Augmenting engineered thermoplastics with natural fibers

The Paris Climate Accord mandate for net-zero carbon by 2050 has kick-started an innovation revolution for natural fibers and sustainably engineered resins.

For years, glass fiber and carbon fiber have ruled the world of reinforcements. Manufacturers demanded high-performance, low-cost, and lightweight fibers for highly engineered resins. Until recently, most of the reinforcements used in these resins have been synthetic.

As manufacturers look to use new materials to produce high-performance, lower carbon footprint products, natural fibers have resurfaced as a sustainable alternative.

Back in the 1930s, industrial hemp became collateral damage in America’s war on drugs. This came after Henry Ford successfully built thousands of vehicles that used hemp fibers as reinforcements. As one of only a few high-performance natural fibers, hemp’s legal status set the world back generations in the commercialization of products that used bio-based materials.

Other natural fibers, such as cotton for clothing and flax fibers for linens, have been used for centuries. But the use of natural fiber reinforcements in composites has been limited because there has been no reliable supply chain, product consistency or market development. Natural fibers also need to be engineered in specific ways to enhance their bonding and performance properties in plastics.

Fortunately, the 2018 Farm Bill made industrial hemp fully legal in the eyes of the U.S. government. This opened the door for the creation of industrial hemp supply chains that could help create stronger, lighter, cheaper and more sustainable products across manufacturing.

Over the past few years, the American automotive OEMs and their suppliers have started to invest in R&D on hemp-filled plastic. European manufacturers, on the other hand, have been using natural fiber reinforcements to reduce the carbon footprint and weight of composites for decades.

Today, natural fibers are best used to augment glass and carbon fibers to create unique mechanical properties.

As an example, earlier this year, BMW (Munich, Germany) participated in an oversubscribed $35 million Series B capital raise for Bcomp (Fribourg, Switzerland), a manufacturer of high-performance composites made from natural fibers. BMW’s work with Bcomp, and its history of using hemp fiber-reinforced composites in its i3 electric vehicle (EV), proves that large manufacturers are investing in high-performance solutions with a smaller carbon footprint. Other European companies, like carmaker Porsche (Stuttgart, Germany), have applied natural fiber-reinforced composites in its 718 Cayman GT4 Clubsport.

Bcomp is focused on woven natural fiber mats that are used for thermoforming and compression molding in polypropylene automotive applications. Heartland (Detroit, Mich., U.S.), a material innovation company that engineers hemp fibers as reinforcements for polymers, is focused on nonwoven applications to reduce the carbon footprint of plastics, rubbers and foams. Heartland and Bcomp also are supplying engineered natural fiber reinforcements to solve sustainability problems across manufacturing.

This natural fiber-reinforced motocross brake cover developed by Bcomp and KTM Technologies highlights the ways in which natural fibers can produce sustainable products. Photo Credit: Bcomp

Efficiency targets in the automotive industry to reduce the cost, weight and the carbon footprint of raw materials have pushed the supply chain to reexamine long-used and depended-on materials. For example, the carbon footprint of 30% glass-filled nylon, which is a mainstay of automotive manufacturing, is not particularly attractive. A carbon-negative and lightweight fiber like industrial hemp can solve this sustainability problem. The secret is to know the right formulation that will create previously unfounded performance properties.

Today, natural fibers are best used to augment glass and carbon fibers to create unique mechanical properties. Mixing glass fibers, which have high stiffness properties, with hemp fibers, which have high modulus properties, creates never-before-seen performance with less weight and a lower carbon footprint. Hemp can also be used to replace additives like talc, calcium carbonate, carbon black and other commonly used minerals.

Compounding natural fibers into traditional thermoplastics isn’t straightforward for those who haven’t worked with cellulosic materials. Without the right additives, bio-based materials and petroleum-based plastics can have bonding and performance problems. One of the nuances of natural fiber-filled nylons, for example, is the temperature the materials are run at. Typically, the melting point of nylon is close to the degradation point of natural fibers. Knowing how to find this temperature balance can mean the difference between a high-performance nylon, and a campfire smell in the facility.

Manufacturers seeking to reduce their carbon footprint likely will seek opportunities to use natural fibers more to displace traditional fibers and additives. For many companies, starting with augmentation has become an easy way to dip their toe in the waters of sustainable materials (without diving in head first).

For most manufacturers, the material changes coming out over the next few years are grounded in sustainability mandates that have been integrated into the world’s largest organizations. Most of these sustainability initiatives are driven by the Paris Climate Agreement, whose members have set out to mandate that countries become net-zero carbon by 2050. Large companies across industries have made similar commitments to their partners and governments. With the recent announcement by the U.S. Securities and Exchange Commission (SEC) on climate-related disclosures, public companies are going to be forced to report their Scope 1, 2 and 3 emissions in their financial reporting.

The Scope 3 emissions of a reporting company will be quantified by the indirect emissions that occur upstream and downstream in the value chain. This calculation will include the carbon footprint of each pound of raw material that is purchased by manufacturers. This means that if a company wants to supply materials or component parts to a publicly traded company, they will have to be able to provide carbon-footprint data to comply with SEC regulations.

As these mandates phase in over the next few years, raw material suppliers will have to effectively quantify the carbon dioxide required to create and distribute each pound of material. In the short term, raw material suppliers should be positioning themselves to help their customers exceed their sustainability mandates. They can do this by accessing reliable supply chains of biomaterials that can replace mined and petroleum-based fibers and additives. Long term, the largest raw material suppliers need to have carbon footprint data ready as the reporting of publicly traded companies phases in through fiscal years 2024 and 2025.

While the issue of accessing reliable supply chains of biomaterials and biochemicals still persists for most companies, ESG (environmental, social and governance) investment is accounting for one-third of total U.S. assets under management, with heavy investments being made in more efficient carbon footprint solutions.

The companies that help the largest manufacturers use lower carbon footprint materials and technologies are positioned to win in an ESG-driven world. Similarly, manufacturers and suppliers who lead sustainable material innovation are positioned to become premier solution providers.

About the Author

Jesse Henry

Jesse Henry is the founder and CEO of Heartland Industries (Detroit, Mich., U.S.), a material innovation company that engineers hemp fibers as reinforcements for plastics. Previously, he was a national speaker for Tony Robbins and chief of staff at Intersection Capital. Earlier in his career, he wrote a book titled “The Millennial Merger: How to Sell, Manage, Empathize and Communicate in a Multi-Generational Workforce.” He also did a TEDx Talk titled “The Theory of Success.” Jesse graduated with a bachelor’s degree in entrepreneurship from Florida State University (FSU). jesse.henry@heartland.io

Related Content

DITF Denkendorf advances sustainable carbon fibers, oxide fibers for CMC and more

The German Institutes of Textile and Fiber Research are targeting more sustainable carbon fiber via low-pressure stabilization and bio-based precursors, and working with Saint-Gobain to commercialize oxide ceramic fibers for CMC.

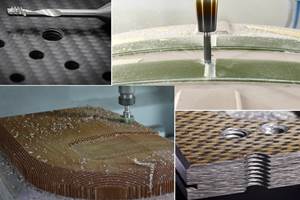

Read MoreOptimizing machining for composites: Tool designs, processes and Industry 4.0 systems

Hufschmied moves beyond optimized milling and drilling tools to develop SonicShark inline quality control system and Cutting Edge World cloud platform for optimized tool use and processes.

Read MoreNASCAR unveils BEV prototype featuring natural fiber bodywork

Implementation of Bcomp technical flax fibers in a U.S. motorsport first represents NASCAR’s step toward more sustainable competition vehicles.

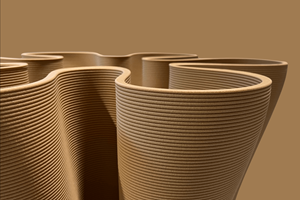

Read MoreSulapac introduces Sulapac Flow 1.7 to replace PLA, ABS and PP in FDM, FGF

Available as filament and granules for extrusion, new wood composite matches properties yet is compostable, eliminates microplastics and reduces carbon footprint.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More