Forvia moves toward more sustainable automotive composites manufacturing

Automotive technology supplier Forvia shares sustainability goals and recent developments aimed at bio-based and recycled materials and ramping up hydrogen tank production for clean mobility.

Automotive technology supplier Forvia (Nanterre, France) was created in 2022 with the combination of automotive technology companies Faurecia and Hella. During a press conference ahead of the 2024 Consumer Electronics Show (CES), Forvia CEO Patrick Koller outlined some of the company’s sustainability goals and initiatives, emphasizing that the company is aiming for net-zero carbon emissions in its operations by 2045 with an initial goal of 40% reduced emissions by 2030.

Forvia’s strategy, Koller said, is three-pronged: reducing the number of components needed for automotive assemblies through modularity, migrating to recycled and/or bio-based materials for certain applications, and introducing recycling and reuse scenarios for many components.

Two examples of modular solutions Koller presented are a seat and an interior, each reported to significantly reduce CO2 emissions compared to current practices (up to 86% for the modular interior design). This savings comes from a reduction in Scope 3 emissions — or those produced by the downstream supply chain in the form of raw materials, processes and related energy use — by introducing a design that uses less overall material, fewer overall components, only one type of material used throughout and implementation of a percentage of recycled or bio-based material.

Forvia claims its concept for modular, sustainable vehicle seating will be easier to assemble and disassemble, simplifying repairs and recyclability.

As more bio-based and recycled content is added to material formulations, Koller noted that generative AI will be key to predicting material properties and ensuring consistent material quality.

Ramping up to hydrogen-powered mobility

According to Koller, Forvia is focused on technologies for enabling hydrogen-powered vehicles both in the light and heavy commercial markets. By 2030, Forvia’s goal is that a full hydrogen tank system would cost the equivalent of a battery pack, with the same amount of power.

The current aim is a ramp up production of Type 4, 700-bar hydrogen tanks at its clean mobility plant in Allenjoie, France, which became operational in October 2023. According to the company’s FY 2023 results announced in February 2024, the goal is to reach full capacity of 100,000 tanks per year by 2030.

The Allenjoie plant joins Faurecia hydrogen tank facilities in China and South Korea, with plans to expand into North America in the near future.

Faurecia Hydrogen Solutions aims to scale up the hydrogen ecosystem, with expectations to announce new customers and an upcoming production facility in North America in 2024.

While Type 4 (composite with a polymer liner) tanks are the company’s current focus, Type 3 (metal-lined tanks with a composite overwrap) tanks are also built for the Asian market, and R&D work is being done on all-composite Type 5 tanks. These tanks can be used in both hydrogen fuel cells or in adapted hydrogen internal combustion engine (ICE) vehicles.

Nick Miller, VP of Faurecia Hydrogen Solutions in North America, says that at each of the company’s facilities, the winding process is highly automated, aiming to ramp up to high-volume production, and includes in-process nondestructive testing (NDT).

In regards to markets, Miller explains that in North America, the main interest is on Class 5-8 medium/heavy-duty trucks first — customers who, he says, currently prefer hydrogen ICE vehicles versus hydrogen fuel cells or battery EVs. The European market sees more opportunity for smaller vehicles such as light-duty trucks and vans, while Asia (specifically China) shows interest in hydrogen-powered vehicles across the board in all bus and truck classes. He adds that in general, batteries will be the method of choice for passenger vehicles.

“Hydrogen ICE is a popular transition stop,” Miller explains. “It’s less expensive than fuel cells and easier to implement — there are fewer changes to existing ICE vehicles. It’s a great bridge technology.” Compared to regular ICE vehicles, hydrogen ICE vehicles also produce low emissions and are more efficient. Fuel cells — the “greenest” overall energy type because they produce no emissions and are the most efficient — require “a more complex transition” and are more expensive.

“It’s common for our customers to test out BEVs [battery electric vehicles] versus hydrogen ICE versus fuel cells to see what is the best fit for them,” adds Charles Shappell, engineering director of Faurecia Hydrogen Solutions.

This year, Forvia expects to announce new customers as well as a future North American hydrogen tank production facility.

In addition, Shappell adds that “sustainability, and in particular building recyclable tanks, is a big goal of ours.” One way the Faurecia hydrogen division is working toward these goals is through cooperation with its Materi’Act division.

Materi’Act: Reducing carbon footprint of carbon fiber, plastics

Materi’Act, an R&D division formed in November 2022 in Lyon, France, aims to develop, produce and sell materials with up to 85% lower carbon footprint than traditional materials. The facility currently houses an in-house lab and pilot workshop, while also hosting startup companies.

Akim Khalef, Materi’Act’s sustainable feedstock director for North America, explains that the division is operating in three branches: Compounds, foils and carbon fiber.

The compound division is working toward formulation of resins such as polyolefins and styrenics, made with up to 90% recycled content and up to 90% CO2 reduction using bio-based content. These compounds are developed as pellets for use in injection molding. “We always have to be mindful not to sacrifice quality and mechanical properties,” Khalef notes. As Koller said, Materi’Act uses AI to accurately model and predict material properties. So far, the company says it has tested more than 400 new material formulations.

One of Materi’Act’s goals is to innovate Forvia’s NAFILean hemp fiber/polypropylene products for vehicle interiors, including integration of biomass waste into recycled plastics, and new NAFILean versions with increased stiffness or Class A surfaces for visible parts (a sample of the latter, NAFILean Vision, is pictured).

This division is also working on R&D of new versions of its NAFILean hemp fiber/polypropylene materials, including a stiffer version, and a Class A surface version with visible natural fibers.

“The ultimate goal is to develop a U.S. supply chain for these materials,” Khalef says. Working toward this, Materi’Act recently announced a new joint venture with PCR Recycling called Materi’Act Dallas, with the goal of accelerating development and delivery of recycled compounds in North America. The newly formed company will collect feedstocks, recycle, refine, formulate and compound to supply recycled polymers that meet the stringent requirements of carmakers.

Materi’Act’s foils division is working on bio-based materials for use as foils or “skins” on automotive interiors, using creative feedstocks like pineapple leaf fibers.

The carbon fiber branch works to support the Forvia brand — “We’re primarily working on low CO2 footprint carbon fiber to support hydrogen tank production,” Khalef says, “with up to a 50% lower footprint than traditional fibers.”

One goal of Materi’Act is to produce low carbon footprint carbon fiber made from bio-based precursor, as well as to produce fibers with a less energy-intensive process.

What technology is Materi’Act using? While the company can’t go into too many details yet, Khalef says, “We’re working on it from both a raw materials and process perspectives.” On the process side, the company is working on a less energy-intensive carbon fiber production process — also using renewable energy for the energy that is used — while also aiming to increase yield. The company is also working on a carbon fiber using a bio-based precursor.

What’s the timeline? “We’re aiming to launch our first products by 2028,” Khalef says. “We’ll of course aim to supply carbon fiber for our own use in hydrogen tanks, but ultimately we want to supply to the general market as well.”

Shorter term, the company has also said it aims to grow its Materi’Act branch to 400 employees by 2025 and generate more than €2 billion in sales by 2030.

More sustainable materials for automotive interiors

Working hand in hand with Materi’Act, Forvia’s Interiors division is also working toward developing, validating and implementing more recycled and bio-based materials into its production parts, and helping guide which formulations Materi’Act prioritizes.

Of course, Forvia already uses biocomposites for some of its interior components, especially, as Koller notes, in medium price-range vehicles. The company’s compression moldable, natural fiber-reinforced polypropylene (NFPP) materials were launched in 2003, and its hemp fiber composite NAFILean product line was introduced in 2011 and is now used in more than 9 million vehicles.

Forvia executives say this is just the beginning of the company’s plans for Materi’Act. The company is also exploring new feedstocks and suppliers for its hemp fiber and expects to launch new NAFILean products on the market by 2025.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreAutomotive chassis components lighten up with composites

Composite and hybrid components reduce mass, increase functionality on electric and conventional passenger vehicles.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreTPI manufactures all-composite Kenworth SuperTruck 2 cab

Class 8 diesel truck, now with a 20% lighter cab, achieves 136% freight efficiency improvement.

Read MoreRead Next

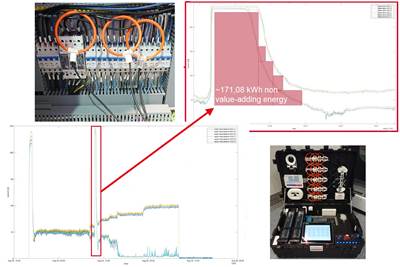

Measuring energy use to enable sustainable composites production

Airbus subsidiary CTC uses new technology to measure energy use in machine components and processes to optimize equipment, production lines and guide decisions for future composites.

Read MoreCW Tech Days explores the composites sustainability challenge

During the one-day virtual event on April 17 from 11 a.m. to 3:30 p.m. ET, seven industry experts will provide insight into hot topics like waste reduction, energy efficiency, bio-materials and recycling.

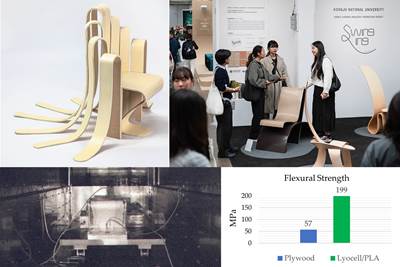

Read MoreKCARBON and KIST develop lyocell/PLA/wood biocomposites

Initial demonstration in furniture shows properties two to nine times higher than plywood, OOA molding for uniquely shaped components.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg)