in the late 1960s to support the production of carbon fiber tape for the manufacture of composite structures on a U.S. National Aeronautics and Space Admin. (NASA) lunar lander. At that time, resin systems were, for the most part, difficult to mix, catalyze, process consistently and manage during production. Because of this, most prepreg manufacturing fell to large chemical companies and resin producers.

Since then, and for most of the composites industry’s life, prepregging has remained the almost exclusive domain of relatively large firms — resin manufacturers and dedicated compounders or the carbon fiber manufacturers themselves. Toray Composites (America) Inc. (Tacoma, Wash.), for example, prepregs carbon fiber in the U.S. for its parent company, Tokyo, Japan-based Toray Industries. Their size makes it possible for them to take advantage of economies of scale as they produce off-the-shelf material designed to meet a particular specification.

At the other end of the spectrum are the R&D specialists who use lab-scale prepregging equipment to create the resin/fiber combinations that eventually work their way onto the production floor.

Consumers of carbon fiber prepreg have long relied on this supply chain to provide the bulk of the certified material used in many of today’s largest manufacturing programs, including the Boeing 787, the Airbus A350 XWB and other aircraft platforms. It’s an arrangement that works well for large composites manufacturers who know they will need massive quantities of a specified material and can, therefore, take advantage of the price breaks associated with buying prepreg in large lots.

All well and good, but ….

Left out of this equation are the relatively small composites manufacturers who need prepreg in quantities greater than can be produced by the R&D lab, but they can’t order off-the-shelf, certified prepreg in quantities large enough to get a competitive price. It is into this niche that companies such as Century Design Inc. (CDI, San Diego, Calif.) are now marketing directly to composites manufacturers a prepregging system that combines R&D flexibility with on-demand production capability.

The question composites manufacturers must answer is how to assess the value of bringing prepregging in-house vs. sticking with the tried-but-not-quite-true supply chain. Keith McConnell, president of CDI, says there are several variables to consider before taking such a leap. Predictably, the first variable all customers ask about is cost: Is there money to be saved with an in-house prepregging system?

Well and good, again, but ….

“This is the wrong question,” McConnell contends. “Although there are economics to consider, acquisition of a prepreg system demands evaluation of several factors.”

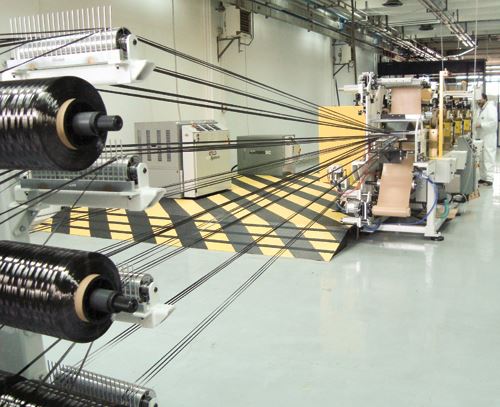

The first, he says, is the aforementioned niche. Is the composites manufacturer serving a market in which expansion demands more flexibility than large prepreggers can provide, but at volumes that cannot be met by small lab-scale systems? How much prepreg is needed, and at what width? Systems of the type provided by CDI measure about 20 ft/6m long, including heaters and chillers, and can produce prepregged material at a rate of about 10m/min (33 ft/min). The control system stores and can retrieve recipes quickly, making the overall system manageable by a single “basic” operator.

The second factor revolves around logistics. Is the manufacturer looking to speed time to market and avoid the chore of storing, freezing and tracking prepreg? An in-house system that is configured properly can be arranged to provide prepreg directly to the tool and bypass storage requirements altogether.

The third factor addresses intellectual property control. A manufacturer who relies on a specialized or proprietary resin formulation could be putting that secret at risk when relying on a traditional prepregger. “This is key for businesses in crowded market spaces,” says McConnell, “where maintaining an advantage requires keeping control of proprietary information.” A smaller prepregging system’s lab-like flexibility also enables the manufacturer to test and tweak resin recipes in-house and more quickly meet the needs of a customer and the demands of the specific application.

Well, that’s good, too, but ….

Of course, installing an in-house prepregging system means that a composites manufacturer also must become a resin formulator, a step that McConnell admits can be challenging. But he says the task is manageable given the automation provided today by many resin development systems. “Resin mixing and storage must be considered,” he says. “The mixing part can be a little more complicated.” He reports that customers who are hesitant can work with resin formulators to develop recipes.

After these variables have been considered, the composites manufacturer is free to contemplate cost and return on investment. McConnell suggests that the capital cost alone should not be considered in a vacuum. It must be checked against other factors that add value to the enterprise and thus increase the value of the prepregging system.

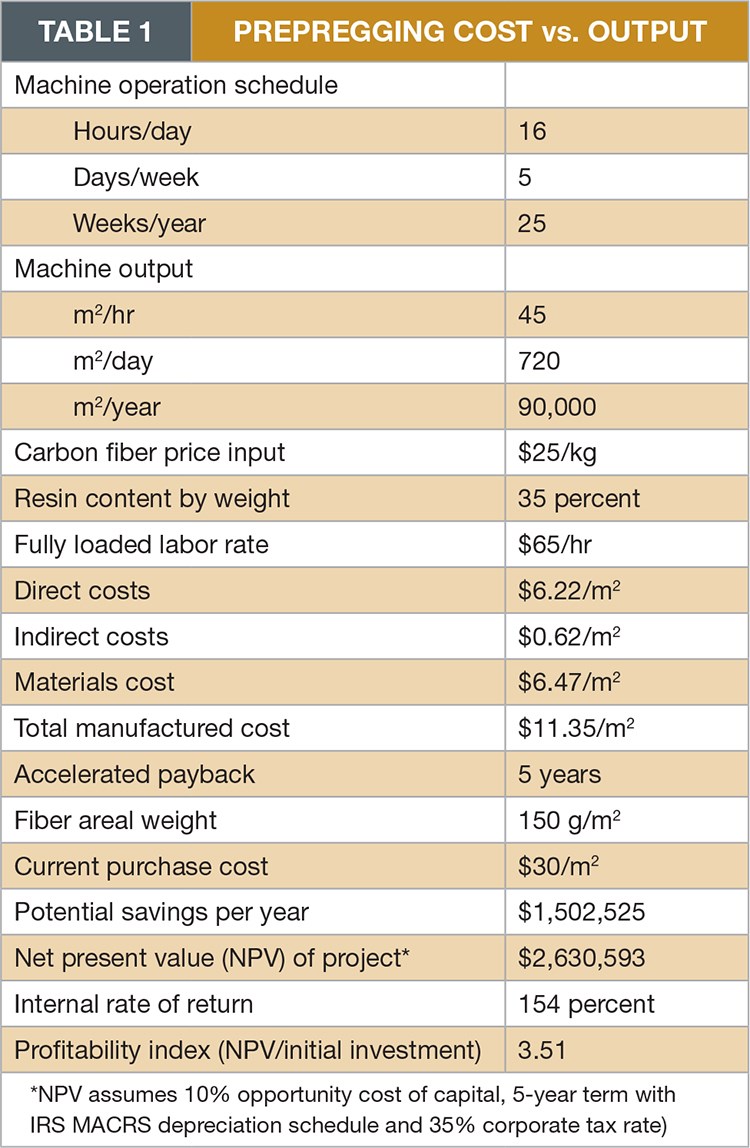

CDI has developed a calculus to help customers determine the value of their investment in a prepregging system. Ted Hile, director of sales at CDI, notes that the calculus takes into account several variables, including machine utilization rate, carbon fiber price input, resin content percentage, labor rate and cost of current prepreg sourced from a third party. It assumes a five-year cash-flow-and-depreciation model and produces two values: Net Present Value of Project (value of prepreg investment to the user) and Internal Rate of Return, which ideally should be more than 100 percent to demonstrate a net benefit to the user.

Good? Well, one more “but”

Hile acknowledges that the calculus is still evolving and needs more testing in a real-world environment, but Table 1 outlines one possible scenario, based on data CDI has gathered. Based on a work schedule of 16 hr/day, 5 days/week and 25 weeks/year, it shows a carbon fiber input cost of $25/kg, a resin content by weight of 35 percent, a fully loaded labor rate of $65/hr and an accelerated payback of five years. Based on these variables and a capital investment of <$1 million for the prepreg machine and creel, CDI projects potential annual savings of $1.5 million, a $2.6 million Net Present Value of Project and a 154 percent Internal Rate of Return. In other words, after five years, the value of an in-house prepregging system would exceed the system’s capital cost of investment by more than three times.

“Variables will change, of course,” admits Hile, “and this formula needs to be tested and refined. But you can see that for many composites manufacturers, an investment like this can make good financial sense.”

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More