On the waterfront: Composite marine piles build on success

Composite sheet pile competes against heavy-gauge steel while composite round piles enhance their position in the market and target wider acceptance in structural applications.

Although glass-fiber reinforced polymers (GFRP) have been used to build boats for decades, similar materials have been slow to catch on in the manufacture of other marine structures. That’s hard to fathom: Composite load-bearing piles are an ideal fit for waterfront piers, docks, seawalls and fendering systems. Unlike traditional piling materials — wood and steel — composites resist rot, insect infestation and corrosion — the three biggest problems that plague conventional constructions.

In fact, composite pile pioneers expect that market forces related to these three factors will soon spike greater interest in composites.Significant growth in the population of marine borers (who do to wood in water what termites do to wood on land) and strict restrictions on the use of toxic waterproofing treatments have made wood pilings less desirable. Likewise, bans on lead-based primers, sandblasting and solvent-based paints have made it progressively more difficult to protect waterfront steel from rust, particularly in seawater environments. Maintenance and replacement costs for deteriorated wood, concrete and steel piling systems are now pegged at more than $1 billion (USD) annually in the U.S. alone, according to the Army Corps. of Engineers (UACE) — a factor expected to put composites in a more favorable position as the material of choice for those far-sighted enough to want to avoid chronic maintenance.

Indeed, composite sheet piling options — corrugated or otherwise profiled panels, often with vertically interlocking edges used to assemble wall-like structures — are opening new channels to applications previously dominated by steel. Similarly, composite round piles (filled or hollow cylindrical tubes) have begun to carve out a significant niche in fendering applications and continue to replace traditional materials in waterfront restoration projects. (Additionally, GFRP wraps are becoming commonplace as an in-situ repair technique for concrete, wood and steel piles. See second sidebar, at bottom of this page.)

Kristofer Grimnes, development manager at Harbor Technologies (Brunswick, Maine), a manufacturer of glass fiber-reinforced round piles, sees fair weather ahead. “It will just take time,” he notes. And like many of his counterparts, Grimnes is relying on word of present successes to clear up any misconceptions about composite piling products and help piling suppliers navigate future competitive waters in this marine niche. “With every success,” he says, “comes a new opportunity.”

Fact sheet on sheet piling

When GFRP composite sheet piling emerged in the waterfront structures market, it was classified as the “lightest of the light, at best,” says Ben Brown, engineering manager, Crane Materials International (CMI, Atlanta, Ga.). “Applications were limited to bulkheads of less than 10-ft [3m] tall, and that’s where composites stayed for many years,” he adds.

“Smaller commercial applications is where composite sheet piling has made its biggest inroads,” confirms Dustin Troutman, director of marketing and product development at Creative Pultrusions Inc. (Alum Bank, Pa.). “It’s more economical to use composites between the 6- and 10-ft wall height,” he explains. “Under that, it’s hard to compete with vinyl. Over that, it’s hard to compete with steel because of the imbalance in the MOE.”

The MOE (modulus of elasticity) is one of the primary tools used by engineers to gauge the degree of deflection a sheet pile system will experience based on wall height, soil loadings and other factors. Vinyl has an MOE of ~380,000 psi; wood is approximately ~1.5 million psi. “With composite sheet piling, we’re seeing an MOE of 4.2 million to 4.5 million psi, ” says Jeff Moreau, product developer at Gulf Synthetics (Suwanee, Ga.), which rose from the ashes of now defunct Northstar Vinyl Products (Cartersville, Ga.).

Meanwhile, the MOE of a steel sheet pile is typically between 24 million and 30 million psi. The USACE classifies sheet piling into six categories based on flexural rigidity as determined by MOE: two light-gauge, two medium-gauge, and two heavy-gauge, Brown explains. Despite advancements in design, most current composite sheet piling competes in the lower half of USACE’s strength range.

Current products include ShoreGuard GG-20 and GG-30 from CMI, Polaris sheet piling from Gulf Synthetics, CompositeZ 100 from Composite Components Inc. (CCI; North Palm Beach, Fla.), EverComp sheet piling from Everlast Synthetic Products (Woodstock, Ga.), and the SuperLoc system from Creative Pultrusions.

“The chief limiting factor, when it comes to replacing metal structures with composite sheet pile, is structural strength,” says Moreau. Yet, rather than looking at the strength of the steel structure that would be required for a specific seawall application and comparing that to alternative materials, Moreau says engineers need to focus instead on what is actually required for the job. By way of illustration, Moreau notes that PZ-27, a popular steel structure used in sheet piling systems, weighs 27 lb/ft². “It would be next to impossible to design a composite sheet to compete directly with PZ-27,” Moreau admits. “However, if you look at the applications where PZ-27 is specified, in only a small fraction of those is the strength of PZ-27 actually required.” What should be the focus, he claims, is the service life. “Each year, a steel wall looses a few mils of wall thickness to corrosion, and that loss must be designed into a steel sheet piling system,” he explains. In a steel design, for example, “an engineer might specify a product that is 0.38-inch/9.7-mm thick, yet if wall thickness was specified based on what would do the job in terms of strength,” he points out, “the actual wall thickness requirement would be more in the one-hundred thousandth range — a structural requirement more in the range of composites.”

Head-to-head with heavy steel

Accordingly, CMI has introduced several new composite sheet pile profiles designed to penetrate the heavier-gauge segment. The first two are box profiles: ShoreGuard GG-50 is 36 inches/91 cm wide and 0.355 inch/0.9 cm thick; GG-70 is 48 inches/122 cm wide and 0.470 inch/1.2 cm thick. Previously, CMI’s largest FRP composite sheet was 18 inches/46 cm wide and 0.26 inch/0.27 cm thick.

Larger still are a pair engineered specifically to replace AZ-13 and PZ-22 steel sheet piling: CMI’s GG-75 piles boast a 24-inch/61-cm-wide Z-profile, while its GG-95 Z-profile measures 30 inches/76.2 cm wide and, at 0.54 inch/13.7 cm thickness, boasts a Z-section modulus of 58.5 in3/ft (3,145 cm3/m). Two Z-profiles combine to create a 60-inch/1.5m-wide box profile that is targeted, conservatively, at 20-ft/6.1m bulkheads, depending on soil and other aspects, says Brown.

Gulf Synthetics has taken a different approach to heavy-gauge piles. The company’s AquaTerra system marries Atlanta, Ga.-based Tensar International Corp.’s GeoGrid reinforcement with Gulf’s Polaris composite sheet pile.

GeoGrid systems, which resemble large nets, are commonly used with retaining walls. Reinforcing the wall’s backfill with a GeoGrid system stops the soil load from acting on the retaining wall. Until now, however, there has not been a method for attaching a GeoGrid to a sheet pile. Gulf’s solution is built around the use of a vertical GridSpine, which interlocks two sheet piles together, and composite rods that run horizontally through holes in the GridSpine. The company specifies a Tensar Bodkin connector to provide a mechanical connection between the GeoGrid and the sheet pile wall along the composite rod. GeoGrid eliminates the need for outer wales (horizontal supports), face piles and deadmans (anchors) and, therefore, reportedly enables the use of composite sheets in taller walls, but also does so at a reduced price.

“The AquaTerra system takes the load off of the sheet pile,” says Moreau. Consequently, retaining walls that once were reserved for heavy-gauge steel piling now can be constructed with light-gauge composite sheet. “When it is no longer a question of structural strength, but instead one of economics,” Moreau adds, “we beat the cost of a metal structure hands down, especially when you consider service life.”

Creative Pultrusions’ Troutman believes the AquaTerra system will allow new market penetration for composite sheet pile. Already, the Department of Environmental Quality (DEQ) in New York has specified the AquaTerra system for a waterfront rehabilitation project on Long Island. And the system also provides the 100-year hurricane wall built around Capella de Pedregal, an exclusive resort exposed directly to the Pacific Ocean in Cabo San Lucas, Mexico. Although the original seawall design called for a 6m/19.7-ft tall concrete wall, partially buried in the sand for aesthetic purposes, a rise in the water table and the fact that heavy-equipment access to the remote jobsite was limited, made the use of concrete, steel and rock impossible. Wall height notwithstanding, AquaTerra met the desired specifications and engineers satisfied the aesthetic requirement by developing a method for adhering stone, granite, or stucco fascia to the face of the sheet pile.

Moreau now is working on a stronger composite sheet pile. Under a joint cooperation agreement, Gulf Synthetics and Bayer MaterialScience (Leverkusen, Germany) are developing new “super-strength, marine-grade resin formulations,” says Moreau. “We’re going to create a … composite product that will … rival current composite sheet piles in terms of price,” he contends. Reportedly, the new resin will offer twice the shear strength of a typical urethane.

Building a strong sheet pile profile

Given their characteristically continuous profiles, GFRP composite sheet piles are all manufactured via pultrusion. Gulf Synthetics contracts with Creative Pultrusions to manufacture its Polaris profiles, which are pultruded using a urethane-modified vinyl ester resin from Reichhold LLC2 (Research Triangle Park, N.C.) in a traditional open bath system. The profiles are packed with rovings and require three layers of bidirectional woven fiber fabric, which enhance strength in the longitudinal (0°) direction and in the transverse (90°) direction. Optional long-fiber carbon reinforcement of the sheet pile interlock system also is available. A surfacing veil is used to prevent fiber blooming and UV degradation.

“We worked closely with Reichhold to develop a marine-grade resin system that was hydrophobic in order to reduce water absorption,” says Moreau. Water absorption is a phenomenon that is accounted for in the design of all sheet pile systems, says Troutman, noting that “urethane systems typically see a 15 percent reduction in compression strength over a 50-year service life.”

“The primary challenge of pultruding sheet piling is getting the glass reinforcement into the connections used to join pile profiles,” says Glenn Barefoot, corporate marketing manager for pultruder Strongwell (Bristol, Va.). Without a good fiber fill, you risk cracking in the field.” With large profiles like those recently introduced by CMI, it’s also critical to have adequate pulling capacity and to properly manage curing, adds Barefoot. In addition, CMI’s products are pultruded using a proprietary polyester resin formulated for marine applications.

“These are heavily engineered products,” stresses CMI’s Brown. “You don’t have a homogenous blend of materials throughout. It’s inconsistent by design, and the single most important thing is that it’s manufactured well and with good quality control,” he adds.

Creative Pultrusions also produces its own SuperLoc piling systems with either polyester or a two-component polyurethane resin. For the latter, the company is using direct inject technology rather than an open bath to apply resin to fiber in the manufacture of its heavier duty 10-inch/245-mm deep by 24-inch/610-mm wide 1610 SuperLoc sheet. “We use high-pressure injection technology to give the part a higher glass fiber volume fraction and a very low coefficient of variation in terms of repeatability of material strength,” explains Troutman. Stitched fabrics, continuous filament mats, E-glass rovings and a heavy veil are used in the SuperLoc products. The all-composite system includes composite corner connectors, top caps, walers, tieback rods and fasteners.

Rounding up the round piles

Unlike sheet pile manufacturers, producers of round composite piles do not all subscribe to a particular manufacturing process. A round pile can be made in several ways. “You’re not always comparing apples to apples,” admits Harbor Tech’s Grimnes. “And even though we may all meet the specifications, where our products are better or worse than others is not always clear cut.”

The first round piles to make an impact on the marina and waterfront market were solid constructions. The Composite Pile 40 (CP40) round pile, a concrete-filled, filament-wound tube from Lancaster Composites (Lancaster, Pa.) was introduced to the market more than 10 years ago. It is designed to be equal in bending strength to a schedule 40 steel pipe of the same diameter.

Without the solid concrete core, the filament-wound pile cannot be driven into anything that offers much resistance. The concrete doubles the bending strength of the filament wound pile and resists crushing and buckling, claims company president Robert Greene, explaining that even if the concrete cracks inside the tube, it still affords support, allowing, for example, a filled tube to bend 20 inches/508 mm before it fails when, unfilled, it would fail at 10 inches/254 mm. The FRP tube, meanwhile, imparts compressive strength of up to three times the tested psi of the concrete core and protects the core from corrosion. “Our piles are about 40 percent stronger than wood of the same diameter,” he adds. This strength allows CP40 to work not only in heavy-duty fendering applications, but also in pier construction.

The CP40 FRP tube is constructed of E-glass rovings and a structural epoxy. During the filament winding process, alternating layers of the resin-rich fiber are wrapped, first in the circumferential direction, and then in the longitudinal orientation. The process is repeated until the specified wall thickness is met. To prevent loose fibers, which are detrimental to achieving full tensile strength, the rovings are wrapped under 10 psi of pressure.

Lancaster uses a custom-built continuous filament-winding machine that enables the company to produce pilings of any length. However, pile length typically is limited by transportation over the road to between 90 ft and 95 ft (27m and 29m). Average wall thickness for the FRP tube is 0.2 inch/5 mm. Concrete filling can be performed at or near the jobsite to reduce transportation cost.

In one such application for the U.S. Navy base at Port Hadlock (Indian Island, Wash.), Lancaster shipped 93-ft/28.4m long, 16.5-inch/419-mm diameter hollow piles to Bellingham, Wash., and had them filled with concrete by a local company.

“We fill the tubes with nonshrink concrete,” adds Greene, noting that a small amount of an expansion agent is added to cause the core to expand and set, applying a permanent positive stress against the inside wall of the FRP tube. This prevents slippage between the two members, which can result in a loss of strength and premature failure.

Hollow piles have their day

Hollow composite piles, those that rely for strength on fiber reinforcement rather than a fill like concrete, were not as readily accepted as their solid cousins in the marketplace. Grimnes points to early setbacks suffered by those who tried to piledrive filament-wound pipes originally designed for drainage operations. “A filament-wound pipe has little longitudinal fiber support, so it won’t transfer the load from the driving mechanism down through the piling and into the ground,” explains Grimnes. “Instead, it will absorb the load by warp, expanding and possibly breaking.”

The hollow composite piles produced today, however, by companies such as Harbor Tech and Pearson Pilings (Fall River, Mass.), represent a new breed of round pile. Both companies use vacuum infusion to manufacture round piles that reportedly have no drivability issues. “We have driven successfully into the hardest of glacial till in Maine, coral rubble in Florida, and lava rock in Hawaii,” says Grimnes. (Harbor Tech recently added pultrusion capacity and plans to pultrude smaller, more standard pile sizes, but will continue to vacuum infuse its large custom-built piles.)

In most cases,” Grimnes explains, “we simply adjust to soil conditions by increasing wall thickness for the harder soils,” he adds. In extreme cases, a steel or concrete driving tip or shoe can be added, or holes can be bored into the ground prior to pile driving.

The latter was required to place fendering piles in the dense lava rock present at the U.S. Navy’s submarine base at Beckoning Point, Hawaii. Harbor Tech supplied 16-inch/406-mm heavy-duty piles with an HDPE protective sleeve specifically designed to withstand the wear created by rubbing contact from submarines docked at the pier. The HDPE is used for the heaviest abrasion applications. Other finishing options include a lightweight veil for low-impact, low-visibility applications, and a three-part abrasion-resistant coating for marina applications with higher visibility and high traffic.

“The bread and butter right now for composite piles are the fendering applications,” says Grimnes. “Fendering accounts for approximately 90 percent of the market for composite pilings.” The more ductile composite piles absorb up to 15 times more energy than a similar cross section of wood, and composites’ low coefficient of friction allows ships to slide more easily along the fender after impact.

The key to a good hollow fendering pile is to find the right balance between strength and flexibility. “We want the pile to be stiff enough to drive right into the ground, but then, if it’s hit by a ship, the pile needs to flex,” he explains. “We equate it to a fiberglass diving board, which has recoverable deflection — it can flex and come right back.”

For fendering, Harbor Tech recommends its 18-inch/457-mm diameter HarborPile with a 0.75-inch/19-mm thick wall, designed to carry both bearing and lateral loads while providing impact-absorbing capacity. It’s HarborPile can be custom-sized as small as 8 inches/203 mm in diameter with a 0.25-inch/6.25-mm wall section, or as large as 2 ft/0.6m in diameter with a 2-inch/51-mm thick wall in lengths of 100 ft/30.5m. A vinyl ester resin is used for strength, flexibility and low water absorption.

“We reinforce with heavy quadraxial materials, so we have fibers running in all four directions,” explains Grimnes. “Approximately 50 percent is running in the longitudinal [0°] direction, which helps drivability. The remainder of the fiber is balanced between +/-45° and 90°.”

Although Harbor Tech strongly promotes use of unfilled composite piles in terms of drivability, Grimnes allows that a fill of concrete or other dense material may be necessary in load-bearing applications. According to Pearson Piling, filling the pile with concrete will “increase the stiffness somewhat, but it will not increase the lateral load capacity because the concrete will crack long before the composite starts to assume the load.”

But Grimnes points out that a custom-built hollow pile with thicker wall laminates also can meet load-bearing specs. “Our pile does not require concrete fill,” he insists, “if you build the wall thick enough.”

Piling up the opportunities

Continued R&D on both sides of the composite marine pile arena, sheet and round, is expected to drive composites use in waterfront application for years to come. Grimnes predicts more structural applications for composite round piles in the near future — a belief that is backed up by the amount of work underway at the behest of federal and state agencies and universities, where the viability of FRP composite piles is under exploration in applications that include bridge substructures. On the sheet piling side, Moreau feels strongly that composites can and will compete successfully against aluminum, concrete and steel sheet pile. “There is going to come a time when composite sheet pile takes over steel,” he predicts. “And that time is not too far away.”

Related Content

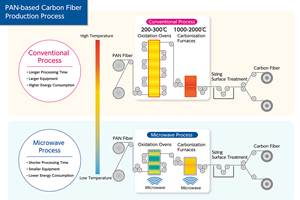

Microwave heating for more sustainable carbon fiber

Skeptics say it won’t work — Osaka-based Microwave Chemical Co. says it already has — and continues to advance its simulation-based technology to slash energy use and emissions in manufacturing.

Read MorePlant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

Read MoreComposites end markets: Electronics (2024)

Increasingly, prototype and production-ready smart devices featuring thermoplastic composite cases and other components provide lightweight, optimized sustainable alternatives to metal.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

Composites Cut Costs Of Repairing Corrosion-Prone Systems

Composites materials and processing methods extend the useful life of noncomposite structures in industrial and infrastructure systems.

Read MorePultruded composite sheet piling replace degraded wood pilings

Creative Pultrusions Inc. has developed a tough composite sheet piling system that is lighter in weight and more corrosion resistant and environmentally stable than wood, concrete or steel piling material.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More