CAMX 2014 show report

Bigger, better and more inclusive than any previous U.S. composites trade event, the inaugural show turns North American eyes forward to the future.

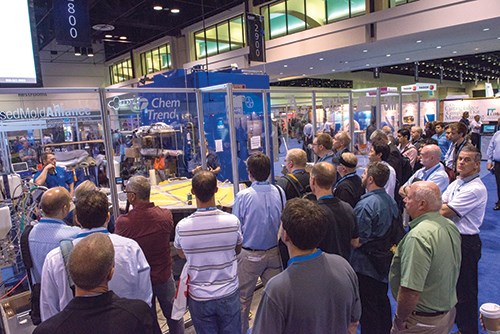

The inaugural Composites & Advanced Materials Expo (CAMX) conference and trade show kicked off on Oct. 13 in Orlando, Fla. It represents a first-of-its-kind event in North America: A single exhibition that unites the full spectrum of composites suppliers and fabricators, representing not only aerospace and other “advanced” applications, but automotive, wind, marine, construction, oil and gas and other “industrial” end-markets. Jointly operated by the American Composites Manufacturers Assn. (ACMA, Arlington, Va.) and the Society for the Advancement of Material and Process Engineering (SAMPE, Covina, Calif.), CAMX offered a promising glimpse of the composites future, featuring materials, technology and software designed to meet the needs of the entire composites industry. The numbers alone — more than 7,100 attendees and 550 exhibitors — made the show a success. CAMX organizers conferred awards on a large group of innovators at the 2014 show (see "CAMX 2014 award winners," at the end of this article or click on its title under "Editor's Picks," at top right). And the CT staff was out in force at CAMX and filed the following report of conference and show highlights.

CAMX keynote

CAMX 2014 was officially launched on Tuesday, Oct. 14 with a presentation by Kevin Mickey, the president of Scaled Composites LLC (Mojave, Calif.). He was introduced by Kim Howard of Owens Corning Composite Solutions Business (Toledo, Ohio), who emphasized the importance of innovation, risk-taking and a collaborative working environment, qualities exemplified by Scaled Composites’ and key to the company’s success.

An engaging speaker, Mickey referred to CAMX attendees as the “world’s brightest people,” and reviewed the many groundbreaking milestones that Scaled Composites has passed since its beginnings in 1982. A notable one, in 2004, was its capture of the $10 million Ansari X-Prize for development of a reusable, rocket-powered composite space vehicle that could transport three people into suborbital space and return them safely to earth, built with funding from billionaire Paul Allen. Tongue firmly in cheek, Mickey elicited laughter when he said of the X-Prize, "Let me give you one piece of business advice: Do not spend $30 million to win $10 million."

Mickey inspired the audience with his company’s philosophy of finding programs, like Virgin Galactic’s (Las Cruces, N.M.) developing space tourism venture, that excite workers and make for a fun working environment. He stressed that risk-taking is important: “If you take chances, you might fail, but if you don’t take chances, you’ll never make any progress. Don’t be afraid of taking educated, calculated risks!” The success of Scaled Composites shows that being bold and taking risks, while celebrating results and learning from failures, is a winning combination. Concluded Mickey, “The process shouldn’t be the product — stop talking and start doing.”

Technology in the spotlight

There was no shortage of actual manufacturing taking place at CAMX, some of it designed to highlight capability, some to educate composite professionals on manufacturing processing methods.

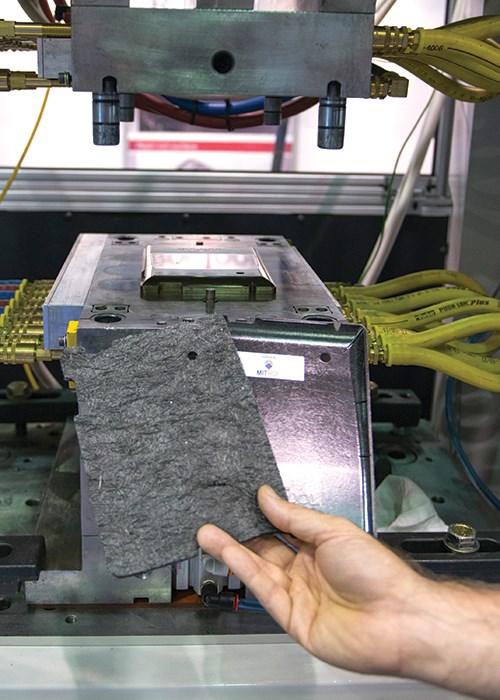

Roctool Inc.(Charlotte, N.C.), which manufactures compression and injection molding systems that use induction-heated molds for fast heating and cooling, garnered much attention at CAMX, where it molded 0.8-mm/0.03-inch thick tablet computer cases using preforms fabricated with material supplied by Materials Innovation Technology Reengineered Carbon Fiber (MIT-RCF, Fletcher, N.C.). The preforms featured MIT-RCF's reclaimed carbon fiber nonwoven at 35 percent loading comingled with a polypropylene (PP) fiber. Preforms were inserted into the mold and heated from 150°F/66°C to 420°F/216°C in 60 seconds, followed by a 60-second hold and a 90-second cool-down for demolding. Advantages of the system include cost-effective nonwoven material, thin walls, resin-rich surface due to induction heating, cost-effective PP resin system, fast cycles, minimal warpage and minimal scrap. The mold for the demo was provided by ComDel Innovation (Wahpeton, N.D.).

Composites One (Arlington Heights, Ill.) and its Closed Mold Alliance demonstrated a variety of manufacturing processes, including infusion, resin transfer molding (RTM) and light RTM. Each was setup as a tutorial, designed to help attendees not only see how each process is used, but also understand best practices — where to inject resin on a given part, how to use pumping equipment (supplied by MVP), how to cope with corners and tight radii, and what to expect as a resin front moves through different fabric types and densities.

Markforged (Somerville, Mass.) had almost continuous traffic at its booth, where the company demonstrated the capabilities of its Mark One additive manufacturing (AM) 3-D printer, which (so far) uniquely produces parts made with continuous carbon fiber in a thermoplastic resin. The Mark One uses fused deposition modeling (FDM), an extrusion-like process, for placement of resin and towpreg in the flat x/y plane of the part. The company says that the fiber can be oriented, or added selectively only where needed, in the x/y plane, but notes that, at present, vertical, or z-directional, orientations aren’t possible. Each build layer is approximately 200 microns thick. Notably, the Mark One has two print heads, both designed and built in-house. One dispenses polyamide (nylon) or polylactide (PLA) resin, and the other dispenses continuous carbon or glass towpreg (dispensing of aramid fiber is in development). The towpreg is made in a proprietary process: A single carbon filament is coated with a specially developed thermoplastic resin, designed specifically for the printer.

CAMX attendees were clearly enthralled and energized by the technology, which is in its infancy and certainly could prove to be highly disruptive.

Innegra Technologies (Greenville, S.C.) demonstrated the increased toughness that its Innegra S high-performance olefin fibers can impart by dropping a 4-lb/1.8-kg weight from roughly 45 inches/1 m simultaneously onto two laminates infused with Gurit SP115 epoxy resin: three plies of 7781 (8Hsatin) 100 percent glass fiber fabric, weighing 8.85 oz/yd2 (300 g/m2), vs. three plies of plain-weave fabric weighing 8.2 oz/yd2 (278 g/m2) made from Innegra HG fiber. The latter comprises Innegra S and glass filaments commingled in a 40 percent/60 percent volume ratio, respectively. After three drops, the images (see photo) show some damage and creasing in the Innegra HG laminate while the glass laminate is fractured and delaminated. This toughness has reduced vibration on ball impact by 17 percent to improve precision and control in the Head Youtek IG tennis racquet used by Wimbledon champion Andy Murray. Other applications include Freestyle World Champion Dan Jackson’s kayak, Bauer hockey sticks, as well as numerous helmets, paddles, surfboards, windsurf boards and stand-up paddle boards.

Composites manufacturer Matrix Composites Inc. (Rockledge, Fla.) highlighted its proprietary Hot Isostatic Resin Pressure Molding (HiRPM) ultra-precision closed-mold out of autoclave (OOA) process, developed for applications that require critical edges and control surfaces. HiRPM delivers part reliability of ±0.003-inch/0.076 mm without expensive autoclave outer mold line (OML) control devices, and it eliminates costly shimming in bonded assemblies, a time-consuming necessity in current aircraft production. It also reportedly eliminates debulking, and thus reduces cost and abbreviates cycle time while keeping void content below 0.5 percent.

Key collaborations

Cyrca Composite Products Co. (Ontario, Calif.), which distributes a range of composite materials and ancillaries, including Lilly-RAM and Axson resins, 3A Composites cores, Arkema catalysts and Sci-Grip adhesives, announced its partnership with SR Composites LLC (Henderson, Nev.), which will focus on training users of its Sprayomer elastomer rubber to make reusable vacuum bags use those bags to make cost-effective closed-molded composite parts.

Hexcel (Stanford, Conn.) showcased its HiTape dry unidirectional carbon fiber reinforcement for automated tape laying (ATL) and fiber placement (AFP) for out of autoclave-cured (OOA) primary aircraft structures (see “CFK-Valley Stade 2014 Conference Report” under “Editor’s Picks,” at top right). According to aerospace direct processes technical support manager Jacques Ducarre, the 140 percent increase in compression-after-impact (CAI) results from HiTape’s thermoplastic veil backing (5 percent by weight), which provides adhesion during automated layup. Ducarre worked with Aerocomposit (Moscow, Russia) in its development of an infused CFRP wingbox for the MS-21 single-aisle jetliner. He also has worked with Coriolis Composites SAS (Queven, France), during trials of this technology for aerospace and automotive applications, and with Ingersoll Machine Tools Inc. (Rockford, Ill.), which has demonstrated the use of 0.25-inch Hi-Tape in its production-level LYNX machine, which is reportedy capable of achieving topology-optimized structures.

IDI Composites International (Nobelsville, Ind.) announced its collaboration with Composite Castings LLC (CC, West Palm Beach, Fla.) to demonstrate volume production of a proprietary thermoset structural composite molding compound in the manufacturing of its proprietary “plastic engine block,” the Polimotor 2. This second refinement of inventor Matti Holtzberg’s original, based on the venerable Cosworth BDA racing engine, cuts the wight of the legacy metal design by 50 percent. IDI and CC have been working closely with Rockwood, Tenn.-based Toho Tenax America Inc. to identify strategic partners that can mold engine components and are expecting to prototype the Polimotor 2 in 2015, with the goal of near-term commercialization. IDI also has worked with DPS Electronics (Bozeman, Mont.) to use its ST-2158 structural thermoset compound in a high-durability, end-of-train wireless communication unit, replacing ome made of aluminum.

Keyrou, the manufactory behind Xin Xiu Electronics Co., Ltd.’s (Dongguan, Guangdong, China) 13 million+ Kevlar composite components used in Motorola’s used in their Razr and Razr MAXX HD cellphones, announced at the show Its new Evutec brand. Marketed from facilities in Walnut, Calif.), Evutek unites ecology — via wood, shell and other natural and recycled materials — with technology, including proprietary inline epoxy and 6D molding processes, the latter using laser cutting to achieve complete encapsulation and seamless parts with reportedy flawless finishes that require no further assembly, at volumes up to 10,000 per day. “We’re exploring where our advanced fiber and thermoset composite molding technologies might enable new applications, for example automotive, but also aerospace and military, where fibers like Kevlar are already well-proven,” says director of design David Rojas.

Autocomposites: Looking ahead

A CT contributing writer and the principal of Composites Forecasts and Consulting LLC (Mesa, Ariz.), market research specialist Chris Red walked CAMX conference attendees through his research into “The Automotive Market – Where is it Going and What’s Needed?” Noting that the auto industry in Europe and North America is only two model generations from the full extent of U.S. fuel economy and European CO2 emissions regulations, and that something similar in China will likely follow, he argued that fines and other penalties that will accrue for models that do not comply will be prime motivators for change. In the U.S., by 2025, CAFE will require that subcompacts achieve about 61 mpge, and a car in the Mercedes S-class will need a 45-mpge rating. He noted, for example, that in Europe, failure to comply will result in fines that will raise the price of an Aston Martin by about $20,000. In the U.S., General Motors (GM), for example, will pay $5.50 per each vehicle, per 1/10th of a missed mile. “So, by 2025,” he estimated for subcompacts, “if GM has got only 45 mpge, instead of what’s required, it could cost them $2 billion.” Red wagers that automakers will not simply pass those penalties on to car buyers, who could be footing the bill for fines to the tune of up to one-third of a car’s purchase price. He believes there a powerful incentive to adopt carbon fiber composites for lightweighting, at least in high-end vehicles. A carbon fiber passenger protection cell, for instance, will cost about $10,000, he notes, but points out that the figure falls well within the penalty situation for the luxury car sector. “That,” said Red, “buys a lot of technology.” The extra cost, will be passed long to the car buyer either way, but passing along the cost of technology that will pay for itself in increased fuel economy is far preferable to passing along fines for failure to comply.

Matthew Marks, the regulatory marketing manager for SABIC (Pittsfield, Mass.) followed Red to the podium. As the chairperson of the American Chemistry Council’s (ACC, Washington, D.C.) Plastics Div., he presented a synopsis of the latter’s new Roadmap for plastics and composites innovation in the automotive world, noting that it is “a strategy document to help us speak with one voice — something the metals industry has done for years,” Marks drew special attention to several provisions: A prime concern is to “foster a culture of collaboration between ACC members, and governmental and auto industry players.” Collaborative efforts, he added, should be directed at a Technology Demonstration Center: development of generic cost models that demonstrate plastics/composites advantages vs. metals; focus on manufacturing speed and multi-material joining and repair technologies; development of a shared materials properties database; new CAE tools and design guidelines; and composites-specific models for crashworhtiness.

Technical sessions also included a SAMPE panel headed by University of Alabama at Birmingham professor Uday Vaidya, which took on the topic of thermoplastic composites. Thermoplastic (TP) materials are gaining increasing attention in aerospace, automotive, energy, sporting goods, defense and emerging applications, thanks to their toughness, rapid processability and recyclability. The six panelists, chosen in equal numbers from industry and academia, included (in addition to Vaidya) Dr. Mark Janney, chief scientist at recycling firm MIT-RCF (Lake City, S.C.) Shridhar Yarlagadda, assistant director of research at the University of Delaware’s Center for Composites Materials; Ed Pilpel, president of Polystrand (Englewood, Colo.); Mike Favaloro, president and CEO of CompositeTechs LLC (Amesbury, Mass.); and Dr. Brent Strong, professor emeritus at Brigham Young University and head of Strong and Assoc. LLC (Sandy, Utah).

The session started with Strong’s overview of the thermoplastic resin space, comparing thermoplastic resins to thermoset resins in terms of properties. He noted the differences between low-cost, commodity thermoplastics (nylon, PE, PP, etc.), which have existed for a century, and high-end advanced thermoplastics such as PEEK, PPS and PEKK, which exhibit high solvent resistance and use temperatures and, with that, higher cost. Long and intertwined molecular structures gives thermoplastics their characteristic toughness and elongation.

Favaloro, who referred to TPs as “the first out-of-autoclave materials,” reviewed some of the current technologies and markets, and noted some new approaches, including Firewind, developed by Fibrtec Inc. (Atlanta, Texas), a method of preheating the tool to help facilitate molding of continuous fiber-reinforced TPs. Pilpel stressed that his company’s focus on, and development of, thermoplastic materials for industry came as a result of wanting to reduce waste while processing faster. His continuous fiber-reinforced TP products are used in automotive, truck and aerospace applications.

Yarlagadda looked critically at the positives and the negatives presented by thermoplastics. He pointed out that the very high processing temperatures required to melt advanced thermoplastics have, in the past, made it difficult to combine them with fibers, especially carbon, because the fiber sizing is severely compromised at those high temperatures. Without adequate sizing, the fiber/resin bond can be a problem, making it impossible to “capture the high toughness” of the material. New sizing forms, he said, are helping.

He also stressed that modeling is needed whenever a complex part geometry is planned (e.g., in a molded automotive part) because broadgoods will shift and fiber direction and orientation will change during molding. Very fast cycle times are non-isothermal, further complicating the picture. His wish? A fully coupled design/analysis/process model that includes fiber orientation. Yarlagadda cautioned attendees to be careful and to consider these potential problem areas.

Finally, Janney discussed the issue of recycling thermoplastic composites, particularly those containing carbon fiber. After noting that the short, discontinuous fibers that result from recycling will never match continuous carbon fiber performance, he went on to say that there are, nevertheless, opportunities for recycled fibers. He discussed, in particular, his company’s trademarked Co-DEP technology that makes them praically useful by commingling recycled carbon fibers with polymer fibers in a wet-laid process to produce processable mats.

The rise of recycling

Other notable sessions included a Green Composites track on Thursday, headed by MIT-RCF’s Janney and Dr. Brian Pillay of the University of Alabama at Birmingham, with the focus on recycling and re-use of composites. CT technical editor Sara Black was a part of the session, and spoke on the topic of life cycle analysis (LCA). The session represented some significant research into the fairly intransigent problem of recycling of composites, particularly thermoset composites.

Polystrand’s Pilpel, whose company is a subsidiary of thermoset fabricator Gordon Holdings Inc. (Montrose, Colo.), spoke about a possible approach for reusing waste products from his continuous fiber thermoplastic composites production. He discussed a project undertaken with the Materials Processing Applications Development (MPAD) center at the University of Alabama Birmingham (UAB), where an experiment was designed to test sample plaques made with Polystrand waste tape material mixed with new nylon resin. Tapes were chopped or shredded and mixed with dried resin, at varying fiber volumes, and then compression molded. While the experiment showed some unexpected variations in strength and modulus of the molded test plaques, depending on how the scrap material was handled and molded, nevertheless it proved that it is possible to collect and, with some value-added preparation, create a new molded product. Challenges include finding a viable end user for the product, and maintaining consistent part quality.

Presenter Pete George, an associate technical fellow at Boeing Research and Development (Tukwila, Wash.), touched on some of the major themes of composites and recycling, with his presentation entitled “Challenges to Successful Implementation of Composites Recycling, and Suggested Solutions.” There’s no question, he said, that carbon fiber composites use has grown dramatically over the past three decades. George backed that conclusion with data generated with partners MIT-RCF and RTP Company (Winona, Minn.). Several types of reclaimed fiber were included in the study, including dry intermediate modulus carbon fibers recovered from textile scrap by MIT RCF, and T800 fibers derived from toughened carbon prepreg scrap using a pyrolysis process. When these short yet high-performance fibers are compounded with thermoplastics in a range of fiber loadings, testing shows superior performance compared to conventional injection molding compounds. That is, the recovered aerospace carbon fiber waste performs better than virgin standard-modulus carbon fiber in typical molding compounds, which certainly offers an incentive for recycling these wastes. And, said George, at low loading levels of 10 to 20 wt-%, the waste carbon compounds can compete with 30 percent glass-filled compounds on a performance basis, offering the potential for a 12 to 14 percent weight reduction in a part. He cautioned, however, that current methods for recovering fibers from prepreg and cured laminates — in particular, pyrolysis — tend to reduce fiber performance, and what he described as the resulting “fluffy” fibers aren’t easily conveyed and metered during compounding. So, much more needs to be done, he maintains, in the area of economical fiber recovery as well as waste material segregation to isolate these high-performance wastes.

Why not make composites easier to recycle from the get-go? That was the message delivered by Rey Banatao of Connora Technologies (Hayward, Calif.), in his presentation, “Recyclable by Design: A Chemical Approach to Recyclable Epoxy Composites.” His company has developed high-performance epoxy curing agents called recyclamines that can be combined with any di-epoxide molecule in standard part processing. The chemistry creates “cleavage points” in the molecular chains, so that the cured thermoset can be broken down, in the presence of an acid compound, into a reusable thermoplastic. Reinforcements can be recovered without damage in their original form and then easily recycled.

Managing thermoset hazards

On Wednesday, at 8:00 a.m., moderator Perry Bennett, the environmental, health and safety (EH&S) director for the Molded Fiber Glass Companies (Ashtabula, Ohio) introduced three speakers who, as participants in the CAMX Regulatory & Legislative conference track, underscored proper safety procedures for those who handle and process thermosets resin systems.

Brian Karlovich, a senior product safety representative at Bayer MaterialScience LLC (Pittsburgh, Pa.) led off with insights into safe handling of two-part polyurethanes (PUs). Noting that they are no threat to health when cured, Karlovich drew attention to hazards associated with PU’s two basic constituents prior to processing. The first is polymeric methylene diphenyl diisocyanate (pMDI) and the second is a polyol system. Both parts are nonflammable, but each can react with water. In a closed container or drum, water-exposure could cause a reaction that would build pressure and burst the container. Although pMDI has an odor, the compound has extremely low volatility. The exposure limit over and eight-hour period is a low 5 parts per billion (ppb) with an upper limit of 220 ppb. Although overheating (>400°F) can cause pMDI’s to become airborne, under ambient processing conditions, he matained that it’s of little risk to worker respiration. The second part, polyol, says Karlovich, has no listed ppb limit for eight-hour exposure. At elevated temperatures, temporary respiratory irritation can result as can sensitization (an allergic reaction). The latter is not reversible, so the worker should avoid further contact to ward off a chronic condition. Skin reaction on contact is also possible but abates when exposure ends. Karlovich did note that some research indicates a connection between dermal contact and subsequent respiratory sensitization. No evidence of cancer in humans has been found.

Karlovich recommended that employers practice medical surveillance, requiring complete physicals, pulmonary testing and regular checkups for all employees. Training in hazards and how to handle them is required by OSHA. Air monitoring in the facility should be done to indicate exposure levels. If exposure is more than 5 ppb per eight-hour shift, a respirator (activated carbon) is recommended.

Bruce Colley, the product manger for the Derakane and Hetron brands at Ashland Performance Materials (Dublin, Ohio) shared from 35 years of EH&S experience with unsaturated polyester and vinyl ester resins. Both types of resin systems can contain inorganic fillers (optional) and additives. Resins have styrene or other reactive diluents. The diluents and additives are the issue. He said that health hazards from incidental contact are low, but inhalation can cause dizziness, headaches or nausea. Skin contact and eye contact should be avoided. And ingestion can be a risk if vapors contact food, so Colley recommends no food inside the plant. But the primary hazard is flammability — a concern even with fire-retardant formulations, which are flammable prior to cure. That said, the risk is reportedly minimal: the flash point of styrene, for example, is very low until it reaches a 9 percent concentration in the air, which Colley says would be unbearable in terms of breathing the odor. Ventilation is important, so volatiles, which are heavier than air, don’t concentrate in low spots. Flammable liquid transfer lines (piping) must be grounded at every step to avoid static buildup. Colley also recommends against he use of plastic totes, noting that regulatory bodies do, in fact, prohibit them, despite a common lack of enforcement.

“Like PUs, these resins also can be problems with water,” Colley added. Water should never be permitted to stand on a drum, because water incursion will alter resin cure performance. He recommends fire training and presence of plans and equipment necessary to do cleanup of accidental spills.

Paul Ubrich, technical service representative, Momentive Specialty Chemicals (Columbus, Ohio), offered EH&S advice on epoxies used in composites. Although they contain no solvents, skin irritation is a risk. Preventing direct worker contact is the key to avoid contact dermatitis and, potentially, sensitization. Ubrich noted that the curing agents used in epoxies can be corrosive, resulting in burns from direct contact.

The three presenters agreed on a number of preventive measures, regardless of the resin system in use. MSDS sheets should be accessible to all employees, and used. Engineering controls (ventilation, automation mixing equipment, etc.) should be in place to avoid worker direct contact. In terms of personal protection equipment (PPE), Goggles, gloves, coveralls, aprons and sleeve protectors (gauntlets) are all necessary, if circumstances bring workers into close contact. Final words? No smoking, of course, and a word of caution: all gloves are not created equal. Employers should carefully select glove materials based on their compatibility (or lack of same) with the materials in use.

Research: Monomer-free SMC

Sheet molding compound (SMC) has had a long but not always happy history in the auto industry. Championed as a lightweight replacement for semistructural steel members and Class A exterior body parts, SMC hit hard times in the early 2000s when the baking processes used to cure automotive paint caused cured SMCs to outgas through surface microcracks, causing eruptions in the paint finish that automakers dubbed “paint pops.” A flurry of research projects tackled the issue and by 2004, paint-pop-free formulations were on the market. Today, SMC faces a second challenge: The U.S. Health and Human Services Department’s designation of styrene as a suspected carcinogen. SMCs now variously contain four different reactive diluents: Styrene is the most common, but vinyl toluene, divnyl benzene and acrylates also have been used recently as styrene replacements. The potential for regulatory difficulties with reactive diluents as a class, however, has prompted efforts to develop reactive diluent-free resins, particularly for SMCs.

Kurt Butler, polymer engineer – R&D in The Composites Group (Premix/Hadlock Plastics/Quantum Composites) (North Kingsville, Ohio) addressed the subject, noting that there are two hurdles to development of SMCs without reactive diluents. The first is thickening of the SMC’s resin paste. The second is shrinkage control to ensure accurate finished-part dimensions. A reactive diluent has been crucial to both in the past.

A commercially available magnesium oxide, in a 30- to 40-percent dispersion, produced acceptable thickening, and Butler’s team also tested proprietary formulations that improve performance. After the thickening hurdle was surmounted, the task was to develop reactive-diluent-free shrinkage-control agents. A number of possibilities were tried, and Butler reports that his team has actually produced SMCs that duplicate the performance of current SMCs. In glass-reinforced formulations — ATH-filled and calcium carbonate-filled — flexural strength and modulus come close to the “control” SMC. Here, Butler considers the combination of shrinkage control and thickening “promising.” Indeed, test data show some formulations are superior in properties.

In carbon fiber-reinforced SMCs, those containing proprietary thickeners and those with magnesium oxide both fell a bit short in flexural strength and tensile strength but some showed superior tensile modulus, with comparable flexural modulus.

Butler concluded by saying that reactive diluent-free resin systems can be thickened successfully for SMC compounding and, although study must continue, it is now clear that both ATH and calcium carbonate can be used as fillers, with no wetting issues. Although temperature must be elevated to accomplish thickening, standard peroxides are still used to catalyze the resins and the SMC compounding process is otherwise unchanged. Butler believes that, over time, the properties shortfalls in the carbon fiber formulations will be overcome.

Related Content

Pittsburgh engineers receive $259K DARPA award for mussel-inspired underwater adhesion

The proposed META GLUE takes inspiration from hydrogels, liquid crystal elastomers and mussels’ natural bioadhesives to develop highly architected synthetic systems.

Read MoreAdhesives, material solutions promote end market versatility

CAMX 2023: Rudolph Bros. and Co. highlights its role as a prominent specialty chemical distributor and solutions provider with a display of high-performance adhesives, sealants, materials and more from well-known manufacturers.

Read MorePontacol thermoplastic adhesive films are well-suited for composite preforms

Copolyester- and copolyamide-based adhesive films eliminate the need for sewing threads or binders when stacking laminates while improving the final part’s mechanical properties.

Read MorePro-Set named official materials supplier for New York Yacht Club American Magic

Competitive sailing team prepares for the 37th America’s Cup beginning in August 2024 with adhesives, resins and laminate testing services for its AC75 monohull construction.

Read MoreRead Next

IBEX 2014 report

A new home port in Florida and fair economic winds propel this boatbuilders’ convention to its best exhibitor/attendee turnout in years.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More