Composites in Aircraft Interiors, 2012-2022

As economic conditions improve and new programs come online, aircraft interior manufacturers are ramping up composites production to meet airline demand.

That any mention of modern commercial transport aircraft involves at least passing attention to advanced composites is almost inescapable. Prized for reducing weight and, therefore, fuel consumption and greenhouse gas emissions, composites have, in 40 years, gone from single-digit percentages to 33 percent or more of airframe weight on recent platforms. Today, even long in-service, single-aisle passenger jets boast from a few hundred to a few thousand pounds of composites per airframe. And during the next decade, the production of advanced composites for airframe components is expected to grow by more than 200 percent worldwide.

Aircraft passengers, however, see the plane’s airframe from the concourse windows. Far more important to the ticketed traveler’s experience is the aircraft’s interior. Subject to many of the same performance demands that drive those who build aircraft primary structures, designers and manufacturers of aircraft interiors have turned to composite materials en masse. Overshadowed by composite airframe structures, interior composites are no less crucial to the operating-cost and revenue-generation discussion. In fact, for many commercial aircraft, the weight of composite interiors significantly exceeds the weight of composite airframe structures!

Background on composite interiors

The history of composite interiors spans several decades and encompasses a wide range of aircraft platforms, including long-distance and regional commercial transports, business and private aircraft and military/government aircraft. For purposes of this “Market Outlook,” however, attention will be focused on the use of composites inside commercial transports. This report is based on data collected for 32 aircraft families (plus variants) with capacities of 50 to more than 550 passengers. For clarity’s sake, the interiors market has been divided into new-build (that is, OEM-supplied structures) and aftermarket, which is typically two to three times larger than the OEM market.

For several decades, suppliers of commercial transport aircraft interiors have employed a variety of composite materials in the construction of a broad range of internal components and fixtures, including floor boards, bulkheads and cabin dividers, lavatories, galleys, wall and ceiling panels and stowage bins. Although competing interior component makers work hard to differentiate their products, the composite materials used to fabricate them are similar, because their builders must comply with common flame, smoke and toxicity (FST), crash safety and other performance mandates published in Federal Aviation Regulations (FAR) Part 25.

Demand up for commercial transports

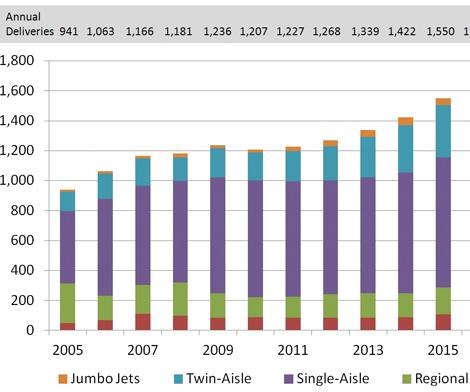

Although the number of new transport aircraft sold in a given year has “whip-sawed” over the past decade, production and deliveries have trended steadily upward. As seen in Fig. 1, this trend will continue in the coming decade. Aircraft manufacturers are expected to deliver more than 17,000 aircraft (including dedicated cargo planes) between 2012 and 2022. About 60 percent of these aircraft will replace aging aircraft. During 2011, Airbus (Toulouse, France), Boeing Commercial Airplanes (Renton, Wash.), ATR (Toulouse Blagnac International Airport, France), Bombardier Aerospace (Montréal, Québec, Canada), Embraer (São José dos Campos, Brazil) and Sukhoi (Moscow, Russia) assembled and delivered slightly more than 1,200 aircraft, or about 5 percent more than deliveries made at the start of the recent recession.

Based on firm sales already announced by commercial aircraft OEMs (not including conditional orders or agreements), delivery slots for single-aisle and twin-aisle transports are nearly full for the next six to seven years. To keep pace with order backlogs, transport OEMs and their supply chains will need to ramp up aggregate unit production capacity by more than 25 percent over the forecast period, with the greatest increase in the next five years. Key events will include:

• Increased production of established and modified members of the Airbus A320 and Boeing 737 aircraft families.

• Ramp up in production of Boeing’s 787 and 747-8 models.

• Entry into service of the Airbus A350, Boeing’s 747, the Bombardier (Quebec, Canada) CSeries (C130 and C150), the OAK MS-21 (designed by Irkut, a div. of JSC United Aircraft Corp., Moscow, Russia), and the Commercial Aircraft Corp. of China (Comac, Shanghai, China) C919.

• Expected development of two new regional turboprops, an advanced Boeing 777 variant and the start of next-generation, single-aisle replacements for the Airbus A320 and Boeing 737.

In Fig. 1, we also see that within the regional transport subset, there continues to be a decline in the relative number of jets to turboprops. At the same time, we see airlines opting for larger regional aircraft, focusing on models that have between 80 and 110 seats. Many established regional aircraft programs have been in production for more than 20 years and are beginning to face strong competition from the East (Russia, Japan and China). Anticipating continued escalation of fuel costs, OEMs that serve the regional jet segment are expected to introduce advanced versions of their existing turboprops to stay competitive.

Of significance to the composites industry, airlines are expected to purchase increasing numbers of single-aisle and large twin-aisle aircraft. The Airbus A320neo and Boeing 737-MAX should provide competitive airframes through the remainder of this decade. That fact will make it unlikely that an A320 or 737 “replacement” will be ready by the end of the forecast period. If, however, the Comac C919 and Irkut MS-21 successfully enter service before the end of this decade, both Airbus and Boeing will have to actively seek next-generation solutions or risk losing significant market share.

A look at the long-term forecasts provided by Boeing and Airbus indicates the potential for at least as many new aircraft during the 2023-2032 time frame as are predicted in this 10-year outlook. Given the trend toward larger aircraft and expanded applications of composites in the fabrication of aircraft cabin equipment, overall growth is expected to be robust.

OEM aircraft requirements

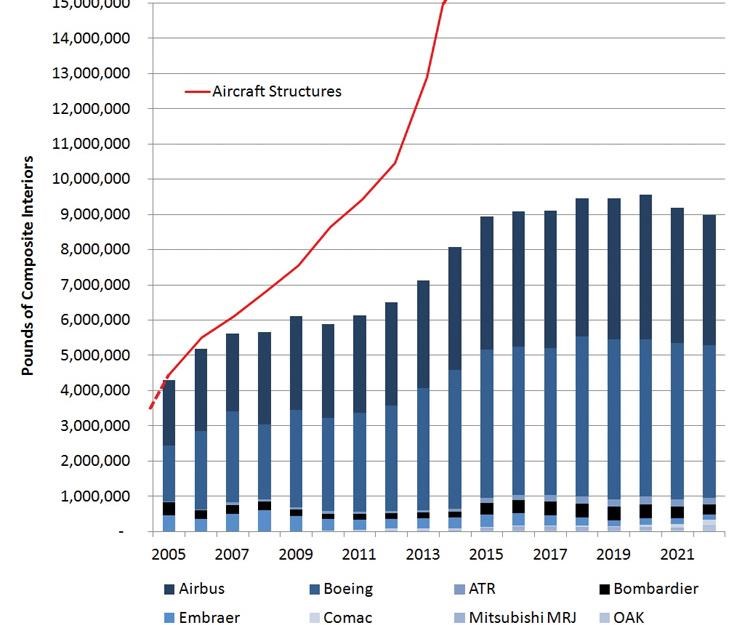

Until the middle of the past decade, OEM composite interiors represented a larger market for composite materials and manufacturing in term of volume (see Fig. 2). In one sense, it can be said that interiors are a fairly mature market. Operating costs, however, are rising, and there is a need to expand revenue generation on each new aircraft brought into service. As a consequence, OEMs, airlines and their approximately 2,000 suppliers have been forced to reconsider virtually every aspect of the aircraft cabin.

Much like aerostructures, interiors have been put on a weight-loss regime. Beyond traditional applications in the floorboards, ceiling and panels, monuments and other components, seating has become a major focal point for composites applications. Lightweighting seats can enable major aircraft weight reductions. Slimmer seat designs also allow operators to make some small increases in the number of seats per aircraft. For example, RECARO GmbH & Co. KG’s (Stuttgart, Germany) model BL3520 seats, adopted by Deutsche Lufthansa (Cologne, Germany) for its entire fleet of A319 aircraft, reportedly weigh 30 percent less than those originally installed on the aircraft, and they are now specified for all new aircraft. For its fleet of 330 A319s, this one change saves 137,000 kg (302,000 lb), or about 415 kg (915 lb) per aircraft. Lufthansa reports that the resulting fuel burn reduction for the aircraft is ~4.3 percent. RECARO already has orders for more than 100,000 of these seats and has delivered more than 40,000. Although they are fewer in number, the heavier business-class, first-class and beyond-first-class seats are seeing similar improvements via composites. To help ensure that transport aircraft meet their targeted performance, the OEMs and airlines are employing similar products in all new designs.

A growing force behind the composites push is the increasing deployment of inflight entertainment (IFE) systems. It is increasingly common to see touch screens and other passenger interfaces for movies, games, music and telephone service. Airlines are aggressively pursing Wi-Fi technology to support Web surfing and other individualized passenger services. These features, unfortunately, do not come free. In fact, IFE represents a critical new revenue stream for airlines, which face a variety of other cost pressures that they cannot always control. The increased weight of electronics places even greater value on lightweight materials and designs that don’t impinge on passenger space and mobility.

Composites in seats and in a variety of small brackets, clips, trays, plinths and other structures are increasing. This and the predicted increase in new aircraft deliveries point to considerable growth over the next five years. As illustrated in Fig. 2, the use of interior composites is expected to increase about 50 percent, from current volumes of about 6 million lb (2.7 million kg) to about 9 million lb (4.1 million kg) somewhere in the 2016-2017 time frame. The Boeing 787 and Airbus A350 families will account for the bulk of the growth, but refinements to single-aisle aircraft interiors will make a significant contribution. The vast majority of these interior parts will be manufactured by approximately 100 different manufacturers around the globe.

An interesting pattern in the market analysis was the projected decline in composite volumes, beginning around 2018. The decline is strongly related to deliveries of the A350 and 787 jetliners, which should reach their production peaks around 2016-2017 and taper off slightly afterwards. When this peak-to-decline period is set in the context of delivery totals for the years that immediately precede and follow it, the forecast is that aircraft delivery numbers should remain fairly steady: 1,450 to 1,550 per year.

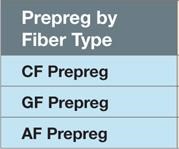

For suppliers, the interiors market represents a sizeable consumer of raw materials. Glass fiber-reinforced composites represent about 65 percent of total volumes. Carbon fiber composites make up most of the remainder, with limited application of aramid fiber composites (primarily in the cargo compartments). In Fig. 3, note that material suppliers are expected to ship ~7.8 million lb (~3.5 million kg) of prepreg materials during 2012, and as much as 11.5 million lb (5.2 million kg) per year by 2020. Based on the pressure to include more IFE, increase revenue generation and reduce operating costs, the use of carbon fiber composites will nearly reach parity with glass fiber composites by 2022.

Aftermarket expansion

As we move beyond new-builds and consider the aftermarket, we find a far more diversified sector. Traditionally, wear and tear and the airlines’ desire to maintain a pleasing cabin environment have motivated airlines to replace interior components on a semiregular basis. The extent of these repair and refurbishment efforts can range from replacing a few components to a complete overhaul.

Although the timing of aftermarket refits can vary, depending on the economic health of the airlines and leasing companies, a few general rules of thumb are frequently cited. Passenger seating is usually replaced at intervals of one to two years. Substantive upgrades are made in four-year cycles. Complete cabin refurbishments are undertaken every eight years or so. Although it is difficult to project with much accuracy, aftermarket interiors historically represent a market about 2.2 to 2.8 times the size of the OEM market. The recent recession, however, resulted in significant delays or cancellations of many refurbishment programs. Because conditions have improved since 2010, many programs have been reinstated. As a result, there is growing demand for aftermarket components. With these factors in mind, and acknowledging the continued susceptibility of the aftermarket to the effects of regular business cycles and rising fuel costs, this forecaster tentatively predicts that between 210 million lb and 270 million lb (95 million kg and 123 million kg) of aftermarket composite interiors will be supplied to airlines around the world.

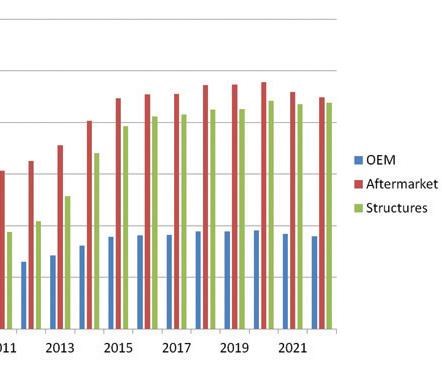

Arming cabin doors for takeoff

Given their unique combination of low flammability, low weight, high strength, durable cosmetics and the efficiency with which they can be processed in the aircraft manufacturing environment, composite materials have a promising future in passenger aircraft interiors. As illustrated in Fig. 4, the OEM and aftermarket interiors segments together represent a market for ~22.5 million lb (~10.2 million kg) of composites this year. Despite the continued media focus on the use of composites in airframe primary structures, the aircraft interior market is twice as big in terms of its consumption of composite materials and manufacturing services.

By 2022, this is expected to grow beyond 32 million lb (14.5 million kg) of components annually — a figure about 50 percent greater than the total 2012 demand for composite airframe structures.

Given the incentives for adopting more composites in interior applications, a number of unconventional technologies are emerging and competing for market share. The inherent FST resistance, durability and short cycle times of thermoplastics — polyetherimide (PEI), polyphenylene sulfide (PPS), polyetheretherketone (PEEK) and polyetherketoneketone (PEKK) — are piquing interest among aircraft operators. Additionally, opportunities are being explored for the use of recycled carbon fiber materials and low-cost carbon fibers (made with alternative precursors). Thus, a broader range of material suppliers and manufacturers can participate in this market. Several major programs are, in fact, currently in design and development or are expected to enter development during this forecast period.

In sum, tremendous opportunities are opening for those who can offer advanced design and processing solutions for the new generation of commercial transport aircraft and those that are already in service.

Related Content

PEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

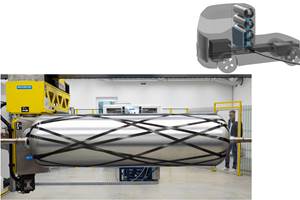

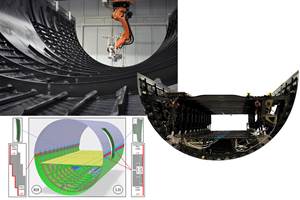

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More