Fossil and mineral resources: Composites expand

Attention-grabbing applications in these challenging, corrosive environments are positioning fiber-reinforced polymers for continued growth.

The easy stuff is already found.

In the world of fossil and mineral resources, that’s been a truism for a generation. Year by year, new oil and gas fields and mineral deposits are increasingly scarce and, therefore, more difficult to locate. Sometimes, these new resources are entirely inaccessible with conventional equipment and techniques.

In the face of that reality, composites are earning respect. Increasingly recognized for their suitability in, and tailorability to, specific and demanding requirements in tough oil and gas industry and mineral mining operations, composites continue to displace metals.

The result? Currently, the oil and gas industry is experiencing one of its longer sustained booms. It’s largely due to new extraction technologies and expansion into unconventional spaces: drilling for oil and gas in ultradeep seawater, hydraulic fracturing, or fracking (for definitions of this and other fossil/mineral-industry terminology, see "Fossil and Mineral Industries: A Short Glossary" at the end of this artice or click its title under "Editor's Picks," at top right) to recover hydrocarbons and methane, and horizontal drilling technology. These methods aid more efficient well development and aid subsequent extraction of gas in oil deposits.

Unconventional extraction methods require a variety of technologies that include high-performance fiber-reinforced polymers (FRPs). “In addition, the traditional North Sea, shallow coast Africa and Gulf of Mexico oil and gas sectors have an especially heightened focus on safety, redundancy and system qualifications,” says Michael Ruby, global composites business manager, engineered materials, Celanese Corporation (Florence, Ky.). “This is also driving a need for lighter weight, higher strength, corrosion-resistant and chemical-resistant materials like composites.” So far, the most significant advances have been in piping infrastructure and fluid-handling systems, but there also is notable progress in structural applications.

Much like oil and gas, the mining industry also demands much from its materials. And composites are most advantageous in a very specific subsegment of the industry. “We’re looking primarily at mineral processing,” explains Thom Johnson, corrosion industry manager at Ashland, LLC (Dublin, Ohio). “We’re not interested in coal, gravel and iron ore, but rather elements like nickel, cobalt, zinc and uranium that are extracted using corrosive leaching agents like sulfuric acid.” A highlight for composites is the mining of rare-earth materials. “These operations are unusual because they employ aggressive media to separate the materials from the ore, as well as additional operations to separate the recovered elements from one another,” explains Johnson. “The process demands a more complex system design that can benefit from composites.”

Unlike the booming oil-and-gas segment, the mining industry’s mineral-processing sector looks less attractive for composites than it has in the past decade. “To forecast the mining industry, we have to look at the end-market,” explains Johnson. “Nickel mining, for instance, is primarily driven by the stainless steel market and, currently, there is an overabundance of stainless steel flooding the market and driving down prices.” Copper mining is in a little better position but is tied, he says, to the global gross domestic product and infrastructure development in underdeveloped nations.

“There will likely be a lull for two or three years, and then capacities will increase again,” Johnson predicts, “although, probably not near the boom time it has been over the past five years.” That said, the long-term prospects hold much promise.

Offshore oil: Deeper than ever

One area where composite solutions are enabling applications is in ultradeep oil and gas extraction. “Established, conventional technology that works well for traditional extraction becomes technically complex and capitally intensive in the ultradeep sector,” says Ruby, in reference to depths greater than 1,500m/5,000 ft. “Top tensioning and flotation systems, installation expenses and deployment time, and longevity of asset life are all areas where high-performance composites can outperform traditional technologies in riser, jumper, intervention line, cabling and umbilical applications. Substantial progress in each of these areas is being made in terms of solution development and qualification.”

“High-performance, high-strength reinforced systems deliver better longevity, better resistance to tough environments, better fatigue resistance, and reduce complexity and capital intensity of the aggregate system,” he adds.

Airborne Oil & Gas BV (Ijmuiden, The Netherlands) manufactures flexible (spoolable), fully bonded thermoplastic composite pipe (TCP). The company started building customer confidence by providing piping for less complicated applications, such as composite coiled tubing as an alternative to steel coiled tubing. Then, Airborne attacked applications with increasingly greater complexity, to “gradually gain trust and confidence in the technology through operational experience in the field,” explains Bart Steuten, Airborne’s business development manager.

The ultimate prize is the composite riser system. “In the application of ultradeep water risers, all of the advantages of TCP come together,” explains Steuten. “Yet, at the same time, out of all the pipeline applications, deepwater risers are the most demanding in terms of complexity and durability, he adds. “A thorough understanding and appreciation of the technology is required by not only the manufacturer but also the end-user.”

Moving beyond composite coiled tubing, Airborne targeted the downline. “In deep water, the light weight and high-tension capability of TCP result in a fast deployment — without the need for buoyancy elements to reduce weight — and low top tensions,” explains Steuten. Saipem SA (Milan, Italy), for example, recently completed the precommissioning process for two pipelines in the Guara & Lula NE gas line project in Brazil, using a flexible 3-inch/72.6-mm inside-diameter (ID) TCP downline from Airborne. Deployed more than 30 times, the downline reached a depth of 2,130m/6,988 ft — a record for a fully composite pipe — and reportedly reduced top tension by 90 percent compared to a steel-reinforced flexible tubular. The lighter TCP construction enabled downline operations from a smaller construction-support vessel than otherwise would have been possible. In addition, the TCP downline was deployed to the seabed in less than 2.5 hours. Conventional flexibles, which require the deployment of additional buoyancy support, would typically require 12 hours or more for a similar deployment, reports Steuten.

Airborne is currently qualifying TCP for well-access and well-intervention services, such as methanol and chemical injection, choke and kill, and plug and abandonment. These temporary services, executed on all drilling rigs and service vessels, benefit from the rapid deployment enabled by spoolable pipe. Moreover, the TCP spools require less shipboard deck space than spooled conventional, steel-reinforced flexible pipe.

Also, the company is conducting a two-year qualification program for the use of TCP in an offshore production flowline for Kuala Lumpur, Malaysia-based mineral producer Petronas. “The project was commissioned by Petronas to mitigate corrosion during operation,” explains Steuten. Anaerobic sulfate-reducing bacteria (SRBs), which produce hydrogen and cause sulfide stress cracking, thrive in the waters and seabed soils of the South China Sea. The composite solution, designed to replace carbon steel, consists of Vestamid NRG, a glass-reinforced polyamide (PA) 12, supplied by Evonik (Marl, Germany). The 6-inch/152.4-mm ID TCP flowline has a working pressure that ranges from 100 to 375 bar (10 to 37.5 MPa/1,450 to 5,440 psi). Petronas is studying the TCP’s long-term integrity, in terms of aging and creep, and is testing an integrated, optical-fiber-based structural health-monitoring system. The program will be completed in mid-2014.

Steuten discussed the company’s composite pipe at the Rio Pipeline Conference and Exposition (Sept. 24-26, 2013, in Rio de Janeiro, Brazil), explaining that unlike conventional flexible pipe design, TCP has a solid wall construction. The pipe wall consists of a neat resin inner liner and outer jacket that encase fiber-reinforced thermoplastic layers, all of which are constructed of the same thermoplastic polymer and then fused together to form a solid, fully bonded laminate. Reportedly, this design eliminates risks associated with unbonded pipes, such as rapid gas decompression or cover blow-off. Currently, Airborne’s TCP is produced from polyethylene, polypropylene or polyamide resin. “Using thermoplastic matrix material rather than a thermoset — epoxy-based — material results in a more ductile structure, yielding superior toughness and impact resistance,” explains Steuten.

Polyvinylidene difluoride (PVDF) pipe systems are currently under development for applications at higher temperature. The reinforcement is based on the demands of the application. At relatively low pressures, E-glass fiber offers the best commercial value, Steuten explains, but structural high-strength-glass (S-glass) is best for high-pressure applications where spoolability is key. For applications that require maximum strength-to-weight ratio and stiffness, carbon fiber is used. Fiber angles can be varied for each layer to optimize design. Flowlines, for example, demand optimized flexibility, internal pressure containment and external pressure capabilities, but a relatively low tensile strength. By contrast, composite risers, downlines and coiled tubing require optimized tension and pressure containment, both internal and external. The pipes are manufactured in a continuous length, limited only by the size of the carousels that can be handled in the factory and during transport.

Magma Global Ltd. (Portsmouth, U.K.) also offers flexible monolithic composite pipe. Constructed of carbon fiber-reinforced polymer (CFRP), Magma’s trademarked m-pipe was developed for use in ultradeep risers, jumpers and flowlines. Magma uses a proprietary process to produce m-pipe from T700 carbon fiber (Toray Industries Inc., Tokyo, Japan) and polyetheretherketone (PEEK) resin from Victrex USA Inc. (Cleveleys, Lancashire, U.K.). The pipe is available with IDs that range from 2 inches to 24 inches (51 mm to 610 mm). Recently, Magma introduced s-pipe, which offers the fundamental qualities of m-pipe in smaller diameters (up to 3 inches/76.2 mm) in versions rated up to 20,000 psi (about 138 MPa). Designed for intervention and work-over applications that require ultrahigh pressure, high temperatures, sour service and fatigue resistance, s-pipe features Victrex PEEK reinforced with a combination of high-strain fibers.

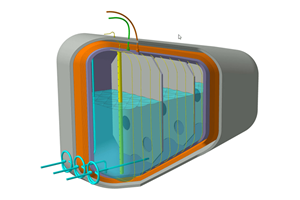

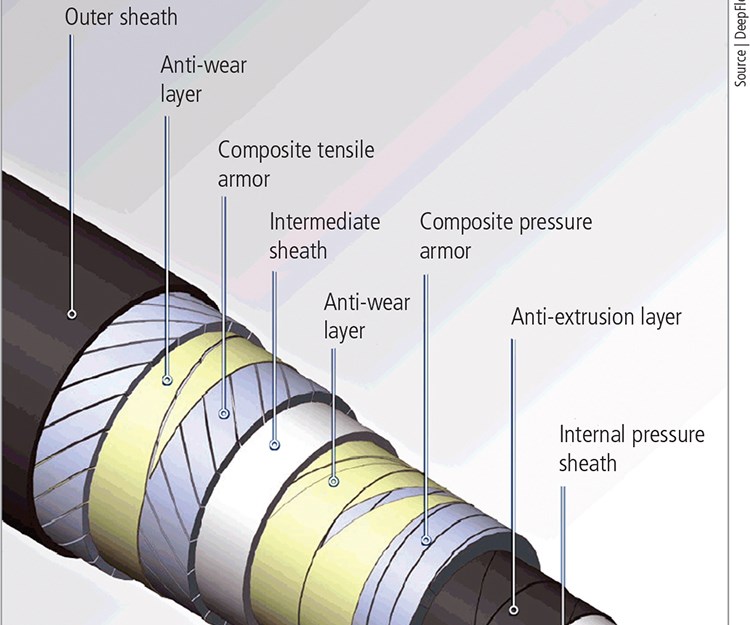

Houston, Texas-based DeepFlex has had flexible composite pipe in service for several years in applications that include downlines for pipeline commissioning in water depths to 1,500m/4,921 ft. However, it has taken a different approach, replacing the steel armor layers in unbonded flexible pipe with layers of FRP. DeepFlex has developed a fully composite, flexible, fiber-reinforced pipe (trademarked FFRP) and a hybrid version (trademarked FHRP). Both are intended for ultradeep seawater applications. In the FFRP design, an internal liner of extruded polymer is chemically resistant to hydrocarbon fluids. Pultruded fiber-reinforced tapes are bonded together to form reinforcement stacks that provide hoop and tensile reinforcement in various layers within the pipe. The hoop layer provides resistance to internal and external pressures, while layers of unidirectional fibrous tapes (with fiber orientation in at least two directions) surround the polymer membrane in the middle of the pipe wall to provide tensile strength. An outer jacket provides abrasion resistance. Notably, the layers are discrete, allowing them to move independently from one another to maximize pipe flexibility. FFRP reportedly offers a 50 percent reduction in weight compared to unbonded steel-reinforced flexible pipe.

DeepFlex is developing, qualifying and will deploy an FHRP riser solution for service in the Gulf of Mexico, with sponsorship from lead operator TOTAL (Paris, France), Shell (Houston), Statoil (Stavanger, Norway), BG Group (Reading, Berkshire, U.K.) and the Research Partnership to Secure Energy for America (RPSEA, Sugar Land, Texas). The FHRP combines composite armor layers with a stainless steel carcass profile and steel-interlocked primary pressure reinforcement layers (see illustration, p. 27). The riser solution designed for qualification has a 7-inch/178-mm ID, a 10,000-psi design pressure, and is rated for 120°C/248°F and a water depth of 3,000m/9,843 ft. A prototype pipe will be put through qualification testing, after which a riser system will be fielded for six months of performance monitoring. Reportedly, the FHRP design provides a 30 percent reduction in top tension, which enables use in water as deep as 3,000m, from lighter-weight installation vessels with smaller footprints and production platforms, which were previously limited to depths of 1,500m/4,921 ft.

Onshore: Fluid management

Although the environments are different, the material requirements are surprisingly similar in onshore efforts to find oil and gas. Distribution and transmission systems for natural gas are reportedly moving toward reinforced thermoplastics because they can be installed with greater speed and offer the ability to more easily install longer pipe networks, enabling suppliers to move the gas from the point of extraction to the point of use.

There are also downhole applications that can benefit from composites. Ruby points, by way of example, to well-bore casing pipe, bearings, couplings and fittings, downhole tooling cables and sucker rods.

Hydraulic fracturing, which requires the management of millions of gallons of water per frack and the outflow and treatment of that water, is also creating opportunities for hub-and-spoke water management and filtration systems, says Celanese Corp.’s Ruby. “Composites are well suited to deal both with influent/feed water, as well as flowback — what’s coming back up out of the ground,” he adds.

FRP significantly reduces pipe weight. A 30-ft/9.1m length of commonly used 12-inch/304.8-mm high-density polyethylene (HDPE) SDR 9 pipe, for example, weighs 655 lb/297 kg. But trademarked Fiberflex-11 glass fiber-reinforced HDPE pipe of the same length, from Composite Fluid Transfer LLC (Kilgore, Texas), weighs only 128 lb/58 kg. At 4.26 lb/ft, Fiberflex-11 is reportedly lighter than all other composite and plastic pipes with comparable diameters and pressure ratings. Designed for general water-transport infrastructure applications, the pipe can be used in distribution systems, oil and gas operations and hydraulic fracturing feed-water and produced-water transportation. The 10.5-inch/267-mm ID, 11.1-inch/282-mm outer diameter (OD), pipe has a 250-psi/1.72-MPa operating pressure (500-psi/3.45-MPa burst pressure).

Glass fiber-reinforced HDPE tape (Celstran CFR-TP from Celanese) is wound around a specially designed, extruded HDPE liner and then heat-fused, using a proprietary process developed by Composite Fluid Transfer. An outside layer of HDPE film, manufactured by Valèron Strength Films (Chicago, Ill.), is added to protect the system from ultraviolet damage and abrasion. The pipe is flexible enough to allow for a 90° bend over a 60-ft/18.9m span of pipe.

In Jacksboro, Texas, FiberFlex-11 pipe was installed to connect a rig site to a water source 1.8 miles/2.9 km away. Specially designed quick-connect fittings reportedly enabled 30-ft/9.1m joint installation in less than 20 seconds. The connections are reportedly leak-free and need no structural support. The piping supplies 73 barrels per minute with one standard 8- by 10-inch (203- by 254-mm) Cornell water-transfer pump, despite an elevation increase of more than 95 ft/29m.

FiberFlex-11 was a finalist in three regions during the 2013 Oil & Gas Awards, and Composite Fluid Transfer was Manufacturer of the Year in the Western U.S. region. The company also picked up a JEC Innovation Award Oct. 2, at JEC Americas 2013 in Boston, Mass, in the Pipes & Water Management category.

Mining: Shining a light on composites

Although the growth of composites in mineral processing has declined after reaching a peak over more than 10 years, Ashland’s Johnson insists it’s a positive time. “I would consider composites to be a relatively new technology in mining,” he explains. “Even though we’ve had a large number of successes and have been in the market for more than 40 years, if you look at the market share, composite material is still a very small player — maybe 1 percent or less of the overall market. In the mineral and rare-earth metal markets, FRP accounts for less than 10 percent, probably closer to 5 percent.”

There is, therefore, plenty of room for growth. “FRP is emerging as a standout,” Johnson contends. “Composites fit very well in corrosive mining operations, and mine owners and engineering firms are becoming more knowledgeable about FRP, especially in light of recent success stories.”

For one, FRP has infiltrated recent hydrometallurgy installations in North America. In the past five years, three large hydrometallurgy plants have been built in North America — Vale’s Long Harbour (Newfoundland, Canada) complex, which is processing nickel, cobalt and copper ores from the Voisey’s Bay mine; Vancouver, B.C.-based Baja Mining Corp.’s El Boleo copper, cobalt, zinc and manganese mineral processing plant in Baja California Sur, Mexico; and Greenwood Village, Colo.-based Molycorp’s Mountain Pass Rare Earth processing plant in California. All three plants feature FRP-based mineral processing equipment and infrastructure. Hundreds of storage tanks, extraction vessels and electrowinning cells, and miles of acid- and abrasion-resistant piping were fabricated, primarily from epoxy vinyl ester resin and corrosion-resistant glass fiber, such as E-CR glass. “The operating conditions associated with mineral processing often require materials that can withstand process acids and acid chlorides at temperatures up to 90°C/194°F,” says Johnson, who discussed the projects at the Materials Science & Technology 2013 conference in Montreal, Quebec, Canada in October 2013.

When it starts up in 2014, Vale’s Long Harbour plant is expected to process 50,000 metric tonnes/yr (110.2 million lb/yr) of nickel ore, extracting the nickel via a proprietary process that relies on hydrochloric acid at elevated temperatures. The plant will house more than 4,536 metric tonnes (10 million lb) of FRP infrastructure, such as acid- and abrasion-resistant piping, ducting and exhaust fans.

Plasticon Canada (Les Cèdres, Quèbec, Canada), one of several fabricators selected to support the project, delivered a wide array of FRP equipment, including 64 cylindrical and six rectangular tanks. The company also supplied scrubbers, demisters, stacks and clarifier circular covers, all fabricated from glass fiber/epoxy vinyl ester. An additional 64 filament-wound FRP storage vessels were sourced from members Ershigs (Bellingham, Wash.), Fabricated Plastics (Maple, Ontario, Canada) and Belco (Belton, Texas). A number of vessels had diameters up to 13.4m/44 ft and heights of 15.7m/51 ft.

“Initially, Vale was unconvinced that such large vessels could be made from FRP,” Johnson recalls. In the end, however, Ershigs was able to point to larger FRP structures currently in service at flue gas desulfurization projects in the power industry to prove their feasibility.

In Mexico, when the Boleo plant comes online, it’s expected to produce as much as 349,000 metric tonnes (769.4 million lb) of copper, cobalt, zinc and manganese carbonate annually. The six 60m/200-ft-diameter counter-current decantation (CCD) vessels have a concrete base and a thick glass fiber/epoxy vinyl ester liner fabricated by Fiber-Tech Industries (Spokane Valley, Wash.) to protect against acid and abrasion. Nearly 200 FRP launders, manufactured by Structural Composite Technologies (Transcona, Manitoba, Canada), complete the CCD system.

RPS Composites supplied the facility’s acid-/abrasion-resistant piping. Plàsticos Industriales de Tampico (PITSA, Tamaulipas, Mexico) is fabricating more than 500 metric tonnes (1.1 million lb) of FRP piping (conductive and nonconductive) and accessories for organic flow service. The conductive piping features a carbon fiber veil and brominated epoxy novalac vinyl ester matrix, with 5 percent antimony added to meet fire retardant requirements.

FRP growth: Slow but steady

As in other industries, replacement of traditional materials (in this case, metal alloys and unreinforced plastics) is following a historically gradual pattern. “In the oil and gas industry, it is through years of qualification and infield testing that a material becomes widely characterized and trusted,” Ruby sums up. “In many cases, composite materials are being built using matrix resins that have been proven in the industry in unreinforced forms,” he points out. “Currently, the areas where composite materials are commercial or near-commercial are those areas where the environmental conditions demand a high-performance composite, or where regulatory circumstances or technological advances help drive the application requirements and, therefore, adoption.” But Ruby believes that as the promise of composites comes to fruition in on- and offshore installations, field personnel will force engineers to consider FRP. “That will feed on itself, eventually reaching a natural tipping point.”

Even more tradition-bound, the mining industry has yet to embrace composites, but mineral processors in search of corrosion-resistant equipment, especially in the acidic environments of the rare-earth segment, now have lightweight composite alternatives with long service lives, installed in prominent processing plants. For proponents of composites, the rest is just a matter of time.

Related Content

Collins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreUpdate: THOR project for industrialized, recyclable thermoplastic composite tanks for hydrogen storage

A look into the tape/liner materials, LATW/recycling processes, design software and new equipment toward commercialization of Type 4.5 tanks.

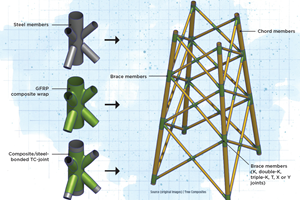

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreHonda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.jpg;width=860)