Filament-wound utility poles. Mitaş Composites can filament wind composite lighting poles up to 12 meters ong and 800 millimeters in diameter. Source | Mitaş Composites

Mitaş Group (Ankara, Turkey), a manufacturer of steel towers, distribution and transmission poles, and substation structures for the energy market, has invested in a filament winding production line for manufacture of composite utility poles. The automation-ready equipment, with a manufacturing capability of 1,000 poles per month, makes Mitaş one of Turkey’s first manufacturers of composite utility poles and is enabling the group to grow and diversify its existing product range.

A competitive differentiator

Mitaş was established by the Turkish government in 1955 to help build the country’s energy infrastructure. Over the subsequent years public ownership progressively declined, and by 1990 the fully privatized Mitaş had embarked on a strategy of international expansion. Today, the group operates nine production facilities at four locations in Turkey and Italy and exports to North America, Europe, Africa and the Middle East. The Mitaş Poles factory in Ankara has an annual manufacturing capacity of 30,000 metric tons and produces galvanized steel poles 12-50 meters long for power transmission and distribution lines, lighting, aerial cable cars, telecommunications, signage, flags and other applications. Enhanced aesthetics and ease of installation are key customer priorities for new pole designs.

The decision to invest in composites production facilities was formalized about three years ago. “Mitaş is essentially a 60-year-old steel company, but for some years it was always in mind to look for alternative materials offering easier installation and lower maintenance,” explains Sezgin Üstün, director of operations, Mitaş Composites Inc. “We saw a growing market trend towards lightweight composite poles in North America and Europe, and in mid-2016 we decided to enter the composites market.”

Mitaş also saw composite poles as a differentiator in the fiercely competitive steel pole market. Composite poles also aligned with the company’s focus on innovation as a route to global business growth.

Drivers for composites use

The first utility poles were made from wood, but concrete, steel and composite poles have been introduced to provide improved performance and durability. Steel is now the dominant material, as steel poles provide higher performance and a longer service life than wood, and eliminate concerns over the environmental impact of the preservatives used to treat wood poles. However, steel poles are still relatively heavy and expensive to transport and install, and are galvanized or coated to improve their corrosion resistance, increasing initial and through-life maintenance costs.

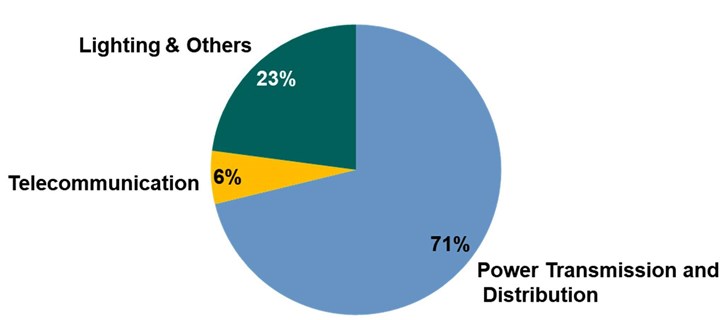

Pole market by application. The global fiber-reinforced plastic (FRP) pole market by end use industry in 2018. Source | Lucintel

Composite poles offer benefits in installation, reliability, maintenance and service life over alternative pole materials, and are especially cost-effective for limited-access sites and where corrosion is a primary concern. Composite poles typically weigh 35-50% less than wood and steel poles, resulting in lower transportation costs and easier, faster installation. Composite poles can be carried and assembled by hand — with no need for heavy lifting equipment — leading to big savings for installations in tight urban spaces, remote locations or challenging terrain with no road access. Composite poles are designed for a service life of more than 70 years and typically require no scheduled maintenance. They are coated to provide UV protection, do not rot or corrode and are immune to natural threats that often plague wood poles, such as termites and woodpeckers. They are not affected by salt air and humidity in coastal and wet environments, where steel can need regular recoating, and do not leach any chemicals into the environment. Composite poles benefit utility grid hardening strategies by providing greater resilience under extreme loads generated by severe weather. With a high dielectric strength, composite poles are also safer for workers, and they absorb more energy under impact than steel or wood, resulting in less damage to vehicles in road traffic accidents.

Despite these benefits, composite poles currently account for less than 1% of the overall utility pole market according to market research firm Lucintel (Dallas, Texas, U.S.), but their share is expected to grow from $228 million in 2018 at a compound annual growth rate (CAGR) of 5.7% to reach $318 million in 2024. This will be driven by increasing demand from infrastructure projects, replacement of wood poles, and the performance benefits of composite poles over wood, steel and concrete. Power transmission and distribution currently accounts for approximately 71% of the global composite pole market, but the lighting segment (23%) is likely to experience a relatively higher growth rate, fueled by the replacement of traditional materials.

Lucintel predicts filament winding will remain the dominant process used to manufacture composite poles over the next five years because of its suitability for high-volume production, ability to work with multiple thermoset resins, and flexibility to manufacture cylindrical, oval and conical poles. Pultrusion, which is limited to the manufacture of poles with constant (or near constant) cross section, is expected to witness the highest growth due to its higher productivity and lower cost, while centrifugal casting, which offers good aesthetics, is restricted to applications requiring relatively low mechanical performance.

Design flexibility

For Mitas, filament winding met the company’s requirement for manufacture of conical poles.

“For conical poles there are only two production methods in composites — filament winding and centrifugal casting,” explains Üstün. “We chose filament winding because it uses continuous fibers and we can obtain the high stiffness and strength required for utility poles. Filament winding also gives us the flexibility to manufacture other products — tubes, pipes or other structures — so we are not restricted to the pole market. Following discussions with suppliers in China, Europe and North America, we chose to work with Autonational because of their advanced technologies, flexibility and adaptation to future automation.”

See this video for more about Mitaş and its design process for utility poles:

Autonational Composites B.V. (IJlst, Netherlands) was founded in 1977 by two engineers who specialized in designing industrial production lines. Filament winding was frequently employed, and five years ago it was decided to focus the business around this technology. Today, Autonational employs approximately 60 people, supplying filament winders, auxiliary processing and testing equipment, and integrated production lines and automated solutions for the automotive, aerospace, infrastructure and other markets. According to marketing and sales manager Harry Fietje, Autonational is seeing increasing demand for automated lines, which now account for 75% of sales. Requests for quotations for utility pole lines are also increasing, he says.

“The Mitaş production line took around three months to design,” he notes. “It was not a difficult line for us, but as Mitaş was new to composites, we worked closely with them on part design and materials selection. We proposed a two-phase approach to fit their investment plans and anticipated production ramp up.”

The first phase involved the supply of an integrated production line to allow manual or semi-automatic manufacturing, based on two mandrel lengths to reduce the complexity and cost of future automation. This enables the manufacture of glass fiber-reinforced polyester composite conical poles with minimum diameter 100 millimeters, maximum diameter 600 millimeters and a length of 12 meters; and carbon fiber-reinforced epoxy composite cylindrical poles with diameters up to 600 millimeters and a length of 6 meters. The line has a manufacturing capacity of 1,000 poles per month. The second phase of the project will address additional functionality and automation.

After a two-month build, Autonational installed and commissioned the equipment in the new Mitaş Composites plant in Ankara in April 2018, and trained Mitaş staff in machine operation. The 17,750-square-meter factory also houses a pultrusion line and an R&D laboratory.

Production sequence

The production line consists of modular equipment to perform filament winding, curing, mandrel extraction, machining and coating. An overhead crane transports mandrels and poles between machines, which are started by an operator and then run automatically under their supervision.

Step 1. The Autonational AMD SW 1000 three-axis filament winder is suitable for manufacture of conical and cylindrical poles up to 12 meters long. Source | Mitaş Composites

Production starts with transport of a steel mandrel, manufactured by Mitaş, to the filament winder, where it is cleaned and prepared. (A separate mandrel preparation station could be added in future to allow increased production capacity.)

Step 2. The fiber delivery tool on the Autonational AMD SW 1000 filament winder. Source | Autonational

To deliver fiber to the winder, Autonational supplied two creel/tensioning units. A pallet creel suitable for up to 16 tows and 64 bobbins, delivering fiber tensions of 2-20 Newtons, is suitable for high production output with glass fiber. For higher performance applications with carbon or glass fiber, a dynamic creel with servo-controlled tensioning allows for accurate fiber tensions of 5-50 Newtons. This creel, based on a modular configuration of two sets of four stacked bobbins, is positioned on a rail connected to the carriage of the filament winder.

Mitaş obtains glass fiber materials from Şişecam (Istanbul, Turkey) and carbon fiber from DowAksa (Istanbul, Turkey). Polyester resin is also available from Turkish suppliers, but epoxy resin has to be sourced from international companies.

Step 3. The basic winding geometry for a glass fiber polyester pole. Source | Mitaş Composites

Autonational supplied equipment to store, pump, mix and dose the resin to the winder via a resin dip tray. The fiber is fed from the creel to the resin tray, which is suitable for use with glass and carbon fiber. Each resin has its own fiber guide insert, based on 16 tows for polyester and eight tows for epoxy. The resin tray features automatic level measurement and temperature control and is designed to provide good fiber impregnation and a consistent resin fraction.

Impregnated roving is guided to the mandrel via a standard fiber delivery tool on the Autonational AMD SW 1000 three-axis, single-spindle filament winder. The winder uses a Siemens Sinumerik 840D CNC controller which is compatible with most filament winding software. According to the selected program, the winder lays the resin-impregnated roving onto the rotating mandrel using a carriage that travels back and forth along the axis of the mandrel to build up successive layers of reinforcement. The program defines the orientations of the fibers to achieve the required pole strength, flexibility and thickness. The winding operation lasts approximately 1 hour.

In addition to this three-axis winder, Mitaş uses a four-axis machine (Autonational AMD SW 800 RD) for the fabrication of poles up to 6 meters long, as well as for carbon fiber tubes and complex parts for R&D projects.

Step 4. The machining station is used to drill holes, cut out inserts and finish the surface of the pole in preparation for coating. Source | Mitaş Composites

Once winding is complete, the mandrel and pole are transported to an input buffer — a shuttle table — in front of an electrically heated batch oven. When the required number of mandrels is reached, the shuttle is moved into the oven. The oven, capable of a maximum temperature of 150°C, can accommodate up to four poles of 600 millimeters in diameter or 16 poles of 100 millimeters in diameter. After cure, which lasts around 8 hours, the shuttle is moved back out of the oven to a cool-down zone. When cool, the wound pole is separated from the mandrel using a hydraulic mandrel extractor. This system can process pole lengths from 6 to 12 meters and mandrel diameters from 100 to 600 millimeters. The maximum extraction force is 100 kiloNewtons and the operation typically takes up to 20 minutes.

The pole is next transferred to a machining center, which is a modification of the AMD SW 1000 filament winder. The winder’s fiber guide is replaced by a milling/sawing unit, the head and tailstock are fitted with revised tooling, and turning/milling software installed in the CNC controller. The unit is capable of drilling, milling, grinding and cutting conical and cylindrical poles. The required drilling, cutting and surface finishing operations generally take 1 hour and the pole then returns to the AMD SW 1000 filament winder for coating. For this operation, the winder’s fiber delivery tool is replaced by a spray gun and the resin supply is switched over to a pigmented topcoat that imparts UV protection to the pole. This process takes 1-2 hours and the coating is allowed to cure in the factory. For automated production, a separate coating station would be added.

Developing the market

Step 5. From left to right, a Mitaş Composites ‘smart’ pole, a 3-meter carbon fiber flagpole, and a decorative lighting pole. Several modules are integrated into the smart pole to enable radar, camera, Wi-Fi and other functionality. The decorative pole is designed for use in natural areas such as parks and gardens. Lights (available in different colors) are fitted inside the pole to illuminate the shaft. Source | Mitaş Composites

Mitaş started filament winding poles in May 2018 and now manufactures a variety of products including power distribution poles, antenna masts and decorative lighting poles. Standard glass fiber conical light poles range from 12 meters long (top inner diameter 120 millimeters; bottom inner diameter 273 millimeters) to 4 meters long (top inner diameter 62 millimeters; bottom inner diameter 102 millimeters). Poles can be supplied in a range of colors, with opaque or illuminated shaft, and with steel or composite base and access door. Carbon fiber is being employed in flag poles as well as some sports applications such as sailing masts.

“We have a lot of flexibility,” notes Üstün. “We can produce poles up to 12 meters in one segment, with diameters from 60 millimeters to 1,000 millimeters. We already have a good amount of mandrels for our standard designs, but if the client needs different options, as a steel producer we can easily adapt mandrels in house.”

The poles have mainly been installed in Turkey, although small numbers have been sent to other countries including Ukraine and Qatar. Customers are so far requesting small orders, up to several hundred poles, for demonstration purposes.

“Autonational designed the equipment for a manufacturing capacity of 1,000 poles per month, but we have not reached this value yet,” Üstün explains. “Up to now we have produced maybe 1,000 poles as we are in the market development stage. If in one to two years we have high enough demand we can add automation.”

Automation options include adding logistic systems such as monorails, manipulators and mandrel buffer systems to automatically move mandrels and products around the production line, as shown in the video. Track and trace functionality can be incorporated into products to record manufacturing variables.

Watch Autonational’s video for more on the production process.

Step 6. Mitaş Composites light poles on display at the Ankara factory. The red pole is 12 meters tall with diameters of 120-273 millimeters. The gray pole is 10 meters tall with diameters of 120-253 millimeters. The top fittings are bolted to the pole. The base of the red pole is composite; the gray pole has a steel base plate. A carbon fiber flagpole can be seen to the left of the red pole. Source | Mitaş Composites

“The Mitaş production line could work in a similar way, with transport between stations automated and manipulators moving the mandrels and poles to the machines,” says Autonational’s Fietje. “The entire production area could be fenced off with one operator overseeing everything. It could be possible to produce a finished pole every 20 minutes rather than the 80 minutes or so currently possible.”

Feedback on Mitaş’ composite poles has been positive, according to Üstün: “Customers like their appearance. The lightweight of the poles is also very interesting for them because they could just raise a 6-meter pole with one man. A 6-meter glass fiber pole weighs approximately 15 kilograms compared with a similar steel pole of 35 kilograms or more.”

However, Mitaş is facing barriers relating to price and customer misconceptions about composites.

“The initial cost is higher than steel, so if the customer is focused on price they always check the initial cost,” he says. “We try to convince them by focusing on the full life cycle cost and the sustainability aspects of composite poles.”

“One other concern we have heard from clients is that composite poles are brittle and they are concerned about vandalism. We are getting these sorts of reactions from the client — they just see composite as a plastic and it will take some time to convince them. We plan to continue our marketing development activities by attending exhibitions, presenting papers and, most importantly, working to convince authorities in target countries.”

One initiative intended to increase confidence in composite poles was recently announced by the American Composites Manufacturers Association (ACMA, Arlington, Va., U.S.). The ANSI-approved Standard Specification for FRP Composite Utility Poles, published in May, was developed by ACMA's Utility and Communication Structures Council to provide a single point of reference for electric utilities. Its objective is to promote a greater understanding of the differences between composite, wood, concrete and steel poles and explain the manufacture, assembly and correct installation of composite poles.

Related Content

TU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreA new era for ceramic matrix composites

CMC is expanding, with new fiber production in Europe, faster processes and higher temperature materials enabling applications for industry, hypersonics and New Space.

Read MoreJeep all-composite roof receivers achieve steel performance at low mass

Ultrashort carbon fiber/PPA replaces steel on rooftop brackets to hold Jeep soft tops, hardtops.

Read MoreLarge-format 3D printing enables toolless, rapid production for AUVs

Dive Technologies started by 3D printing prototypes of its composite autonomous underwater vehicles, but AM became the solution for customizable, toolless production.

Read MoreRead Next

Filament winding, reinvented

Robots and digital technology deliver speed plus larger, more complex parts, while generative 3D winding obviates mandrels and waste for automotive applications.

Read MoreOptima 3D launches next-generation 3D weaving machines for composites

Digital control and innovative shuttle system enable rapid parameter and sequence change for net shape preforms, billets, para beams and more.

Read More